Chapter 7 Presentation Click Here

advertisement

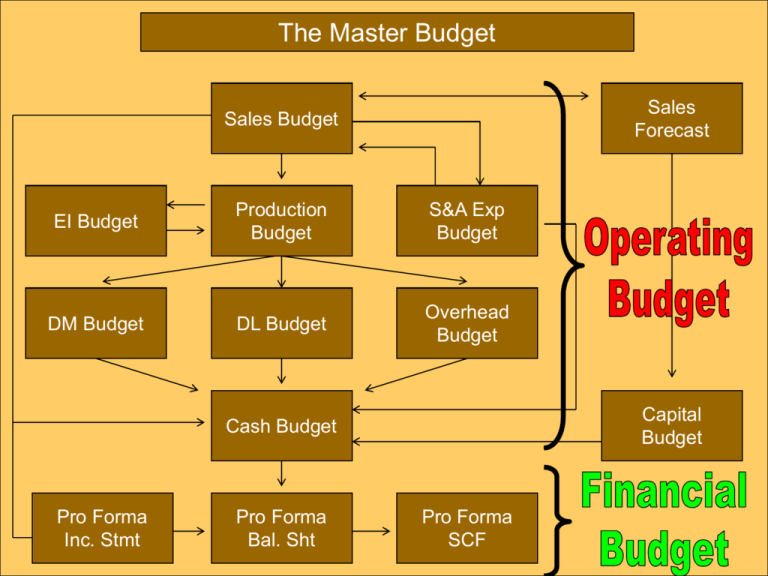

The Master Budget Sales Forecast Sales Budget EI Budget Production Budget S&A Exp Budget DM Budget DL Budget Overhead Budget Capital Budget Cash Budget Pro Forma Inc. Stmt Pro Forma Bal. Sht Pro Forma SCF The Master Budget The Text Example Hampton Freeze Tom Willis is the majority stockholder and chief executive officer of Hampton Freeze, Inc., a company he started in 2001. The company makes premium popsicles using only natural ingredients and featuring exotic flavors such as tangy tangerine and minty mango. The company’s business is highly seasonal, with most of the sales occurring in spring and summer. In 2002, the company’s second year of operations, a major cash crunch in the first and second quarters almost forced the company into bankruptcy. In spite of this cash crunch, 2002 turned out to be overall a very successful year in terms of both cash flow and net income. With the full backing of Tom Wills, Larry Giano set out to create a master budget for the company for the year 2003. In his planning for the budgeting process, Larry drew up the following list of documents that would be a part of the master budget. 1 6 2 3 4 5 8 9 10 7 The Sales Budget A budget showing the number of units, sales price and total sales for each quarter (or month). Research into the history of cash collections at Hampton Freeze indicated that – 70% of sales are collected in the quarter in which the sale is made and – the remaining 30% are collected in the following quarter. The Production Budget A budget showing the number of units that must be produced during each budget period to meet sales needs and to provide for the desired ending inventory. Finished Units to be Produced = Expected Sales in Units + Desired EI of Finished Units - BI of Finished Units • Hampton Freeze would like the ending inventory of finished goods to be equal to 20% of next quarter’s sales. • The company has 2,000 units of beginning inventory. 2. Equals expected sales in units 4. Less BI of finished units. 3. Plus Desired EI of finished units. 1. Finished units to be produced Desired Ending Inventory of Finished Goods equals 20% of next quarter’s sales. Ending Inventory for one quarter equals Beginning Inventory for next quarter. Notice how inventories are accounted for on the spreadsheet. Required Purchases of Raw Materials = Amount Required for Production + Desired EI of Raw Materials - BI of Raw Materials The Direct Materials Purchases Budget A budget showing the raw materials that must be purchased to fulfill the production budget and to provide for adequate inventories. • Hampton Freeze has established a policy of maintaining RM equal to 10% of the amount required for production in the subsequent quarter. • In the first quarter the company plans on producing 14,000 units (from the production budget) • Each unit requires parts costing $0.20. • To prepare the Schedule of Expected Cash Disbursements for Materials, Hampton’s policy is to – Pay for 50% of purchases in the quarter in which the purchase is made, and – Pay the remaining 50% in the following quarter. 2. Equals amount required for production. 3. Plus Desired EI of raw materials. 4. Less BI of raw materials. 1. Required purchases of Direct Materials The Direct Labor Budget A budget showing the direct labor hours (and total amount) needed to produce the number of units specified in the production budget. • Each case produced requires 0.4 direct labor hour. • Each hour costs $15 The Direct Labor Budget The MOH Budget A budget showing all costs of production other than direct materials and direct labor. The MOH Budget The Ending Finished Goods Inventory Budget A budget showing the carrying cost of the unsold units remaining in inventory. The Ending FG Inventory Budget The Selling and Administrative Expense Budget A budget showing expenses for areas other than manufacturing. The S&A Expense Budget HAMPTON FREEZE, INC. Selling and Administrative Cash Disbursement For the Year Ended December 31, 2003 Quarter 1st 2nd 3rd 4th Year Salaries Freight out Advertising Other expense Total 93,000 $ 130,900 $ 184,750 $ 129,150 $ 537,800 HAMPTON FREEZE, INC. Other Cash Disbursements Projections For the Year Ended December 31, 2003 Quarter Equipment Purchase Dividends 1st 2nd 3rd 4th Year 50,000 40,000 20,000 20,000 130,000 8,000 8,000 8,000 8,000 32,000 The Cash Budget The Budgeted (Pro-Forma) Income Statement The Budgeted Balance Sheet