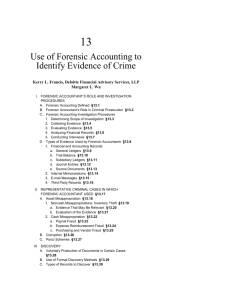

New-England-Graduate..

advertisement

Fraud & Forensic Accounting New England Graduate Accounting Studies Conference June 20, 2014 Agenda ► What is EY FIDS and what do we do? ► What is forensic accounting? ► Why forensic accounting? ► Fraud and financial restatement statistics ► Description of investigative process ► Case examples Page 2 Tony Jordan - Bio Tony Jordan Partner Forensic Investigation & Dispute Services Tel: + 1 617 585 1951 Mobile: +1 617 413 5736 Fax: +1 866 780 9736 Email: tony.jordan@ey.com Tony Jordan is a Partner in the Fraud Investigation & Dispute Services (FIDS) practice of Ernst & Young LLP (EY). Tony’s areas of focus include forensic accounting investigations, issues surrounds Generally Accepted Accounting Principles and general business-related disputes. He has extensive litigation consulting, forensic accounting and auditing experience, is a certified public accountant, and has been providing financial consulting advice to clients for over 18 years. Tony has been involved in a variety of investigations, working on behalf of Special Committees formed by Boards of Directors, named directors and officers and / or senior management. These investigations have involved analyses of various Securities and Exchange Commission (SEC) reporting matters, including revenue recognition (for software companies, as well as for various manufacturers, distributors, retailers and healthcare providers), and accounting for promotional marketing allowances, derivative transactions, and for stock options. He has also been involved in several matters assessing the adequacy of reserves and dealing with inventory manipulations, along with various other issues around the interpretation and application of GAAP. In addition, he has participated in a variety of other litigation matters, including purchase price disputes, valuations, the preparation and analysis of damage claims, the investigation of employee improprieties and / or defalcations, and royalty audits. Prior to joining EY, Tony was a partner at StoneTurn Group LLP, a boutique litigation support firm. Before that, he held the position of Accounting Branch Chief in the Boston District Office of the SEC where he oversaw and performed numerous investigations into violations of the securities laws relating to accounting and financial fraud matters. Page 3 Dawn Aiello - Bio Dawn E. Aiello, CPA Manager Forensic Investigation & Dispute Services Tel: + 1 617 425 7309 Mobile: +1 978 852 3556 Fax: +1 866 633 2172 Email: dawn.aiello@ey.com Dawn is a Manager in EY’s Fraud Investigation & Dispute Services (“FIDS”) Practice in Boston, Massachusetts. Dawn has extensive litigation consulting experience, which includes assisting clients in various industries and geographies with forensic accounting investigations, issues surrounding Generally Accepted Accounting Principles (GAAP), and general business-related disputes. Dawn has been involved in a variety of forensic accounting investigations, which have involved analyses of Securities and Exchange Commission matters, including software revenue recognition, and accounting for stock options. She has also been involved in matters dealing with issues around interpretation and application of GAAP. In addition, she has participated in other litigation matters, including purchase price disputes, and the preparation and analysis of damage claims. Prior to joining EY, Dawn was a Forensic Accountant at the Federal Bureau of Investigation. Before that, she was a Manager at StoneTurn Group LLP, a boutique litigation support firm. Her professional history also includes serving as a Forensic Accountant at Berman DeValerio, LLP and an Associate in the Financial and Economic Consulting practice at Huron Consulting Group. Page 4 EY Fraud Investigation & Dispute Services ► ► ► Anti-Fraud Corporate Compliance Dispute Services ► ► ► Forensic Technology and Discovery Services ► ► ► Damage Analyses Purchase Price Disputes Cyber Security Data Analytics Fraud Investigations ► ► ► Page 5 Financial Statement/Occupational Fraud Investigations Shadow Investigations FCPA Who are our clients? ► Lawyers and their clients ► Companies ► Individuals ► EY Audit Teams Page 6 Who are we? ► CPAs and other Accountants ► Certified in Financial Forensics (CFF) ► Certified Fraud Examiners (CFE) ► Finance Professionals ► Economists ► Information Technology Specialists ► Criminal Justice / Former Law Enforcement Page 7 What is Forensic Accounting? Merriam Webster Online Dictionary – “forensic” ► ► ► 1 : belonging to, used in, or suitable to courts of judicature or to public discussion and debate 2 : ARGUMENTATIVE, RHETORICAL 3 : relating to or dealing with the application of scientific knowledge to legal problems (i.e. forensic medicine, forensic science, forensic pathologist, forensic expert) Forensic Accounting is the application of accounting to legal problems. Page 8 Why Forensic Accounting? Page 9 Types of Fraud Former Microsoft Accountant Sentenced to 2 Years in Prison for Stealing $1.1M Page 10 ACFE 2014 Report to the Nations ► What is the impact of Fraud? ► ► ► Typical organization loses 5% of its revenues to fraud each year. Equates to a potential projected global fraud loss of more than $3.7 trillion annually The median loss caused by occupational fraud cases is $145,000. 22% of the time losses are at least $1 million Detection ► ► Page 11 Frauds schemes typically last an average of 18 months before being detected. Occupational fraud is more likely to be detected by a tip than by any other method. The majority of tips reporting fraud come from employees of the victim organization. ACFE 2014 Report to the Nations (cont.) ► Who performs fraud? ► The median loss among frauds committed by owner/executives was $500,000; managers was $130,000; and employees was $75,000. ► 77% of all frauds were committed by individuals working in accounting, operations, sales, executive/upper management, customer service and purchasing. ► Most occupational fraudsters are first-time offenders with clean employment histories. ► ► ► 95% never previously convicted of a fraud-related offense 82% never previously punished or terminated for fraud-related conduct Red Flags ► In 92% of cases, one or more behavioral red flags exist ► ► ► ► Page 12 Living beyond means (44% of cases), Financial difficulties (33%), Unusually close association with vendors or customers (22%) Control issues/Unwillingness to Share Duties (21%) Where does fraud occur? Page 13 Restatements: Where have we been? 2001 to 2006 Restatements ► ► ► ► ► Dramatic increase in the number and size of restatements – 2001 = 617 restatements and 2006 = 1,849 restatements (a 200% increase during the period and an average of 26.2% per year) Data showed an increase in issuers filing multiple restatements Rising trend in number of periods contained in each restatement (in 2004, 40% contained at least 3 years of restated financials) 75% of restatements reported by companies w/ revenues > $500 million Increase in the # of issues per restatement (peak of 2.43 issues per restatement in 2005) 2007 to 2013 Restatements ► ► ► ► Steady decrease in the number of restatements from ‘07 to’09 (avg. decrease of 25.8% per year) Decrease in the number of periods restated (average of 1.5 years in 2013) Amount of time to restate has decreased (avg. of approximately 30 days in 2007, which dropped to a low of 4.4 days in 2010 and 5.5 days in 2013) Decrease in the # of issues per restatement from 2007 through 2012 (only 1.38 issues per restatement in 2012; up to 1.61 in 2013) Page 14 Restatement Statistics – Total Restatements Source: “2013 Financial Restatements: A Thirteen Year Comparison”, Audit Analytics, April 2014 Page 15 Restatement Statistics – Largest Restatements Source: “2013 Financial Restatements: A Thirteen Year Comparison”, Audit Analytics, April 2014 Page 16 SEC Enforcement Actions Page 17 Source: “Floyd Advisory: Summary of Accounting and Auditing Releases for the Year Ended December 31, 2013” AAER Trends – Where are the issues? 45 40 35 30 25 20 15 10 5 0 Improper Revenue Recognition Balance Sheet Manipulation Intentional Mistatement of Expenses 2011 Page 18 Manipulation of Reserves Options Backdating Defalcations 2013 Source: “Floyd Advisory: Summary of Accounting and Auditing Releases for the Year Ended December 31, 2013” Forensic Investigation Tools ► Accounting discipline ► Forensic technology tools ► ► E-Discovery Data analytics ► Interview skills ► Use of industry specialists as required Page 19 Forensic Investigations - Where do we start? ► ► ► ► ► ► ► Start with the allegation – what is it? Who’s your audience? What are the controls and processes around the area? Who’s involved in the controls and processes? Where are the potential breakdowns? What would it look like? What other information is available for me to analyze? ► ► ► ► ► Page 20 Business Intelligence Email Accounting Records Other data from the accounting system Data from third parties Data Analysis ► Trending of performance metrics ► ► ► ► ► Based on internal and external metrics Identification of anomalies that may suggest further review required Anomaly Detection Targeted Analyses Additional testing (manual or electronic) used to follow up on anomalies identified from trending and data analytics ► Page 21 Sometimes simple frauds require simple analysis Stages of an Investigation Scoping Summary of Investigation Data Gathering Additional Investigation Investigation Interviews Page 22 Preliminary Findings Building the Information Page 23 23 Financial Statement Fraud Example Product CUST ETS $ Page 24 ETS - What did they do? Investment $ Product ETS CUST $ Page 25 ETS - What did they do? Investment $ CUST ETS Investment Certificate DIST Page 26 Financial Statement Fraud Example: ETS - Timeline ► Friday, February 2, 2002 – announce they are being investigated by the SEC and they initiated an internal review ► ► ► ► Monday, February 5, 2002 ► ► ► ► Closing Price of Stock = $10.75/share Market Capitalization = $2.1 Billion Quarterly sales = $150-$200 million Closing Price of Stock = $4.13/share Market Capitalization = $816 Million Loss to Investors = 61% or $1.3 Billion in one day Tuesday, March 22, 2005 ► ► ► Page 27 Closing Price of Stock = $1.46/share Market Capitalization = $307 Million Quarterly sales = $80-$90 million Enterasys Networks - Timeline (cont.) ► ► ► ► 2/27/02 – 3 executives in Asia fired 3/2002 – 2 sales people and 3 executives in U.S. fired (including CEO) 8/12/02 – Announce sale of Aprisma (sub.) for $7.4 Million 11/26/02 – File restated financials for past 2 yrs ► ► ► ► ► Page 28 reduction of revenue and net loss of over $200 Million Fall 2002 – CFO fired December 2002 – Mgr. Financial reporting fired 2001 – 2002 = 730 people laid off October 2003 – pay $50 Million to settle class action Enterasys Networks – Timeline (cont.) ► ► ► ► ► Page 29 May 2004 – 7 executives charged by US Attorney’s office (3 plead guilty) November 2004 – Former exec, Hor Chang Boey, arrested in Atlanta while attempting to enter US for family vacation January 2005 – pay $10.5 Million to settle class action March 2006 – Acquired by two private equity firms for $386 million. No longer a public company April 2007 – 3 of 4 executives found guilty of securities fraud and sentenced to 5 – 14 years in federal prison Page 30 Example: Fannie Mae (FM) – Key Players ► Roger Barnes - Accounting Manager & Whistleblower ► Franklin Delano Raines – Chairman & CEO ► Tim Howard – Vice Chairman & CFO ► Leanne Spencer – Senior Vice President & Controller Page 31 Example: Fannie Mae (FM) – Timeline ► August 2003 – Barnes raises concerns to OFHEO re: accounting practices ► ► ► October 2003 – OFHEO initiated examination of FM January 2004 – Special Review Committee (SRC) formed September 2004 – ► ► ► OFHEO issues report and discloses certain accounting violations at FM SRC hires attorneys/forensic accountants to investigate OFHEO’s claims February 2006 – Rudman report issued outlining accounting and other issues at FM ► December 2006 – FM issues restated financials ($6.3B reduction in RE) Page 32 Example: Fannie Mae (FM) – Procedures ► Over 4 million pages of hard copy & electronic documents reviewed ► Over 240 interviews conducted ► Financial modeling ► GAAP research and interpretation ► Preparation of internal report presented to BOD and Congress Page 33 Fannie Mae – Issues Identified ► SFAS 91 - Accounting for Nonrefundable Fees and Costs Associated with Originating or Acquiring Loans and Initial Direct Costs of Leases ► ► 1998 – Catch-Up Adjustment (recorded only $240M of $439M) 2000 – Development and implementation of amortization policy ► SFAS 133 - Accounting for Derivative Instruments and Hedging Activities ► Corporate Governance & Internal Controls ► Executive Compensation ► Other Accounting Issues Page 34 Example: Fannie Mae (FM) – Excerpts from Document Review ► 1996 Email from Spencer to Howard: ► ► “What do I have up my sleeve to solve an earnings shortfall?” “I recognize (and thought about it yesterday) that we might want to show the board $2.48. I made the decision that I wanted to show you the real answer and the let you decide if you wanted me to make any adjustment.” ► ``KPMG has apparently forgotten about these transactions, and we have not brought the issues to their attention. They have experienced significant turnover since we originally adopted the `package' accounting, and, as a result, there is currently only one member of the audit team left from 1995.'' (undated memo from Howard's staff) ► “I have given serious thought to the many conflicts of conscience I have had over management decision-making. Again, over the past few weeks issues after issue have arisen regarding FAS133 compliance where scenarios were last month…rerun and changed multiple times until we got a result we liked.” (2002 email from Barnes) Page 35 Fannie Mae – Report Conclusions ► Accounting Methods Not GAAP-Compliant ► ► $200M in expenses pushed to future periods allowing executives to receive $27M in bonuses Amortization policy designed to avoid audit differences ► Inadequate Accounting Systems ► Unqualified Staff ► Tone at the Top/Corporate Culture Page 36 Fannie Mae – Where are they now? ► Fannie Mae – Restated financials ($6.3B) ► Franklin D. Raines – ► ► Tim Howard – ► ► ► Golden Parachute ($240M in benefits) Golden Parachute ($20M in benefits) Author – The Mortgage Wars (2013) Leanne Spencer – Independent Real Estate Professional? Page 37 1 January 2014 Presentation title Data Analytics Example ► Fact Pattern ► ► ► ► ► ► Controller of a healthcare facility was fired for performance related issues Controller was in his position from January 2009 through July 2011 Upon review of his work management discovered some erroneous entries around A/R write-offs in Q2 2011 Company reports revenue metrics to headquarters based on revenue by healthcare program and expenses by financial statement Company reports expense metrics to headquarters based on expenses by financial statement category. Our Task ► ► ► Page 38 Determine whether the errors were intentional or unintentional Identify any other erroneous entries Determine whether anyone else involved Financial Statement Fraud Example ► Fact Pattern ► ► ► ► ► ► Controller of a healthcare facility was fired for performance related issues Controller was in his position from January 2009 through July 2011 Upon review of his work management discovered some erroneous entries around A/R write-offs in Q2 2011 Company reports revenue metrics to headquarters based on revenue by healthcare program and expenses by financial statement Company reports expense metrics to headquarters based on expenses by financial statement category. Our Task ► ► ► Page 39 Determine whether the errors were intentional or unintentional Identify any other erroneous entries Determine whether anyone else involved Trending of Performance Metrics Accrued Expenses Trending (January 2009 - July 2011) $60,000 $40,000 $20,000 Aug-11 Jul-11 Jun-11 May-11 Apr-11 Mar-11 Feb-11 Jan-11 Dec-10 Nov-10 Oct-10 Sep-10 Aug-10 Jul-10 Jun-10 May-10 Apr-10 Mar-10 Feb-10 Jan-10 Dec-09 Nov-09 Oct-09 Sep-09 Aug-09 Jul-09 Jun-09 May-09 Apr-09 Mar-09 Feb-09 $(20,000) Jan-09 $- $(40,000) $(60,000) $(80,000) $(100,000) $(120,000) Source: 2009, 2010 and 2011 Trial Balance Page 40 Accrued Expenses Note : data points represent balances at end of month Trending of Performance Metrics (cont.) Monthly Product A Revenue Trending (January 2009 - July 2011) 300,000 250,000 200,000 150,000 Adult IOP/TLP Revenue Actual Adult IOP/TLP Revenue Budget 100,000 50,000 0 Source: Monthly Operating Revenue Schedules January 2009 - July 2011 Page 41 Trending of Performance Metrics (cont.) Monthly Other Program Revenue Trending (January 2009 - July 2011) 40,000 35,000 30,000 25,000 20,000 Other Programs Actual Other Programs Budget 15,000 10,000 5,000 Source: Monthly Operating Revenue Schedules January 2009 - July 2011 Page 42 Jul-11 Jun-11 May-11 Apr-11 Mar-11 Feb-11 Jan-11 Dec-10 Nov-10 Oct-10 Sep-10 Aug-10 Jul-10 Jun-10 May-10 Apr-10 Mar-10 Feb-10 Jan-10 Dec-09 Oct-09 Nov-09 Sep-09 Aug-09 Jul-09 Jun-09 May-09 Apr-09 Mar-09 Feb-09 Jan-09 0 Finding: Intentionally Inflated Rates Rate Charged per Procedure Page 43 Formula Used to Determine Rate Example: Canopy Financial – Success Story? ► Developed software for banks and healthcare providers to manage health savings accounts ► As of 2009 was one of the fastest growing private companies in the U.S. ► Reported a cash balance of $9 million ► Raised $75 million from outside investors ► Reported that they had 1,012,002 customers Page 44 Canopy Financial - Fraud Uncovered ► Fraud identified through identification of a fake audit opinion Page 45 Canopy Financial - Reality ► ► ► ► ► Two co-founders engaged in fraud that resulted in theft of $93,125,918 over only a one year period Stole monies from investors and the health savings accounts of their customers Had only $800k in cash versus the $9 million reported Had only 81,618 customers versus the 1 million reported Funds were used to: ► ► ► ► ► ► ► ► Page 46 Operate the company Purchase of exotic automobiles Use of a private jet Purchase of a home for one of the co-founders’ parents Home renovations Sports tickets Jewelry Credit card purchases Canopy Financial - Automobiles ► 20 Cars purchase in total, including: ► 2010 Range Rovers (2) ► 2008 Lamborghini ► 2009 Rolls Royce Phantom ► 2009 Aston Martin DBS ► 2009 Bentley Continental ► 2009 Ferrari 430 Page 47 Canopy Financial - Where are they now??? ► Anthony Banas – Chief Technology Officer ► ► Jeremy Blackburn – President and COO ► ► Sentenced to 13 years in federal prison Sentenced to 15 years in federal prison Both men ordered to pay restitution and forfeit assets totaling $93 million Page 48 Example: Occupational Fraud - Lars Bildman CEO of Astra Pharmaceutical USA ► Salary = $1.1M per year ► “Supplemental Income” ► ► ► ► ► ► $4 Million of construction on his homes Family vacations Prostitutes Sexual harassment of numerous female employees (cost company $10 million) Sentenced to 21 months in prison for tax evasion Page 49 Example: Occupational Fraud – Bradford Bleidt ► Full-service investment advisor w/ businesses in Boston including a radio station ► Performed fraud over a period of 20 years ► Stole in excess of $30 million from clients ► Many clients elderly and their life savings were gone ► Currently serving a 13 year sentence in federal prison Page 50 Questions Page 51