Use of Forensic Accounting to Identify Evidence of Crime

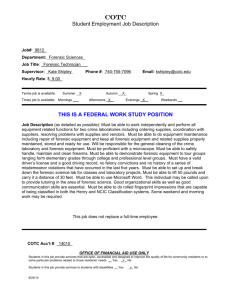

advertisement

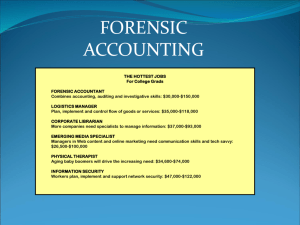

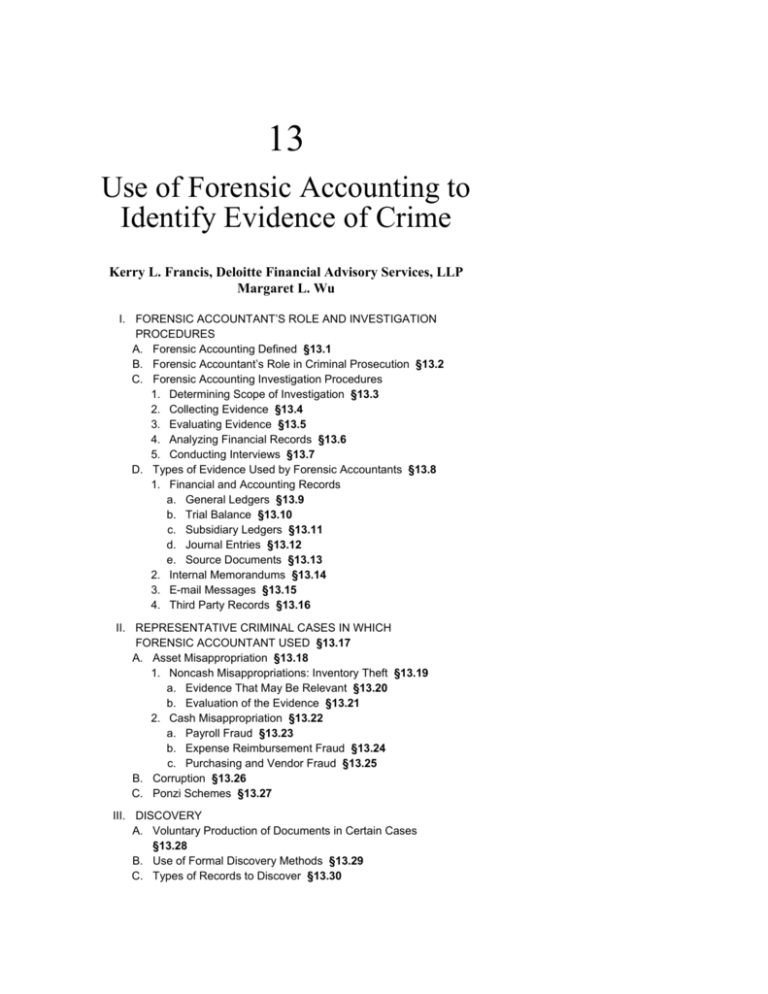

13 Use of Forensic Accounting to Identify Evidence of Crime Kerry L. Francis, Deloitte Financial Advisory Services, LLP Margaret L. Wu I. FORENSIC ACCOUNTANT’S ROLE AND INVESTIGATION PROCEDURES A. Forensic Accounting Defined §13.1 B. Forensic Accountant’s Role in Criminal Prosecution §13.2 C. Forensic Accounting Investigation Procedures 1. Determining Scope of Investigation §13.3 2. Collecting Evidence §13.4 3. Evaluating Evidence §13.5 4. Analyzing Financial Records §13.6 5. Conducting Interviews §13.7 D. Types of Evidence Used by Forensic Accountants §13.8 1. Financial and Accounting Records a. General Ledgers §13.9 b. Trial Balance §13.10 c. Subsidiary Ledgers §13.11 d. Journal Entries §13.12 e. Source Documents §13.13 2. Internal Memorandums §13.14 3. E-mail Messages §13.15 4. Third Party Records §13.16 II. REPRESENTATIVE CRIMINAL CASES IN WHICH FORENSIC ACCOUNTANT USED §13.17 A. Asset Misappropriation §13.18 1. Noncash Misappropriations: Inventory Theft §13.19 a. Evidence That May Be Relevant §13.20 b. Evaluation of the Evidence §13.21 2. Cash Misappropriation §13.22 a. Payroll Fraud §13.23 b. Expense Reimbursement Fraud §13.24 c. Purchasing and Vendor Fraud §13.25 B. Corruption §13.26 C. Ponzi Schemes §13.27 III. DISCOVERY A. Voluntary Production of Documents in Certain Cases §13.28 B. Use of Formal Discovery Methods §13.29 C. Types of Records to Discover §13.30 1. 2. 3. 4. 5. 6. General Business Records §13.31 Financial and Accounting Records §13.32 Records Reflecting Assets §13.33 Records Reflecting Liabilities §13.34 Records Reflecting Revenues §13.35 Records Reflecting Costs and Expenses §13.36 IV. EVIDENCE ISSUES REGARDING ACCOUNTING RECORDS A. Secondary Evidence Rule §13.37 B. Authentication §13.38 C. Hearsay §13.39 V. ADMITTING ACCOUNTING EXPERT TESTIMONY A. Expert Accounting Testimony Routinely Admitted §13.40 B. Selecting a Forensic Accounting Expert §13.41 C. Qualifying Expert §13.42 D. Basis of Expert’s Opinion §13.43 E. Sample Questions for Proponent of Evidence 1. Qualifying the Forensic Accountant §13.44 2. Forensic Accountant’s Investigation and Basis for Opinion §13.45 3. Admitting Accounting Records §13.46 VI. CHALLENGING ACCOUNTANT EXPERT TESTIMONY A. Challenges Based on Expert’s Qualifications §13.47 B. Challenges Based on Basis of Expert’s Opinion §13.48 C. Sample Questions for Opponent of Evidence 1. Challenging Qualifications §13.49 2. Challenging Investigation or Basis for Opinion §13.50 3. Challenging Accounting Records §13.51