View/Open

advertisement

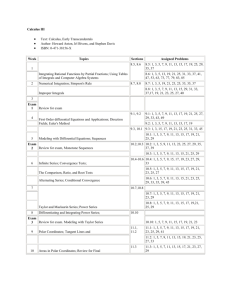

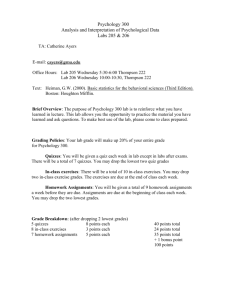

ACCTG 321 – INTEGRATIVE ACCOUNTING TOPICS I FINANCIAL REPORTING MODULE FALL 2012 INSTRUCTOR: Kevin Hee EMAIL: khee@mail.sdsu.edu CLASS TIMES: Sec02 – M/W: 13:00 – 15:40 (SSE 1401) Sec03 – M/W: 19:00 – 21:40 (NE 60) OFFICE: Student Services East Building (SSE) 2422 OFFICE HOURS: Tuesday 10:00-11:30 Wednesday 10:00-11:30 (If students cannot make these above times, students can always make an appointment to come see me in my office.) OFFICE PHONE: 619-594-6021 PREREQUISITES: Admission to Accountancy major, minor, or certificate. Minimum grade of C in both ACCTG 201 and 202. Completion of General Education requirement in Communication and Critical Thinking. Proof of completion of prerequisites required: Copy of transcript. TEXTBOOKS: Intermediate Accounting, 7th Edition (with Connect access card); Spiceland, Sepe, Nelson and Tomassini (REQUIRED) ADDITIONAL: We will be using the red Parscore forms (F-289) for ALL EXAMS AND QUIZZES in the financial module. 1 STUDENT LEARNING OUTCOMES FOR THIS MODULE: The purpose of this module of ACCT 321 is to enhance and expand your current understanding of corporate financial reporting for the subject areas covered in the module. More specifically, we will take an in-depth look at the mechanics of financial accounting and the theory behind U.S. GAAP as presented in the statement of operations (i.e., income statement) and the statement of financial position (i.e., balance sheet). We will also cover the impact of International Financial Reporting Standards how these rules differ from GAAP for the relevant topics. At the end of this module for this course students should be able to: Identify, measure, classify, present and disclose financial information in accordance with U.S. Generally Accepted Accounting Principles and International Financial Reporting Standards. (SLO #1.1) Properly record transactions in the relevant topic areas. This means knowing how to calculate the amount of the accounting impact of a transaction under accrual accounting and how to properly journalize such transactions. (SLO # 1.1, 1.2) Effectively work in groups to analyze business transactions and apply the correct accounting techniques in properly recording those transactions and present the effects on financial statement presentation (SLO 2.11b). ACADEMIC HONESTY According to the SDSU Academic Senate policy on cheating and plagiarism: 2.2 Plagiarism shall be defined as the act of incorporating ideas, words, or specific substance of another, whether purchased, borrowed, or otherwise obtained, and submitting same to the University as one’s own work to fulfill academic requirements without giving credit to the appropriate source. Plagiarism shall include but not be limited to (a) submitting work, either in part or in whole, completed by another; (b) omitting footnotes for ideas, statements, facts, or conclusions that belong to another; (c) omitting quotation marks when quoting directly from another, whether it be a paragraph, sentence, or part thereof; (d) close and lengthy paraphrasing of the writings of another; (e) submitting another person’s artistic works, such as musical compositions, photographs, paintings, drawings, or sculptures; and (f) submitting as one’s own work papers purchased from research companies. Unprofessional conduct adversely impacts your fellow students, the accounting faculty, the Charles W. Lamden School of Accountancy, SDSU, and the accounting profession. The Charles W. Lamden School of Accountancy takes academic honesty very seriously and vigorously enforces university policy related to any such infractions. Any student suspected of academic dishonesty will be reported to the SDSU Center for Student Rights and Responsibilities; if found 2 responsible, the student will receive a failing grade (F) for the entire financial accounting module. BLACKBOARD: This course module will be managed via the Blackboard course website. Therefore, each student needs an email account (either SDSU Rohan or an alternative email system like Google, Yahoo, Hotmail, etc.). Please make sure that you update your email address in the SDSU database. You can check on your Blackboard email account (or update/change it) by going to the SDSU Web Portal at http://sunspot.sdsu.edu/portal. Please note that Hotmail accounts sometimes do not accept mail sent directly through Blackboard’s mass email system, but they do receive individual emails. If you do not receive an announcement via email, you may want to change servers from your Hotmail server to another mail server. The Blackboard website will be where I make announcements, upload class slides and solutions for assignments and quizzes. You can find all of the financial module items in the “Assignments/Financial Module” folder on the course Blackboard site. All points for assignments, quizzes and exams that factor into the students’ grades will be posted on Blackboard. CLASS LECTURES: Classes will consist of lectures using PowerPoint slides and in-class problems/exercises that are designed to help students better understand the correct financial reporting rules for a variety of common business transactions. Students are responsible for downloading and printing the slides from the Blackboard website. The pace of my lectures and in-class exercises are based on the assumption that students have read the textbook material ahead of time and printed out the relevant slides for class. ASSESSMENT POINTS (PERCENT) Exam #1 (September 10, 2012) 200 (20%) Exam #2 (October 1, 2012) 200 (20%) Exam #3 (October 17, 2012) 200 (20%) Quizzes (25 points each) 200 (20%) Homework (12.5 points each) 100 (10%) In-Class Group Simulation (15 points each) 60 (6%) Class Participation/Professionalism 40 (4%) TOTAL 1,000 (100%) Grades will be combined on an equal weighted basis with the tax module. EXAMS: There will be three non-comprehensive multiple-choice exams in this module. Students will need a Parscore sheet (F-289) for the exams. Exams will be administered during class times on the dates listed in the class schedule. Makeup exams can only be given in the case discussed in the Special Accommodations section below. If you miss an exam and offer an acceptable reason for missing the exam your remaining exam scores will represent your entire exam score for this 3 module. Students must notify me that they will miss an exam PRIOR TO THE EXAM. QUIZZES: Quizzes are multiple-choice and will NOT be announced ahead of time. Students will need a Parscore sheet (F-289) for the quizzes. Each quiz will be administered at the beginning of class and covers material from the prior class. I design the quizzes such that students should complete the quizzes in approximately 20 minutes. It is imperative not to fall behind in this class because of the volume of concepts covered and the sustained pace of the module. Please be aware that the quizzes are not designed to be wholly representative of the difficulty of questions on the exams. The quizzes are designed as a tool to ensure that students are keeping up-to-date with the material covered in lectures. Each quiz is worth 25 points. The lowest quiz grade will be dropped when calculating the student’s final point tally in this module. Also, your highest quiz grade will count twice in calculating your total quiz points during the semester. IN-CLASS ASSIGNMENTS/SIMULATIONS: At the beginning of the semester, students will be assigned to groups via Blackboard. This group will be your permanent group for the entire semester for all graded group assignments. There will also be four graded simulation assignments during the semester. These simulations are designed for students to work in their groups outside of class. Points will be earned on a group basis based on the accuracy of the groups’ answers to the simulations. Whatever number of points earned by the group is the number of points earned by the individual student within the group (e.g., if the group earns 12 out of a possible 15 points on a simulation, each group member that worked on the simulation will earn 12 points each.). The in-class group work will consist of open-book/notes ungraded exercises designed to have students analyze different business transactions and practice application of relevant concepts and principles in financial reporting. In-class group work does not have to be done in your assigned groups. CLASS PARTICIPATION/PROFESSIONALISM: Class participation will be a mix of group peer evaluations (each member in the group will evaluate other group members at the end of the semester), attendance and overall professionalism and respect shown in class for the professor and other classmates. CONNECT ONLINE HOMEWORK: The homework assigned for each lecture must be completed and submitted online before 1 PM on the due date (THIS TIME DEADLINE IS FOR BOTH SECTIONS!). I will not accept homework turned in during class time in hard copy form. The homework is designed to be a supplementary tool to help students: 1) understand the concepts covered in the financial module and 2) 4 apply the concepts in a practical situation. All homework assignments will be completed online via Connect that comes with your edition of the Spiceland textbook. All students must register online in accordance with the instructions found in your Connect access card that you purchased with your Spiceland textbook. You will need to provide a user name and password to log on and do the homework assignments throughout the semester. Multiple students cannot use the same access card. The following website is where you need to go to access the homework problems. Please register at the following websites (depending on your section) by clicking on the “Register as Student” link and following the instructions: 1pm Section: http://connect.mcgraw-hill.com/class/k_hee_mw_fall_2012_1pm 7pm Section: http://connect.mcgraw-hill.com/class/k_hee_mw_fall_2012_7pm The homework system will not accept any homework submissions made after the assigned date and time. Due to the fact that the homework due by the start of class each day will relate to material that I have not yet lectured on, students will be allowed to three attempts for each homework problem. Each homework assignment is worth a maximum of 15 points and points are earned on a sliding scale based on the accuracy of your answers. The grading scale will be as follows: % of Homework Answered Correctly 0 – 49% 50 – 74% 75 – 100% Homework Points Earned 0 points 8 points 12.5 points The lowest homework grade will be dropped in when calculating the student’s final point tally in this module. CALCULATORS: A financial calculator is required for use in this module when we cover bonds and leases in Chapters 14 and 15. Examples include (but are not limited to): TEXAS INSTRUMENTS MODEL – BA II PLUS HEWLETT PACKARD MODEL – 10B HEWLETT PACKARD MODEL – 12C Financial calculators are calculators that have the time value of money function keys (e.g., PV, FV, PMT, N, I/YR). SPECIAL ACCOMODATIONS: If you qualify for accommodations because of a disability, please present me a letter from Student Disability Services so that your needs may be addressed. Disability Services (619-594-6473; Calpulli Center, Suite 3101, http://www.sa.sdsu.edu/sds) determines accommodations based on documented disabilities. 5 In accordance with University-wide policies, accommodations will be made for students when any test date conflicts with religious observances. To schedule make-up exams based on conflicts with religious observances, you should contact me at least TWO WEEKS prior to the scheduled exam date. 6 DATE Aug 27 Aug 29 Sept 3 Sept 5 Sept 10 Sept 12 Sept 17 Sept 19 Sept 24 Sept 26 Oct 1 Oct 3 Oct 8 Oct 10 Oct 15 Oct 17 RELEVANT CHAPTERS TOPIC COVERED Financial Accounting Framework Review of the Accounting Process (in-class exercise) Balance Sheet & Income Statement (Quiz 1/in-class exercise) LABOR DAY – NO CLASS Income Statement and Statement of Cash Flows (Quiz 2/Simulation #1) FINANCIAL EXAM #1 Accounting Orientation – First half of class Revenue Recognition Revenue Recognition (pp. 230-258, 263-266) (In-class exercise) Cash and Receivables (pp. 358-375) (Quiz 3/Simulation #2) Inventory (pp. 420-443, 474-486) (Quiz 4/In-class exercise) TBD (Quiz 5) FINANCIAL EXAM #2 Fixed Assets & Depreciation Intangible Assets & Amortization (pp. 528-544, 546-547, 551-552, 556-561; 588601, 603-625) (in-class exercise) Current and Long-Term Liabilities (pp. 736-744, 752-754, 759-763; 796-810, 814820) (Quiz 6/Simulation #3) Long-term Liabilities (maybe Leases too) (Quiz 7/in-class exercise) Leases (pp. 806-814, 818-820) (Quiz 8/Simulation #4) FINANCIAL EXAM #3 CONNECT CH 1 CH 2 Chapters 1 & 2 Assignment(ungraded) CH 3 CH 4 NONE Chapter 3 NONE CH 4 CH 1-4 Chapter 4 CH 5 NONE CH 5 Chapter 5 CH 7 CH 8, 9 Chapter 7 Chapters 8 & 9 CH 5,7-9 CH 10/11 Chapters 10 and 11 (two separate assignments on Connect) CH 13, 14 Chapter 13 & 14 CH 14 (maybe 15) CH 15 CH 10-11,13-15 Chapter 15 JOIN CALCPA The CalCPA is a professional organization dedicated to increasing the value and promoting the integrity of the CPA profession, contributing to the success of their members and strengthening client, employer, public and government trust in CalCPA member advice, work products and opinions. 7 As new accounting majors, you likely have a multitude of questions about the profession and what it means to be an accountant in the state of California. The CalCPA’s website (http://www.calcpa.org/content/home.aspx) is a useful resource in learning more about the accounting profession. The website also provides information that can be very useful to someone wanting to learn more about the accounting profession such as CPA exam information, CPA license requirements in the state of CA and other career resource information. In addition to the information resource benefits, CalCPA has multiple scholarship opportunities available to its student members. As a requirement for this course, every ACCTG 321 student is required to join the CalCPA as a student member. Membership is free. You must join by September 10, 2012. Please email me proof of your membership (e.g. a snapshot of your account information under the “My Account” link). Any students who do not join will be subject to a 10 point penalty in your overall point total for the course. 8