File a Tax Return

advertisement

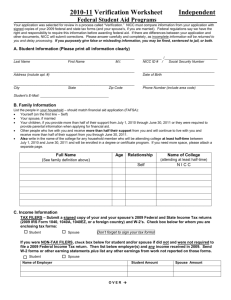

Completing a Form 1040 EZ Tax return: set of forms that taxpayers use to calculate their tax obligations ◦ If tax return shows that your withholding wasn’t enough to cover your taxes, you must send remaining to the government ◦ If tax return shows that your withholding more than covered your taxes, then government sends you a refund Income is more than wages, it includes: ◦ Tips ◦ Amount earned for odd jobs ◦ Anything from interest Every part of you income will be TAXED! YOU are responsible for the accuracy of the return ◦ Even if you hire a professional Form W-2 Form 1099-INT Summary of your earnings and withholdings for the year By January 31, employers must give this to their workers You should receive one from every employer you had in the year When you file your tax return, you must send a copy of your W-2 Your employer also sends a copy to the IRS If you fail to report your earnings, the IRS will come after you Statement of the interest your bank paid on your savings that year Interest is a source of income – not very much usually – but you’re still adding money to what is already in there Your bank must mail this to you as well as a copy to the IRS Form 1040EZ Form 1040 Form 1040A To qualify to use this form: ◦ You are single or married and filing jointly with your spouse ◦ You have no dependents (people you support financially) ◦ You and your spouse are under 65 ◦ Neither you nor your spouse are blind ◦ You have a taxable income of less than $50,000 ◦ You earned no more than $1,500 in interest ◦ You had no income other than wages, interest, tips, scholarships, or unemployment compensation https://www.irs.gov/pub/irs-prior/f1040ez-2014.pdf Use Form W-2 and Form 1099-INT to it out When you are older, your life will be a bit more complicated – own your own house, run small business, invest in stock market, etc. This form helps itemize deductions (expenses you can legally subtract from your income when figuring your taxes)