Valuation of IR Swaps

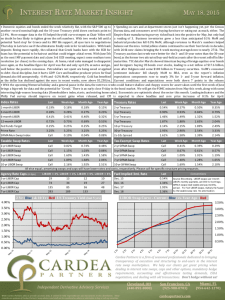

advertisement

Swaps Chapter 7 7.1 Goals of Chapter 7 Introduce interest rate (IR) swaps (利率交換) – – – – Introduce currency swaps (貨幣交換) – Definition for swaps An illustrative example for IR swaps Discuss reasons for using IR swaps Quotes and valuation of IR swaps Payoffs, reasons for using currency swaps, and the valuation of currency swaps Credit risk of swaps Other types of swaps 7.2 7.1 Interest Rate (IR) Swaps 7.3 Definition of Swaps A swap is an agreement to exchange a series of cash flows (CFs) at specified future time points according to certain specified rules – The first swap contracts were created in the early 1980s – Swaps are traded in OTC markets – Swaps now occupy an important position in OTC derivatives markets – The calculation of CFs depends on the future values of an interest rate, an exchange rate, or other market variables 7.4 Interest Rate Swap The most common type of swap is a “plain vanilla” IR swap – One party agrees to pay CFs at a predetermined fixed rate on a notional principal for several years – The other party pay CFs at a floating rate on the same notional principal for the same period of time – The floating rate in most IR swaps depends on the LIBORs with different maturities in major currencies – An illustrative example: On Mar. 5 of 2013, Microsoft (MS) agrees to receive 6-month LIBOR and pay a fixed rate of 5% with Intel every 6 months for 3 years 7.5 on a notional principal of $100 million Cash Flows of an Interest Rate Swap ---------Millions of Dollars--------Floating Fixed Net Cash Flow Cash Flow Cash Flow Date LIBOR Rate Mar.5, 2013 4.2% Sept. 5, 2013 4.8% +2.10 –2.50 –0.40 Mar.5, 2014 5.3% +2.40 –2.50 –0.10 Sept. 5, 2014 5.5% +2.65 –2.50 +0.15 Mar.5, 2015 5.6% +2.75 –2.50 +0.25 Sept. 5, 2015 5.9% +2.80 –2.50 +0.30 +2.95 –2.50 +0.45 Mar.5, 2016 ※ For each reference period, the 6-month LIBOR in the beginning of the period determine the payment amount at the end of the period – According to this rule, there is no uncertainty about the first CF exchange ※ Note that it is not necessary to exchange the principal at any time point – This is why the principal is termed the notional principal (名義本金或名目本金), or just the notional 7.6 Cash Flows of an Interest Rate Swap If the Principal was Exchanged ---------Millions of Dollars--------Floating Fixed Net Cash Flow Cash Flow Cash Flow Date LIBOR Rate Mar.5, 2013 4.2% Sept. 5, 2013 4.8% +2.10 –2.50 –0.40 Mar.5, 2014 5.3% +2.40 –2.50 –0.10 Sept. 5, 2014 5.5% +2.65 –2.50 +0.15 Mar.5, 2015 5.6% +2.75 –2.50 +0.25 Sept. 5, 2015 5.9% +2.80 –2.50 +0.30 +102.95 –102.50 +0.45 Mar.5, 2016 ※ If the principal were exchanged at the end of the life of the swap, the nature (or said the net cash flows) of the deal would not be changed in any way – Since only the net CF changes hands in practice for IR swaps, it is not necessary to exchange the principal at any time point ※ The IR swap can be regarded as the exchange of a fixed-rate bond (with the CFs in the 4th column) for a floating-rate bond (with the CFs in the 3rd column) ※ This characteristic helps to evaluate the value of an IR swap (introduced later) 7.7 Interest Rate Swap – Day count conventions for IR swaps in the U.S. Since the 6-month LIBOR is a U.S. money market rate, it is quoted on an actual/360 basis As for the fixed rate, it is usually quoted as actual/365 For the first CF exchange on Slide 7.6, because there are 184 days between Mar. 5, 2013 and Sep. 5, 2013, the accurate CF amounts are 184 = $2.1467 mil. (for the floating-rate 360 184 = $2.5205 mil. (for the fixed-rate CF) 365 $100 mil.× 4.2% × $100 mil.× 5% × CF) For clarity of exposition, this day count issue will be ignored in the rest of this chapter 7.8 Interest Rate Swap Reasons for using IR swaps 1. Converting a liability from fixed rate to floating rate floating rate to fixed rate ※The Intel and Microsoft example 5.2% 5% MS Intel LIBOR + 0.1% LIBOR Original fixedrate debt of Intel IR swap Original floatingrate debt of MS – The net borrowing rate for Intel’s liability is LIBOR + 0.2% – The net borrowing rate for MS’s liability is 5.1% 7.9 Interest Rate Swap 2. Converting an asset (or an investment) from fixed rate to floating rate floating rate to fixed rate ※The Intel and Microsoft example LIBOR – 0.2% 5% MS Intel 4.7% LIBOR Original floatingrate asset of Intel IR swap Original fixed-rate asset of MS – The net interest rate earned for Intel’s asset is 4.8% – The net interest rate earned for MS’s asset is LIBOR – 0.3% 7.10 Interest Rate Swap When a financial intuition is involved – Usually two nonfinancial companies do not get in touch directly to arrange a swap It is unlikely for a company to find a trading counterparty which needs the opposite position of the IR swap, i.e., another firm agrees with the principal and maturity but shows a different preference for the floating or fixed IR In practice, each of them deals with a financial institution (F.I.) 5.015% 4.985% 5.2% F.I. Intel Original fixedrate debt of Intel MS LIBOR LIBOR IR swap IR swap LIBOR + 0.1% Original floatingrate debt of MS 7.11 Interest Rate Swap LIBOR – 0.2% Original floatingrate asset of Intel MS F.I. Intel 5.015% 4.985% LIBOR LIBOR IR swap IR swap 4.7% Original fixed-rate asset of MS Note that the F.I. has two separate and offsetting IR swap contracts, and it has to honor the both contracts even Intel or MS defaults In most cases, Intel and MS do not even know whether the F.I. has entered into an offsetting swap with another firm In practice, there are many F.I.’s as market markers (or say dealers) in OTC markets and always preparing to trade IR swaps without having an offsetting swap – They can hedge their unoffset swap positions with Treasury bonds, FRAs, or other IR derivatives 7.12 Quotes By a Swap Market Maker Maturity Bid (%) Offer (%) Swap Rate (%) 2 years 6.03 6.06 6.045 3 years 6.21 6.24 6.225 4 years 6.35 6.39 6.370 5 years 6.47 6.51 6.490 7 years 6.65 6.68 6.665 10 years 6.83 6.87 6.850 ※ The quotes of IR swaps are expressed as the rate for the fixed-rate side – Bid rate: the fixed rate that the market maker pays for buying (receiving) a series of CFs according to LIBOR – Offer rate: the fixed rate the market marker earns for selling (paying) a series of CFs according to LIBOR – Swap Rate: the fixed rate such that the value of this swap is zero (introduced later), and the bid-offer quotes usually center on the swap rate in practice – The plain vanilla fixed-for-floating swaps are usually structured so that the 7.13 financial institution earns about 0.03% to 0.04% in the U.S. Comparative Advantage Argument The comparative advantage argument explains the popularity of the IR swaps – AAA Corp. prefers to borrow at a floating rate and BBB Corp. prefers to borrow at a fixed rate – The fixed or floating IRs they need to pay are Fixed Floating AAA Corp. 4.00% 6-month LIBOR – 0.1% BBB Corp. 5.20% 6-month LIBOR + 0.6% A key feature is that the difference between the two fixed rates (1.2%) is greater than the difference between the two floating rates (0.7%) AAA (BBB) Corp. has comparative advantage in borrowing fixed-rate (floating-rate) debt 7.14 Comparative Advantage Argument An ideal win-win solution with a swap – AAA Corp. borrows fixed-rate funds at 4% – BBB Corp. borrows floating-rate funds at LIBOR + 0.6% – Both enter into a fixed-for-floating IR swap to obtain the IRs they prefer 4.35% 4% BBB AAA LIBOR + 0.6% LIBOR Borrow at a fixed rate IR swap Borrow at a floating rate The net borrowing rate for AAA Corp. is LIBOR – 0.35%, which is by 0.25% lower than LIBOR – 0.1% if it borrows at a floating rate directly The net borrowing rate for BBB Corp. is 4.95%, which is by 0.25% lower than 5.2% if it borrows at a fixed rate directly 7.15 Comparative Advantage Argument – Suppose AAA and BBB cannot deal directly and a F.I. is involved 4% BBB F.I. AAA Borrow at a fixed rate 4.37% 4.33% LIBOR LIBOR IR swap IR swap LIBOR + 0.6% Borrow at a floating rate The net interest rate for AAA Corp. is LIBOR – 0.33%, which is by 0.23% lower than LIBOR – 0.1% if it borrows at a floating rate directly The net interest rate for BBB Corp. is 4.97%, which is by 0.23% lower than 5.2% if it borrows at a fixed rate directly The gain of the F.I. is 0.04% – Note that in both cases, the total gains of all participants is 0.5% , which equals (1.2% – 0.7%), where 1.2% (0.7%) is the difference between the fixed (floating) borrowing IRs for AAA and BBB Corp. 7.16 Criticism of the Comparative Advantage Argument The comparative advantage arises from the unmatched maturities for different IR rates – The 4% and 5.2% rates available to AAA and BBB are, for example, 5-year rates – The LIBOR – 0.1% and LIBOR + 0.6% rates are available to AAA and BBB for only 6 months The fixed IR level or the spread above or below the LIBOR reflects the creditworthiness of AAA and BBB corporations – Since the 6-month period is so short that the default prob. of BBB is small, BBB can enjoy the comparative advantage on borrowing at a floating rate – In contrast, since lenders intend to cover the default uncertainty for a longer period of time, the 5-year fixed borrowing rate for BBB is relatively more expensive 7.17 Criticism of the Comparative Advantage Argument Note that the floating-rate loan will be reviewed (so as the creditworthiness of the borrower) and rolled over every 6 months, so the true cost to borrow at a floating rate depends on the (LIBOR + spread) in the future – spread changes with the creditworthiness of BBB – The net borrowing rate for BBB is NOT FIXED at (LIBOR + 0.6%) + 4.37% – LIBOR = 4.97% for 5 years, but is (LIBOR + spread) + 4.37% – LIBOR = 4.37% + spread dependent on its future creditworthiness every 6 months – In contrast, if BBB borrows at a fixed rate, the borrowing rate is fixed at 5.2% for 5 years, regardless of its future creditworthiness – As a result, BBB cannot achieve its goal with a swap perfectly if its creditworthiness changes in the future ※ The above inference disprove that the comparative advantage 7.18 argument can explain the popularity of IR swaps The Nature of Swap Rates The n-year swap rate is a constant interest rate corresponding to a credit risk for 2n consecutive 6-month LIBOR loans to AA-rated companies – First, it is known that the 6-month LIBOR is a shortterm AA-rating borrowing rate – Second, a F.I. can earn the n-year swap rate by Lending for the first 6-month loan to a AA borrower and relending it for successive 6-month periods to other AA borrowers for n years, and 2. Entering into a IR swap to exchange the LIBOR income in the above step for the constant CFs at the n-year swap rate7.19 1. The Nature of Swap Rates – Note that the n-year swap rates are lower than nyear AA-rating fixed borrowing rates For the swap rate, the creditworthiness of the borrowers are always AA for the whole n-year period For n-year AA-rating fixed borrowing rates, it is only known that the initial creditworthiness of the borrower is AA-rating at the beginning of the n-year period ※The lower credit risk for earning the swap rate leads to the lower n-year swap rate than the n-year AA-rating fixed borrowing rate ※Recall that the credit risks of AA-rating companies are small in practice, it can be inferred that the swap rates are closer to risk-free 7.20 Valuation of IR Swaps There are two approaches to price IR swaps 1. Regard the value of an IR swap as the difference between the values of a fixed-rate bond and a floating-rate bond (see Slide 7.7) 2. Regard an IR swap as a portfolio of forward rate agreements (FRAs) (For the Intel and MS 3year IR swap, it can be regarded separately as 5 FRAs) 7.21 Valuation of IR Swaps Valuation in terms of bond prices – For a swap where fixed CFs are received and floating CFs are paid, its value can be expressed as 𝑉swap = 𝐵fix − 𝐵fl , where 𝐵fix and 𝐵fl denote the values of a fixed-rate and floating-rate bonds – The value of a fixed-rate bond (Bfix) can be derived with the traditional discounted cash flow method – The value of a floating-rate bond (Bfl) that pays 6month LIBOR is always equal to its PAR VALUE immediately after the each payment date 7.22 Valuation of IR Swaps Price Bfl (with the face value to be $100) with 1.5 years to maturity in one possible scenario for the 6-month LIBOR $100+$2 $3 $4 6% 4% 8% t=0 t=0.5 t=1 $100 ( $100 ( $100 ( $3 $100 1 6% 0.5 $4 $100 1 8% 0.5 $3 1 6% 0.5 t=1.5 $2 $100 1 4 % 0 .5 $4 1 8% 0.5 ) $102 (1 8% 0.5)((1 4% 0.5) $4 (1 6% 0.5)(1 8% 0.5) ) $102 (1 6% 0.5)(1 8% 0.5)(1 4% 0.5) ) ※ Note that in any scenario for LIBOR and for different life time of bonds, the Bfl is worth its par value on the issue date and on each date immediately after the coupon payment date 7.23 Valuation of IR Swaps Generalization for pricing Bfl (with the principal (or said par value) L) Value = L = PV of L+k* at t* Value = L Value = L+k* 0 Valuation Date t t* First Pmt Date (Floating Pmt = k*) Second Pmt Date Maturity Date ※ Note that the value of a Bfl at any time point 𝑡 is the PV of (𝐿 + 𝑘 ∗ ) at 𝑡, ∗ i.e., 𝐿 + 𝑘 ∗ 𝑒 −𝑟(𝑡 −𝑡) , where 𝐿 + 𝑘 ∗ is the value of the Bfl on the next payment date and 𝑟 is the continuously compounding zero rate corresponding to the time to maturity of (𝑡 ∗ − 𝑡) 7.24 Valuation of IR Swaps An example for pricing IR swaps – For the party to pay the six-month LIBOR and receive fixed 8% (semi-annual compounding) on a principal of $100 million – Remaining life of the IR swap is 1.25 years – LIBOR rates for 3-months, 9-months and 15months are 10%, 10.5%, and 11% (continuously compounding) – The 6-month LIBOR on the last payment date was 10.2% (semi-annual compounding) 7.25 Valuation of IR Swaps Time 𝑩𝐟𝐢𝐱 CF (yr) 𝑩𝐟𝐥 CF Discount Factor 0.25 $4 $105.1 𝑒 −10%∙0.25 = 0.9753 $3.901 0.75 $4 𝑒 −10.5%∙0.75 = 0.9243 $3.697 1.25 $104 𝑒 −11%∙1.25 = 0.8715 $90.640 Total PV of 𝑩𝐟𝐢𝐱 CF $98.238 PV of 𝑩𝐟𝐥 CF $102.505 $102.505 ※ For per $100 principal – The coupon payment of 𝐵fl after 3 months is 0.5 × 10.2% × $100 = $5.1 – The value of 𝐵fl today is $100 + $5.1 𝑒 −10%∙0.25 = $102.505 according to the formula on Slide 7.23 – 𝑉swap = 𝐵fix − 𝐵fl = $98.238 − $102.505 = −$4.267 7.26 Valuation of IR Swaps Valuation in terms of FRAs – Each exchange in an IR swap is an FRA Note that for a newly issued IR swap, the first exchange of payments is known when the swap is negotiated For each of other exchanges, it can be regarded as a FRA applied for a future period of 6 months – Recall that for a FRA applied in (𝑇1 , 𝑇2 ], the payoff of the lender at 𝑇2 is 𝐿(𝑅𝐾 − 𝑅𝑀 ) 𝑇2 − 𝑇1 (see Slide 4.35), where 𝐿 is the principal, 𝑅𝐾 is the fixed IR specified in the FRA contract, and 𝑅𝑀 is the actual LIBOR in (𝑇1 , 𝑇2 ] – Considering a pay-floating-receive-fixed IR swap with the principal 𝐿, for each 6 months, the swap holder can receive the net payoff of 𝐿 𝑅𝐾 − 𝑅𝑀 ×0.5, where 𝑅𝑀 is the actual 6month LIBOR for that period and 𝑅𝐾 is the fixed IR specified in the swap contract 7.27 Valuation of IR Swaps – Note that the value of any derivatives equals the present value of it expected payoff This approach has been used to price FRA on Slide 4.38 To evaluate the expected payoff of an exchange in an IR swap, the expectation of the future LIBOR is needed 𝑒 −𝑅2 𝑇2 𝐸 𝐿 𝑅𝐾 − 𝑅𝑀 𝑇2 − 𝑇1 = 𝑒 −𝑅2 𝑇2 𝐿 𝑅𝐾 − 𝐸[𝑅𝑀 ] 𝑇2 − 𝑇1 = 𝑒 −𝑅2 𝑇2 𝐿[𝑅𝐾 𝑇2 − 𝑇1 − 𝐸[𝑅𝑀 ] 𝑇2 − 𝑇1 ] It is known that the expected future LIBORs equal the forward rates (𝑅𝐹 ) based on today’s term structure of IRs: Value of an exchange = 𝑒 −𝑅2 𝑇2 𝐿[𝑅𝐾 𝑇2 − 𝑇1 − 𝑅𝐹 𝑇2 − 𝑇1 ] = 𝑒 −𝑅2 𝑇2 𝐿(𝑅𝐾 − 𝑅𝐹 ) 𝑇2 − 𝑇1 ※ The above formula is identical to the FRA pricing formula on Slide 4.38 7.28 Valuation of IR Swaps – Consider the pay-floating-receive-fixed IR swap example on Slide 7.24. For per $100 principal, Time (yr) Fixed CF Expected floating CF Expected net CF Discount factor PV of expected net CF 0.25 $4 $5.100 –$1.100 0.9753 –$1.073 0.75 $4 $5.522* –$1.522 0.9243 –$1.407 1.25 $4 $6.051** –$2.051 0.8715 –$1.787 –$4.267 Total ∗ 𝑅𝐹 = 10.5%×0.75−10%×0.25 0.5 = 10.75% (cont. comp.) ⇒ 11.044% (semi-annual comp.) Expected cash outflow at 𝑡 = 0.75 is $100 × 11.044% × 0.5 = $5.522 ∗∗ 𝑅𝐹 = 11%×1.25−10.5%×0.75 0.5 = 11.75% (cont. comp.) ⇒ 12.102% (semi-annual comp.) Expected cash outflow at 𝑡 = 1.25 is $100 × 12.102% × 0.5 = $6.051 7.29 Valuation of IR Swaps An IR swap is worth zero when it is first initiated – When a swap contract is first negotiated, the swap rate is determined such that the value of the swap is zero initially This feature is similar to set the delivery prices of futures contracts to be the futures prices such that the futures contracts are worth zero when they are initiated – With the passage of time, the value of an IR swap emerges and can be either positive or negative One party’s gains are the other party’s losses, so two parties of a swap have opposite points of view on the swap value 7.30 Valuation of IR Swaps – Although the swap is zero initially, it does not mean that the value of each individual FRA is zero initially The initial zero value of a swap actually means that the sum of the values of all FRAs underlying the swap is zero For a pay-fixed-receive-floating swap on the issue date, – If the zero curve is upward sloping forward rates ↑ with T The forward rates with shorter time to maturities < the swap rate negative values for FRAs with shorter time to maturities The forward rates with longer time to maturities > the swap rate positive values for FRAs with longer time to maturities – If the zero curve is downward sloping forward rates ↓ with T The forward rates with shorter time to maturities > the swap rate positive values for FRAs with shorter time to maturities The forward rates with longer time to maturities < the swap rate negative values for FRAs with longer time to maturities 7.31 Determine LIBOR Zero Curve with Eurodollar Futures and Swaps Construct the LIBOR zero curve (Note that derivatives traders commonly use LIBOR as proxies for risk-free rates when trading derivatives) – 𝑇 < 1: the quotes of spot LIBOR (given different 𝑇) provided by financial institutions are used – 𝑇 in [1,2] (sometimes [1,5]): the quotes of Eurodollar futures are used to derive the LIBOR zero rates Suppose the zero rate 𝑅1 for 𝑇1 is known With the convexity adjustment, the forward rates (𝑅𝐹 ) for [𝑇1 , 𝑇2 ] can be derived from the futures rates implied from the quotes of Eurodollars futures Finally, we can deduce 𝑅2 through 𝑅𝐹 = 𝑅2 𝑇2 −𝑅1 𝑇1 𝑇2 −𝑇1 ⇒ 𝑅2 = 𝑅𝐹 𝑇2 −𝑇1 +𝑅1 𝑇1 𝑇2 7.32 Determine LIBOR Zero Curve with Eurodollar Futures and Swaps – For longer 𝑇: the quotes of swap rates are used to derive the LIBOR zero rate Consider a pay-floating-receive-fixed IR swap with the swap rate of 5%, principal of $100, and 2 years to maturity Suppose the 6-month, 12-month, and 18-month LIBOR zero rates are 4%, 4.5%, and 4.8% with cont. compounding Since the initial value of a swap is zero, then 𝑉swap = 𝐵fix − 𝐵fl = 𝐵fix − $100 = 0 and thus $2.5𝑒 −4%∙0.5 + $2.5𝑒 −4.5%∙1 + $2.5𝑒 −4.8%∙1.5 + $102.5𝑒 −𝑅∙2 = $100 Solve for the 2-year LIBOR zero rate to be 4.953% The above equation also demonstrates a swap rate equals a par yield ※Similar to the bootstrap method, LIBOR rates for shorter 𝑇 should be solved first before solving LIBOR rates for longer 𝑇 7.33 Overnight Indexed Swaps (OISs) An OIS is a swap where a fixed rate for a period is exchanged for the geometric average of the overnight rates during the period – The fixed rate is referred to as the OIS rate, which is determined such that an OIS is worth zero initially – OISs tend to have short lives (≤ 3 months) – Longer-term OISs are typically divided into threemonth sub-periods At the end of each sub-period, the net of the actual geometric average of the overnight rates during the sub-period and the fixed OIS rate will be exchange – Should the 3-month OIS rate equal the 3-month LIBOR rate? 7.34 Overnight Indexed Swaps (OISs) 1. Borrow $100 in the overnight market for 3 months (92 days for example), rolling the interest and principal on the loan forward each night (pay the geometric average of the overnight rates) 2. Enter into an OIS to convert the geometric average of the overnight rates to the 3-month OIS rate 3. Lend the borrowed $100 to another AA-rated financial institution for three months at LIBOR ※ Final payoff = $100 × (92/365) (LIBOR − OIS rate) > 0 – Thus, the OIS rate is lower than the LIBOR This is because OIS rate is a continually refreshed overnight rate (always lend or borrow daily with AA financial institutions) To earn 3-month LIBORs, the bank will bear the default risk of its trading counterparty, which is rated AA initially The OIS rate is even closer to the risk-free interest rate 7.35 Overnight Indexed Swaps (OISs) – In practice, many derivatives dealers choose to use OIS rates for discounting collateralized transactions (less risky) and use LIBORs for discounting noncollateralized transactions (more risky) – The (LIBOR – OIS) spread Defined as the 3-month LIBOR rate over the 3-month OIS rate Can be used to measure the degree of stress in financial markets – In normal market condition, this spread is about 10 basis points – In Oct. 2009, this spread spiked to an all-time high of 364 basis points because banks are reluctant to lend to each other for threemonth periods – In Dec. 2011, due to the concern of the crisis in Greece, this 7.36 spread rose to 50 basis points Determine Zero Curve Using OISs Similar to the method for constructing the LIBOR zero curve, we can derive zero curve using OIS quotes – 𝑇 < 3 months: the quotes of OIS rates provided by financial institutions are used – For a longer 𝑇 (when there are periodic settlements (usually every 3 months) in OIS contracts) The OIS rate approximately defines a par yield bond For a 1.25-year OIS contract with the OIS rate to be 4%, it can be regarded as a bond paying a quarterly coupon at a rate of 4% per annum and sold at par Suppose the 3-, 6-, 9-, and 12-month OIS zero rates are 3%, 7.37 3.5%, 4%, and 4.5% with continuous compounding Determine Zero Curve Using OISs This OIS contracts implies that $1𝑒 −3%∙0.25 + $1𝑒 −3.5%∙0.5 + $1𝑒 −4%∙0.75 + $1𝑒 −4.5%∙1 +$101𝑒 −𝑅∙1.25 = $100 Solve for the 1.25-year OIS zero rate to be 3.9798% – For a 𝑇 is so long such that the quotes of OIS rates are not available or unreliable, e.g., 𝑇 > 5 years Note that LIBOR IR swaps are traded for longer maturities than OIS Assume the (LIBOR – OIS) spread is constant and as it is for the longest OIS maturity for which there is reliable data, e.g., the 5-year OIS contract and the corresponding (LIBOR – OIS) spread is 20 basis points Use the LIBOR zero curve minus the constant (LIBOR – OIS) 7.38 spread to derive the OIS rate zero curve 7.2 Currency Swaps 7.39 Currency Swap Currency swap is another popular type of swaps – It involves exchanging principal and interest payments in one currency for principal and interest payments in another currency Different from IR swaps, the principal amounts (in different currencies) are exchanged at the beginning and at the end of the life of a currency swap The principal amounts are chosen to be approximately equivalent using the exchange rate at the swap’s initiation – An example of a currency swap: IBM pays 5% on a principal of £10,000,000 and receive 6% on a principal of $15,000,000 from British Petroleum (BP) 7.40 every year for 5 years Currency Swap £10 mil. Year Dollar CF for IBM (millions) Sterling CF for IBM (millions) 2013 –15.00 +10.0 2014 +0.90 –0.5 2015 +0.90 –0.5 2016 +0.90 –0.5 2017 +0.90 –0.5 2018 +15.90 –10.5 BP IBM $15 mil. Dollar 6% BP IBM Sterling 5% $15 mil. BP IBM £10 mil. ※ A currency swap can be regarded as two concurrent loans denominated in different currencies ※ The values of $15 mil. and £10 mil. are set to be equivalent initially ⇒ Two parties lend equivalent amount of loans to each other ⇒ The net value of the currency swap is zero initially 7.41 Currency Swap Typical uses of a currency swap is to – Convert a liability in one currency to a liability in another currency Dollar 6% Dollar 6% BP IBM Sterling 5% Sterling 5% – Convert an investment in one currency to an investment in another currency Dollar 6% BP IBM Sterling 5% Dollar 6% Sterling 5% 7.42 Comparative Advantage Arguments for Currency Swaps The comparative advantage argument explains the popularity of the currency swaps – General Electric (GE) prefers to borrow AUD and Qantas Airways (QA) prefers to borrow USD – The USD and AUD borrowing IRs they face are USD AUD General Electric 5.0% 7.6% Qantas Airways 7.0% 8.0% ※GE has a comparative advantage in the USD market, whereas QA has a comparative advantage in the AUD market 7.43 Comparative Advantage Arguments for Currency Swaps Exploit the comparative advantage with currency swaps – Suppose that GE intends to borrow 20 mil. AUD and QA intends to borrow 15 mil. USD, and the current exchange rate is 0.75USD per AUD – GE borrows USD, QA borrows AUD, and they use currency swaps to transform GE’s USD loan into a AUD loan and QA’s AUD loan into a USD loan USD 6.3% USD 5.0% USD 5.0% QA F.I. GE AUD 6.9% AUD 8.0% AUD 8.0% ※GE pays 6.9% in AUD (0.7% better off) and QA pays 6.3% in USD (0.7% better off) 7.44 Comparative Advantage Arguments for Currency Swaps – Different ways to arrange the currency swaps 1. QA bears some foreign exchange risk USD 5.2% USD 5.0% USD 5.0% QA F.I. GE AUD 8.0% AUD 6.9% AUD 6.9% 2. GE bears some foreign exchange risk USD 6.3% USD 6.1% USD 5.0% QA F.I. GE AUD 8.0% AUD 8.0% AUD 8.0% ※ These two alternatives are unlikely to be used in practice because the firms prefer to eliminate the foreign exchange risk with currency swaps thoroughly 7.45 Valuation of Currency Swaps Like IR swaps, currency swaps can be valued either as the difference between 2 bonds or as a portfolio of forward contracts – Valuation in terms of bond prices For a receive-dollar-pay-foreign-currency currency swap, then 𝑉swap = 𝐵𝐷 − 𝑆0 𝐵𝐹 , where 𝐵𝐷 is the domestic bond defined by the remaining USD CFs, 𝐵𝐹 is the bond defined by the remaining foreigncurrency CFs, and 𝑆0 is the spot exchange rate (expressed as dollars for per unit of foreign currency) In contrast, for a pay-dollar-receive-foreign-currency currency swap, then 𝑉swap = 𝑆0 𝐵𝐹 − 𝐵𝐷 7.46 Valuation of Currency Swaps An example for pricing currency swaps – All Japanese LIBOR zero rates are 4% (foreign IR) – All USD LIBOR zero rates are 9% (domestic IR) – A currency swap is to received 5% in yen and pay 8% in dollars. Payments are made annually – Principals are $10 million and 1,200 million yen – Swap will last for 3 more years – Current exchange rate is 110 yen per dollar 7.47 Valuation of Currency Swaps Time (yr) Cash Flows of 𝑩𝑫 (million $) PV of 𝑩𝑫 (million $) Cash flows of 𝑩𝑭 (million yen) PV of 𝑩𝑭 (million yen) 1 0.8 (=10×8%) 0.7311 60 (=1,200×5%) 57.65 2 0.8 (=10×8%) 0.6682 60 (=1,200×5%) 55.39 3 0.8 (=10×8%) 0.6107 60 (=1,200×5%) 53.22 3 10 7.6338 1,200 1,064.30 Total 9.6439 ※𝑉swap = 𝑆0 𝐵𝐹 − 𝐵𝐷 = 1,230.55 − 110 1,230.55 9.6439 = 1.543 (million $) 7.48 Valuation of Currency Swaps – Valuation in terms of forward contracts Each exchange of payments in a fixed-for-fixed currency swap is a foreign exchange (FX) forward contract – FX forwards is an agreement to trade an amount of a foreign currency at the specified price on a predetermined future date – FX forwards are similar to the foreign currency futures contracts (introduced in Ch. 5) except that FX forwards are traded in OTC markets and thus there is no daily settlement requirement – Suppose the principal is 𝐿 and the specified trading price is 𝐾 (expressed as domestic dollars / per foreign dollar) – Payoff of a FX forwards to purchase the foreign currency at 𝑇 is 𝐿(𝑆𝑇 − 𝐾), where 𝑆𝑇 is the domestic-dollar price of the foreign currency (or the FX rate) at 𝑇 – Rewrite the payoff to be 𝐿𝑆𝑇 − 𝐿𝐾, which can be reinterpreted as buying 𝐿 units of a foreign currency (worth 𝑆𝑇 at 𝑇) with 𝐿𝐾 7.49 units of domestic dollars at 𝑇 Valuation of Currency Swaps – The value of a FX forward is the PV of its expected payoff 𝑒 −𝑟𝑇 𝐸 𝐿𝑆𝑇 − 𝐿𝐾 = 𝑒 −𝑟𝑇 (𝐿𝐸 𝑆𝑇 − 𝐿𝐾) – The forward (or futures) price of the foreign currency provide the unbiased approximation for 𝐸 𝑆𝑇 based on the information of IRs today – Since the forward price of the foreign currency is 𝐹0 = 𝑆0 𝑒 (𝑟−𝑟𝑓)𝑇 (introduced on Slides 5.23-5.24), we can obtain 𝐸 𝑆𝑇 = 𝐹0 = 𝑆0 𝑒 𝑟−𝑟𝑓 𝑇 – Thus, the value of a FX forward is 𝑒 −𝑟𝑇 (𝐿𝐹0 − 𝐿𝐾) – The forward FX rates of Japanese Yen, 𝐹0 , in the example on Slide 7.47 are Time (yr) Forward FX rate ($/per Yen) 1 2 3 1 (9%−4%)∙1 𝑒 110 = 0.009557 1 (9%−4%)∙2 𝑒 110 = 0.010047 1 (9%−4%)∙3 𝑒 110 = 0.010562 7.50 Valuation of Currency Swaps – Take the first exchange in the currency swap for example: it can be regarded as a FX forward to purchase ¥60 million with $0.8 million – Value of the first exchange = 𝑒 −9%∙1 ¥60 ∙ 𝐸 𝑆1 − $0.8 = 𝑒 −9%∙1 ¥60 ∙ 0.009557 − $0.8 = −0.2071 (million $) Time Dollar CF Yen CF Expected future (yr) (mil. $) (mil. Yen) FX rate = forward FX rate Yen CF in dollar (mil. $) Net CF (mil. $) PV of net CF (mil. $) 1 –0.8 60 0.009557 0.5734 –0.2266 –0.2071 2 –0.8 60 0.010047 0.6028 –0.1972 –0.1647 3 –0.8 60 0.010562 0.6337 –0.1663 –0.1269 3 –10 1,200 0.010562 12.6746 +2.6746 +2.0417 Total +1.5430 7.51 7.3 Credit Risk of Swaps 7.52 Credit Risk Contracts such as swaps or forwards that are private arrangements between two parties entail credit risk – A swap is worth zero to both counterparties initially – At a future time point, its value is possible to be either positive or negative – A swap trader has credit risk exposure only when the value of its swap or forward position is positive The trading counterparty has the chance not to honor its losses, which results in the credit risk – Potential losses from defaults on a swap are much less than the potential losses from defaults on a loan with the same principal 7.53 Credit Risk Since the value of a swap is the difference between two concurrent bonds, the value of a swap is usually a small fraction of its notional principal – Potential losses from defaults on a currency swap are greater on an IR swap because the principal amounts in different currencies are exchanged at the end of the life of a currency swap – Credit vs. Market risks Credit risk arises from the possibility of a default, but the market risk arises from the changes of the market variables, such as IR and FX rates Market risks can be hedged by entering into offsetting contracts, but credit risks are more difficult to hedge 7.54 Credit Risk Credit default swaps (信用違約交換) (CDSs) – Invented by JPMorgan in 1997 – An insurance policy with payoffs depending on the occurrence of the default event of a corporate bond or loan – CDSs can shift the default risk from the protection buyer to the protection seller (see the next slide) – CDSs allow financial institutions to hedge credit risks in the same way that they have hedged market risks – The total size of outstanding CDS contracts reaches a peak of $63 trillion before the 2008-2009 credit crisis (US GDP is about $14 trillion per year) 7.55 Credit Risk ※ When the default event occurs, the protection seller should compensate the protection buyer any losses on principal in the default event ※ For the protection buyer, CDS provides insurance against the possibility that a borrower (the reference entity (參考實體)) might not pay ※ For the protection seller, CDS provides a way to earn profits by bearing default risk without ever holding the credit instrument physically 7.56 7.4 Other Types of Swaps 7.57 Other Types of Swaps Variations on IR swaps – The tenors (i.e., the payment frequency) for the floating- and fixed-rate sides could be different – Other floating rates, like the commercial paper rate, could be used – Amortizing (攤銷) (or step up) swaps The principal reduces (or increases) in a predetermined way – Deferred swaps Also known as the forward-start swap, where the parties do not begin to exchange interest payments until some future date 7.58 Other Types of Swaps – Constant maturity swaps (CMS swaps) An agreement to exchange a LIBOR + spread (or a fixed rate) for a fixed-maturity swap rate (constant maturity side) For example, exchange the 6-month LIBOR + 0.1% (or 5.5%) for 10-year swap rates every 6 months for the next 5 years – Constant maturity Treasury swaps E.g., exchange 6-month LIBOR + 0.15% for the 2-year Treasury par yield every 6 months for the next 3 years – Par yield: a coupon rate that causes the bond price to equal its face value – Compounding swaps Interest on one or both sides is compounded to the end of the life of the swap and thus there is only one payment at the end of the life of the swap 7.59 Other Types of Swaps – LIBOR-in-arrears (遞延) swaps The LIBOR observed on the payment date is used to calculate the payment on that date Note that for standard IR swaps, the 6-month LIBOR prevailing six months ago determines the current floating payment – Accrual (孳生) swaps The interest on one side accrues only when the floating reference rate is in a certain range For example, when the LIBOR rates are between [1%,2%], the floating interest payments should be exchanged 7.60 Other Types of Swaps Other currency swaps – Fixed-for-floating currency swaps A LIBOR in one currency is exchanged for a fixed rate in another currency A combination of a fixed-for-floating IR swap and a fixedfor-fixed currency swap It is also known as a cross-currency interest rate swap – Floating-for-floating currency swaps A LIBOR in one currency is exchanged for a LIBOR in another currency A combination of two fixed-for-floating IR swaps and a fixed-for-fixed currency swap 7.61 Other Types of Swaps – Differential Swaps For example, for an amount of notional principal in USD, exchange LIBOR in USD with LIBOR in yen Note that the theoretically LIBOR in yen should be applied to the principal in yen rather than the principal in USD It is also known as quanto swap Other types of swaps – Equity swaps Exchange the total return (dividends plus capital gains) realized on an equity index for either a fixed or a floating IR Used by portfolio managers to purchase a series of equity index returns with a fixed or floating IR Useful to escape from the capital controls of some nations 7.62 Other Types of Swaps – Commodity swaps An agreement where a floating (or market or spot) price based on an underlying commodity is exchanged for a fixed price for a following period It can be decomposed into a series of forward contracts on a commodity with different maturity dates and identical delivery price – Volatility swaps At the end of each reference period, one side pays a preagreed volatility, e.g., 20%, and the other side pays the actual volatilities of the underlying variable, e.g., 23%, in the past reference period Both volatilities are multiplied by the same notional principal in calculating payments 7.63