adms3531_-_lecture_3_-_pa

advertisement

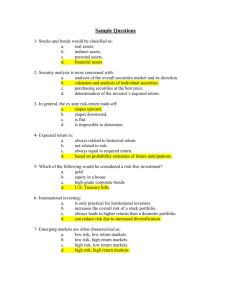

Personal Investment Management ADMS 3531 - Fall 2011 – Professor Dale Domian Lecture 3, Part 1 – The Stock Market – Sept 27 Chapter Six Outline - The primary and secondary stock markets. The New York Stock Exchange. The Toronto Stock Exchange and TSX Venture Exchange. Nasdaq Third and Fourth Market. Stock Market Information. The Stock Market - ‘Big picture’ overview of: o Who owns stocks. o How a stock exchange works, and o How to read and understand the stock market information reported in the financial press. The Primary Stock Markets - The primary market is the market where investors purchase newly issued securities. o Initial public offering (IPO) – An initial public offer occurs when a company offers stock for sale to the public for the first time. The Secondary Stock Markets - The secondary market is the market where investor’s trade previously issued securities. An investor can trade: o Directly with other investors. o Indirectly through a broker who arranges transactions for others. o Directly with a dealer who buys and sells securities from inventory. The Primary Market for Common Stock - An IPO involves several steps. Company appoints investment banking firm to arrange financing. o Investment banker designs the stock issue and arranges for fixed commitment or best effort underwriting. - o Company prepares a prospectus (usually with outside help) and submits it to securities and exchange commissions for approval. o Investment banker circulates preliminary prospectus (red herring). Upon obtaining approval, company finalizes prospectus. Underwriters place announcements (tombstones) in newspapers and begin selling shares. The Secondary Market - The bid price: o The price dealers pay investors. The ask price: o The price dealers receive from investors. The difference between the bid and ask prices is called the bid-ask spread, or simply spread. Most common stock trading is directed through an organized stock exchange or trading network. Whether a stock exchange or trading network, the goal is to match investors wishing to buy stocks with investors wishing to sell stocks. The New York Stock Exchange - The New York Stock Exchange (NYSE), popularly known as the Big Board, celebrated its bicentennial in 1992. The NYSE has occupied its current building on Wall Street since the turn of the century. The NYSE has 1,366 exchange members. NYSE-Listed Stocks - In 2003, stocks from about 2,800 companies were listed, with a collective market value of about $15 trillion. An initial listing fee, as well as annual listing fees, is charged based on the number of shares. In 2003, the average stock trading volume on the NYSE was just over 1 billion shares a day. The Toronto Stock Exchange - The Toronto Stock Exchange started its operations in 1861 with 18 securities and 14 member firms. - - - The initial members paid $250 to purchase a seat at that time. In 1901, the price of a membership rose to $12,000 and trading volume became approximately 1 million shares per year. To be listed on the Toronto Stock Exchange, technology companies must have at least one million free shares with total market value of $4 million or $10 million. These shares must be held by at least 300 public shareholders. In 1999, the Canadian exchanges were restructured and the Toronto Stock Exchange became the major stock exchange for trading senior equities. TSX Venture Exchange - Small and emerging Canadian companies are listed at the TSX Venture Exchange. Majority of the listed companies are mining, oil and technology companies. New companies seeking access to venture capital market prefer TSX venture exchange. As companies get bigger they apply to be listed on senior exchanges. Companies are listed in three different tiers at TSX venture exchange. Each tier has different listing requirements. Firms can use the following ways to be listed on TSX venture exchange: o Initial public offering. o Reverse takeover. o The capital pool company program. o Currently, there are more than 2500 companies listed at TSX venture exchange. Nasdaq - - The name ‘Nasdaq’ is derived from the acronym NASDAQ, which stands for National Association of Securities Dealers Automated Quotations system. Introduced in 1971, the Nasdaq market is a computer network of securities dealers who disseminate timely security price quotes to Nasdaq subscriibers. There are two key differences between the NYSE and Nasdaq: o Nasdaq is a computer network and has no physical location where trading takes place. o Nasdaq has a multiple market maker system rather than a specialist system. Like NYSE specialists, Nasdaq market users use their inventory as a buffer to absorb buy and sell order imbalances. Nasdaq is often referred to as an OTC market. An Over –the-counter (OTC) market is a securities market in which trading is almost exclusively done through dealers who buy and sell for their own inventories. Nasdaq is actually made up of two separate markets, the Nasdaq National Market (NNM) and the Nasdaq SmallCap Market. - In 2001, trading volume on the Nasdaq was 471 billion shares, compared to 308 billion shares at the NYSE. Market value of Nasdaq firms was $3 trillion, compared to $15 trillion for the NYSE. Nasdaq Participants - In 2003, there were about 500 competing Nasdaq dealers (market makers), which amounts to about 15 or so per stock. In the late 1990s, the Nasdaq system was opened to the election communications network (ECNs). o ECNs are websites that allow individual investors to trade directly with one another. o ECN orders are transmitted to the Nasdaq and displayed along with market maker prices. Third and Fourth Market - The third market is an off-exchange market for securities listen on an organized exchange. The fourth market is for exchange-listed securities in which investor’s trade directly with one another, usually through a computer network. For dually listed stocks, regional exchanges also attract substantial trading volume. Stock Market Indexes - - Indexes can be distinguished in four ways: o The market covered, o The types of stocks included, o How many stocks are included, and o How the index is calculates (price-weighted, e.g. DJIA, versus value-weighted, e.g. S&P 500). For a value-weighted index (i.e., the S&P 500), companies with larger market values have higher weights. For a price-weighted index (i.e., the DJIA), higher priced stocks receive higher weights. o This means stock splits cause issues. o But, stock splits can be addressed by adjusting the index divisor.