Spring, 2016 ECON 445 Quiz #2 Fill the blanks or choose the

advertisement

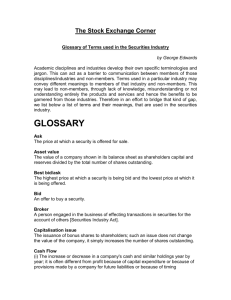

Spring, 2016 ECON 445 Quiz #2 Fill the blanks or choose the correct word. Each blank is worth 2 points unless specified otherwise. [1] (a) The financial market plays four important roles in economy: Informational role, consumption smoothing, (allocation of risk), and separation of ownership and management. One of the benefits of the last role is the stability of the management of firms. However, it also causes the (principal-agent) problem. To avoid this problem, salaries of managers are often tied to the profits of the company. This gives strong incentives to the managers to focus on the (short-run, long-run) profits, and to falsify the profits. One example is the case of (Enron) corporation whose managers moved debts into special purpose entities to make the corporation look more profitable. Another example is the telecommunication company (WorldCom). The managers of this company reported the line cost, which is the interconnection expense with other telecommunication companies, as capital investment on the balance sheet. (b) Financial intermediaries include depositary banks, investment companies and investment bankers. Investment companies such as mutual fund companies pool the fund from many investors and manage the funds for investors. The investment bankers specialize in the IPO, which stands for the (Initial Public Offering), in the primary market of equities or bonds by “underwriting” new issues of securities. Underwriting means that a syndicate of banks, who are called the lead managers, have taken on the risk of distributing the securities. If they are unable to find enough investors, they will have to (return unsold shares to the company, hold unsold shares themselves). They offer advices on the price of the new security. (c) One of the recent trend in the financial market is the globalization. If U.S. investors want to invest in foreign companies, they can buy ADR, which stands for (American Depository Receipt), instead of buying the shares of foreign companies whose prices in dollars are subject to the (exchange) rate risk. To overcome this, a broker purchases a block of foreign shares, deposits them in a (trust) and issues ADRs in the U.S. They are traded in (dollars, foreign currency) in the US market, and holders of the ADR receive dividends in (dollars, foreign currency). The WEBS, which stands for the (World Equity Benchmark Shares), are the same as ADRs, but are for portfolios of stocks. (d) Securitization is the process of creating securities by pooling together various financial assets that generate (cash-flows). Examples of such financial assets are (home mortgages), (auto loans), and etc. These securities are then sold to the investors. One of these securities is the MBS, which stands for the (Mortgage Backed Securities) and played a significant role in the recent financial crisis. [2] An example of equity securities is the common stock. It represents a share of ownership of the company and they are traded in stock markets. The largest stock markets in the U.S. are the (New York) stock exchange, (American) stock exchange, and the NASDAQ which stands for the (National Association of Securities Dealers Automatic Quotations). There are many stock market indexes that represent the overall performance of various stocks. The most prominent three indexes are the DJIA, (S&P 500), and (NASDAQ) composite indexes. The DJIA stands for the (Dow Jones Industrial Average) and the DJIA index is the price weighted index of (30) largest companies (so called the large cap companies). [3] There are two types of orders in transactions of stocks. One is called the (market) order which is executed immediately at the current market price. Another type is called the (price contingent) order. This type of order specifies the price at which transactions will be executed. You may place a ‘stop-loss order’ which instructs the broker to sell if price falls below a specific price (this is used to prevent further losses). A ‘stop-buy order’ instructs the broker to sell if price rises above a specific price. This can be used to cover short sales. You may also ask the broker to buy the stock if the price is at or below a specified price. This type of order is called the (limit buy) order. A (limit sell) order instructs the broker to sell if price is at or above a specified price. [4] The take home part of Quiz 1 is posted at the class website. Complete it and email it to the TA (dongnizhu@tamu.edu) by 5 p.m. on Friday. You may work on it alone, or work with another student and submit one file with two names. One file cannot have more than two names. If two names appear, the proportion of each student’s contribution must be specified.