Hedge Fund - Pulp Fusion

advertisement

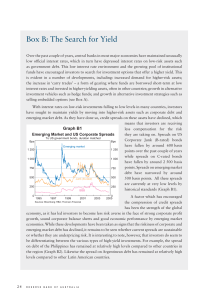

THE STRUCTURE AND OPERATIONS OF HEDGE FUNDS First Hedge Fund Formed by Alfred Winslow Jones in 1949 Started with $100,000 Between 1955-1965 had returns of 670% Primarily long positions, but also short Black Box Funds Esoteric Portfolio Theory Highly complex mathematical formulas Computer driven Quants Hedge Fund a private investment vehicle that engages in the active trading of various types of securities and commodities, employ sophisticated investment techniques, such as arbitrage, leverage, and hedging and whose structure and operations are designed to promote the goal of absolute returns. Pooled/Partnerships of Investment advisors registered with the Securities & Exchange Commission Frequently invested in one or more upper tier partnerships Low turn over of investments Low turn over of partners and partners are often committed to additional contributions There are usually no distributions until investment in upper tier is sold Long Term Capital When Genius Failed by Roger Lowenstein Players James Simons John Paulson Former Math Professor Code Breaker for Department of Defense Uses computer driven models to detect pricing anomalies in stocks, commodities, futures, and options Charges 5 and 44 Earns over 20% for his partners over a multi-year period Worked in mergers & acquisitions at Bear Stearns Founded his own hedge fund with $2 million and 2 employees Under his direction, Paulson & Co. capitalized on the problem in the foreclosure and mortgage backed securities market In 2007 alone his firm earned $15 billion! He personally made $3.7 billion In 2008, his firm hired former Fed Chairman, Alan Greenspan Management Fee % of total assets in fund usually 2% Incentive Fee % of net income – usually 20% High water mark – Meaning no compensation for manager if he/she has net income in year one but, falls behind in year 2, than no more incentive until he gets back to where he was. High water mark may only apply for 2 years Absolute Return Strategy vs. Relative Return Strategy Relative is relative to something else, i.e., Standard & Poors You can’t eat relative returns! Absolute returns stand alone Alpha producing returns not tied to an index Four Primary Characteristics Organized as partnerships with the General Partner having a significant investment Managers are compensated based on fund performance Investors purchase interest in fund for a % of a fund profit. Interests are significant, restricted transferability and limited redemption Provide liquidity and capital to the market place • A role that has been vacated by the large brokerage firms as they have shut down their proprietary trading desks Limited Partnerships/LLC Fees typically are 2 and 20 Normally utilize a high water mark or hurdle rate Claw back provision No rules Unlimited types of investments Shorts permitted Margins permitted Limited redemption opportunities Governed by the partnership agreement Approximately 8,000 hedge funds with more than $2.68 trillion currently Types of Funds Fund of Funds Master Feeder Funds • Assets are pooled into one account and managed as a single portfolio • Profits and losses are allocated on where funds come from (capital contributions/distributions) 3(c)(7) Fund– under 500 investors, limited to only qualified investors (investors with over $5 million in liquid, investable assets) 3(c)(1) Fund– under 100 investors and limited to 35 non-accredited sophisticated investors (accredited investors have excess of $200,000 of annual income or a minimum of $1 million in net worth exclusive of Primary residence Except for the exemption under Sec. 3(c)(1) or Sec. (c)(7) above, hedge funds would fall under the regulations for regulated investment companies Entry normally limited to yearly, quarterly, or monthly per partnership agreement Sold through a private placement memorandum Partnership Agreement Subscription Agreement Administration/Operations Prime Broker • Execution of trades done monthly through trading screens piped through the internet to a broker • Provides portfolio reporting, securities lending, office space, technology help, leverage, etc. Hedge Fund Hotels • Could be the prime broker or a non-clearing broker • Provides office space, computer, and the rest of build out in the office quarters Administrator Provide general ledger accounting The allocation of income and expenses and gains and losses to the partners Calculation of management and incentive fees, highwater-marks and hurdle rates There is an interface between what the prime broker provides and what the administrator provides • The prime broker often provides a special trade date run that complies with U.S. GAAP Accounting Break Period • Occurs as partners ownership percentages changes through purchases and redemptions Aggregate Method vs. Layering Method • The Aggregate Method does not take into account each partners individual portion of unrealized gain or loss for each security held by the fund Allocations are based on the unrealized gain or loss of the partnership’s securities as a whole • The Layering Method accounts for each partner’s share of unrealized gain or loss generated on each security over a period of time Rule 206(4), an investment advisor registered with the Sec and acting as general partner to a pooled investment vehicle, such as a hedge fund, and has custody of the client’s assets is subject to this rule. 1 Must maintain client’s funds and securities with a qualified custodian Must be audited annually Must distribute audited U.S. GAAP financial statements to all investors within 120 days of the end of the fiscal year or 180 days for Fund-of-Funds Must have a compliance officer 1 Hedge funds must register with the Securities and Exchange Commission when they have $100 million in assets.