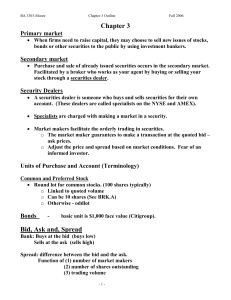

Security market

advertisement

Investment and Risk Analysis Chapter Two Securities Market Slides Prepared By Mohd. Mohsin, Assistant Professor of Finance, IIUC Three interrelated reasons for constructing global investment portfolios When investors compare the absolute and relative sizes of domestic and foreign markets for stocks and bonds, they see that ignoring foreign markets reduces their choices to less than 50 percent of available investment opportunities. 2. The rates of return available on global securities often have substantially exceeded those for domestic securities. 1. 3. One of the major tenets of investment theory is that investors should diversify their portfolios. WHAT IS A MARKET? A market is the means through which buyers and sellers are brought together to aid in the transfer of goods and/or services. Several Aspects of Market Definition 1) A market need not have a physical location. It is only necessary that the buyers and seller can communicate 1) The market does not necessarily own the goods and services involved; the important criterion is the smooth ,cheap transfer of goods and services. 1) A market can deal any variety of goods and services Characteristics of Good Market 1. Timely and accurate information is available on the price and volume of past transactions and the prevailing bid and ask prices. 2. It is liquid, meaning an asset can be bought or sold quickly at a price close to the prices for previous transactions (has price continuity), assuming no new information has been received. In turn, price continuity requires depth. 3. Transactions entail low costs, including the cost of reaching the market, the actual brokerage costs, and the cost of transferring the asset. 4. Prices rapidly adjust to new information; thus, the prevailing price is fair because it reflects all available information regarding the asset. Organization of Securities Market PRIMARY CAPITAL MARKETS The primary market is where new issues of bonds, preferred stock, or common stock are sold by government units, municipalities, or companies to acquire new capital. Three Methods of Stock/ Bond Issues 1. Competitive bid sales typically involve sealed bids. The bond issue is sold to the bidding syndicate of underwriters that submits the bid with the lowest interest cost 2. Negotiated sales involve contractual arrangements between underwriters and issuers wherein the underwriter helps the issuer prepare the bond issue and set the price and has the exclusive right to sell the issue. 3. Private placements involve the sale of a bond issue by the issuer directly to an investor or a small group of investors usually institutions). The firm enjoys lower issuing costs because it does not need to prepare the extensive registration statement required for a public offering. return. In fact, the institution should require a higher return because of the absence of any secondary market for these securities, Best Effort :Investment banker acts as broker 4. Underwriting Function The underwriting function can involve three services: origination, risk bearing, and distribution. 1. Origination involves the design of the bond issue and initial planning. 2. The risk bearing function involves the underwriter acquires the total issue at a price dictated by the competitive bid or through negotiation and accepts the responsibility and risk of reselling it for more than the purchase price. 3. Distribution means selling it to investors, typically with the help of a selling syndicate that includes other investment banking firms and or commercial banks. Underwriting Continued------- Corporate Stock Issues For corporations, new stock issues are typically divided into two groups: (1) seasoned equity issues : Seasoned equity issues are new shares offered by firms that already have stock outstanding. (2) Initial public offerings (IPOs) : Initial public offerings (IPOs) involve a firm selling its common stock to the public for the first time. SECONDARY FINANCIAL MARKETS Secondary markets permit trading in outstanding issues; that is, stocks or bonds already sold to the public are traded between current and potential owners. The proceeds from a sale in the secondary market do not go to the issuing unit (the government, municipality, or company) but, rather, to the current owner of the security. Three major segments Of Secondary Equity Markets: (1) the major national stock exchanges, including the New York, the Tokyo, and the London stock exchanges; (2) regional stock exchanges in such cities as Chicago, San Francisco, Boston, Osaka and Nagoya in Japan, and Dublin in Ireland; and (3) the over-the-counter (OTC) market, which involves trading in stocks not listed on an organized exchange. Third Market & Fourth Market Third market describes OTC trading of shares listed on an exchange. Although most transactions in listed stocks take place on an exchange, an investment firm that is not a member of an exchange can make a market in a listed stock. Fourth market describes direct trading of securities between two parties with no broker intermediary. In almost all cases, both parties involved are institutions. Listing Requirements in DSE Application for listing as per Form I; (ii) Memorandum & Articles of Association; (iii) Copy of the Certificate of incorporation; (iv) Copy of the Certificate of Commencement of Business; (v) Copy of the Feasibility Report, in case of a new project; (vi) Copy of the certificate of registration of the industrial Units issued by the Council of Investment or any other competent authority; (vii) Copies of all material contracts and agreements entered into or exchanged with foreign participants, machinery suppliers and any other financial institutions; (viii) Copies of Letter (s) of Credit established in favour of Machinery Suppliers, if linked with the public issue; (ix) Copy of Consent order issued by the Commission; (x) Names of Directors along with directorship of other companies listed on the Exchange; i. Continued-------------------------(xi) Draft prospectus/Offer for sale; (xii) Auditors Certificate for the amount subscribed by the promoters/directors/subsidiaries/associates; (xiii) Copies of the agreements relation to issue to securities for consideration other than cash, if any; (xiv) Copy of underwriting agreement (if any); (xv) Statement of audited accounts for the last 5 years or for a shorter number of years if the company is in operation only for such shorter period; (xvi) Statement showing the cost of project and means of finance; (xvii) Copies of the approval of tax-holiday application under Ordinance, 1984; (xviii) Copies of the consent Letters from Bankers or Financial Institution to the Issues; (xix) Application for submission of Under of Undertaking and payment of fees as per Form II; (xx) Copy of approval of prospectus/offer for sale from Commission; and (xxi) Any other documents/material contract and such other particulars as may be required by the Exchange or by the Council and/or by the Commission; Exchange Membership Securities exchanges typically offer four major categories of membership: (1) Specialist, (2) Commission broker : are employees of a member firm who buy or sell for the customers of the firm. (3) Floor broker : Floor brokers are independent members of an exchange who act as brokers for other members. (4) Registered traders are allowed to use their memberships to buy and sell for their own accounts. Types of Orders Market Orders : The most frequent type of order is a market order, an order to buy or sell a stock at the best current price. Market orders provide immediate liquidity for someone willing to accept the prevailing market price. Example of Market Order Assume you are interested in General Electric (GE) and you call your broker to find out the current “market” on the stock. The quotation machine indicates that the prevailing market is 45 bid— 45.25 ask. This means that the highest current bid on the books of the specialist is 45; that is, $45 is the most that anyone has offered to pay for GE. The lowest offer is 45.25, that is, the lowest price anyone is willing to accept to sell the stock. If you placed a market buy order for 100 shares, you would buy 100 shares at $45.25 a share (the lowest ask price) for a total cost of $4,525 plus commission. If you submitted a market sell order for 100 shares, you would sell the shares at $45 each and receive $4,500 less commission. Limit Order------------------ Limit order specifies the buy or sell price.You might submit a bid to purchase 100 shares of Coca-Cola stock at $50 a share when the current market is 60 bid–60.25 ask, with the expectation that the stock will decline to $50 in the near future. A limit order can be instantaneous (“fill or kill,” meaning fill the order instantly or cancel it). Stop loss order A stop loss order is a conditional market order whereby the investor directs the sale of a stock if it drops to a given price. Example: Assume you buy a stock at 50 and expect it to go up. If you are wrong, you want to limit your losses. To protect yourself, you could put in a stop loss order at 45. In this case, if the stock dropped to 45, your stop loss order would become a market sell order, and the stock would be sold at the prevailing market price. Short Sales A short sale is the sale of stock that you do not own with the intent of purchasing it back later at a lower price. Specifically, you would borrow the stock from another investor through your broker, sell it in the market, and subsequently replace it at (you hope) a price lower than the price at which you sold it. Margin Transactions Margin transaction means leveraging the transaction. means the investor pays for the stock with some cash and borrows the rest through the broker, putting up the stock for collateral. Initial Margin: That part of transaction's value that a customer must pay to initiate the transaction Examples of Margin Transaction Assume you acquired 200 shares of a $50 stock for a total cost of $10,000. A 50 percent initial margin requirement allowed you to borrow $5,000, making your initial equity $5,000. If the stock price increases / decreases by 20 percent to $60 / $40 a share Required: i. Find the return on your investment if the share price increases / decreases by 20 %. ii. What would be the answer of requirement 1 if you have to pay 6% interest on your borrowed fund and $1000 commission on your transaction? Solution-------------------------- Continued------------- Maintenance margin, It is the required proportion of your equity to the total value of the stock; the maintenance margin protects the broker if the stock price declines. Margin call Call for more equity funds or additional cash from the broker as a result of the actual margin declining below the maintenance margin Examples of Margin Call SECURITY MARKET (Indicator Series)INDEXES It gives the answer to the question “What happened to the market today?” to investors Supply investors with a composite report on market performance USES OF SECURITY MARKET INDEXES Security market indexes are used: As benchmarks to evaluate the performance of professional money managers . To create and monitor an index fund . To measure market rates of return in economic studies . For predicting future market movements by technicians . As a proxy for the market portfolio of risky assets when calculating the systematic risk of an asset STOCK MARKET INDICATOR SERIES Three principal weighting series are used: (1) a price-weighted series, (2) a market-value-weighted series, and (3) an un weighted series, or what would be described as an equally weighted series. Price-Weighted Series A price-weighted series is an arithmetic average of current prices, which means that index movements are influenced by the differential prices of the components. Dow Jones Industrial Average(DJIA) is a price-weighted average of 30 large, well-known industrial stocks of US The DJIA is computed by totaling the current prices of the 30 stocks and dividing the sum by a divisor that has been adjusted to take account of stock splits and changes in the sample over time. Example of Price Weighted Series Market –Value-Weighted Series A market-value-weighted series is generated by deriving the initial total market value of all stocks used in the series (Market Value = Number of Shares Outstanding × Current Market Price). This initial figure is typically established as the base and assigned an index value (the most popular beginning index value is 100, but it can vary—say, 10, 50). Subsequently, a new market value is computed for all securities in the index, and the current market value is compared to the initial “base” value to determine the percentage of change, which in turn is applied to the beginning index value. Continued------- where: Index t = index value on day t Pt = ending prices for stocks on day t Qt = number of outstanding shares on day t Pb = ending price for stocks on base day Qb = number of outstanding shares on base day Continued--------------------------- Continued ------------------