How Securities Are Traded

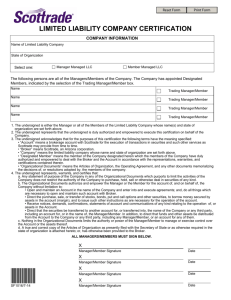

advertisement

How Securities Are Traded • Process of Securities Issue – New securities issued in a primary market such as NYSE – Initial Public Offer (IPO)/Seasoned Issues – IPOs are typically smaller firms, no public history – Bond issue: (1) public offer is sold to public and later traded; (2) private placement - sold to few institutional investor and then held until maturity •Underwriting –lead bank forms underwriting syndicate to share with other banks share the commitment, which can be firm commitment or best-efforts basis • Shelf Registration –in 1982, SEC passed Rule 415 that allows firms to register securities for a 2-year period and market them when needed • Underpricing – New issues are often underpriced – conflict of interest: a guarantee of issue success, less proceeds to issuing firm. Trading Places • Secondary Market – trading of existing securities – adds liquidity to primary market – all exchanges are in the secondary market – most US stocks are traded on the exchanges; most bonds are traded over-the-counter (OTC) market • OTC Market – a loosely organized network of dealers linked by a computer quotation system • Third Market – exchange-listed securities traded in OTC • Fourth Market – market where traders trade exchange-listed securities directly between themselves Trading Systems • Specialist System – A person in charge of 8-10 stocks and smoothes out the supply and demand of the stocks – specialist sometimes provides liquidity by buying/selling on his/her account – performs broker and dealer function – specialist system exists in NYSE • Market Maker System – a market maker quotes a bid-ask price for a stock in the market for other investors to buy/sell stock; – market maker takes risk – OTC market/FX market Trading on Exchanges • Trading Methods – Continuous Auction – Call Method • Settlement Method – exchange order must be settled within five business days; – often stock certificates are left with the brokerage firm, in street name. • Participants – commission broker (large retail brokerage firms’ employees) owns the largest seats, executes their clients’ orders – floor broker: independent broker and act for commission broker in trades – registered traders, execute their own portfolios and few in number – specialists • Types of Orders – market order: order to buy/sell at prevailing price – limit order: a order to buy/sell at a certain price or within a certain time period – stop-loss order: stop-loss order is an order to sell if the price falls below a certain level; a stop-buy order to buy if price is above a certain level --- these orders are accompanied by short sales. Buy <$40 Limit Buy >$50 Stop-buy order sell Stop-loss limit sell order Regulations of Stock Market • Securities Act of 1933 requires disclosure of new issues • Securities Act of 1934 established the SEC to enforce the 1933 act • Circuit Breakers: if DIJA falls below 250 pts from previous day close, trading halts for 1-hr and if 400 pts, trading halts for 2-hrs (also individual stock trading halts • Insider Trading Insiders are major shareholders, officers and directors. They must disclose their trades to the SEC, and cannot profit from insider information when trade •Margin Requirement Initial margin is the percentage (50%) of fund acquired from investor; the balance is borrowed from broker. It is set by Federal Reserve System. Maintenance margin (MM): the amount below which there will be margin call from brokers. It is set by NYSE and the brokerage firm. – Below MM: investor must either send in cash or sell the shares – Above MM: investor can (1) do nothing, (2) buy additional shares without paying, or (3) increase loan. No Margin buy: buy 100 shares @$50; sell them for $70 1-yr later Profit = $2000 (i.e., $20x100) Return = profit/initial investment = 2000/5000 = 40% Margin Buy: Purchase 200 shares @$50 (borrow $5000 @ 9%) Interest cost = $450 (i.e., 5000x9%) sell shares @$70 in 1-yr profit = $3,550 (i.e., ($70-50)x200 - $450) Return = profit/initial investment = 3550/5000 = 71% • Short Sales – allows investor to profit from stock price decline – uptick rule – Illustration: (1) You go short 100 Shares @$50, (2) MM =30%, (3) 50% IM (which means $2,500 cash deposited with broker). Your initial account at broker will be: Assets Proceed $5,000 Cash $2,500 $7,500 Liab & Equity Short $5,000 Equity $2,500 $7,500 IM = Equity/stock value = 2500/5000=0.5 MM= 0.3 = (Asset- liabilities)/liability = (7,500-100P)/100P P = $57.69 Mutual Funds • Mutual funds pool the funds of many investors and purchase securities in large blocks • Open-End Funds – Open-end funds are continuously issuing new shares, which sell at net asset value (NAV) plus commission (load), if any: NAV = MKT value of securities/#shares – load funds are purchased from a broker; no-load are purchased directly from the investment company and involve no commissions • Closed-End Funds – Do NOT issue new shares and trade at prices differing from NAV Cost/benefit of Mutual funds Advantag e• Diversification • • • • Professional management Small investment Switching privileges reinvestment of dividends and realized capital gains Disadvantage • commission may be high (including front-end load about 4-8.5%, a back-end load and operating expenses about 0.22% per year) • may not receive funds immediately upon selling of mutual funds Other Investment Cos • Unit investment Trusts pools of funds invested in portfolio that is fixed for the life of the fund • Commingled Funds These funds are managed by banks or insurance companies and pool retirement and trust accounts that are too small to be managed individually • Real Estate Investment Trust (REITs) similar to closed mutual funds, except that they invest in real estate (equity trusts) or in real estate mortgages (mortgage trusts) • Index Fund replicates broad market index Investment Concepts • Real vs Nominal Return (rate) 1 + R = (1+r)(1+inf) where R = Nominal rate (or interest rate) r = real rate inf= inflation rate R = r + inf + r*inf or R = r + inf (Fisher equation) Interest Rate vs Inflation • To test if Treasury bill is a good proxy for inflation, i.e, it is tested against the Fisher effect, (i.e., one-to-one relationship with inflation rate) • R = a + b(inflation) + e where R is the nominal Tbill rate a is the intercept e is the residual (error) term Ho : b =1 (null hypothesis) Stock Return vs Inflation • R = (P1 - P0 + cash dividend)/P0 where P1 is the ending period price P0 is the beginning price R = return (or HPR) Suppose the price of share is currently $100, in one-year, you received $4 dividend and the year-end price is $110, then: R = (110 - 100 + 4)/100 = 14% • In hypothesis testing for equity return, the null hypothesis (one-one relationship between return and inflation) is generally rejected, i.e., R = a + b(inf) + e Some basic concepts • Risk premium= expected return - riskfree rate • Excess return = actual return - riskfree rate • Hedging is investing in an asset that can reduce the overall risk of the portfolio • Statistical definition of return and risk Mean and Variances • Expected return E(R) = p1R1 + ... + pnRn where p is the probability at state i R is the return • Variance (var): pi(Ri-E(R))2+...+ pn(Rn-E(R))2 • Sample statistics (mean and var) R = (R1+...+Rn)/n s2 = [(R1-R)2+...+(Rn-R)]2/n Covariance (i.e., cov(x,y)) = [(Rx,1-Rx)(Ry,1-Ry)+... (Rx,n-Rx)(Ry,n-Ry)]/(n-1) Correlation coefficient = cov(x,y)/sxsy where correlation coefficient is between -1 and +1, a standardized measure of relationship between two variables, x and y. Return x y time Risk vs Return Intuition tells us that higher risk means higher return Return Risk (s2 or s)