Matt_resume2013 - Jesuit Schools Network

advertisement

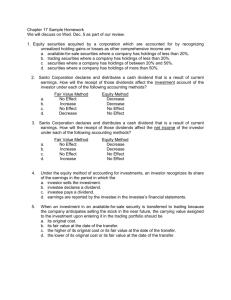

Matthew F. Favata 130 Vernon Avenue Rockville Centre, New York 11570 (516) 665-2200 (646) 398-3600 Email address: matthew.favata@gmail.com OBJECTIVE Apply my management skills, diverse work experience, and education in a new opportunity. EXPERIENCE UBS Securities LLC, UBS Investment Bank, Stamford, CT Regional Head of Cash Equity and Fixed Income Client Support; Options Clearing; Syndicate Operations Manage teams of 16 onshore and 20 offshore. Responsible for trade allocation / confirmation and processing risk management across global cash product from deal issuance through settlement. Oversee Options Clearing process. Implement and oversee confirm delivery solutions across all relevant STP platforms including Omgeo, FIX, and Swift, leveraging and building vendor relationships to accommodate complex client demands. Developed business case and executed plan to create a Fixed Income Client Support team, absorbing functions from Front Office. Identified, prioritized and executed technology and process changes improving Omgeo Benchmarks performance by 75% in six months. Offshored core functions in Equity and Fixed Income Client Support, reducing onshore headcount by 40%. Created and manage confirm control framework for fixed income and cash equity securities. Led review and re-architecture of 15A-6 process for Cash Equity Operations. Created client account remediation strategy for Market Access & Large Trader ID. Drove requirements for Straight Through Processing Account Initiative providing global process efficiency. Implemented vendor process for 10b-10 confirm suppression. Manage Zyen strategy in partnership with CRM; represent UBS Operations at industry forums. Manage regional office staff in San Francisco, Chicago and Boston. Morgan Stanley and Co., Inc., New York, N.Y. 2010-Present 1998-2010 Institutional Listed Derivatives Client Service – Vice President (June 2001 – August 2010) Manage four direct reports, including two managers, in the support of twenty traders and salespeople. Extensive product knowledge of U.S. and foreign listed options, common stock, and option strategies. Oversaw trade allocation and confirmation processes along with exchange reconciliations and client account margin settlement of transactions. Partnered with Prime Brokerage and market making to enable dramatic volume increases from vol arb and retail flow. Collaborated with Projects and Finance to implement cost-plus model for U.S. Listed Options. As Operational Relationship Manager, implement strategic post execution client solutions and initiatives. Provide senior client contacts with product knowledge and targeted operational advice. Global Lead for Multi-Asset Class Commercial opportunities development. Identified and executed tactical business process improvements aimed at providing scalability and increased client service for Institutional Futures Client Service. Regularly work with internal and external auditors / key contact for bank holding company conversation. Business Unit project manager for successful implementation of new processing model for U.S. options business. Engineered client specific statistics for division management, pioneered product client scorecards. Corporate Financial Strategies Group (November 2000 – June 2001) Serviced a large client base of corporations buying back stock, selling restricted stock, and hedging their buyback program, working regularly with CFO’s and senior management. Worked closely with controllers, IED Restricted Stock Desk, and Investment Banking. Created Customized trading and client reporting using FactSet, Time and Sales, and Bloomberg. U.S. Equity Institutional Sales Support (February 2000 – November 2000) Liaised with global client service teams in support of seven salespeople servicing foreign client accounts. Created and presented U.S. equity processing guidelines; performed sales trading analytics and “Focus Client” metrics. Y2K Risk Management (July 1999 – February 2000) Key infrastructure contact in event management, supplier risk mitigation and contingency planning. Management Trainee (July 1998 – July 1999) Completed classroom training and Rotations through Mortgage Backed Securities, Domestic Equities, and Y2K Risk Management; managed project to create Analyst Training Website. EDUCATION Fordham University, Graduate School of Business Administration New York, NY (January 2003 – April 2006) Completed MBA in Management with a Marketing focus as a part-time student; cumulative 3.9 GPA. Fordham University, Fordham College Rose Hill, Bronx, New York (September 1994 – May 1998) 50% scholarship, 50% self-financed Double Major: Economics (Public Finance) and Philosophy; GPA 3.3 Member of Philosophy Honor Society LICENSES / SKILLS Series 7, 63, 55, & 3 licensed; Microsoft Office Suite