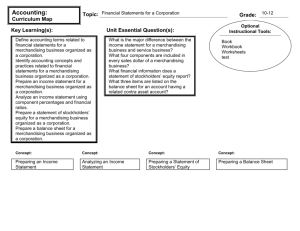

Financial Statements

advertisement

Financial Statements Chapter 19 Study Guide Financial Statements Discuss the nature of a consolidated financial statement? Understand the relationship between the work sheet and the financial statements. Explain the how the financial statements differ between a corporation and sole proprietorship Analyze the financial data contained on the statement and how to utilize this information internally and externally. Determine the cost of inventory Prepare an Income Statement for a Corporation Notes and practice problem (yes there are formulas~ you need to know) Chapter 19 Terms to Know…soon administrative expenses net sales base year operating income capital stock operating expenses comparability relevance cost of merchandise sold reliability full disclosure retained earnings gross profit on sales selling expense horizontal analysis statement of retained earnings materiality stockholders equity net purchases vertical analysis working capital Understanding Ownership of A Corporation How the ownership for a corporation differs from the ownership of a sole proprietorship? • Sole Proprietorship • • Corporation Owned by one person Ownership is owned by one person or by thousands of people through Share of Stock Recording Ownership: Sole Proprietorship: Cash in Bank DR CR + 25,000 Sanchez, Capital DR CR + 25,000 Corporation’s Ownership: __Cash in Bank___ Capital Stock DR CR DR CR + + 25,000 25,000 Recording Ownership: On June 30 stockholders invested $25,000 in exchange for shares of stock of the corporation, Receipts 997. Corporation’s Ownership: ___Cash in Bank___ DR CR + 25,000 __Capital Stock__ DR CR + 25,000 Recording Ownership: The main difference in the way the sole proprietorship and corporation is the way it is reported on the balance sheet. Corporations Owner’s Equity account on the balance sheet is now called… Stockholders’ Equity Stockholders Equity has 2 laws. . . 1. Equity contributed by stock holders 2. Equity earned through business profits Must be reported in either of these two parts. Equity Earned Contributions Stockholders contribute to equity by buying shares of stock issued by corporation, this transaction This “stockholders’ investment” is recorded In the capital stock account Equity Earned through business profits . . . . . . . Stockholders’ equity increased that is retained by the corporation; however, not distributed to the stockholders most of the time “reinvested into the company” Oil & Gas… use this for further “exploration activities” Comparison of Capital Sections: Sole Proprietorship Corporation Owner’s Equity : Owner’s, Capital Stockholders’ Equity: Capital Stock Retained Earnings Financial Statements are used by Managers to evaluate past performance and project future operational needs. Stockholders are interested in the performance, potential growth Creditors review it to know the ability to pay back its debts timely. Government, employees, potential employees and consumers interested in the financial position of the business. Characteristics & Guidelines 1. Comparability “compare apples to apples” 2. Reliability “confidence it is true” 3. Relevance “make a difference” for the user 4. Full Disclosure “make known” 5. Materiality “deemed relative – include it” Income Statement 5 sections for a merchandising business 1. Revenue 2. Cost of Merchandise Sold 3. Gross Profit on Sales 4. Operating Expenses 5. Net Income (or Loss) Income Statement Comparison Service Business Merchandising Business Revenue - Expenses Net Income (Loss) Revenue - Cost of Merchandise Sold Gross Profit on Sales - Operating Expenses Net Income (Loss) Income Statement Cost of Merchandise Sold Beginning Merchandise Inventory + Net Purchases (during the period) Cost of Merchandise Available for Sale - Ending Merchandise Inventory Cost of Merchandise Sold Income Statement Net Purchase: Purchases + Transportation In Cost of Delivered Merchandise - Purchases Discount - Purchases Returns & Allowances Net Purchases Example of an Income Statement Parts of the Income Statement Four columns Parts of the Income Statement Total column This is the amount used to complete the next statement. Practice Income Statement Problem 19-5 (use worksheet on page 520-523 workbook) use file in teachers resource folder Prepare an income statement with all the appropriate sections and calculations for an merchandising company. 1. 2. 3. 4. 5. Revenue Cost of Merchandise Sold Gross Profit on Sales Operating Expenses Net Income (or Loss) Income Statement Chapter 19 study guide completed All terminology Formulas to calculate all major and minor sections of the worksheet Net Purchases Net Sales