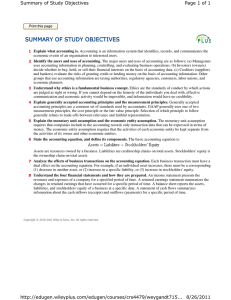

Chapter One - Raymond J. Harbert College of Business

advertisement

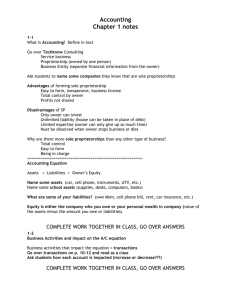

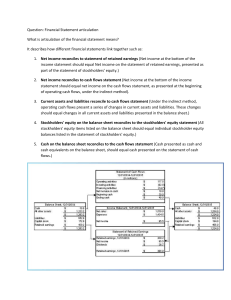

CHAPTER 1 NOTES Primary Forms of Business Organization A business may be organized as a sole proprietorship, partnership, corporation, or _____________________________________. Sole proprietorship - a business _________________________ Advantages simple to establish owner controlled tax advantages Disadvantages proprietor personally liable financing may be difficult transfer of ownership may be difficult Partnership - a business _________________________________________ Advantages simple to establish shared control broader skills and resources tax advantages Disadvantages partners personally liable transfer of ownership may be difficult Corporation - ___________________________________________ Advantages easy to transfer ownership greater capital raising potential lower legal liability Disadvantages unfavorable tax treatment Limited Liability Company- ____________________________________________ Limited liability for partner/member Pass thru tax structure of partnerships and sole proprietorships (generally less taxes) There is a passage in the book which states, "Although the combined number of proprietorships and partnerships in the United States is more than five times the number of corporations, the revenue produced by corporations is eight times greater. Most of the largest enterprises in the United States--for example, Coca Cola, Exxon, General Motors, Citicorp, and Pacific Gas and Electric--are corporations." Why do you think this is true? 1-1 Identify the Users and Uses of Accounting The primary function of accounting is to _______________________________________________. The users of financial information fall into two categories--internal users and external users. Internal users - users _________________________________. Marketing managers, production supervisors, finance directors and company officers Questions asked by internal users – What is the cost of manufacturing each unit of product? Which product is the most profitable? External users - users __________________________________. Investors (owners) Creditors (suppliers and bankers) Others (i.e. IRS, SEC, FTC, etc.) External users may ask: How does the company compare in size and profitability with competitors? Will the company be able to pay its debts as they come due? THINK ABOUT IT: If you were the manager of a Chick-fil-A, what questions could be answered with financial information? What about a production supervisor at Russell in Alex City? What about the owner of The Buzz? If you were a creditor of Anders Bookstore, what kind of questions might be able to be answered using financial information? What about an investor in Auburn Bank? What about the IRS? Three Principal Types of Business Activity There are three types of business activity: Financing activities - to start or expand a business the owner or owners quite often need cash from ____________________. The two primary sources are: Borrowing from __________which creates a __________ bank loan debt securities (bonds) goods on credit from suppliers Selling __________________ in the corporation to ______________ THINK ABOUT IT: If you had extra money to invest, how they would prefer to invest the money? Would you consider loaning money to a corporation or would you rather buy shares of stock in the company? Why did you make the decision to lend or buy? If you were a business owner, and needed some cash, would you choose to borrow money or sell stock, and why? 1-2 Investing activities - obtaining _____________ or _______________ needed to operate the business (i.e. equipment, office supplies, etc.). Operating activities - involve the primary activities for which the organization is in business. Revenue is generated from ________or __________ ____________ are incurred in earning revenue THINK ABOUT IT: Just because a business is making money is no reason to assume that the business has a lot of money in the bank. Thinking about the three business activities, what might have happened to the cash? Could a business reporting a net loss have money in the bank? If so, how? Content and Purpose of Each of the Financial Statements Accountants communicate with users through four _____________ ___________________: Income Statement Reports __________ or _____________ of the company's operations during the period. Summarizes all revenue and expenses for period--month, quarter, or year. If revenues exceed expenses, the result is a net income. If expenses exceed revenue, the result is a (net loss). Retained Earnings Statement Indicates amount paid out in ___________ and amount of _________ or ________ for period. Shows ________ in retained earnings balance during period covered by statement. Balance Sheet Shows relationship between ________ and ___________--on a particular date. Assets and ____________ (liabilities and stockholders' equity) must balance. Statement of Cash Flows Reports the ________ _________ of a company's operations for a period of time. Shows cash increases and decreases from investing and financing activities. Indicates increase or decrease in ___________ as well as ending _____________. Interrelationship of Statements- Sierra Corporation (Page 17) Retained earnings statement is dependant on results of the income statement Balance sheet and retained earnings statement are interrelated. Statement of cash flows and balance sheet are interrelated. BE 1-4, BE 1-7. E 1-4, E 1-7 1-3 Assets, Liabilities, and Stockholders' Equity and the Basic Accounting Equation Assets - _____________ owned by the business. Liabilities - ___________ claims on total ___________ (obligations or debts of the business). Stockholders' Equity - __________ claim on total __________. What is the difference between Accounts Payable and Notes Payable? What about Paid-In Capital and Retained Earnings? The accounting equation: Assets = Liabilities + Stockholders' Equity This is an algebraic equation whose components can be moved around in the same way you would any equation. (A-L=SE A-SE= L) BE 1-8, E 1-12, E 1-13 Components that Supplement the Financial Statements in an Annual Report Companies traded on an organized exchange like the New York Stock Exchange or The American Stock Exchange are required to provide shareholders with an ____________ ___________ which always includes financial statements. In addition, the annual report includes the following information: ___________ __________ and ____________ - covers three aspects of a company: liquidity, capital resources, and results of operation. ________ to Financial Statements Clarify information presented in the financial statements. Describe accounting policies or explain uncertainties and contingencies. ____________ ____________ Auditor, a professional accountant, who conducts an independent examination of the financial accounting data presented by a company. Auditor gives an unqualified opinion if the financial statements present the financial position, results of operations, and cash flows in accordance with accepted accounting standards. BE 1-11 1-4 Basic Assumptions and Principles Underlying Financial Statements The preparation of financial statements relies on the following key assumptions and principles: Monetary unit assumption States that only transactions expressed in terms of ________ may be included in accounting records. Assumes that unit of measure remains constant over time. An example of a transaction expressed in terms of money would be the purchase of a building, paying the rent for the month, or paying the payroll. On the other hand, hiring an employee or making a bid on a perspective job would not be a transaction expressed in terms of money. Economic entity assumption Assumes economic events can be identified with a particular unit of accountability. Requires economic activities of an entity be kept _______ from those of owner and separate from all other economic entities. Example: If you own a bicycle shop in a nearby community, the economic transactions of the business would be kept separate from the your personal transactions. Time period assumption - allows the business to be divided into artificial time periods. Financial statements may be prepared monthly, quarterly, or annually, depending on the needs of the business. Going concern assumption Assumes business will be in _________ long enough to carry out goals. Assumption allows use of _____ when recording assets. A bicycle shop is in the business to sell bicycles, not the building in which it is located or the computer used in keeping records. The market price of the building and computer is insignificant. They are not going to be sold. Therefore, the building and computer can be recorded at original cost. Cost principle - requires assets to be recorded at _________ ________ as it is verifiable. Full disclosure principle – requires all ___________ and ________ that would make a difference to financial statement users should be disclosed. BE 1-12, P1-3A 1-5