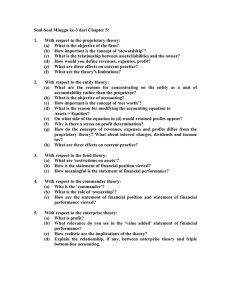

accounting. Concepts

advertisement

ACCOUNTING CONCEPTS See note 10.3 Page 114 (12 edition) th The preparation of final accounts is based on certain assumptions. These assumptions are known as the concepts of accounting. Concepts are therefore rules which the accountant has to follow when preparing final accounts. The basic accounting concepts are: 1. The historical Cost concept This concept says that assets are shown in the balance sheet at cost price and that this is the basis for valuation of the assets. 2. The Money Measurement concept This concept states that accounting only shows the facts measurable in money. Accounting does not show whether there are any problems with the business, whether there are good or bad managers, whether there is a rival product or new laws in the country. Therefore accounting and financial statements do not tell you everything about a business. 3. The Business Entity Concept This concept states that the accounting of a business shows only the transactions and activities which have to do with the business and not the owner’s private activities. The owner’s activities are shown in the accounting only when the owner adds or reduces the capital of the business. 4. The Dual Aspect Concept This establishes the accounting equation. It states that every transaction in accounting deals with two aspects – assets and claims against them. The claims against them are equal to the assets. So we can say: Assets = Capital + Liabilities 5. Time Interval Concept Accounting has to be made with regular intervals of one year. These intervals are needed. Sometimes for the internal management, accounting is prepared more frequently for example per month. The interval depends on the business or firm. Fundamental Accounting Concepts 6. Going Concern Concept In a business it is always assumed that the business is going to continue for a long time so the assets are shown at cost price. This does not happen when the business knows it is going to be suffering losses from assets or there is shortage of cash in the business. i.e. if the business is undergoing difficulties it might not be a going concern. 7. Consistency Concept If policies of calculating certain figures are changed from one year to the other, this would lead to misleading profits being calculated from the accounting records. In order to keep consistent in the preparation of accounts, policies should not be changed unnecessarily. If policies need to be changed then a note should be written in the accounts stating how and why the changed policy took place. In this way, accounts of one year after another will be comparable. 8. Prudence It is the accountant’s duty to see that people get the proper facts about a business. Accountants should always be on the side of safety, and this is known as prudence. It is better to take the figure that will understate rather than overstate the profit. An accountant should also make sure that all losses are recorded in the books but profits should not be shown until they have actually been made. This leads to the realisation concept . 9. Realisation Concept This is a broader concept of prudence where profit and gains can only be taken into account when the ultimate cash realized is capable of being assessed (i.e. determined) with reasonable certainty. 10. The Accruals Concept (Accrual basis) This concept states that transactions are reported in the financial statements of the period to which they relate. Net profit is the difference between revenues(income) and expenses incurred in generating those revenues. (i.e. revenues – expenses = net profit) The term matching expenses against revenues means that an accountant calculates the expenses used up to obtain the revenues. 11. Materiality This concept tells us – do not waste your time in the elaborate recording of trivial items. Keep track only of items of material nature. Employing someone to record trivial items will be more expensive for the business.