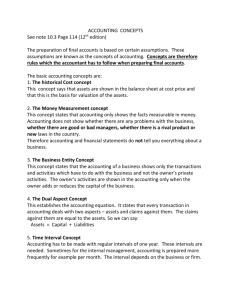

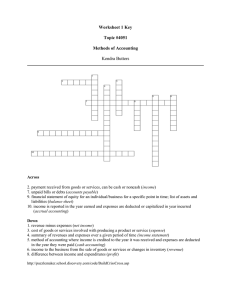

THE ACCOUNTING CONCEPTS Chapter 2 – First Part McGraw-Hill/Irwin Copyright © 2010 by The McGraw-Hill Companies, Inc. All rights reserved. A Objectivity and Subjectivity Objectivity is enhanced by using methods that are generally agreed. Generally agreed method is not used, it is regarded as subjective. 2-2 B Concepts and Convention Concept is an idea or abstract principle which relates to a particular view of a subject. Convention refers to the ways of thinking and behaving that are believed to be normal and right by most people in a particular field 2-3 C 1. 2. 3. 4. 5. 6. 7. 8. 9. Basic Accounting Concepts Business entity concept Dual aspect concept Money measurement concept Historical cost concepts Going concern concept Realization concept Accrual concept The Matching concept The Prudence Concept 2-4 1 Business Entity Concept An entity is an organization for which accounting records are prepared. This concept means that the accounts of a business shall only record the events relating to the business and shall not record the personal events of the owners (that do not relate to this business). 2-5 1 Business Entity Concept This concept helps in maintaining the clarity of the business position as separate from the owners financial position. For example, if the owner of the business provides capital to the business, this event shall be recorded in the book of the firm as it relates to the business. But when the owner buys a house from his personal funds this transaction shall not be recorded in the books of the business. 2-6 2 Dual Aspect Concept Dual aspect concept states that there are two aspects of accounting Every accounting entry affects at least 2 accounts. This is called the dual-aspect concept of accounting. 2-7 2 Dual Aspect Concept Another meaning of this concept is that all assets of the business are either provided from the funds of the owner or from the funds of the creditors. This means, ASSETS = LIABILITIES + OWNER’S EQUITY This is the basic accounting equation. 2-8 3 Money Measurement Concept This means that all information shown in the accounts of a business is in form of money. In other words, all assets and liabilities of a business are shown in money terms. Money serves as a common measurement tool and it is easier than stating that the business has 2 buildings, 6 machines, 30,000 kilos of raw-material etc. 2-9 4. Historical Cost Concept All assets of a business are recorded at the cost at which they were purchased. This is called the book value (or historical cost) of the assets. For example, if a company purchases a machine for 20,000 AFs it will be shown at the same price and not at the amount for which it can be sold in the market today. 10 2-10 5 Going Concern Concept Going concern concept states that a business is assumed to continue to operate in the foreseeable future. The assets are recorded at their original cost rather than their current market values in the book, even the business is operating at a loss for years. This means that accountants do not calculate the value of assets of the business daily and the assets appear in the accounts at the cost at which they were purchased. 11 2-11 6 Realisation concept Realisation concept specifies the point of time at which revenue should be recognised and recorded in the book. This means the business should : • only record the amount at which the sales were actually made, and • and record the sales when the goods have been delivered even if the customer has not paid cash 12 2-12 6 Realisation concept Several criteria have to be observed before realisation can occur: l goods or services are provided for the buyer; l the buyer accepts liability to pay for the goods or services; l the monetary value of the goods or services has been established; l the buyer will be in a situation to be able to pay for the goods or services. 13 2-13 7 • • Accrual Concept Recognizes revenues as the goods are delivered to the customer Recognizes expenses as they happen in generation of revenues For example, a shop sells goods to Ali and he promises to repay in 30 days. The accountant will not wait 30 days to recognize the revenue. He will book it as soon as the goods are given to customer. 2-14 Accrual Basis versus Cash Basis The accrual basis of accounting recognizes revenues and expenses when they occur instead of when cash is received or disbursed. The cash basis of accounting recognizes revenue and expense when cash is received and disbursed. 16 - 15 2 - 15 In Cash accounting – •Revenues are recognized only when cash is received •Expenses are recognized when cash is spent. For example, a business using cash-based accounting shall not recognize revenue when the customer takes goods and promises to pay later. In fact, they would not even make a general entry at that time and will wait till the time the customer pays cash to the business. Similarly, expenses are recognized only when cash is paid. For example, the business buys some raw-material, the whole of the cost of the raw-material is expensed at that time. They will not wait for the time when rawmaterial is processed and sold to customer. Cash-based accounting could give us mismatched accounts. For example, it could show us huge profits in one year and huge losses in other years. Therefore, only small shop-owners use cash-based accounting. Big companies always use accrual accounting systems. 2-16 8 Matching Concept This concept needs that the accountant matches the revenue with the expenses made to earn that revenue. For example, a business purchased raw-materials worth $2000 and total processing expenses on these materials are $500. Then the business sold the goods for $4000. 2-17 8 Matching Concept The accountant should deduct the total expenses from the revenue to get the income (profit) made by the business, that is: • purchases = $2000, plus • processing expenses = $500 • TOTAL EXPENSES= $2500 PROFIT = SALES – TOTAL EXPENSES = $4000 - $2500 = $1500 So the matching-concept helps us match the expenses with the revenue earned to get the correct income amount. 18 2-18 D Accounting Convention Materiality / Conservatism Prudence Principle of Consistency 2-19 1 Materiality Materiality concept is used to judge what sorts of transactions or items are significant and their classification in the financial statements. e.g. A box of paperclips can be used for several years. It will not be recorded as fixed assets, because of its immaterial value. 2-20 2 Prudence / Conservatism Prudence concept ensures that the net assets and profits of a business are not overstated. Thus, revenues should not be anticipated; Expenses should be anticipated. 2-21 3 Principle of Consistency Consistency is to keep using the same accounting method on similar items, except for special cases. Example, A company depreciates the machinery by using reducing balance method. The proprietor want to overstate the profit by changing the depreciation method. This violates the principle of consistency. 2-22