Accting for Artists - Visual Arts Alberta

advertisement

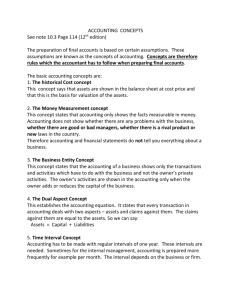

Accounting for Artists By Amanda Kriaski This workshop aims to provide you, the artist, with simple bookkeeping practices to keep track of the financial side of your artistic practice. What we will cover: Useful accounting terminology. How to use a basic accounting spreadsheet. Bookkeeping tips and tricks. Budgeting and how to use a basic budget spreadsheet. Handy resources. Some useful terminology: Accounting – the process of identifying, recording, and communicating the economic events of a business to interested users of the information Bookkeeping – recording financial transactions Revenues/ income –economic resources that result from the operating activities of a business, such as the sale of a product or provision of a service OR cash coming into your practice Disbursements/ expenses – the cost of assets consumed or services used in ordinary ongoing operations to generate revenue OR cash going out of your practice Profit – when revenues exceed expenses Loss – when expenses exceed revenues Depreciation – the process of allocating the cost of a depreciable asset over its useful life. Known as Capital Cost Allowance (CCA) by the Canada Revenue Agency *Some definitions taken from Financial Accounting by Kimmel, Weygandt, Kieso, Trenholm, Fourth Canadian Edition The accounting spreadsheet: The spreadsheet provides a way to keep track of all revenues and expenses (money in and money out) You can immediately see how much money you have available (if it’s up to date!) It sorts revenues and expenses into useful categories - You can easily see how much is spent on each type of expense - It can help you determine whether you are pricing your work fairly. - Preparing taxes will be simpler. You can easily reconcile the spreadsheet with your bank statements. Tips and tricks: Remember, you are a business, so conduct yourself in a businesslike manner! Keep accurate records of your activities, revenues, expenses. Stay up to date! Try and input all of your transactions once a month. Open a separate bank account and use a separate credit card. Keep a cheque log. It is good business practice to use a daytimer to record your mileage (where you went, when, why, who you met with), travel (where, why, when), meals and entertainment (who you met with, why, write on receipt as well). Maintain a filing system – keep everything in one place! GST – you must register for a number if you have more than $30,000 in sales in any twelve month period. Budgets and budgeting: Budgets allow you to plan ahead to help you meet your targets and goals. They help you anticipate revenues and expenses and how they will affect the total picture. Be realistic when preparing a budget – it is not useful if you are not being reasonable. You can use the budget to track your progress throughout the year by changing the budgeted amounts to actual amounts once the month is over. Resources Accounting - Information for Artists: A Practical Guide for Visual Artists, book published by CARFAC Ontario Business: - www.iheartmydreamjob.com - The Studio Handbook for Working Artists by Ted Godwin - Craft Inc. by Meg mateo Ilasco Taxation: - Visual Arts Alberta has a link on their website with details on taxation: http://visualartsalberta.com/professional-development-2/taxation-for-artistsworkshop-notes/ - Elephant Artist relief Society runs tax workshops during tax season. - Canada Revenue Agency Interpretation bulletin IT-504R2 Visual Artists and Writers - Canada Revenue Agency Guide for form T2125 Statement of Business Activities: http://www.cra-arc.gc.ca/E/pub/tg/t4002/README.html