File - JASON HUR

advertisement

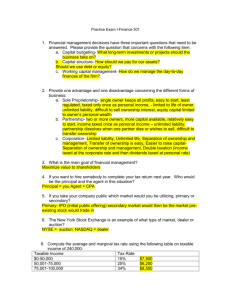

CORPORATE ANALYSIS Dr. Jaclyn Beierlein FINA 4734 – Financial Management II Submitted by: Jason Hurley Table of Contents Executive Summary…………………………………………………………………………….. 3 Company Overview……………………………………………………………………………...4 Ratios: Profitability………………………………………………………………………………5 Market Value…………………………………………………………………………….6 Financial Leverage and Coverage……………………………………………………...7 Liquidity………………………………………………………………………………….8 Asset Management………………………………………………………………………9 Corporate Governance…………………………………………………………………………10 Cost of Capital: Introduction……………………………………………………………………………..11 Cost of Equity……………………………………………………………………12,13,14 Cost of Debt……………………………………………………………………………..15 Market Value of Debt…………………………………………………………………..16 Market Value of Equity………………………………………………………………...17 Weighted Average Cost of Capital…………………………………………………….17 References……………………………………………………………………………………….18 Executive Summary Dr. Pepper Snapple Group, incorporated on October 24, 2007, is an integrated brand owner, manufacturer and distributor of non-alcoholic beverages in the United States, Canada and Mexico with a diverse portfolio of flavored carbonated soft drinks and non-carbonated beverages (NCBs), including ready-to-drink teas, juices, juice drinks and mixers. The goal of this report is to analyze and understand Dr. Pepper Snapple Group. In order to do this, I must analyze and look at the underlying factors that have influenced the corporation. The primary sections of this report will be to include and review an analysis on DPS’ riskiness, cost of capital, performance and its capital structure. In this analysis, I will discuss how DPS operates financially as a company and what they must do to ensure consistency into the future using 2011 as a comparative year with their competitors, as I feel it is a good representation within our industry. With a corporate history closely associated with the history of the beverage and soft drink industry, DPS resides in a competitive state over the industry and has recently yielded profitable returns with a little bit of risk involved. Through two different approaches in estimating Intel's beta, a measure of systematic risk, we have inferred DPS’ beta is under 1.0 and therefore implying a minimal amount of riskiness. A beta of less than 1 means that the security will be less volatile than the market. Analyzing DPS risk will require the use of various quantitative methods such as looking at the company’s market value, cost of capital, and weighted average cost of capital. Utilizing these measures of risk, I can calculate an appropriate cost of capital for the firm by looking at its debt and equity structure. Using the total debt to equity ratio and other key performance ratios, I will be able to draw conclusions that shall accurately illustrate this company’s performance and explain DPS’ current and future financial standing. Company Overview Dr. Pepper Snapple Group, Inc. is a leading integrated brand owner, manufacturer, and distributor of non-alcoholic beverages in the United States, Canada, and Mexico. They have some of the most recognized beverage brands in North America, with significant consumer awareness levels and long histories that evoke strong emotional connections with consumers. The company now known as Dr. Pepper Snapple Group has grown from a mixture of discovery, invention and collaboration. This rich history includes the very birth of the soft drink in 1783, when Jean Jacob Schweppe perfected the process for carbonating water and created the world's first carbonated mineral water. Dr. Pepper and Snapple, the flagship brands of DPS, have origins that share Schweppe's entrepreneurial spirit. Charles Alderton, a young pharmacist in Waco, Texas, invented Dr. Pepper in 1885. It was served at the drug store where Alderton worked and the first Dr. Pepper fans asked for a "Waco." The oldest soft drink in the United States, it was later named Dr. Pepper, according to legend, after Dr. Charles Pepper, a friend of the drug store owner. Nearly 100 years later, three New York-area health food storeowners created a unique apple soda they named Snapple. They began selling the original Snapple in health centers in 1973. Throughout the 1970s, the company that owned Snapple was known as The Unadulterated Food Corporation, later becoming Snapple Beverage Corp. In the 1980’s through the mid-1990’s, they began building on their then existing Schweppes business by adding brands such as Mott’s, Canada Dry and A&W, and a license for Sunkist soda. In 1995, they acquired Dr. Pepper/Seven Up, Inc., having previously made minority investments in the company. In 1999, they acquire a 40% interest in Dr. Pepper/Seven Up Bottling Group, Inc., which was then their largest independent bottler, and increased their interest to 45% in 2005. In 2000, they acquired Snapple and other brands, significantly increasing their share of the U.S. NCB market segment. In 2003, they created Cadbury Schweppes Americas Beverages by integrating the way they managed their four North American Businesses (Mott’s, Snapple, Dr. Pepper/Seven Up and Canada Dry and A&W). They were incorporated in Delaware on October 24, 2007. Cadbury Schweppes separated its beverage business in the U.S., Canada, Mexico and the Caribbean from its global confectionary business by contributing the subsidiaries that operated its Americas Beverages business to them. Dr. Pepper Snapple Group, Inc. has been able to yield profitable returns with the exception of 2008. Dr. Pepper Snapple Group, Inc. has seen revenues remain relatively flat, though the company was able to grow net income from $606.0M to $629.0M. A reduction in the percentage of sales devoted to selling, general and administrative costs from 38.23% to 37.83% was a key component in the bottom line growth in the face of flat revenues. Total Revenue Gross Profit Net Income 12/31/2012 $5,995,000 12/31/2011 $5,903,000 12/31/2010 $5,636,000 12/31/2009 $5,531,000 12/31/2008 $5,710,000 $3,495,000 $629,000 $3,418,000 $606,000 $3,393,000 $528,000 $3,297,000 $555,000 $3,120,000 ($312,000) Profitability The return on assets is the rate of return being earned on the firm's assets. It is a measure of how resourcefully the company is using all stakeholders' assets to gain returns. Compared to the competition, DPS’ return on assets, with the exception of Constellation Brands Inc., is not on par with the rest of the companies chosen for this industry. The return on equity looks at the return to equity investors, using the net income as a measure of this return. The profit margin is a measure of profitability and is calculated by finding the net income as a percentage of the revenue. DPS’ ROA, ROE and Profit Margin in 2012 are, respectively, .0668, .2567, and .10. Dr. Pepper Snapple Group is at a decent standing in terms of profitability and always has room for improvement. In order to turn more profit, they must come up with more innovative ideas and start making more new remarkable products, as well as seek out more assets. 12/31/2011 ROA ROE Profit Margin DPS Coca-Cola Constellation Brands Inc. 6.68% 25.67% 10% 11.21% 27.37% 18.55% 7.80% 21.90% 16.80% National Beverage Corp. 34% 78% 6.79% Jones Soda 94% 163% 41% Market Value Market Capitalization is a measurement of value based on share price and number of shares outstanding. It commonly epitomizes the market's view of a company's stock value and is a decisive aspect in stock valuation. The P/E ratio can be viewed as the number of years it takes for the company to earn back the price you pay for the stock. Since the P/E ratio measures how long it takes to earn back the price you pay, the P/E ratio can be applied to the stocks across different industries. That is why it is the one of the most important and widely used indicators for the valuation of stocks. As the number 3 company in the soft drinks and beverages industry, behind PepsiCo and Coca Cola, Dr. Pepper fares pretty well. 12/31/2011 DPS Coca-Cola Constellation Brands Inc. P/E Market to Book 13.96 3.74 36.69 9.93 1.15 0.22 National Beverage Corp. 17.34 8.80 Jones Soda 1.73 2.77 DPS keeps a continuing trend going of increasing their price by small amounts as to increase their overall P/E ratio. The market to book value is a financial ratio used to compare a company's book value to its current market price. Theoretically, if you purchased stock with a price to book value less than one and the company immediately went bankrupt, you would gain money on your investment. In reality, this may not be true since there are times when liquidation value, or the price at which a company's assets can be sold, is less than the book value of those assets. If your business has a low market/book ratio, it’s considered a good investment opportunity. In order to gain more investors, Dr. Pepper should consider lowering their stock price on a monthly basis more often. Investors looking for value stocks often look for low market to book companies. Financial Leverage and Coverage Leverage ratio is used by investors to gain insight about a company’s financial methods as well as its ability to repay its debts. The term leverage pertains to the use of debts to fund investments or acquisitions, with the hope that the rate of return from the investment is higher than the rate of interest on the debts. Investing in companies that are highly leveraged is considered risky by many investors because such companies are very much vulnerable to economic declines, as they need to pay off their debts despite decreasing sales and production. Coverage is a measure of a company's ability to meet its financial obligations. The higher the coverage ratio, the better the ability of the enterprise to fulfill its obligations to its lenders. The trend of coverage ratios over time is also studied by analysts and investors to ascertain the change in a company's financial position. 12/31/2011 DPS Coca-Cola Constellation Brands Inc. Jones Soda 0.64 National Beverage Corp. 0.56 Total Debt/Equity Debt/Equity Equity Multiplier Long-Term Debt Times Interest Earned Cash Coverage 0.74 0.30 3.10 4.10 0.76 1.76 1.81 2.81 1.28 2.28 0.72 1.72 0.50 0.30 0.95 0.25 0.09 9.23 24.35 2.57 632.83 - 6.02 29.04 3.26 518.12 - 0.41 Debt when used properly can increase shareholder returns. Having too much, however, leaves firms vulnerable to economic downturns and interest rate scrambles. Too much debt can also increase the perceived risk with the business and discourage investors from investing more capital. Compared to Coca Cola, Dr. Pepper seems to be a little more aggressive with financing their growth with debt. A low debt to equity ratio indicates lower risk, because debt holders have fewer claims on the company's assets. I believe that DPS is taking advantage of many opportunities that it could not pursue when it was under Cadbury Schwepppes ownership, and as the number three firm, they are beginning to prosper in an industry dominated by Coca Cola and PepsiCo. With the company operating with a good portion of debt, they are implacably looking to grow, but it is a little harder for them to meet their interest expense obligations. Liquidity Liquidity is important for both individuals and companies. While a person may be rich in terms of total value of assets owned, that person may also end up in trouble if he or she is unable to convert those assets into cash. The same holds true for companies. Without cash coming in the door, they can quickly get into trouble with their creditors. Banks are important for both groups, providing financial intermediation between those who need cash and those who can offer it, thus keeping the cash flowing. An understanding of the liquidity of a company's stock within the market helps investors judge when to buy or sell shares. Finally, an understanding of a company's own liquidity helps investors avoid those that might run into trouble in the near future. 12/31/2011 DPS Coca-Cola Constellation Brands Inc. Quick Ratio Current Ratio Cash Ratio 0.69 0.92 0.37 0.78 1.05 0.57 1.08 3.14 0.01 National Beverage Corp. 0.97 1.41 0.10 Jones Soda 1.43 2.31 0.69 Even though the company is not at a poor financial standing, their liquidity ratios imply that they are not efficiently using their assets and facilities. In order to grow, they need to expand their assets so that they exceed their liabilities. Once their current assets exceed their current liabilities, it will be much easier for the company to meet its short-term obligations. Compared to the other companies, they have lower liquidity ratios, as most of the other company’s ratios exceed 1. Liquidity ratios are used to determine a business’s ability to pay off its short-term debt obligations. The first liquidity ratio I used in my analysis is the current ratio. Coca-Cola has a current ratio of 1.05 and DPS has a current ratio of 0.92. Coca-Cola is more able to cover its short-term debt obligations than DPS. DPS’s current ratio indicates that the company is in somewhat of a bad position because it is not able to meet its current debt obligations using only its current assets. The quick ratio indicates a company’s ability to pay off its current debt obligations using only its most liquid assets. This differs from the current ratio in that it does not include inventory as an asset. Asset Management 12/31/2011 DPS Coca-Cola Constellation Brands Inc. Jones Soda 0.46 7.99 National Beverage Corp. 3.28 10.65 Asset Turnover Receivables Turnover Inventory Turnover Cash Conversion Cycle 0.65 9.79 0.61 6.34 10.90 9.96 1.56 11.44 5.50 53.36 75.62 256.98 19.06 72.06 8.85 Companies with low profit margins tend to have high asset turnover, while those with high profit margins have low asset turnover. Companies in the retail industry tend to have a very high turnover ratio. Compared to the other companies in my industry, Dr. Pepper Snapple Group’s asset turnover is shows that they use their assets efficiently as they are on par with Coca-Cola, the number one company in the industry overall. The receivable turnover ratio quantifies a company's ability to collect liabilities/debts. It helps investors gauge the efficiency of a company's collection and credit policies. A high ratio value indicates an efficient and effective credit policy, and a low ratio indicates a debt collection problem. In terms of receivables, Dr. Pepper Snapple Group has efficiency compared to the other companies. They operate on a good amount of debt, but are able to pay it back and do not have many collection problems. The inventory turnover ratio is a ratio showing how many times a company's inventory is sold and replaced over a period. This ratio should be compared against industry averages. A low turnover implies poor sales and, therefore, excess inventory. A high ratio implies either strong sales or ineffective buying, which DPS has in comparison to the other companies. High inventory levels are unhealthy because they represent an investment with a rate of return of zero. It also opens the company up to trouble should prices begin to fall. The cash conversion cycle is the theoretical amount of time between a company spending cash and receiving cash per each sale, output, unit of operation, etc. It is basically a measure of how long cash is tied up in working capital. Management needs to divide up more sufficiently the amount of time spent in each section of spending. They are on a good scale, but should try to improve in the upcoming years. Corporate Governance Corporate Governance is a system in which rules, practice and processes of a company are directed and controlled. It concerns the relationships among the management, Board of Directors, controlling shareholders, minority shareholders and other stakeholders. Good corporate governance contributes to sustainable economic development by enhancing the performance of companies and increasing their access to outside capital. Since corporate governance also provides the framework for attaining a company's objectives, it covers practically every aspect of management, from action plans and internal controls to performance measurement and corporate disclosure. My criteria for a good Corporate Governance includes displaying integrity and ethical behavior, giving equal treatment to shareholders, distributing roles and responsibilities among the board, and how a company caters to the interest of other stakeholders. The Board of Directors of Dr. Pepper Snapple Group, Inc. sets high standards for the Company's employees, officers and directors. Implicit in this philosophy is the importance of sound corporate governance. It is the duty of the Board of Directors to serve as a prudent fiduciary for shareholders and to oversee the management of the Company's business. To fulfill its responsibilities and to discharge its duty, the Board of Directors follows the procedures and standards that are set forth in these guidelines. These guidelines are subject to modification from time to time as the Board of Directors deems appropriate in the best interests of the Company or as required by applicable laws and regulations. The business affairs of the company are managed under the direction of the Board, which represents and is accountable to the stockholders of the company. The Board’s responsibilities include regularly evaluating the strategic direction of the company, management’s policies and the effectiveness with which management implements its policies and overseeing compliance with legal and regulatory requirements. The basic responsibility of the directors is to exercise their business judgment to act in what they reasonably believe to be in the best interests of the company and its stockholders. Each director should regularly attend and participate in committee meetings and review information deemed to be important to the best conduct of business by the company. The Code of Business Conduct and Ethics embodies their commitment to conduct business in accordance with all applicable laws, rules and regulations, to provide full, fair, accurate and timely disclosure in public communications, reports and filings, and honest and ethical conduct. They have adopted this code to promote compliance and avoid even the appearance of improper conduct and behavior. Failure to comply with these regulations may lead to company-imposed sanctions, including immediate dismissal for cause, whether or not there is a violation of law. Cost of Capital The cost of capital refers to the cost of a company’s funds, including both debt and equity. It is used to evaluate new projects because it represents the minimum return that investors expect for providing capital to the company. In this section, I calculated the cost of equity, cost of debt, and the capital structure in order to estimate costs associated with raising capital. Dr. Pepper Snapple Group’s preferred stock is $.01 of par value, and 15,000,000 shares authorized, but no shares have been issued. Therefore preferred stock will be excluded. Sub-sections: - Cost of Equity - Cost of Debt - Market Value of Equity and Debt - Weighted Average Cost of Capital Cost of Equity Cost of equity is reward to the shareholders for the risk they take to invest capital. I have calculated DPS’ cost of equity using the Capital Asset Pricing Model approach to determine required return. This equation, seen below, calculates the required return from the risk free rate plus the beta multiplied by the market risk premium: 𝑹𝒆 = 𝑹𝒇 + 𝑩(𝑹𝒎 − 𝑹𝒇) Beta Regression Beta Bottom-Up Beta 0.6867 0.8403 The Capital Asset Pricing Model breaks down expected stock returns into two components. The first is the return that would be expected based on covariance with the movements of the market. The second part is the increase in the price of a stock that is not explained by the market. The first part is what beta captures. We break down betas into their business components, operating leverage, and financial leverage to come up with estimates. The bottom-up beta provides an alternative way of measuring betas such that we do not need previous prices of an individual firm to estimate its beta. Dr. Pepper Snapple Group has a market risk of 12.42%, with 87.58% being firm-specific. I will choose the bottom-up and regression beta in my cost of equity estimation. The bottom-up beta can reflect recent and even forthcoming changes to a firm's business mix and financial leverage, because we can change the mix of businesses and the weight on each business in making the beta estimate. My bottom up calculation is as follows: 𝑩𝑼𝑩 = 𝑼𝒏𝒍𝒆𝒗𝒆𝒓𝒆𝒅 𝒆𝒒𝒖𝒊𝒕𝒚 𝒃𝒆𝒕𝒂 ∗ (𝟏 + (𝟏 − 𝒕) ∗ 𝑴𝑽 𝑫/𝑬) Unlevered equity beta = 0.84 Marginal tax rate = 40% Market Value D/E Ratio = 0.000800456 Risk-free Rate: The risk-free rate used to come up with expected returns should be measured in a way consistent with how the cash flows are measured. The risk-free rates I chose are rates from Bloomberg that are 10-year and 5-year Treasury bonds. For the purpose of this analysis, I chose these rates because they are generally safe investments. DPS’ strengths can be seen in multiple areas, such as its revenue growth, notable return on equity, reasonable valuation levels, solid stock price performance and growth in earnings per share. I feel these strengths outweigh the fact that the company has had generally high debt management risk. 10-Year Treasury Bond Rate 5-Year Treasury Bond Rate 2.00% 0.86% http://www.bloomberg.com/markets/rates-bonds/government-bonds/us/ Market Risk Premium: Implied Risk Premium Historical Risk Premium 5.78% 2.47% http://pages.stern.nyu.edu/~adamodar/ These market risk premiums come from Aswath Damodaran’s website. When calculating the cost of equity, I have determined that the historical risk premium of 2.47% provides a rather inaccurate cost of equity for DPS. The implied risk premium is more preferable as it is adjusted for growth estimates by analysts, while the historical risk premium moves frequently in the wrong direction. If a company values its assets, it is better to stick closer to the implied risk premium. DPS has admirable asset management and thus their cost of equity is better estimated with the implied risk premium. Sensitivity Analysis: I have conducted an analysis to show how the stock price fluctuates with the changes in several core assumptions. I considered a reasonable range in order to adjust to economic, industry, and company specific trends. I believe that the bottom-up and regression beta most accurately portrays the company’s risk level, and gives different variations of volatility. Considering the changing economic conditions and market trends, it is necessary to test price sensitivity against different possible risk-free rates and market risk premiums. Generally, a higher market risk premium means a higher result. Below I have put together a table and chart that represents the different cost of equity variations I calculated changing either the risk-free rate, beta, or market risk premium: Risk-free Rate Beta 10-Year = 2.00% 10-Year = 2.00% 5-Year = 0.86% 10-Year = 2.00% Bottom Up = 0.84 Regression = 0.6868 Bottom Up = 0.84 Bottom Up = 0.84 Market Risk Premium Implied = 5.78% Implied = 5.78% Implied = 5.78% Historical = 2.47% Cost of Equity 6.86% 5.97% 5.72% 4.07% 8.00% 7.00% 6.00% 5.00% 4.00% 3.00% 2.00% 1.00% 0.00% Cost of Equity (Bottom Up, 10-Year, IPR) Cost of Equity (Regression, 10-Year, IPR) Cost of Equity (Bottom Up, 5-Year, IPR) Cost of Equity (Bottom Up, 10-Year, HPR) Cost of Debt Cost of debt is the effective rate that a company pays on its current debt obligations. In order to determine DPS’ cost of debt, I will include the bond rating which determines the default spread used in calculating a premium associated with issuing debt. I have determined that DPS has a synthetic rating of BB, which means they have an acceptable capacity to meet financial commitments, but are somewhat susceptible to adverse economic conditions and changes in circumstances. The default spread associated with this rating is 4%. The cost of debt is then calculated by adding the default spread to the risk-free rate of 2%, which would equal 6%. Risk-free Rate 2.00% Interest Coverage Ratio (AVG) Estimated Bond Rating Default Spread Cost of Debt 3.11 BB 4.00% 6.00% EBIT (2012) Interest Expense (2012) Times Interest Earned (EBIT/Int. Exp.) $1,092,000 $125,000 8.74 DPS has an actual debt rating of BBB, which implies a default spread of 2%. When it is added to the risk-free rate of 2%, the cost of debt is equal to 4%. A difference between the actual rating and our synthetic rating can be contributed to the fact that the synthetic rating is simply looking at DPS’ ability to pay interest at the current time. I have not determined the effects of changes in the economy that could create an inability to cover debt obligations. Market Value of Debt Present Value of Operating Leases Year 2014 2015 2016 2017 2018 2019 and beyond Debt Value of leases = Commitment $ 48.00 $ 39.00 $ 30.00 $ 23.00 $ 60.00 $ 30.00 Present Value $ 45.28 $ 34.71 $ 25.19 $ 18.22 $ 44.84 $ 41.10 $ 209.34 Present Value of Interest Bearing Debt Rate (Cost of Debt) Weighted Average Maturity 4.00% 6.82 BVD (2012) $6,648,000 Interest Expense (2012) PV of Debt $173,400 $5,867,339 𝑴𝑽𝑫 = 𝑷𝑽 𝒐𝒇 𝑰𝒏𝒕𝒆𝒓𝒆𝒔𝒕 𝑩𝒆𝒂𝒓𝒊𝒏𝒈 𝑫𝒆𝒃𝒕 + 𝑷𝑽 𝒐𝒇 𝑶𝒑𝒆𝒓𝒂𝒕𝒊𝒏𝒈 𝑳𝒆𝒂𝒔𝒆𝒔 MVD = $5,867,338.84 + $209.34 MVD = $5,867,548.18 DPS has issued a relatively small amount of debt, $6.6 million, with a weighted average of 6.82 years until maturity. The present value of this debt is calculated by taking the total debt and linking it together using the weighted average maturity, current interest expense, and the cost of debt rate. From this method we are able to determine the first half of the market value of debt. The second half of the debt calculation involves finding the present value of operating leases that DPS is bound to. Operating leases contribute to the market value of debt because they are an agreement in which one party gains a long-term rental agreement, and the other party receives a form secured long-term debt. Through combining both of these values we conclude that DPS’ market value of debt is just under $6 million. Market Value of Equity The market value of equity for DPS has been determined by multiplying the number of shares outstanding by the price for one share on December 31, 2012. This gives us a total market value of equity of $9,379,414. 𝑀𝑉𝐸 = 𝑃 ∗ 𝑆ℎ𝑎𝑟𝑒𝑠 𝑂𝑢𝑡𝑠𝑡𝑎𝑛𝑑𝑖𝑛𝑔 + 𝐸𝑞𝑢𝑖𝑡𝑦 𝑉𝑎𝑙𝑢𝑒 𝑜𝑓 𝐶𝑜𝑛𝑣𝑒𝑟𝑡𝑖𝑏𝑙𝑒 𝐷𝑒𝑏𝑒𝑛𝑡𝑢𝑟𝑒𝑠 Shares Outstanding (12/2012) Share Price (12/31/2012) Market Value of Equity 212,300 $44.18 $9,379,414 After determining the market value of debt and market value of equity, we are able to find the total market value of the firm by adding the two. We found the weights of MVD and MVE by dividing them by the total market value. After calculating the weights, we are able to use the costs associated with each to determine the weighted average cost of capital which is a weighted average representing the cost of financing derived from the returns demanded by shareholders and creditors. Weighted Average Cost of Capital 𝑾𝑨𝑪𝑪 = 𝑬𝒒𝒖𝒊𝒕𝒚 𝑾𝒆𝒊𝒈𝒉𝒕 ∗ 𝑹𝒆 + 𝑫𝒆𝒃𝒕 𝑾𝒆𝒊𝒈𝒉𝒕 ∗ 𝑹𝒅 (𝟏 − 𝑻) Equity Weight = MVE / Total Market Value = 9,379,414 / 15,246,753 = 61.52% Debt Weight = MVD / Total Market Value = 5,867,339 / 15,246,753 = 38.48% (FIX THIS) Equity Weight 0.6152 0.6152 0.6152 Debt Weight 0.3848 0.3848 0.3848 Cost of Equity 0.0686 0.0597 0.0686 Cost of Debt Tax Rate WACC 0.06 0.06 0.04 34% 40% 40% 5.74% 5.06% 5.14% WACC is one of the most important figures in assessing a company’s financial health, both for internal use and external use. It gives companies an insight into the cost of their financing, can be used as a hurdle rate for investment decisions, and acts as a measure to be minimized to find the best possible capital structure for the company. To try to see how my weighted average cost of capital would differ if I were to change certain values, I divided up my cost of equity and cost of debt estimations, while applying marginal tax rates. As the table above shows, my WACC is within a consistent range of five to six percent. References http://pages.stern.nyu.edu/~adamodar/ http://quotes.morningstar.com/stock/dps/s?t=dps http://www.drpeppersnapplegroup.com/ http://www.reuters.com/finance/stocks/companyOfficers?symbol=DPS. N http://finance.yahoo.com/q/pr?s=dps http://www.marketwatch.com/investing/stock/dps/profile http://www.wikinvest.com/stock/Dr_Pepper_Snapple_Group_(DPS) http://www.bloomberg.com/quote/DPS:US