Dr. Pepper Snapple Group (DPS) Covering Analyst: Joshua Jordan

advertisement

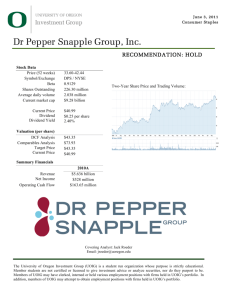

Dr. Pepper Snapple Group (DPS) Covering Analyst: Joshua Jordan jjordan3@uoregon.edu DPS History › Dr. Pepper brand since 1885 › Series of Acquisitions › Most recent: DPSU, DPSUBG › Incorporated October 24, 2007 Business Overview › Brand Owner › United States (89%) › Manufacturer › Canada (4%) › Distributor › Latin America (7%) Dr. Pepper, 7-Up, A&W, Sunkist, Canada Dry, Snapple, Hawaiian Punch, Mott’s Dr. Pepper Snapple’s Strategy › Expand distribution channels › Build and enhance existing brands › Take advantage of high-margin channels › Become more efficient through RCI LRB Industry › Highly Competitive › Centralized › 15.2 Billion Cases 2011 LRB Market Share 34% Coca-Cola 27% PepsiCo 11% Dr Pepper Snapple 10% Nestle Waters 4% Cott 14% Other CSD Industry › Dominated by CocaCola, PepsiCo, and Dr. Pepper Snapple › 9.3 Billion Cases 2011 CSD Market Share 41.9% KO 28.5% PEP 16.7% DPS 5.2% COT 2.8% FIZZ 1.2% MNST 3.7% Other Risks and Drawbacks › Consumer Health Preferences › Commodity Prices › Health Regulations › Competition › Retail Contracts Positives › Research and development is creating healthier beverages › Penetrating distribution channels › More efficient operations through RCI Revenue › Beverage Concentrates 2008 Revenue Beverage Concentrates 17% Latin America Beverages 7% – Highest Margins › Packaged Beverages Packaged Beverages 76% – Lowest Margins › Latin America Beverages Projected 2017 Revenue Beverage Concentrates 20% Latin America Beverages 8% Packaged Beverages 72% Customers › Retailers – Wal-Mart (10% of total sales) – The Kroger Co. – Safeway › Food Service – – – – – Mcdonald’s Yum! Burger King Sonic Wendy’s › Convenience Stores – 7-Eleven DCF Expectations › Increasing COGS as a percent of revenue › SG&A decreasing slightly as a percent of revenue › Tax rate increasing to 37% › Gradual rates as opposed to straight-line rates › Increasing capital expenditures DCF Valuation › Possible reasons for price differential – Beta – Cost of Debt Implied Price 60 Current Price 46 Undervalued 30.28% Comparables Screening › Industry › Licensing › Size › Beta › Growth › Margins Comparables › Coca-Cola (KO) – 30% – Coke, Fanta, Sprite, Barq’s › PepsiCo (PEP) – 30% – Pepsi, Mountain Dew, Sierra Mist, Mug › Monster (MNST) – 20% – Monster, Hansen’s › Cott (Cot) – 10% – Cott, RC Cola › National Beverage (FIZZ) – 10% – Shasta Forward Comparables Valuation Multiple EV/Revenue EV/Gross Profit EV/EBIT EV/EBITDA EV/(EBITDA-Capex) Market Cap/Net Income = P/E Price Target Current Price Undervalued Implied Price $66.20 74.41 53.54 49.49 46.73 48.78 $51.52 45.20 13.98% Weight 10% 0% 20% 50% 15% 5% Final Valuation Source Forward Comps DCF Price Target Current Price Undervalued Implied Price Weight $51.52 50% 59.84 50% 55.68 45.20 23.18% Profit Returns › Dividends › Stock Repurchases 450 400 350 300 250 200 150 100 50 0 DPS 100% 80% Stock Repurchases Dividend Percent (%) Cash Flow (millions $) DPS 60% 40% 20% 0% Stock Repurchases Dividends Comparable Profit Returns Recommendation: Hold for Tall Firs and Svigals › Outperforming strong competitors in market share › Increasing profit returns to shareholders through dividends › Innovative product line and cost-cutting techniques › Note: Future update is important to valuate success of ten-calorie soda lines Questions