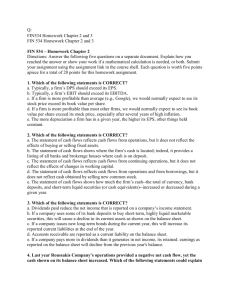

Exam Review 1-full solutions 2/10/08

advertisement

Practice Exam I-Finance 301 1. Financial management decisions have three important questions that need to be answered. Please provide the question that concerns with the following item: a. Capital budgeting- What long-term investments or projects should the business take on? b. Capital structure- How should we pay for our assets? Should we use debt or equity? c. Working capital management- How do we manage the day-to-day finances of the firm? 2. Provide one advantage and one disadvantage concerning the different forms of business: a. Sole Proprietorship- single owner keeps all profits, easy to start, least regulated, taxed only once as personal income, - limited to life of owner, unlimited liability, difficult to sell ownership interest, equity capital limited to owner’s personal wealth b. Partnership- two or more owners, more capital available, relatively easy to start, income taxed once as personal income – unlimited liability, partnership dissolves when one partner dies or wishes to sell, difficult to transfer ownership c. Corporation- Limited liability, Unlimited life, Separation of ownership and management, Transfer of ownership is easy, Easier to raise capitalSeparation of ownership and management, Double taxation (income taxed at the corporate rate and then dividends taxed at personal rate) 3. What is the main goal of financial management? Maximize value to shareholders 4. If you want to hire somebody to complete your tax return next year. Who would be the principal and the agent in this situation? Principal = you Agent = CPA 5. If you take your company public which market would you be utilizing, primary or secondary? Primary- IPO (initial public offering) secondary market would then be the market preexisting stock would trade in 6. The New York Stock Exchange is an example of what type of market, dealer or auction? NYSE = auction NASDAQ = dealer 8. Compute the average and marginal tax rate using the following table on taxable income of 240,000: Taxable Income Tax Rate $0-50,000 15% $7,500 50,001-75,000 25% $6,250 75,001-100,000 34% $8,500 100,001-335,000 Marginal – 39% 39% 54,600 Average – 32% $76,850/ $240,000 marginal = $93,600 9. For the following items, recognize whether it’s a use or source of cash a. Increase to Accounts Receivable - use b. Decrease in Notes Payable - use c. Decrease in Long-Term Debt note - use d. Decrease in Accounts Receivable – source e. Increase in Notes Payable – source f. Decrease in PP&E – source 10. Define the following two terms a. Planning horizon - divide decisions into short-run decisions (usually next 12 months) and long-run decisions (usually 2 – 5 years) b. Aggregation - combine capital budgeting decisions into one big project 11. From the following income statement information, calculate the net income and operating cash flow. Net Sales Cost of goods sold Operating exp Depreciation Interest Expense Tax rate Dividend payout ration 16,500 $10350 3118 1120 900 34% 50% NI = 668 16500-10350-3118-1120-900= 1012 -344 = 668 OCF = 1912EBIT + 1120 – 344(taxes) = 2688 Now suppose in the previous problem, there are 650 shares outstanding, what is the EPS? What is the DPS? NI/No of shares outstanding 668/650 = $1.03 DPS; Div. Paid/ NO. of shares outstanding Dividends paid = 668 *.5 = 334 DPS = 334/650 = .5138 12. Net fixed assets (NFA) of ABC corp. as of Dec. 2002 is 6.5 million and NFA showed an asset balance of 3 million last year. ABC corp’s income statement for the year 2002 showed depreciation expense of $650,000. What was the Net Capital Spending of 2002 NCS = End FA- Beg FA + Dep 6.5 -3 + .65 = 4.15 million 13. Company M has a current ratio of 2, quick ratio of 1.8, net income of $180,000, profit margin of 10% and account receivable balance of $150,000. What is the firm’s Average Collection period? ACP = 365/ A/R turnover AR turnover = Sales/ Avg. accounts receivable X / 150,000 PM = NI/Sales .1 = 180,000/X X = 1,800,000 for sales SO… 1,800,000/150,000 = 12 AR turnover ACP = 365/12= 30.4 days it takes about 30 days on average to collect back from customers 14. External Financing and Growth: The most recent financial statements for Last in Line, Inc., are shown here: Income Statement Balance Sheet Sales $3,400 Current Assets $4,400 Current Liabilities $880 Costs 2,800 Fixed Assets 5,700 Long-term debt 3,580 Taxable income $600 Equity 5,640 Taxes (34%) 204 Total $10,100 Total $10,100 Net Income $396 Assets, costs, and current liabilities are proportional to sales. Long-term debt and equity are not. The company maintains a constant 50 percent dividend payout ratio. As with every other firm in its industry, next year’s sales are projected to increase by exactly 15 percent. What is the external financing needed? Next Year: Sales = 3,910 Costs = 3,220 Taxable Income = 690 Taxes (34%) = 234.6 Net Income = 455.4 Current Assets = 5060 Fixes Assets = 6,555 TA = 11,615 Current Liabilities = 1,012 Long-term debt = 3,580 Equity = 5,640 + 227.7 = 5867.7 Total = 10,459.7 External Financing needed = 11,615- 10,459.7 = $1,155.3 15. If ABC Corp. has Profit margin of 12% debt equity ratio of 2.1, debt ratio of .60 and total asset $35,000 and sales of $22,000. The dividend payout has remained constant as 40% What is the SGR? SGR = ROE * b / 1- (ROE * b) ROE = NI/TE Debt Ratio = TD/TA PM = NI/Sales B= 1-.4= .6 .12 = NI/22,000 NI = 2640 .6 = TD/35000 TD = 21000 35000 = 21000 + TE TE=14000 ROE = 2640/14000 = .1886 or 18.86% SO: SGR = .1886 * .6/ 1- (.1886 * .6) = .1132/1-.1132 = .1276 or 12.76%