Federal Deposit Insurance

advertisement

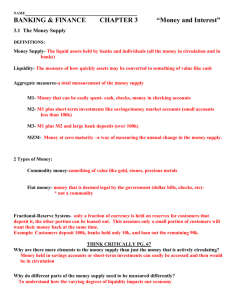

Funding the Bank 1 The Relationship Between Liquidity Requirements, Cash, and Funding Sources The amount of cash that a bank holds is influenced by the bank’s liquidity requirements The size and volatility of cash requirements affect the liquidity position of the bank Deposits, withdrawals, loan disbursements, and loan payments affect the bank’s cash balance and liquidity position 2 3 The Relationship Between Liquidity Requirements, Cash, and Funding Sources Recent Trends in Bank Funding Sources Bank customers have become more rate conscious Many customers have demonstrated a a strong preference for shorter-term deposits Core deposits are viewed as increasingly valuable Bank often issue hybrid CDs to appeal to rate sensitive depositors 4 The Relationship Between Liquidity Requirements, Cash, and Funding Sources Recent Trends in Bank Funding Sources Retail Funding Deposit Accounts Transaction accounts Money market deposit accounts Savings accounts Small time deposits 5 The Relationship Between Liquidity Requirements, Cash, and Funding Sources Recent Trends in Bank Funding Sources Borrowed Funding Federal Funds purchased Repurchase agreements Federal Home Loan Bank borrowings 6 The Relationship Between Liquidity Requirements, Cash, and Funding Sources Recent Trends in Bank Funding Sources Wholesale Funding Includes borrowed funds plus large CDs Equity Funding Common stock Preferred stock Retained earnings 7 The Relationship Between Liquidity Requirements, Cash, and Funding Sources Recent Trends in Bank Funding Sources Volatile (Managed) Liabilities Funds purchased from rate-sensitive investors Federal Funds purchased Repurchase agreements Jumbo CDs Eurodollar time deposits Foreign Deposits Investors will move their funds if other institutions are paying higher rates 8 The Relationship Between Liquidity Requirements, Cash, and Funding Sources Recent Trends in Bank Funding Sources Core Deposits Stable deposits that customers are less likely to withdraw when interest rates on competing investments rise Includes: Transactions accounts MMDAs Savings accounts Small CDs 9 10 11 12 Characteristics of Retail-Type Deposits Retail Deposits Small denomination (under $100,000) liabilities Normally held by individual investors Not actively traded in the secondary market 13 Characteristics of Retail-Type Deposits Transaction Accounts Most banks offer three different transaction accounts Demand Deposits DDAs Negotiable Order of Withdrawal NOWs Automatic Transfers from Savings ATS 14 Characteristics of Retail-Type Deposits Transaction Accounts Demand Deposits Checking accounts that do not pay interest Held by individuals, business, and governmental units Most are held by businesses since Regulation Q prohibits banks from paying explicit interest on for-profit corporate checking accounts 15 Characteristics of Retail-Type Deposits Transaction Accounts NOW Accounts Checking accounts that pay interest ATS Accounts Customer has both a DDA and savings account The bank transfers enough from savings to DDA each day to force a zero balance in the DDA account For-profit corporations are prohibited from owning NOW and ATS accounts 16 Characteristics of Retail-Type Deposits Transaction Accounts Although the interest cost of transaction accounts is very low, the non-interest costs can be quite high Generally, low balance checking accounts are not profitable for banks due to the high cost of processing checks 17 Characteristics of Retail-Type Deposits Nontransactional Accounts Non-transaction accounts are interestbearing with limited or no checkwriting privileges 18 Characteristics of Retail-Type Deposits Nontransactional Accounts Money Market Deposit Accounts Pay interest but holders are limited to 6 transactions per month, of which only three can be checks Attractive to banks because they are not required to hold reserves against MMDAs 19 Characteristics of Retail-Type Deposits Nontransactional Accounts Savings Have no fixed maturity Small Accounts Time Deposits (Retail CDs) Have a specified maturity ranging from 7 days on up Large Time Deposits (Jumbo CDs) Negotiable CDs of $100,000 or more Typically can be traded in the secondary market 20 Characteristics of Retail-Type Deposits Estimating the Cost of Deposit Accounts Interest Costs Legal Reserve Requirements Check Processing Costs Account Charges NSF fees Monthly fees Per check fees 21 Characteristics of Retail-Type Deposits Estimating the Cost of Deposit Accounts Transaction Account Cost Analysis Classifies check-processing as: Deposits Electronic Non-Electronic Withdrawals Electronic Non-Electronic 22 Characteristics of Retail-Type Deposits Estimating the Cost of Deposit Accounts Transaction Account Cost Analysis Classifies check-processing as: Transit Checks Deposited Cashed Account Opened or Closed On-Us checks cashed General account maintenance Truncated Non-Truncated 23 Characteristics of Retail-Type Deposits Estimating the Cost of Deposit Accounts Transaction Account Cost Analysis Electronic Transactions Conducted through automatic deposits, Internet, and telephone bill payment Non-Electronic Transactions Conducted in person or by mail Transit Checks Checks drawn on any bank other than the bank it was deposited into 24 Characteristics of Retail-Type Deposits Estimating the Cost of Deposit Accounts Transaction Account Cost Analysis On-Us Checks Cashed Checks drawn on the bank’s own customer’s accounts Deposits Checks or currency directly deposited in the customer's account Account Maintenance General record maintenance and preparing & mailing a periodic statement 25 Characteristics of Retail-Type Deposits Estimating the Cost of Deposit Accounts Transaction Account Cost Analysis Truncated Account A checking account in which the physical check is ‘truncated’ at the bank and the checks are not returned to the customer Official Check Issued A check for certified funds. Net Indirect Costs Those costs not directly related to the product such as management salaries or general overhead costs 26 27 Characteristics of Retail-Type Deposits Calculating the Average Net Cost of Deposit Accounts Average Measure of average unit borrowing costs for existing funds Average Historical Cost of Funds Interest Cost Calculated by dividing total interest expense by the average dollar amount of liabilities outstanding 28 Characteristics of Retail-Type Deposits Calculating the Average Net Cost of Deposit Accounts Average net cost of bank liabilitie s Interest expense Noninteres t expense - Noninteres t income 12 Average balance net of float (1 - Reserve requiremen t ratio) 29 Characteristics of Retail-Type Deposits Calculating the Average Net Cost of Deposit Accounts Example: If a demand deposit account does not pay interest, has $20.69 in transaction costs charges, $7.75 in fees, an average balance of $5,515, and 5% float, what is the net cost of the deposit? Average Net Cost of Demand Deposit $0 $20.69 - $7.75 12 3.29% $5,515 (1 - .05) (1 - .10) 30 31 Characteristics of Large Wholesale Deposits Wholesale Liabilities Customers move these investments on the basis of small rate differentials, so these funds are labeled: Hot Money Volatile Liabilities Short-Term Non-Core funding 32 Characteristics of Large Wholesale Deposits Wholesale Liabilities Jumbo CDs $100,000 or more Negotiable Can be traded on the secondary market Minimum maturity of 7 days Interest rates quoted on a 360-day year basis Insured up to $100,000 per investor per institution Issued directly or indirectly through a dealer or broker (Brokered Deposits) 33 Characteristics of Large Wholesale Deposits Wholesale Liabilities Jumbo CDs Fixed-Rate Variable-Rate Jump Rate (Bump-up) CD Depositor has a one-time option until maturity to change the rate to the prevailing market rate 34 Characteristics of Large Wholesale Deposits Wholesale Liabilities Jumbo CDs Callable Zero Coupon Stock Market Indexed Rate tied to stock market index performance Rate Boards Represent venues for selling non-brokered CDs via the Internet to institutional investors Rate boards help raise funds quickly and represent a virtual branch for a bank 35 Characteristics of Large Wholesale Deposits Individual Retirement Accounts Each year, a wage earner can make a tax-deferred investment up to $8,000 of earned income Funds withdrawn before age 59 ½ are subject to a 10% IRS penalty This makes IRAs an attractive source of long-term funding for banks 36 Characteristics of Large Wholesale Deposits Foreign Office Deposits Eurocurrency Financial claim denominated in a currency other than that of the country where the issuing bank is located Eurodollar Dollar-denominated financial claim at a bank outside the U.S. Eurodollar deposits Dollar-denominated depots in banks outside the U.S. 37 38 Characteristics of Large Wholesale Deposits Borrowing Immediately Available Funds Federal Funds Purchased The term Fed Funds is often used to refer to excess reserve balances traded between banks This is grossly inaccurate, given reserves averaging as a method of computing reserves, different non-bank players in the market, and the motivation behind many trades Most transactions are overnight loans, although maturities are negotiated and can extend up to several weeks Interest rates are negotiated between trading partners and are quoted on a 360-day basis 39 Characteristics of Large Wholesale Deposits Borrowing Immediately Available Funds Security Repurchase Agreements (RPs or Repos) Short-term loans secured by government securities that are settled in immediately available funds Identical to Fed Funds except they are collateralized Technically, the RPs entail the sale of securities with a simultaneous agreement to buy them back later at a fixed price plus accrued interest 40 Characteristics of Large Wholesale Deposits Borrowing Immediately Available Funds Security Repurchase Agreements (RPs or Repos) Most transactions are overnight In most cases, the market value of the collateral is set above the loan amount when the contract is negotiated. This difference is labeled the margin The lender’s transaction is referred to as a Reverse Repo 41 Characteristics of Large Wholesale Deposits Borrowing Immediately Available Funds Structured Repurchase Agreements Embeds an option (call, put, swap, cap, floor, etc.) in the instrument to either lower its initial cost to the borrower or better help the borrower match the risk and return profile of an investment Flipper Repo Carries a floating rate that will convert, or flip, to a fixed rate after some lock-out period 42 Characteristics of Large Wholesale Deposits Borrowing From the Federal Reserve Discount Window Discount Rate Policy is to set discount rate 1% (1.5%) over the Fed Funds target for primary (secondary) credit loans To borrow from the Federal Reserve, banks must apply and provide acceptable collateral before the loan is granted Eligible collateral includes U.S. government securities, bankers acceptances, and qualifying short-term commercial or government paper 43 Characteristics of Large Wholesale Deposits Borrowing From the Federal Reserve Discount Rate Current Interest Rates 9/09/2009 Primary Credit 0.50% Secondary Credit 1.00% Seasonal Credit 0.25% Fed Funds Target 0 - 0.25% 44 Characteristics of Large Wholesale Deposits Borrowing From the Federal Reserve Primary Credit Available to sound depository institutions on a short-term basis to meet short-term funding needs 45 Characteristics of Large Wholesale Deposits Borrowing From the Federal Reserve Secondary Credit Available to depository institutions that are not eligible for primary credit Available to meet backup liquidity needs when its use is consistent with a timely return to a reliance on market sources of funding or the orderly resolution of a troubled institution 46 Characteristics of Large Wholesale Deposits Borrowing From the Federal Reserve Seasonal Credit Designed to assist small depository institutions in managing significant seasonal swings in their loans and deposits 47 Characteristics of Large Wholesale Deposits Borrowing From the Federal Reserve Emergency Credit May be authorized in unusual and exigent circumstances by the Board of Governors to individuals, partnerships, and corporations that are not depository institutions 48 Characteristics of Large Wholesale Deposits Other Borrowing from the Federal Reserve Term Auction Facility Allows banks to bid for an advance that will generally have a 28-day maturity Banks must post collateral against the borrowings and cannot prepay the loan 49 Characteristics of Large Wholesale Deposits Other Borrowing from the Federal Reserve Term Securities Lending Facility A facility in which the Open Market Trading Desk of the Federal Reserve Bank of New York makes loans to primary securities dealers 50 Characteristics of Large Wholesale Deposits Federal Home Loan Bank Advances The FHLB system is a governmentsponsored enterprise created to assist in home buying The FHLB system is one of the largest U.S. financial institutions, rated AAA because of the government sponsorship Any bank can become a member of the FHLB system by buying FHLB stock If it has the available collateral, primarily real estate related loans, it can borrow from the FHLB FHLB advances have maturities from 1 day to as long as 20 years 51 52 Electronic Money Intelligent Card Contains a microchip with the ability to store and secure information Memory Card Simply store information 53 Electronic Money Debit Card Online PIN based Transaction goes through the ATM system Offline Signature based transactions Transaction goes through the credit card system 54 Electronic Money Electronic Funds Transfer (EFT) An electronic movement of financial data, designed to eliminate the paper instruments normally associated with such funds movement Types of EFT ACH: Automated Clearing House POS: Point of Sale ATM Direct Deposit Telephone Bill Paying Automated Merchant Authorization Systems Preauthorized Payments 55 56 Check 21 Check Clearing for the 21st Century Act Facilitates check truncation by reducing some of the legal impediments Foster innovation in the payments and check collection system without mandating receipt of check in electronic form Improve the overall efficiency of the nation’s payment system 57 Check 21 Check Truncation Conversion of a paper check into an electronic debit or image of the check by a third party in the payment system other than the paying bank Facilitates check truncation by creating a new negotiable instrument called a substitute check 58 Check 21 Substitute Check The legal equivalent of the original check and includes all the information contained on the original Check 21 does NOT require banks to accept checks in electronic form nor does it require banks to create substitute checks It does allow banks to handle checks electronically instead of physically moving paper checks 59 60 Check 21 Check Clearing Process Banks typically place a hold on a check until it verifies that the check is “good” Expedited Funds Availability Act Under Reg CC, it states that: Local check must clear in no more than two business days Non-local checks must clear in no more than five business days Government, certified, and cashiers checks must be available by 9 a.m. the next business day 61 62 Measuring the Cost of Funds Average Historical Cost of Funds Many banks incorrectly use the average historical costs in their pricing decisions The primary problem with historical costs is that they provide no information as to whether future interest costs will rise or fall. Pricing decisions should be based on marginal costs compared with marginal revenues 63 Measuring the Cost of Funds The Marginal Cost of Funds Marginal Measure of the borrowing cost paid to acquire one additional unit of investable funds Marginal Cost of Equity Measure of the minimum acceptable rate of return required by shareholders Marginal Cost of Debt Cost of Funds The marginal costs of debt and equity 64 Measuring the Cost of Funds The Marginal Cost of Funds Costs of Independent Sources of Funds It is difficult to measure marginal costs precisely Management must include both the interest and noninterest costs it expects to pay and identify which portion of the acquired funds can be invested in earning assets 65 Measuring the Cost of Funds The Marginal Cost of Funds Costs of Independent Sources of Funds Marginal costs may be defined as : Marginal Cost of Liability j Interest Rate Servicing Costs Acquistion Costs Insurance Net Investable Balance of Liability j 66 Measuring the Cost of Funds The Marginal Cost of Funds Costs of Independent Sources of Funds Example: Market interest rate is 2.5% Servicing costs are 4.1% of balances Acquisition costs are 1.0% of balances Deposit insurance costs are 0.25% of balances Net investable balance is 85% of the balance (10% required reserves and 5% float) 67 Measuring the Cost of Funds The Marginal Cost of Funds Costs of Independent Sources of Funds Example: 0.025 0.041 0.01 0.0025 Marginal Cost 0.0924 9.24% 0.85 68 Measuring the Cost of Funds The Marginal Cost of Funds Costs of Independent Sources of Funds Cost of Debt Equals the effective cost of borrowing from each source, including interest expense and transactions costs This cost is the discount rate, which equates the present value of expected interest and principal payments with the net proceeds to the bank from the issue 69 Measuring the Cost of Funds The Marginal Cost of Funds Costs of Independent Sources of Funds Cost of Debt Example: Assume the bank will issue: $10 million in par value subordinated notes paying $700,000 in annual interest and a 7-year maturity It must pay $100,000 in flotation costs to an underwriter The effective cost of borrowing (kd) is 7.19% 70 Measuring the Cost of Funds The Marginal Cost of Funds Costs of Independent Sources of Funds Cost of Debt Example: 7 $700,000 $10,000,000 $9,900,000 t 7 (1 k ) (1 k ) t 1 d d Thus k d 7.19% 71 Measuring the Cost of Funds The Marginal Cost of Funds Costs of Independent Sources of Funds Cost of Equity The marginal cost of equity equals the required return to shareholders It is not directly measurable because dividend payments are not mandatory 72 Measuring the Cost of Funds The Marginal Cost of Funds Costs of Independent Sources of Funds Cost of Equity Several methods are commonly used to approximate this required return: Dividend Valuation Model Capital Asset Pricing Model (CAPM) Targeted Return on Equity Model Cost of Debt + Risk Premium 73 Measuring the Cost of Funds The Marginal Cost of Funds Costs of Independent Sources of Funds Cost of Preferred Stock Preferred stock acts as a hybrid of debt and common equity Claims are superior to those of common stockholders but subordinated to those of debt holders Preferred stock pays dividends that may be deferred when management determines that earnings are too low. The marginal cost of preferred stock can be approximated in the same manner as the Dividend Valuation Model however, dividend growth is zero 74 Measuring the Cost of Funds The Marginal Cost of Funds Costs of Independent Sources of Funds Trust Preferred Stock Trust preferred stock is attractive because it effectively pays dividends that are tax deductible This loan interest is tax deductible such that the bank effectively gets to deduct dividend payments as the preferred stock 75 Measuring the Cost of Funds Weighted Marginal Cost of Total Funds This is the best cost measure for asset-pricing purposes It recognizes both explicit and implicit costs associated with any single source of funds 76 Measuring the Cost of Funds Weighted Marginal Cost of Total Funds It assumes that all assets are financed from a pool of funds and that specific sources of funds are not tied directly to specific uses of funds m WMC w j k j j1 77 78 Funding Sources and Banking Risks Banks face two fundamental problems in managing liabilities. Uncertainty over: What rates they must pay to retain and attract funds The likelihood that customers will withdraw their money regardless of rates 79 Funding Sources and Banking Risks Funding Sources: Liquidity Risk The liquidity risk associated with a bank’s deposit base is a function of: The competitive environment Number of depositors Average size of accounts Location of the depositor Specific maturity and rate characteristics of each account 80 Funding Sources and Banking Risks Funding Sources: Liquidity Risk Interest Elasticity How much can market interest rates change before the bank experiences deposit outflows? If a bank raises its rates, how many new funds will it attract? Depositors often compare rates and move their funds between investment vehicles to earn the highest yields It is important to note the liquidity advantage that stable core deposits provide a bank 81 Funding Sources and Banking Risks Funding Sources: Interest Rate Risk Many depositors and investors prefer short-term instruments that can be rolled over quickly as interest rates change Banks must offer a substantial premium to induce depositors to lengthen maturities Those banks that choose not to pay this premium will typically have a negative one-year GAP 82 Funding Sources and Banking Risks Funding Sources: Interest Rate Risk One strategy is to aggressively compete for retail core deposits Individual are not as rate sensitive as corporate depositors and will often maintain their balances through rate cycles as long as the bank provides good service 83 Funding Sources and Banking Risks Funding Sources: Credit and Capital Risk Changes in the composition and cost of bank funds can indirectly affect a bank’s credit risk by forcing it to reduce asset quality For example, banks that substitute purchased funds for lost demand deposits will often see their cost of funds rise Rather than let their interest margins deteriorate, many banks make riskier loans at higher promised yields While they might maintain their margins in the near-term, later loan losses typically rise with the decline in asset quality 84 11 Managing Liquidity 85 Meeting Liquidity Needs Bank Liquidity A bank’s capacity to acquire immediately available funds at a reasonable price Firms can acquire liquidity in three distinct ways: 1. 2. 3. Selling assets New borrowings New stock issues 86 Meeting Liquidity Needs How effective each liquidity source is at meeting the institution’s liquidity needs, depends on: Market conditions The market’s perception of risk at the institution as well as in the marketplace The market’s perception of bank management and its strategic direction The current economic environment 87 Meeting Liquidity Needs Holding Liquid Assets “Cash Assets” Do not earn any interest Represents a substantial opportunity cost for banks Banks attempt to minimize the amount of cash assets held and hold only those required by law or for operational needs Liquid Assets Can be easily and quickly converted into cash with minimum loss 88 Meeting Liquidity Needs Holding Liquid Assets “Cash Assets” do not generally satisfy a bank’s liquidity needs If the bank holds the minimum amount of cash assets required, an unforeseen drain on vault cash (perhaps from an unexpected withdrawal) will cause the level of cash to fall below the minimum for legal and operational requirements 89 Meeting Liquidity Needs Holding Liquid Assets Banks hold cash assets to satisfy four objectives: 1. To meet customers’ regular transaction needs 2. To meet legal reserve requirements 3. To assist in the check-payment system 4. To purchase correspondent banking services 90 Meeting Liquidity Needs Holding Liquid Assets Banks own five types of liquid assets 1. Cash and due from banks in excess of requirements 2. Federal funds sold and reverse repurchase agreements 3. Short-term Treasury and agency obligations 4. High-quality short-term corporate and municipal securities 5. Government-guaranteed loans that can be readily sold 91 Meeting Liquidity Needs Borrowing Liquid Assets Banks can provided for their liquidity by borrowing Banks historically have had an advantage over non-depository institutions in that they could fund their operations with relatively lowcost deposit accounts 92 Meeting Liquidity Needs Objectives of Cash Management Banks must balance the desire to hold a minimum amount of cash assets while meeting the cash needs of its customers The fundamental goal is to accurately forecast cash needs and arrange for readily available sources of cash at minimal cost 93 Reserve Balances at the Federal Reserve Bank Banks hold deposits at the Federal Reserve because: The Federal Reserve imposes legal reserve requirements and deposit balances qualify as legal reserves To help process deposit inflows and outflows caused by check clearings, maturing time deposits and securities, wire transfers, and other transactions 94 Reserve Balances at the Federal Reserve Bank Required Reserves and Monetary Policy The purpose of required reserves is to enable the Federal Reserve to control the nation’s money supply The Fed has three distinct monetary policy tools: Open market operations Changes in the discount rate Changes in the required reserve ratio 95 Reserve Balances at the Federal Reserve Bank Required Reserves and Monetary Policy Example A required reserve ratio of 10% means that a bank with $100 in demand deposits outstanding must hold $10 in legal required reserves in support of the DDAs The bank can thus lend out only 90% of its DDAs If the bank has exactly $10 in legal reserves, the reserves do not provide the bank with liquidity If the bank has $12 in legal reserves, $2 is excess reserves, providing the bank with $2 in immediately available funds 96 Reserve Balances at the Federal Reserve Bank Impact of Sweep Accounts on Required Reserve Balances Under Reg. D, banks have reserve requirements of 10% on demand deposits, ATS, NOW, and other checkable deposit (OCD) accounts not reservable 97 Reserve Balances at the Federal Reserve Bank Impact of Sweep Accounts on Required Reserve Balances MMDAs are considered personal saving deposits and have a zero required reserve requirement ratio 98 Reserve Balances at the Federal Reserve Bank Impact of Sweep Accounts on Required Reserve Balances Sweep accounts are accounts that enable depository institutions to shift funds from OCDs, which are reservable, to MMDAs or other accounts, which are not reservable 99 Reserve Balances at the Federal Reserve Bank Impact of Sweep Accounts on Required Reserve Balances Sweep Accounts Two Types Weekend Program Reclassifies transaction deposits as savings deposits at the close of business on Friday and back to transaction accounts at the open on Monday On average, this means that for three days each week, the bank does not need to hold reserves against those balances 100 Reserve Balances at the Federal Reserve Bank Impact of Sweep Accounts on Required Reserve Balances Sweep Accounts Two Types Threshold Account The bank’s computer moves the customer’s DDA balance into an MMDA when the dollar amount reaches some minimum and returns funds as needed The number of transfers is limited to 6 per month, so the full amount of funds must be moved back into the DDA on the sixth transfer of the month 101 102 Meeting Legal Reserve Requirements Required reserves can be met over a two-week period There are three elements of required reserves: The dollar magnitude of base liabilities The required reserve fraction The dollar magnitude of qualifying cash assets 103 Meeting Legal Reserve Requirements 104 Meeting Legal Reserve Requirements Historical Problems with Reserve Requirements Reserve requirements varied by type of bank charter and by state. Non-Fed member banks had lower reserve requirements than Fed member banks 105 Meeting Legal Reserve Requirements Lagged Reserve Accounting Computation Consists of two one-week reporting periods beginning on a Tuesday and ending on the second Monday thereafter Maintenance Period Period Consists of 14 consecutive days beginning on a Thursday and ending on the second Wednesday thereafter 106 Meeting Legal Reserve Requirements Lagged Reserve Accounting Reserve Balance Requirements The balance to be maintained in any given maintenance period is measured by: Reserve requirements on the reservable liabilities calculated as of the computation period that ended 17 days prior to the start of the maintenance period Less vault cash as of the same computation period 107 Meeting Legal Reserve Requirements Lagged Reserve Accounting Reserve Balance Requirements Both vault cash and Federal Reserve Deposits qualify as reserves The portion that is not met by vault cash is called the reserve balance requirement 108 109 110 Meeting Legal Reserve Requirements An Application: Reserve Calculation Under LRA Four 1. 2. 3. 4. steps: Calculate daily average balances outstanding during the lagged computation period. Apply the reserve percentages. Subtract vault cash. Add or subtract the allowable reserve carried forward from the prior period 111 112 Meeting Legal Reserve Requirements Correspondent Banking Services System of interbank relationships in which the correspondent bank (upstream correspondent) sells services to the respondent bank (downstream correspondent) 113 Meeting Legal Reserve Requirements Correspondent Banking Services Common Correspondent Banking Services Check collection, wire transfer, coin and currency supply Loan participation assistance Data processing services Portfolio analysis and investment advice Federal funds trading Securities safekeeping Arrangement of purchase or sale of securities Investment banking services Loans to directors and officers International financial transactions 114 Meeting Legal Reserve Requirements Correspondent Banking Services Banker’s Bank A firm, often a cooperative owned by independent commercial banks, that provides correspondent banking services to commercial banks and not to commercial or retail deposit and loan customers 115 Liquidity Planning Short-Term Liquidity Planning Objective is to manage a legal reserve position that meets the minimum requirement at the lowest cost 116 Liquidity Planning 117 Liquidity Planning Managing Float During any single day, more than $100 million in checks drawn on U.S. commercial banks is waiting to be processed Individuals, businesses, and governments deposit the checks but cannot use the proceeds until banks give their approval, typically in several days Checks in process of collection, called float, are a source of both income and expense to banks 118 Liquidity Planning Liquidity versus Profitability There is a short-run trade-off between liquidity and profitability The more liquid a bank is, the lower are its return on equity and return on assets, all other things equal In a bank’s loan portfolio, the highest yielding loans are typically the least liquid The most liquid loans are typically government-guaranteed loans 119 Liquidity Planning The Relationship Between Liquidity, Credit Risk, and Interest Rate Risk Liquidity risk for a poorly managed bank closely follows credit and interest rate risk Banks that experience large deposit outflows can often trace the source to either credit problems or earnings declines from interest rate gambles that backfired Potential liquidity needs must reflect estimates of new loan demand and potential deposit losses 120 Liquidity Planning The Relationship Between Liquidity, Credit Risk, and Interest Rate Risk 121 Traditional Aggregate Measures of Liquidity Risk Asset Liquidity Measures The most liquid assets mature near term and are highly marketable Any security or loan with a price above par, in which the bank could report a gain at sale, is viewed as highly liquid Liquidity measures are normally expressed in percentage terms as a fraction of total assets 122 Traditional Aggregate Measures of Liquidity Risk Asset Liquidity Measures Highly Liquid Assets Cash and due from banks in excess of required holdings Federal funds sold and reverse RPs. U.S. Treasury securities and agency obligations maturing within one year Corporate obligations and municipal securities maturing within one year and rated Baa and above Loans that can be readily sold and/or securitized 123 Traditional Aggregate Measures of Liquidity Risk Asset Liquidity Measures Pledging Requirements Not all of a bank’s securities can be easily sold Like their credit customers, banks are required to pledge collateral against certain types of borrowings U.S. Treasuries or municipals normally constitute the least-cost collateral and, if pledged against debt, cannot be sold until the bank removes the claim or substitutes other collateral 124 Traditional Aggregate Measures of Liquidity Risk Asset Liquidity Measures Pledging Requirements Collateral is required against four different liabilities: Repurchase agreements Discount window borrowings Public deposits owned by the U.S. Treasury or any state or municipal government unit FLHB advances 125 Traditional Aggregate Measures of Liquidity Risk Asset Liquidity Measures Loans Many banks and bank analysts monitor loan-to-deposit ratios as a general measure of liquidity Loans are presumably the least liquid of assets, while deposits are the primary source of funds A high ratio indicates illiquidity because a bank is fully loaned up relative to its stable funding 126 Traditional Aggregate Measures of Liquidity Risk Liability Liquidity Measures Liability Liquidity: The ease with which a bank can issue new debt to acquire clearing balances at reasonable costs Measures typically reflect a bank’s asset quality, capital base, and composition of outstanding deposits and other liabilities 127 Traditional Aggregate Measures of Liquidity Risk Liability Liquidity Measures Commonly used measures: Total equity to total assets Risk assets to total assets Loan losses to net loans Reserve for loan losses to net loans The percentage composition of deposits Total deposits to total liabilities Core deposits to total assets Federal funds purchased and RPs to total liabilities Commercial paper and other short-term borrowings to total liabilities 128 Traditional Aggregate Measures of Liquidity Risk Liability Liquidity Measures Core Deposits A base level of deposits a bank expects to remain on deposit, regardless of the economic environment Volatile Deposits The difference between actual current deposits and the base estimate of core deposits 129 Longer-Term Liquidity Planning This stage of liquidity planning involves projecting funds needs over the coming year and beyond if necessary Forecasts in deposit growth and loan demand are required Projections are separated into three categories: base trend, short-term seasonal, and cyclical values The analysis assesses a bank’s liquidity gap, measured as the difference between potential uses of funds and anticipated sources of funds, over monthly intervals 130 131 Longer-Term Liquidity Planning The bank’s monthly liquidity needs are estimated as the forecasted change in loans plus required reserves minus the forecast change in deposits: Liquidity needs = Forecasted Δloans + ΔRequired reserves - Forecasted Δdeposits 132 Longer-Term Liquidity Planning 133 Longer-Term Liquidity Planning 134 Longer-Term Liquidity Planning 135 Longer-Term Liquidity Planning Considerations in the Selection of Liquidity Sources The costs should be evaluated in present value terms because interest income and expense may arise over time The choice of one source over another often involves an implicit interest rate forecast 136 Contingency Funding Financial institutions must have carefully designed contingency plans that address their strategies for handling unexpected liquidity crises and outline the appropriate procedures for dealing with liquidity shortfalls occurring under abnormal conditions 137 Contingency Funding Contingency Planning A contingency plan should include: A narrative section that addresses the senior officers who are responsible for dealing with external constituencies, internal and external reporting requirements, and the types of events that trigger specific funding needs 138 Contingency Funding Contingency Planning A contingency plan should include: A quantitative section that assesses the impact of potential adverse events on the institution’s balance sheet (changes), incorporates the timing of such events by assigning deposit and wholesale funding run-off rates, identifies potential sources of new funds, and forecasts the associated cash flows across numerous short-term and long-term scenarios and time intervals 139 Contingency Funding Contingency Planning A contingency plan should include: A section that summarizes the key risks and potential sources of funding, identifies how the modeling will monitored and tested, and establishes relevant policy limits 140 Contingency Funding Contingency Planning The institution’s liquidity contingency strategy should clearly outline the actions needed to provide the necessary liquidity The institution’s plan must consider the cost of changing its asset or liability structure versus the cost of facing a liquidity deficit 141 Contingency Funding Contingency Planning The contingency plan should prioritize which assets would have to be sold in the event that a crisis intensifies The institution’s relationship with its liability holders should also be factored into the contingency strategy The institution’s plan should also provide for back-up liquidity 142 12 The Effective Use of Capital 143 Why Worry About Bank Capital? Capital requirements reduce the risk of failure by acting as a cushion against losses, providing access to financial markets to meet liquidity needs, and limiting growth Bank capital-to-asset ratios have fallen from about 20% a hundred years ago to around 8% today 144 145 Risk-Based Capital Standards Historically, the minimum capital requirements for banks were independent of the riskiness of the bank Prior to 1990, banks were required to maintain: a primary capital-to-asset ratio of at least 5% to 6%, and a minimum total capital-to-asset ratio of 6% 146 Risk-Based Capital Standards Primary Capital Common stock Perpetual preferred stock Surplus Undivided profits Contingency and other capital reserves Mandatory convertible debt Allowance for loan and lease losses 147 Risk-Based Capital Standards Secondary Capital Long-term subordinated debt Limited-life preferred stock Total Capital Primary Capital + Secondary Capital Capital requirements were independent of a bank’s asset quality, liquidity risk, interest rate risk, operational risk, and other related risks 148 Risk-Based Capital Standards The 1986 Basel Agreement In 1986, U.S. bank regulators proposed that U.S. banks be required to maintain capital that reflects the riskiness of bank assets The Basel Agreement grew to include riskbased capital standards for banks in 12 industrialized nations Regulations apply to both banks and thrifts and have been in place since the end of 1992 Today, countries that are members of the Organization for Economic Cooperation and Development (OECD) enforce similar riskbased requirements on their own financial institutions 149 Risk-Based Capital Standards The 1986 Basel Agreement A bank’s minimum capital requirement is linked to its credit risk The greater the credit risk, the greater the required capital Stockholders' equity is deemed to be the most valuable type of capital 150 Risk-Based Capital Standards The 1986 Basel Agreement Minimum capital requirement increased to 8% total capital to riskadjusted assets Capital requirements were approximately standardized between countries to ‘level the playing field' 151 Risk-Based Capital Standards Risk-Based Elements of Basel I 1. 2. 3. Classify assets into one of four risk categories Classify off-balance sheet commitments into the appropriate risk categories Multiply the dollar amount of assets in each risk category by the appropriate risk weight 4. This equals risk-weighted assets Multiply risk-weighted assets by the minimum capital percentages, currently 4% for Tier 1 capital and 8% for total capital 152 153 Risk-Based Capital Standards 154 Risk-Based Capital Standards 155 156 157 158 159 What Constitutes Bank Capital? Capital (Net Worth) The cumulative value of assets minus the cumulative value of liabilities Represents ownership interest in a firm 160 What Constitutes Bank Capital? Total Equity Capital Equals the sum of: Common stock Surplus Undivided profits and capital reserves Net unrealized holding gains (losses) on available-for-sale securities Preferred stock 161 What Constitutes Bank Capital? Tier 1 (Core) Capital Equals the sum of: Common equity Non-cumulative perpetual preferred stock Minority interest in consolidated subsidiaries, less intangible assets such as goodwill 162 What Constitutes Bank Capital? Tier 2 (Supplementary) Capital Equals the sum of: Cumulative perpetual preferred stock Long-term preferred stock Limited amounts of term-subordinated debt Limited amount of the allowance for loan loss reserves (up to 1.25 percent of risk-weighted assets) 163 What Constitutes Bank Capital? Leverage Capital Ratio Tier 1 capital divided by total assets net of goodwill and disallowed intangible assets and deferred tax assets Regulators are concerned that a bank could acquire practically all low-risk assets such that risk-based capital requirements would be virtually zero To prevent this, regulators have also imposed a 3 percent leverage capital ratio 164 165 What Constitutes Bank Capital? 166 What Constitutes Bank Capital? 167 What Constitutes Bank Capital? Tier 3 Capital Requirements for Market Risk Under Basel I Market Risk The risk of loss to the bank from fluctuations in interest rates, equity prices, foreign exchange rates, commodity prices, and exposure to specific risk associated with debt and equity positions in the bank’s trading portfolio 168 What Constitutes Bank Capital? Tier 3 Capital Requirements for Market Risk Under Basel I Banks subject to the market risk capital guidelines must maintain an overall minimum 8 percent ratio of total qualifying capital [the sum of Tier 1 capital, Tier 2 capital, and Tier 3 capital allocated for market risk, net of all deductions] to risk-weighted assets and market risk–equivalent assets 169 What Constitutes Bank Capital? Basel II Capital Standards Risk-based capital standards that encompass a three-pillar approach for determining the capital requirements for financial institutions Basel II capital standards are designed to produce minimum capital requirements that incorporate more types of risk than the credit risk-based standards of Basel I Basel II standards have not been finalized 170 What Constitutes Bank Capital? Basel II Capital Standards Pillar I Credit risk Market risk Operational risk Pillar II Supervisory review of capital adequacy Pillar III Market discipline through enhanced public disclosure 171 What Constitutes Bank Capital? Weaknesses of the Risk-Based Capital Standards Standards only consider credit risk Ignores interest rate risk and liquidity risk Core banks subject to the advanced approaches of Basel II use internal models to assess credit risk Results of their own models are reported to the regulators 172 What Constitutes Bank Capital? Weaknesses of the Risk-Based Capital Standards The new risk-based capital rules of Basel II are heavily dependent on credit ratings, which have been extremely inaccurate in the recent past Book value of capital is often not meaningful since It ignores: changes in the market value of assets unrealized gains (losses) on held-to-maturity securities 97% of banks are considered “well capitalized” in 2007 Not a binding constraint for most banks 173 What is the Function of Bank Capital For regulators, bank capital serves to protect the deposit insurance fund in case of bank failures Bank capital reduces bank risk by: Providing a cushion for firms to absorb losses and remain solvent Providing ready access to financial markets, which provides the bank with liquidity Constraining growth and limits risk taking 174 What is the Function of Bank Capital 175 How Much Capital Is Adequate? Regulators prefer more capital Reduces the likelihood of bank failures and increases bank liquidity Bankers prefer less capital Lower capital increases ROE, all other things the same Riskier banks should hold more capital while lower-risk banks should be allowed to increase financial leverage 176 The Effect of Capital Requirements on Bank Operating Policies Limiting Asset Growth The change in total bank assets is restricted by the amount of bank equity ROA(1 DR) ΔEC/TA 2 ΔTA/TA 1 EQ1/TA 1 where TA = Total Assets EQ = Equity Capital ROA = Return on Assets DR = Dividend Payout Ratio EC = New External Capital 177 178 The Effect of Capital Requirements on Bank Operating Policies Changing the Capital Mix Internal versus External capital Change Asset Composition Hold fewer high-risk category assets Pricing Policies Raise rates on higher-risk loans Shrinking the Bank Fewer assets requires less capital 179 Characteristics of External Capital Sources Subordinated Debt Advantages Interest payments are tax-deductible No dilution of ownership interest Generates additional profits for shareholders as long as earnings before interest and taxes exceed interest payments 180 Characteristics of External Capital Sources Subordinated Debt Disadvantages Does not qualify as Tier 1 capital Interest and principal payments are mandatory Many issues require sinking funds 181 Characteristics of External Capital Sources Common Stock Advantages Qualifies as Tier 1 capital It has no fixed maturity and thus represents a permanent source of funds Dividend payments are discretionary Losses can be charged against equity, not debt, so common stock better protects the FDIC 182 Characteristics of External Capital Sources Common Stock Disadvantages Dividends are not tax-deductible, Transactions costs on new issues exceed comparable costs on debt Shareholders are sensitive to earnings dilution and possible loss of control in ownership Often not a viable alternative for smaller banks 183 Characteristics of External Capital Sources Preferred Stock A form of equity in which investors' claims are senior to those of common stockholders Dividends are not tax-deductible Corporate investors in preferred stock pay taxes on only 20 percent of dividends Most issues take the form of adjustable-rate perpetual stock 184 Characteristics of External Capital Sources Trust Preferred Stock A hybrid form of equity capital at banks It effectively pays dividends that are tax deductible To issue the security, a bank establishes a trust company The trust company sells preferred stock to investors and loans the proceeds of the issue to the bank Interest on the loan equals dividends paid on preferred stock The interest on the loan is tax deductible such that the bank deducts dividend payments Counts as Tier 1 capital 185 Characteristics of External Capital Sources TARP Capital Purchase Program The Troubled Asset Relief Program’s Capital Purchase Program (TARPCPP), allows financial institutions to sell preferred stock that qualifies as Tier 1 capital to the Treasury Qualified institutions may issue senior preferred stock equal to not less than 1% of risk-weighted assets and not more than the lesser of $25 billion, or 3%, of risk-weight assets 186 187 Characteristics of External Capital Sources Leasing Arrangements Many banks enter into sale and leaseback arrangements Example: The bank sells its headquarters and simultaneously leases it back from the buyer The bank receives a large amount of cash and still maintains control of the property The net effect is that the bank takes a fully depreciated asset and turns it into a tax deduction 188 Capital Planning Process of Capital Planning Generate pro formal balance sheet and income statements for the bank Select a dividend payout Analyze the costs and benefits of alternative sources of external capital 189 Capital Planning Application Consider a bank that has exhibited a deteriorating profit trend Assume as well that federal regulators who recently examined the bank indicated that the bank should increase its primary capital-to-asset ratio to 8.5% within four years from its current 7% The $80 million bank reported an ROA of just 0.45 percent During each of the past five years, the bank paid $250,000 in common dividends 190 Capital Planning Application Consider a bank that has exhibited a deteriorating profit trend The following slide extrapolates historical asset growth of 10% Under this scenario, the bank will actually see its capital ratio fall The following slide also identifies three different strategies for meting the required 8.5% capital ratio 191 192 Depository Institutions Capital Standards The Federal Deposit Insurance Improvement Act (FDICIA) focused on revising bank capital requirements to: Emphasize the importance of capital Authorize early regulatory intervention in problem institutions Authorized regulators to measure interest rate risk at banks and require additional capital when it is deemed excessive 193 Depository Institutions Capital Standards The Act required a system for prompt regulatory action It divides banks into categories according to their capital positions and mandates action when capital minimums are not met 194 Depository Institutions Capital Standards 195 196 Federal Deposit Insurance Federal Deposit Insurance Corporation Established in 1933 Coverage is currently $100,000 per depositor per institution Original coverage was $2,500 197 Federal Deposit Insurance Federal Deposit Insurance Corporation Initial Objective: Prevent liquidity crises caused by large-scale deposit withdrawals Protect depositors of modes means against a bank failure 198 Federal Deposit Insurance Federal Deposit Insurance Corporation The Financial Institution Reform, Recovery and Enforcement Act of 1989 authorized the issuance of bonds to finance the bailout of the FSLIC The act also created two new insurance funds, the Savings Association Insurance Fund (SAIF) and the Bank Insurance Fund (BIF); both were controlled by the FDIC 199 Federal Deposit Insurance Federal Deposit Insurance Corporation The large number of failures in the late 1980s and early 1990s depleted the FDIC fund During 1991 - 92, the FDIC ran a deficit and had to borrow from the Treasury In 1991 FDIC began charging risk-based deposit insurance premiums ranging from $0.23 to $0.27 per $100, depending on a bank’s capital position. By 1993, the reduction in bank failures and increased premiums allowed the FDIC to pay off the debt and put the fund back in the black 200 Federal Deposit Insurance 201 Federal Deposit Insurance FDIC Insurance Assessment Rates FDIC insurance premiums are assessed using a risk-based deposit insurance system Deposit insurance assessment rates are reviewed semiannually by the FDIC to ensure that premiums appropriately reflect the risks posed to the insurance funds and that fund reserve ratios are maintained at or above the target designated reserve ratio (DRR) of 1.25% of insured deposits Deposit insurance premiums are assessed as basis points per $100 of insured deposits 202 Federal Deposit Insurance FDIC Insurance Assessment Rates FDIC Improvement Act Merged the BIF and SAIF into the Deposit Insurance Fund (DIF) Increasing coverage for retirement accounts to $250,000 and indexing the coverage to inflation Established a range of 1.15% to 1.50% within which the FDIC Board of Directors may set the Designated Reserve Ratio (DRR) 203 Federal Deposit Insurance FDIC Insurance Assessment Rates 204 Federal Deposit Insurance FDIC Insurance Assessment Rates Subgroup A Financially sound institutions with only a few minor weaknesses This subgroup assignment generally corresponds to the primary federal regulator’s composite rating of “1” or “2” 205 Federal Deposit Insurance FDIC Insurance Assessment Rates Subgroup B Institutions that demonstrate weaknesses that, if not corrected, could result in significant deterioration of the institution and increased risk of loss to the BIF or SAIF This subgroup assignment generally corresponds to the primary federal regulator’s composite rating of “3” 206 Federal Deposit Insurance FDIC Insurance Assessment Rates Subgroup C Institutions that pose a substantial probability of loss to the BIF or the SAIF unless effective corrective action is taken This subgroup assignment generally corresponds to the primary federal regulator’s composite rating of “4” or “5” 207 Federal Deposit Insurance FDIC Insurance Assessment Rates 208 Federal Deposit Insurance Problems With Deposit Insurance Deposit insurance acts similarly to bank capital In banking, a large portion of borrowed funds come from insured depositors who do not look to the bank’s capital position in the event of default A large number of depositors, therefore, do not require a risk premium to be paid by the bank since their funds are insured Normal market discipline in which higher risk requires the bank to pay a risk premium does not apply to insured funds 209 Federal Deposit Insurance Problems With Deposit Insurance Too-Big-To-Fail Many large banks are considered to be “too-big-to-fail” As such, any creditor of a large bank would receive de facto 100 percent insurance coverage regardless of the size or type of liability 210 Federal Deposit Insurance Problems With Deposit Insurance Deposit insurance has historically ignored the riskiness of a bank’s operations, which represents the critical factor that leads to failure Two banks with equal amounts of domestic deposits paid the same insurance premium, even though one invested heavily in risky loans and had no uninsured deposits while the other owned only U.S. government securities and just 50 percent of its deposits were fully insured The creates a moral hazard problem 211 Federal Deposit Insurance Problems With Deposit Insurance Moral Hazard A lack of incentives that would encourage individuals to protect or mitigate against risk In some cases of moral hazard, incentives are created that would actually increase risk-taking behavior 212 Federal Deposit Insurance Problems With Deposit Insurance Deposit insurance funds were always viewed as providing basic insurance coverage Historically, there has been fundamental problem with the pricing of deposit insurance Premium levels were not sufficient to cover potential payouts 213 Federal Deposit Insurance Problems With Deposit Insurance Historically, premiums were not assessed against all of a bank’s insured liabilities Insured deposits consisted only of domestic deposits while foreign deposits were exempt Too-big-to-fail doctrine toward large banks means that large banks would have coverage on 100 percent of their deposits but pay for the same coverage as if they only had the same $250,000 coverage as smaller banks do 214 Federal Deposit Insurance Weakness of the Current Risk-Based Deposit Insurance System Risk-based deposit system is based on capital and risk Hence, banks that hold higher capital, everything else being equal, pay lower premiums “Too Big to Fail” The FDIC must follow the “least cost” alternative in the resolution of a failed bank. Consequently, the FDIC must consider all alternatives and choose the one that represents the lowest cost to the insurance fund 215