File

advertisement

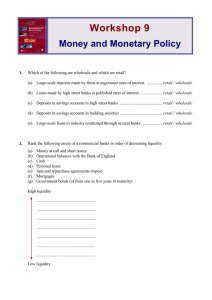

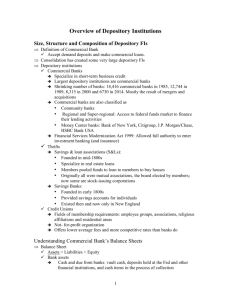

Money & Banking Chapter 17 2008 Q 8 • Explain with the aid of an example, how it is possible for banks to create credit. • Mr X lodges €100 into the bank • The bank knows from experience that only 10% of this money is ever demanded in cash. • So if it keeps €10 in the bank it can lend out the other €90 (=10x9). • Banks are not happy to do just this. • They want more!!! • If they keep the full €100 cash in the bank then they can get away with lending €900 (= 100X9). • Where does this €900 come from? • They generate €900 by allowing customers to open overdraft a/c’s. • Customers then write cheques. • These cheques will eventually be lodged in the bank as deposits. • The bank now has deposits of €1,000. • But still only has €100 cash which is all it needs as only 10% will be demanded! • No cash changes hands in these transactions. • Credit has been created based on the Primary Liquidity Ratio (PLR). Primary Liquidity Ratio • The amount of loans a bank gives out is related to, but in excess of their cash deposits and is based on their reserve ratio. • It is written as a percentage. Formula Reserve Ratio/PLR = Cash X 100 Total Deposits €100 €1,000 Reserve Ratio/PLR = 10 % X 100 Increase in the Money Supply (increase in cash reserves x 1 ) – inc in cash reserves reserve ratio ( €100 x 1 ) - €100 .10 €900 Note • The lower the PLR the more money the banks can create. • The higher the PLR the less money the banks can create. Balance Sheet of a Bank 1 Assets Cash lodged by Mr X €100 Total Assets €100 Liabilities Mr X’s Deposit Total Liabilities €100 €100 Balance Sheet of a Bank 2 Assets Cash lodged by Mr X €100 Loans €900 Total Assets €1,000 Liabilities Mr X’s Deposit Deposits Total Liabilities €100 €900 €1,000 Secondary Liquidity Ratio • Is the ratio of liquid assets (easily turned into cash eg. shares) held by the banks to claims on the bank. • PLR = Cash:Loans • SLR = Cash & Liquid Assets: Loans Measuring the Money Supply M1 • Is the notes & coins in circulation. • Plus all balances in current a/c’s in all licenced banks in the state. M 3 The Broad Money Supply • Is the notes & coins in circulation. • Plus all balances in current a/c’s in all licensed banks in the state. • Plus balances in deposit a/c’s. • Plus borrowings from other credit institutions. • Less inter-bank balances. Limits on the powers of banks to create credit P 148 1. Availability of cash deposits: 2. Availability of creditworthy customers. 3. Customer’s demand for cash: 4. ECB guidelines & PLR 2002 Q 5 (b) • Demand for cash falls. • Therefore the bank can keep less cash reserves. • Therefore banks can loan out more. • People can spend more in shops. • Shops can deposit more in banks. 2009 Q 5 (c) • Motor Industry • Decreased demand for cars. • People have less chance of getting a loan so cannot buy a new or second hand cars………… Sub-prime lenders 2008 • A desire to reduce their level of bad debts will reduce the banks ability to create credit. • They will hold more cash and lend out less. • Not issuing loans means less credit is created. 2009 Q 4 (a) • Banks may fail by overextending their loan book. • Explain this statement within the context of a bank’s twin requirements of liquidity and profitability.