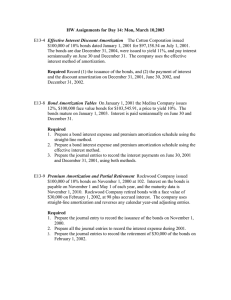

Exercise 11-8 Problem 14-5A

advertisement

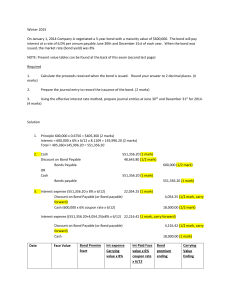

Exercise 11- 8 Sept. 30 Payroll Taxes Expense ........................................... FICA—Social Security Taxes Payable............. FICA—Medicare Taxes Payable ....................... Federal Unemployment Taxes Payable ........... State Unemployment Taxes Payable............... To record employer payroll taxes. 83.40 49.60 11.60 4.80 17.40 Problem 14-5A Part 1 Ten payments of $8,125* .......................... $ 81,250 Par value at maturity .................................. 250,000 Total repaid ................................................. 331,250 Less amount borrowed .............................. (255,333) Total bond interest expense...................... $ 75,917 *$250,000 x 0.065 x ½ =$8,125 or: Ten payments of $8,125 ............................ $ 81,250 Less premium ............................................ (5,333) Total bond interest expense..................... $ 75,917 Part 2 (A) (B) Semiannual Cash Interest Bond Interest Interest Paid Expense Period-End [3.25% x $250,000] [3% x Prior (E)] (C) (D) Premium Unamortized Amortization Premium [(A) - (B)] 1/01/2013 (E) Carrying Value [Prior (D) - (C)] [$250,000 + (D)] $5,333 $255,333 6/30/2013 $ 8,125 $ 7,660 $ 465 4,868 254,868 12/31/2013 8,125 7,646 479 4,389 254,389 6/30/2014 8,125 7,632 493 3,896 253,896 12/31/2014 8,125 7,617 508 3,388 253,388 6/30/2015 8,125 7,602 523 2,865 252,865 12/31/2015 8,125 7,586 539 2,326 252,326 6/30/2016 8,125 7,570 555 1,771 251,771 12/31/2016 8,125 7,553 572 1,199 251,199 6/30/2017 8,125 7,536 589 610 250,610 12/31/2017 8,125 7,515* 610 0 250,000 $81,250 $75,917 $5,333 *Adjusted for rounding. Part 3 2013 June 30 Bond Interest Expense ................................................. 7,660 Premium on Bonds Payable ......................................... 465 Cash ......................................................................... 8,125 To record six months’ interest and premium amortization. 2013 Dec. 31 Bond Interest Expense ................................................. 7,646 Premium on Bonds Payable ......................................... 479 Cash ......................................................................... 8,125 To record six months’ interest and premium amortization. Part 4 As of December 31, 2015 Cash Flow Table Par value ...................... B.1 Interest (annuity) ......... B.3 Price of bonds ............. Table Value* 0.8885 3.7171 Amount $250,000 8,125 Present Value $222,125 30,201 $252,326 * Table values are based on a discount rate of 3% (half the annual original market rate) and 4 periods (semiannual payments). Comparison to Part 2 Table This present value ($252,326) equals the carrying value of the bonds in column (E) of the amortization table ($252,326). This shows a general rule: The bond carrying value at any point in time equals the present value of the remaining cash flows using the market rate at the time of issuance.