Chapter 15

CHAPTER 15

Long-Term Liabilities

Chapter Overview

This chapter introduces the student to long-term liabilities, particularly bonds payable, as a way to finance operations.

General background information is given as to bond terminology, types of bonds, interest rates, and bond quotations. The concept of how bond prices are related to present value is briefly explained. Entries are illustrated for issuing bonds at par, paying semi-annual interest, and paying bonds at maturity. Next, students learn about bonds issued at a discount and at a premium and the differences in accounting for them. At this point, straight-line amortization of the premium or discount is presented. Following a discussion of how to report bonds payable on the financial statements and how to accrue interest and amortize premium or discount at the year-end, Decision Guidelines and a mid-chapter summary problem review many of the concepts and journal entries presented in the first half of the chapter.

The second half of the chapter begins with a presentation of the effective-interest method of amortizing the discount or premium on bonds payable. Illustrations and tables help the student grasp the effective-interest method. The concept of selling bonds between interest dates at par value plus accrued interest is explained. Retirement and conversion of bonds payable prior to maturity is discussed. Next, the chapter discusses how the long-term debt is reported on the balance sheet. Comparisons of financing by borrowing or by issuing stock helps the student understand the advantages and disadvantages of borrowing. The Decision Guidelines offer answers to important questions about long-term liabilities. An Excel Application Problem helps students review important topics from the chapter. A summary problem tests students’ understanding of the amortization table, journal entries for bonds, and the effective-interest method.

An appendix on time value of money covers both future value and present value. This section teaches the student how to compute both future value and present value of a single payment and of an annuity. Calculations based on future value and present value tables are explained and illustrated. Finally, the appendix shows how to calculate the market price of a note or bond.

Learning Objectives

After studying Chapter 15, your students should be able to:

1. Account for bonds payable transactions

2.

3.

Measure interest expense by the effective-interest method

Account for retirement and conversion of bonds payable

4.

5.

Report liabilities on the balance sheet

Show the advantages and disadvantages of borrowing

Chapter Outline

Bonds payable: An introduction

A. Bonds payable are groups of notes issued to many lenders (bondholders).

B.

1. Purchasers receive a bond certificate bearing the name of the issuer that includes the following information: a. The principal

—the amount the company has borrowed.

The principal, also referred to as the maturity value, or par value, is usually stated in multiples of $1,000. b. c.

The maturity date

—the date on which the principal amount must be repaid to the bondholder.

The stated interest rate and the interest dates (generally semi-annually).

2. Exhibit 15-1 is an example of a bond certificate.

Types of bonds include:

C.

1. Term bonds —mature on a specific date.

2.

3.

Serial bonds —mature in installments.

Secured, or mortgage, bonds —give the bondholder the right to take specific assets (called collatera l) if the company defaults (fails to pay interest or principal).

4. Unsecured, or debenture, bonds —are backed only by the good faith of the borrower.

A bond is issued at a premium when issued at a price above its maturity value. A bond is issued at a discount when issued at a price below its maturity value.

D.

1.

2.

As a bond approaches the maturity date, the price of a bond moves toward its maturity value.

The market value is equal to the maturity value ( par value ) on the maturity date.

3. Refer to Exhibit 15-2 to see how bond information is quoted in the Wall Street Journal .

The purchase price of a bond, the amount an investor is willing to pay for it, is affected by the time value of money— the fact that money earns income over time.

E.

1. The amount a person would pay at the present time to receive a greater amount at a future date is the present value. (Refer to the Appendix for a detailed discussion.)

2. The present value is always less than the future value.

Two interest rates work to set the market price of a bond—the stated interest rate and the market interest rate.

The market price is the maximum amount that an investor will pay for a bond.

1. The stated interest rate (or contract rate) determines the cash interest paid. The stated rate is set by the bond stated and does not change during the life of the bonds.

2. The market interest rate (or effective rate) is the rate investors demand for loaning their money and may vary from day to day. (Exhibit 15-3 summarizes how these two interest rates interact to determine bond prices.)

a. b.

If investors demand a higher rate than the stated rate, the bonds will sell at a discount .

If investors demand a lower rate than the stated rate, the bonds will sell at a premium .

Objective 1: Account for bonds payable transactions

A. Journal entries for bonds issued at maturity (par) value on an interest date follow:

B.

2.

3.

1.

2.

On the date of issuance:

Cash

Bonds Payable

On the interest payment date:

XX

Interest Expense

Cash

On the maturity date:

XX

XX

XX

3.

Bonds Payable

Cash

XX

XX

Bonds are issued at a discount because the market interest rate is greater than the stated interest rate .

The account, Discount on Bonds Payable , a contra account, records the difference between the issue price and the maturity value. This account balance must be amortized (reduced) over the life of the bonds.

1. The entry to record the issuance of bonds at a discount is:

4.

5.

Cash XX

Discount on Bonds Payable XX

Bonds Payable XX

The bonds are reported as a long-term liability as follows:

Bonds Payable (par value)

Less: Discount on Bonds Payable

$XX

XX $XX

An entry is recorded on each semiannual interest payment date to record the interest payment and the amortization of the discount. The discount is accounted for as interest expense. a. b.

Cash interest paid + Discount amortization = Interest expense

Under straight-line amortization , the amount that is amortized is divided equally over each semiannual interest period and is recorded as follows:

Interest Expense

Cash

XX

XX

Discount on Bonds Payable XX

Amortization of the discount reduces the balance of Discount on Bonds Payable, thus increasing the carrying amount of the bonds.

On the maturity date, the Discount on Bonds Payable will be completely amortized (have a zero balance), and the carrying amount will be equal to the maturity value.

D.

E.

C. Bonds are issued at a premium when the market interest rate is less than the stated interest rate .

The account,

Premium on Bonds Payable is added to Bonds Payable to show the carrying amount of the bonds. This account must also be amortized over the life of the bonds.

1.

Issuance of bonds at a premium is rare, because companies don’t like to pay a higher rate than the market rate. The entry to record the issuance of bonds at a premium is:

2.

Cash

Bonds Payable

XX

XX

Premium on Bonds Payable XX

The following entry is recorded on each semiannual interest payment date to record the interest payment and the amortization of the premium. The premium is like a savings of interest and thus reduces interest expense. a. b.

Cash interest paid – Premium amortization = Interest expense

The entry to record the interest payment and amortization of the premium is:

Interest Expense XX

Premium on Bonds Payable XX

Cash XX

Bonds payable are reported on the balance sheet at maturity value plus any bond premium or minus bond discount. Over the life of the bonds, the balance of any premium/discount will be reduced to zero.

Bonds Payable (par value)

Plus: Premium on Bonds Payable (unamortized portion)

$XX

XX $XX

If the year-end is not an interest-payment date, an entry is required to accrue interest and to amortize a portion of the premium or discount based on the number of months since the last interest date. This entry results in both the correct amount of interest expense and the correct carrying amount.

1. The year-end accrual is:

Bonds issued at a discount

Interest Expense

Interest Payable

Discount on Bonds Payable

XX

XX

XX

2.

Bonds issued at a premium

Interest Expense

Premium on Bonds Payable

Interest Payable

The next semiannual interest payment is recorded as follows:

XX

XX

XX

Bonds issued at a discount Bonds issued at a premium

Interest Expense

Interest Payable

Cash

Discount on Bonds Payable

D.

XX

XX

XX

XX

Interest Expense

Interest Payable

Premium on Bonds Payable

Cash

Decision Guidelines help provide answers to important questions about bonds.

XX

XX

XX

XX

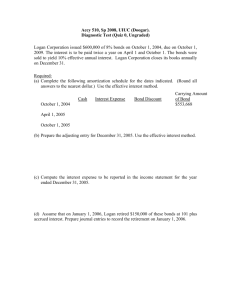

Objective 2: Measure interest expense by the effective-interest method

A.

B.

C.

Cash (E)

Discount on Bonds Payable (D)

The effective-interest method of amortization is another method of amortizing premium or discount and is considered preferable to the straight-line method.

4.

5.

2.

3.

6.

1. Under the straight-line method, the interest expense is the same dollar amount each period. Under the effective-interest method, the interest expense is a constant percentage of the bonds’ carrying amount.

2. GAAP requires that interest expense be measured using the effective-interest method unless the difference between the effective-interest method and the straight-line method is immaterial.

3. The total amount of premium or discount amortized is the same under the two methods; the total expense is the same.

When using the effective-interest method, an amortization table is helpful. The table has the following headings as shown in Exhibit 15-4 (discount) and Exhibit 15-6 (premium):

1. Semiannual Interest Period

Column A:

Column B:

Column C:

Column D:

Interest Payment—

Interest Expense— stated rate (semiannual) x maturity value market rate (semiannual) x carrying amount

Discount / Premium Amortization

Discount or Premium Balance

—difference between columns A and B

—previous balance – column C

Column E: Bond Carrying Amount: a. For bonds issued at a discount—maturity value – column D b. For bonds issued at a premium— maturity value + column D

The accounts debited and credited are the same under the effective-interest method and the straight-line method.

Only the amounts are different. These entries are summarized below with a column reference from the amortization table.

Bonds issued at a discount Bonds issued at a premium

Bonds Payable

Interest Expense (B)

Discount on Bonds Payable (C)

Cash (A)

Interest Expense (B)

Interest Payable (A)

Discount on Bonds Payable (C)

At issuance

XX

XX

XX

Cash (E)

To pay interest

Bonds Payable

Premium on Bonds Payable (D)

XX

XX

XX

XX

XX

XX

Interest Expense (B)

Premium on Bonds Payable (C)

Cash (A)

To accrue interest

XX

XX

XX

XX

XX

XX

Interest Expense (B)

Premium on Bonds Payable (C)

Interest Payable (A)

XX

XX

XX

To pay interest following accrual

Interest Expense (B)

Interest Payable (A)

Discount on Bonds Payable (C)

Cash (A)

XX

XX

XX

XX

Interest Expense (B)

Premium on Bonds Payable (C)

Interest Payable (A)

Cash (A)

XX

XX

XX

XX

Note: the amounts from the table must be adjusted for partial periods when interest is accrued and in the following entry when the payment is made.

When bonds are issued at a discount , the carrying amount increases each period until maturity.(Exhibit 15-5). D.

E. When bonds are issued at a premium , the carrying amount increases each period until maturity. (Exhibit 15-7).

Objective 3: Account for retirement and conversion of bonds payable

A. Bonds issued between interest dates are sold at their market value plus accrued interest , that is, the interest since the last semiannual interest date.

1. The entry to record the issuance is:

B.

2.

Cash

Bonds Payable

Interest Payable

XX

XX

XX

On the next interest date, the issuer will pay six months’ interest; however, the interest expense recorded is for the amount of time the bonds have been outstanding.

Interest Payable

Interest Expense

Cash

XX

XX

XX

Normally, companies wait until maturity to pay off bonds payable. If a company wants to retire the bonds early, two options exist.

1. If the bonds are callable , the issuer may call the bonds, that is, retire the bonds at some specified price

(usually above par).

2. Alternatively, the company may purchase the bonds at the current market price. In either case, the journal entry is the same.

C. Follow these steps when retiring bonds before maturity:

1.

2.

Record partial-period amortization of discount or premium.

Write off the portion of Discount or Premium that relates to the portion of bonds being retired.

3. Compute the gain or loss on retirement.

Loss on retirement of bonds issued at a discount Gain on retirement of bonds issued at a premium

Bonds Payable

Discount on Bonds Payable

Cash

Gain on Retirement of Bonds

XX

XX

XX

XX

Bonds Payable

Loss on Retirement of Bonds

Premium on Bonds Payable

Cash

XX

XX

XX

XX

D. Convertible bonds payable allow the bondholder the option to exchange the bonds for common stock.

1. Bondholders may convert if the market price of the common stock gets high enough.

2.

3.

The carrying amount of the bonds becomes the amount of the new stockholders' equity.

The journal entry removes bonds payable and the related unamortized premium or discount from the accounts and increases common stock and paid-in capital in excess of par; no gain or loss is recorded.

Conversion of bonds issued at a discount Conversion of bonds issued at a premium

Bonds Payable

Discount on Bonds Payable

Common Stock

XX

XX

XX

Paid-in Capital in Excess of Par XX

E. Serial bonds

Bonds Payable

Premium on Bonds Payable

Common Stock

XX

XX

XX

Paid-in Capital in Excess of Par XX are payable in installments. The portion of the bonds payable within one year— the current portion of long-term debt —is reported as a current liability; the remainder is considered long-term.

Objective 5: Show the advantages and disadvantages of borrowing

A.

The advantage of issuing bonds payable is that it is a cheaper source of money. Borrowing can help increase a company’s earnings per share of common stock . (See Exhibit 15-8.)

B. The advantage of issuing common stock is that it is less risky than borrowing money.

C. Decision Guidelines review important concepts about bonds payable.

Appendix to Chapter 15

A. The term time value of money refers to the fact that money earns interest over time. Interest is the cost of using money. The process of computing a future value is called accumulating because the future value is more than the present value.

B. The future value of an investment is the amount that an amount invested today would accumulate to in the future. (Refer to Exhibit 15A-1.)

1. Three factors must be known to compute the future value.

The amount of the investment. a. b. c.

The

The length of time interest rate. between investment and future accumulation.

2. The future value can be computed using the following formula:

Present value X (1 + Interest rate) = Future value

3. To compute a future value for a single sum easily, use the Future Value of $1 table (Exhibit 15A-2).

Find the factor in the table that corresponds with the number of interest periods and the interest rate.

Multiply that factor by the amount of the investment.

C.

2.

3.

4. To compute a future value of an annuity (Refer to Exhibit 15A-3), use the Future Value of Annuity table

(Exhibit 15A-4).

An annuity is a series of periodic investments at fixed intervals. a. b. To use the tables, the amount of the annuity must be the same each period. To compute the future value, find the factor in the table that corresponds with the number of periods and the interest rate. Multiply that factor by the amount of the periodic investment.

The present value (PV) is the amount that would have to be invested now to accumulate to some specified future amount. The process of computing present value is called discounting.

1. Present value depends on three factors: a. The amount of the payment (receipt).

4.

5. b. c.

The length of time between investment and future receipt (payment).

The interest rate.

Present value can be calculated by using a formula that is the reciprocal of the future value formula (For a comparison of present value and future value, refer to Exhibit 15-A5):

Future value

(1 + Interest rate)

=

Present

Value

The present value of a single sum can also be computed using the Present Value of $1 table (Exhibit

15A-6). Find the factor in the table that corresponds with the number of interest periods and the interest rate. Multiply that factor by the future value.

The present value of an annuity is determined by using the factors in the Present Value of an Annuity table (Exhibit 15-A7). To compute the present value of an annuity, find the factor in the table that corresponds with the number of periods and the interest rate. Multiply that factor by the amount of the periodic payment (receipt). a. b.

The present value techniques can be applied to determining the market price of a bond. The market price of a bond is determined by making two computations:

First compute the PV of the principal . Multiply the principle by the appropriate factor in Present

Value of $1 table.

Then compute the PV of the interest payments . Multiply one interest payment amount by the appropriate factor in the Present Value of an Annuity table. c. Add the amounts from a. and b. to determine the market price of the bonds.