Many labor-intensive production operations experience a learning

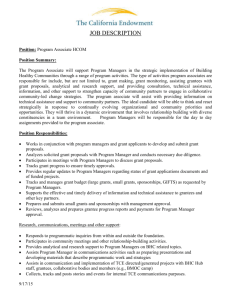

advertisement