here

________________________________________________________________

Your name and Perm #

Econ 234A

Test 1

John Hartman

February 11, 2014

Instructions:

You have 60 minutes to complete this test, unless you arrive late. Late arrival will lower the time available to you, and you must finish at the same time as all other students.

Each question shows how many points it is worth. Show all work in order to receive credit. You will receive partial credit for incorrect solutions in some instances. Clearly circle your answer(s) or else you may not receive full credit for a complete and correct solution.

Cheating will not be tolerated during any test. Any suspected cheating will be reported to the relevant authorities on this issue.

You are allowed to use a nonprogrammable four-function or scientific calculator that is NOT a communication device. You are NOT allowed to have a calculator that stores formulas, buttons that automatically calculate IRR, NPV, or any other concept covered in this class. You are NOT allowed to have a calculator that has the ability to produce graphs. If you use a calculator that does not meet these requirements, you will be assumed to be cheating.

Unless otherwise specified, you can assume the following:

Negative internal rates of return are not possible

All equivalent annual cost problems are in real dollars

You are allowed to turn in your test early if there are at least 5 minutes remaining. As a courtesy to your classmates, you will not be allowed to leave during the final 5 minutes of the test.

Your test should have 4 problems, some with multiple parts. The maximum possible point total is 36 points. If your test is incomplete, it is your responsibility to notify a proctor to get a new test.

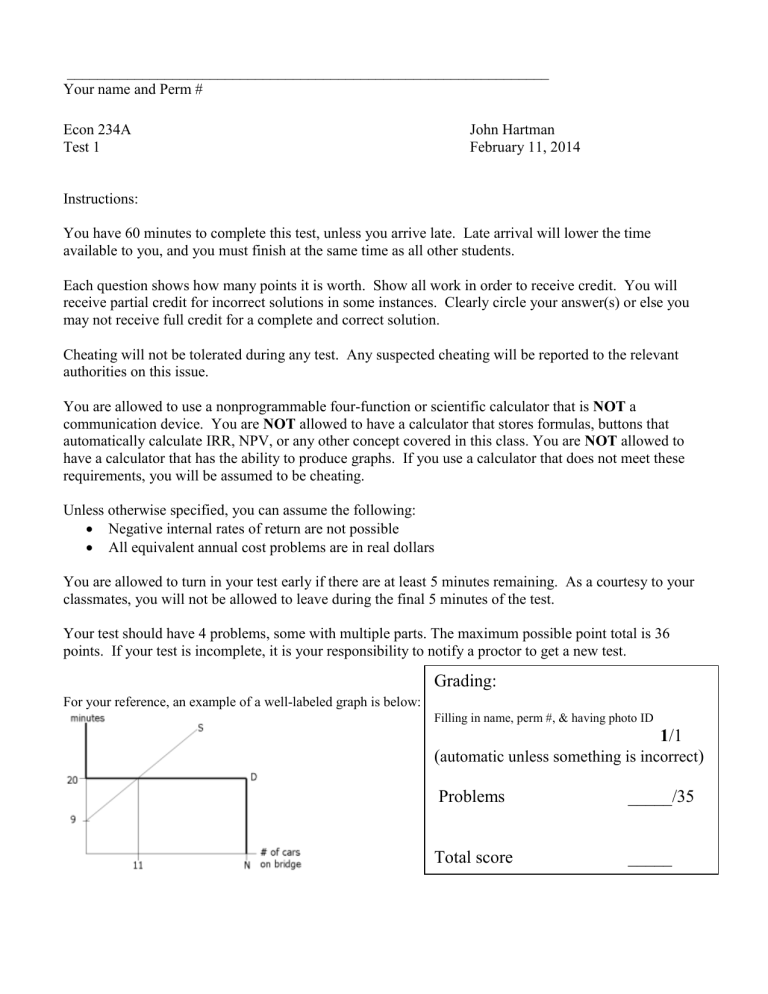

For your reference, an example of a well-labeled graph is below:

Grading:

Filling in name, perm #, & having photo ID

1 /1

(

automatic unless something is incorrect

)

Problems _____/35

Total score _____

For the following problems, you will need to write out the solution. You must show all work to receive credit. Each problem (or part of problem) shows the maximum point value. Provide at least four significant digits to each answer or you may not receive full credit for a correct solution.

1. (11 points) Suppose that you are advising a couple just about to get married about how much they need to save for college for their future children. They plan on having 2 children, one 3 years from today and the other 5 years from today. Each child will start college 18 years after being born. You estimate the children’s annual cost of education will be $80,000 per year per child, payable at the beginning of each school year. We assume four years of college expenses for each child. The effective annual interest rate is

6%.

When you ask the couple how they plan to save for their children’s college funds, they tell you that they want to make 15 equal deposits of $ X each year, starting two years from now. The total of these payments will be exactly enough to cover all of their children’s college expenses. Find

X .

PV of the costs = 80,000/1.06

21

+ 80,000/1.06

80,000/1.06

25 + 80,000/1.06

26 = $163,361.66

22

+ 160,000/1.06

23

+ 160,000/1.06

24

+

If we made annual deposits in years 1-15, we could use the following calculation:

163,361.66 = (C/0.06) * (1 – 1/1.06

15

)

C = 16,820.17

Instead, we are making annual payments in years 2-16, so we need to adjust this number upward by one year’s interest: C’ = 16,820.17 * 1.06 = $17,829.38. This is the annual deposit needed to accomplish the couple’s goal.

2. (8 points) Oliver is planning the finances for an oil well he has just purchased. He will pay $600,000 today to buy the land, oil rights, and equipment. He expects to drill $1.5 million in oil one year from today. Two years from today, he will sell his equipment for $100,000, pay $1 million to satisfy environmental regulations, and pay $1,000 for a legal statement that eliminates all future environmental cost obligations. If his assumptions are correct, find all annual internal rates of return, showing all of your algebra in the solution process. (Assume no other costs or benefits other than what is listed above.)

Overall cash flows, by year: Yr. 0 (today), –$600,000; Yr. 1, +$1,500,000; Yr. 2: –$901,000

Let X = 1 + r, and solve in $1000s:

–600 + 1500/X – 901/X 2

= 0

–600X

2

+1500X – 901 = 0. Use the quadratic formula, with a=–600, b=1500, c=–901, to get X = 1.25 ± 0.246644

X = 1.496644, 1.003356

The two IRRs are 49.6644% and 0.3356%.

3. (7 points) Olivia is about to borrow $80,000 from the Mortimer Cheese Bank. The effective annual interest rate is 11%. Suppose that the loan is amortized over 15 years with monthly payments, and that

Olivia will pay an equal amount of principal each month. How much will the 4 th payment be?

Note that this problem asks for constant reduction in principal reduction per month. So if you solved this problem by having equal monthly payments, you answered something different than what is asked for here.

Monthly principal reduction is $80,000/180 = $444.44. So in 3 months the balance will be

12

$80,000 – $444.44 (3) = $78,666.67. The monthly interest rate is √1.11

− 1 = 0.873459% . So the 4 th payment will be $444.44 + $78,666.67 * 0.00873459 = $1,131.56.

4. (9 points) Klikkety Cola stock is about to pay its annual dividend today (Feb. 11, 2014), $3 per share.

Every subsequent dividend payment until Feb. 11, 2018 will be 30% higher than the previous dividend.

For the 6 years after that, each subsequent dividend payment will be 12% higher than the previous dividend. After that, dividends will be constant forever. The effective annual interest rate is 15%. What is the present value of this stock, assuming that you will receive the next dividend later today?

Year

2014

2015

Nominal payment

$3

$3.90

$5.07

$6.591

$8.5683

$9.5965

# of years of discounting

0

1

2

3

4

5

PV of payment

$3

$3.3913

$3.8336 2016

2017

2018

2019

2020

2021

2022

2023

2024 and beyond

$10.748

$12.038

$13.482

$15.10

$16.912

6

7

8

9

See below

$4.3337

$4.8990

$4.7712

$4.6467

$4.5255

$4.4073

$4.2924

See below

See the table above to see the present value for each year from 2014-2023. For years 2024 and beyond, we can use the perpetuity formula, discounted by 9 years: ($16.912/.15)*(1/1.15

9

) = $32.05. Adding up all of the numbers in bold, we find the total PV of all payments, $74.15.