here

advertisement

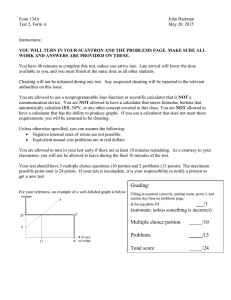

Name_______________________________________ Econ 134A Test 3, Form A Perm #_______________________________ John Hartman March 18, 2015 Instructions: YOU WILL TURN IN YOUR SCANTRON AND THE PROBLEMS PAGE. MAKE SURE ALL WORK AND ANSWERS ARE PROVIDED ON THESE. You have 160 minutes to complete this test, unless you arrive late. Late arrival will lower the time available to you, and you must finish at the same time as all other students. Cheating will not be tolerated during any test. Any suspected cheating will be reported to the relevant authorities on this issue. You are allowed to use a nonprogrammable four-function or scientific calculator that is NOT a communication device. You are NOT allowed to have a calculator that stores formulas, buttons that automatically calculate IRR, NPV, or any other concept covered in this class. You are NOT allowed to have a calculator that has the ability to produce graphs. If you use a calculator that does not meet these requirements, you will be assumed to be cheating. Unless otherwise specified, you can assume the following: Negative internal rates of return are not possible. Equivalent annual cost problems are in real dollars. You are allowed to turn in your test early if there are at least 10 minutes remaining. As a courtesy to your classmates, you will not be allowed to leave during the final 10 minutes of the test. Your test should have 10 multiple choice questions (20 points) and 7 problems (49 points). The maximum possible point total is 70 points. If your test is incomplete, it is your responsibility to notify a proctor to get a new test. Grading: For your reference, an example of a well-labeled graph is below: Filling in scantron correctly, putting name and perm # on this page, & having photo ID ___/1 (automatic unless something is incorrect) Multiple choice portion _____/20 Problems _____/49 Total score _____/70 MULTIPLE CHOICE: Answer the following questions on your scantron. Each correct answer is worth 2 points. All incorrect or blank answers are worth 0 points. If there is an answer that does not exactly match the correct answer, choose the closest answer. 1. An effective annual interest rate of 50% is equivalent to what stated annual interest rate if interest is compounded daily? (Assume 365 days in a year.) A. 40.5% B. 40.6% C. 40.7% D. 40.8% E. 40.9% 𝑺 𝒎 𝑬𝒕 = (𝟏 + 𝒎𝒕 ) − 𝟏 ⟹. 𝟓 = (𝟏 + 𝑺𝟏−𝒚𝒆𝒂𝒓 𝟑𝟔𝟓 𝟑𝟔𝟓 ) − 𝟏 ⟹ 𝑺𝟏−𝒚𝒆𝒂𝒓 ≈. 𝟒𝟎𝟓𝟕 OR 𝟒𝟎. 𝟓𝟕% 2. Stock X has a beta of 1.75 and a rate of return of 27.5%. Stock Y has a beta of 0.5 and a rate of return of 15%. What is the market rate of return? A. 16% B. 17% C. 18% D. 19% E. 20% 𝑹𝑺 = 𝑹𝑭 + 𝜷(𝑹𝑴 − 𝑹𝑭 ) . 𝟐𝟕𝟓 = 𝑹𝑭 + 𝟏. 𝟕𝟓(𝑹𝑴 − 𝑹𝑭 ) & . 𝟏𝟓 = 𝑹𝑭 +. 𝟓(𝑹𝑴 − 𝑹𝑭 ) ⟹. 𝟐𝟕𝟓−. 𝟏𝟓 = 𝑹𝑭 − 𝑹𝑭 + 𝟏. 𝟕𝟓(𝑹𝑴 − 𝑹𝑭 )−. 𝟓(𝑹𝑴 − 𝑹𝑭 ) ⟹ 𝑹𝑭 = 𝑹𝑴 −. 𝟏 ∴, . 𝟏𝟓 = (𝑹𝑴 −. 𝟏)+. 𝟓[𝑹𝑴 − (𝑹𝑴 −. 𝟏)] ⟹ 𝑹𝑴 =. 𝟐 3. At 9:00 today, XYZ Sousaphones, Inc. planned to pay a $10 dividend every year, starting one year from today. At 2:00 pm, the company will revise its dividend to $9 per year, starting today. What will be the change in the value of this stock if the equilibrium price is always based on the company’s planned dividend stream of payments? Assume a 20% effective annual interest rate. A. Down by $5 B. Down by $4 C. No change D. Up by $4 E. Up by $5 𝑷𝟗:𝟎𝟎 𝒂𝒎 = 𝑪 𝟏𝟎 = = $𝟓𝟎 𝒓 .𝟐 𝑪 𝟗 = 𝟗 + = $𝟓𝟒 𝒓 .𝟐 ∴, ∆𝟗𝒂𝒎→𝟐 𝒑𝒎 = 𝟓𝟒 − 𝟓𝟎 = $𝟒 𝑷𝟐:𝟎𝟎 𝒑𝒎 = 𝑫𝟎 + 4. Based on lecture, what is the change in median housing price in the United States from 2012 to 2014? (Remember to pick the closest answer.) A. Down by 15% B. Down by 5% C. Unchanged D. Up by 5% E. Up by 15% Housing prices increased by 𝟏𝟓% 5. Joey owns a European call option for a stock. The stock currently has a $45 value. The option has an exercise price of $50, with an expiration date 3½ years from today. Starting one year from today, the value of the stock will go up by $3 with 90% probability or go down by $8 with 10% probability each year. What is the probability that the option will have positive value on the expiration date? A. 45% B. 55% C. 65% D. 75% E. 80% 𝑷𝑼𝒑,𝑼𝒑,𝑼𝒑 = $𝟓𝟒 > $𝟓𝟎 𝑷𝑼𝒑,𝑼𝒑,𝑫𝒐𝒘𝒏 = $𝟒𝟑 < $𝟓𝟎 ∴, only the stock increasing each year yields a positively valued call option ⟹ 𝑷𝒓(𝑼𝒑, 𝑼𝒑, 𝑼𝒑) =. 𝟗 ∗. 𝟗 ∗. 𝟗 =. 𝟕𝟐𝟗 6. A company currently has half of its value through stocks and half through bonds. Currently, the return on bonds is 6%. If the company did not have bonds issued, the rate of return for stock ownership of this company would be 10%. What is the current rate of return for stocks? A. 2% B. 6% C. 8% D. 13% E. 14% 𝑹𝑺 = 𝑹𝟎 + 𝑩 .𝟓 (𝑹𝟎 − 𝑹𝑩 ) ⟹ 𝑹𝑺 =. 𝟏 + (. 𝟏−. 𝟎𝟔) ⟹ 𝑹𝑺 =. 𝟏𝟒 𝑺 .𝟓 7. Jack currently owns a American call option for the Transylvania Railroad Model company. Today, he receives information that the value of each share of stock has gone up. Also, he believes that the stock is now more volatile. If Jack correctly applies concepts covered in this class, which of the following conclusions can be made? A. The option’s value must go up (and not remain the same) B. The option’s value must go down (and not remain the same) C. The option’s value could be the same or go down D. The option’s value could be the same or go up E. None of the above statements is correct Increase in stock price → Increase in call option value Increase in stock volatility → Increase in call option value ∴, the value of the option must go up 8. Aaliyah just bought a share of Accordian Falafel Pitas, Inc. stock. The value of the stock is $50 per share. The company will pay a $1 dividend one year from today, and the appropriate discount rate for the company is 15%. The company will pay subsequent dividends yearly, with an annual growth rate of X . What is the value of X ? A. 5% B. 8% C. 10% D. 13% E. 15% 𝑪 𝟏 𝑷𝟎 = 𝒓−𝒈 ⟹ 𝟓𝟎 = .𝟏𝟓−𝑿 ⟹ 𝑿 =. 𝟏𝟑 OR 𝟏𝟑% 9. Action Axe Supplies, Inc. stock is currently selling for $60 per share. One year from today, the value of the stock will come from a uniform distribution with a lower bound of $58 and an upper bound of $68. (Remember that with this uniform distribution, any price from $58 to $68 is equally probable in 1-cent increments, but no other price can occur with positive probability. You can use a continuous distribution as an approximation if you want.) What is the present value of a European call option with exercise price $64, expiration date one year from today, and an effective annual discount rate of 25%? A. $0.60 B. $0.80 C. $1.20 D. $1.60 E. $2.00 𝐏𝐫(𝟔𝟒 ≤ 𝑷 ≤ 𝟔𝟖) =. 𝟒 𝟔𝟖+𝟔𝟒 Average Price within 𝟔𝟒 ≤ 𝑷 ≤ 𝟔𝟖 = 𝟐 = 𝟔𝟔 𝟔𝟔 − 𝟔𝟒 𝑷𝟎 = 𝑷𝑽 = ∗. 𝟒 = $𝟎. 𝟔𝟒 𝟏. 𝟐𝟓 10. An investment asks for $40,000 today, with the promise of $5,000 payments made annually, starting 18 months from today. What is the profitability index of this investment if the effective annual interest rate is 20%? (Assume all promised future payments are made.) A. 0.57 B. 0.60 C. 0.63 D. 0.66 E. 0.69 𝟔 𝒎𝒐𝒏𝒕𝒉𝒔 𝟏 𝑬𝟔−𝒎𝒐𝒏𝒕𝒉 = (𝟏 + 𝑬𝟏−𝒚𝒆𝒂𝒓 )𝟏𝟐 𝒎𝒐𝒏𝒕𝒉𝒔 − 𝟏 = (𝟏+. 𝟐𝟎)𝟐 − 𝟏 ≈. 𝟎𝟗𝟓𝟒 𝑪 𝟓𝟎𝟎𝟎 𝑬𝟏−𝒚𝒆𝒂𝒓 𝑷𝑽𝑪𝒂𝒔𝒉 𝑭𝒍𝒐𝒘𝒔 = = . 𝟐𝟎 ⟹ 𝑷𝑽𝑪𝒂𝒔𝒉 𝑭𝒍𝒐𝒘𝒔 ≈ $𝟐𝟐, 𝟖𝟐𝟏. 𝟕𝟕 𝟏 + 𝑬𝟔−𝒎𝒐𝒏𝒕𝒉 𝟏. 𝟎𝟗𝟓𝟒 𝑷𝑰 = 𝑷𝑽𝑪𝒂𝒔𝒉 𝑭𝒍𝒐𝒘𝒔 𝟐𝟐𝟖𝟐𝟏. 𝟕𝟕 ≈ ⟹ 𝑷𝑰 ≈. 𝟓𝟕𝟎𝟓 𝑪𝒐𝒔𝒕 𝒐𝒇 𝑰𝒏𝒗𝒆𝒔𝒕𝒎𝒆𝒏𝒕 𝟒𝟎𝟎𝟎𝟎 For the following problems, you will need to write out the solution. You must show all work to receive credit. Each problem (or part of problem) shows the maximum point value. Provide at least four significant digits to each answer or you may not receive full credit for a correct solution. Show all work in order to receive credit. You will receive partial credit for incorrect solutions in some instances. Clearly circle your answer(s) or else you may not receive full credit for a complete and correct solution. 11. (5 points) Each share of stock in a company is scheduled to pay a $1 dividend later today, followed by subsequent dividends yearly. Each dividend paid in future years will be $0.20 less than the previous dividend. When the dividend reaches $0, the company will go out of business and pay nothing else to stock holders. What is the present value of the stock if the effective annual interest rate is 12%? 𝑷𝑽 = 𝑷𝟎 = 𝟏 + .𝟖 .𝟔 .𝟒 .𝟐 + + + ⟹ 𝑷𝟎 ≈ $𝟐. 𝟔𝟎 𝟐 𝟑 𝟏. 𝟏𝟐 𝟏. 𝟏𝟐 𝟏. 𝟏𝟐 𝟏. 𝟏𝟐𝟒 12. Solve each of the following: (a) (3 points) In the fictional country of Switzeralia, from 1925-2014, the standard deviation of largecompany stocks was 18.2%. The average rate of return for large-company stocks was 14.6%. The average return on short-term government bonds in Switzeralia (assumed to be risk free) was 2.5%. What is the Sharpe ratio in Switzeraliz from 1925-2014? Sharpe Ratio = 𝑹𝑺 −𝑹𝑭 𝝈𝑺 = .𝟏𝟒𝟔−.𝟎𝟐𝟓 .𝟏𝟖𝟐 ⟹ Sharpe Ratio ≈. 𝟔𝟔𝟒𝟖 (b) (3 points) A 25-year bond with a face value of $9,000 was first issued five years ago. It pays annual coupons of 10% of its face value once per year, with the last coupon payment on the date the bond matures. The bond currently sells for $10,000. Assume that the next coupon payment will occur one year from today, and that the bond will mature in 20 years. Will the bond have a rate of return of more or less than 10% over the next 20 years? Justify your answer completely in order to receive credit. 𝑪 𝟏 𝑭𝑽 𝟗𝟎𝟎 𝟏 𝟗𝟎𝟎𝟎 [𝟏 − ] + ⟹ 𝟏𝟎𝟎𝟎𝟎 = [𝟏 − ] + (𝟏 + 𝒓)𝒏 (𝟏 + 𝒓)𝟐𝟎 (𝟏 + 𝒓)𝟐𝟎 (𝟏 + 𝒓)𝟐𝟎 𝒓 𝒓 Let 𝒓 =. 𝟏: 𝟏𝟎𝟎𝟎𝟎 > 𝟗𝟎𝟎𝟎 ⟹ 𝒓 must be smaller 𝑷𝟎 = (c) (3 points) Blech Ball Company currently trades for $50 per share. Daniel owns a European call option for Blech Ball Company with an exercise price of $60, with an expiration date of one year from today. Daniel believes that one year from today, the Blech Ball company will have value of $40, $50, $60, or $70, each with 25% probability. What is Daniel’s perceived present value of the option? Assume the effective annual interest rate is 10%. 𝑷𝑽 = (𝟕𝟎 − 𝟔𝟎) ∗. 𝟐𝟓 ⟹ 𝑷𝑽 = $𝟐. 𝟐𝟕𝟐𝟕 𝟏. 𝟏 (d) (4 points) Valentine will receive $1,000 four months from today and $2,500 eight months from today. The stated annual interest rate is 8%, compounded twice per year. Find the total of the present value of the two payments. 𝑬𝟏−𝒚𝒆𝒂𝒓 𝑺𝟏−𝒚𝒆𝒂𝒓 𝒎 . 𝟎𝟖 𝟐 = (𝟏 + ) − 𝟏 = (𝟏 + ) − 𝟏 =. 𝟎𝟖𝟏𝟔 𝒎 𝟐 𝟒 𝒎𝒐𝒏𝒕𝒉𝒔 𝟏 𝑬𝟒−𝒎𝒐𝒏𝒕𝒉 = (𝟏 + 𝑬𝟏−𝒚𝒆𝒂𝒓 )𝟏𝟐 𝒎𝒐𝒏𝒕𝒉𝒔 − 𝟏 = (𝟏+. 𝟎𝟖𝟏𝟔)𝟑 − 𝟏 ≈. 𝟎𝟐𝟔𝟓 𝑷𝑽 = 𝟏𝟎𝟎𝟎 𝟐𝟓𝟎𝟎 + ⟹ 𝑷𝑽 = $𝟑, 𝟑𝟒𝟔. 𝟕𝟕 𝟏. 𝟎𝟐𝟔𝟓 𝟏. 𝟎𝟐𝟔𝟓𝟐 13. (6 points) There are 3 states of the world, each with one-third probability of occurring: L, M, and C. In the L state of the world, Stock A has a 17% return and stock B has a 10% return. In the M state of the world, stock A has a 50% return and stock B has a 15% return. In the C state of the world, stock A has a –60% return and stock B has a 20% return. What is the correlation coefficient of stocks A and B? (Assume all returns given are annual returns.) 𝒄𝒐𝒗(𝑨, 𝑩) = 𝑬[(𝑨 − 𝑬(𝑨))(𝑩 − 𝑬(𝑩))] ≈ −. 𝟎𝟏𝟐𝟖 𝝈𝑨 = √𝝈𝟐𝑨 = √𝑬[𝑨 − 𝑬(𝑨)]𝟐 ≈. 𝟒𝟔𝟎𝟗 𝝈𝑨 = √𝝈𝟐𝑩 = √𝑬[𝑩 − 𝑬(𝑩)]𝟐 ≈. 𝟎𝟒𝟎𝟖 ∴, 𝝆𝑨,𝑩 = 𝒄𝒐𝒗(𝑨,𝑩) 𝝈𝑨 𝝈𝑩 .𝟎𝟏𝟐𝟖 ≈ − .𝟒𝟔𝟎𝟗∗.𝟎𝟒𝟎𝟖 ⟹ 𝝆𝑨,𝑩 ≈ −. 𝟔𝟖𝟐𝟏 14. Suzanne is considering an investment that will require her to pay $100 investment today and $240 two years from today. In return, she will receive a single $320 payment one year from today. (a) (4 points) Find all internal rates of return. 𝟏𝟎𝟎 + 𝟐𝟒𝟎 𝟑𝟐𝟎 = ⟹ 𝟓(𝟏 + 𝑰𝑹𝑹)𝟐 − 𝟏𝟔(𝟏 + 𝑰𝑹𝑹) + 𝟏𝟐 = 𝟎 ⟹ 𝑰𝑹𝑹 = 𝟏 & . 𝟐 (𝟏 + 𝑰𝑹𝑹)𝟐 𝟏 + 𝑰𝑹𝑹 (b) (4 points) For what discount rates will there be positive net present values for this investment? You must completely justify your answer to receive credit. Part (a) provides the discount rates that make the 𝑵𝑷𝑽 = 𝟎 ⟹ only need to look on the sides of each 𝑰𝑹𝑹 For 𝒓 > 𝟏 and 𝒓 <. 𝟐: 𝑵𝑷𝑽 < 𝟎 For . 𝟐 < 𝒓 < 𝟏: 𝑵𝑷𝑽 > 𝟎 15. (5 points) Jeremiah has just finalized a loan contract at RTY National Bank. He will receive $50,000 today, and must make equal daily payments to pay off the loan over the next year (starting tomorrow). The stated annual interest rate is 14.6%, and interest is compounded daily. How much will Jacob have to pay every day to completely pay off the loan one year from today? (You can assume there are 365 days this year.) 𝑬𝟏−𝒅𝒂𝒚 = 𝑺𝟏−𝒚𝒆𝒂𝒓 . 𝟏𝟒𝟔 = =. 𝟎𝟎𝟎𝟒 𝒎 𝟑𝟔𝟓 𝑷𝑽𝑳𝒐𝒂𝒏 = 𝑪 𝟏 𝑪 𝟏 [𝟏 − ] ⟹ 𝟓𝟎𝟎𝟎𝟎 = (𝟏 − ) ⟹ 𝑪 ≈ $𝟏𝟒𝟕. 𝟐𝟔 𝒏 (𝟏 + 𝒓) 𝒓 . 𝟎𝟎𝟎𝟒 𝟏. 𝟎𝟎𝟎𝟒𝟑𝟔𝟓 16. There are two investments that could go on an empty lot in Walla Walla, WA. Due to the small size of the lot, only one of the investments can be implemented. This lot cannot be used for any other purposes in the next 10 years. Assume an effective annual interest rate of 15%. To implement an investment called “Gregory’s Pizza Parlour,” $100,000 must be invested today, and $500,000 will be received 10 years from today. To implement an investment called “Doug’s Statistical Software Store,” $25,000 must be invested today, and $50,000 will be received one year from today. (a) (4 points) What is the internal rate of return for each investment? 𝟏𝟎𝟎𝟎𝟎𝟎 = 𝟐𝟓𝟎𝟎𝟎 = 𝟓𝟎𝟎𝟎𝟎𝟎 ⟹ 𝑰𝑹𝑹𝑮𝑷𝑷 ≈. 𝟏𝟕𝟒𝟔 (𝟏 + 𝑰𝑹𝑹𝑮𝑷𝑷 )𝟏𝟎 𝟓𝟎𝟎𝟎𝟎 ⟹ 𝑰𝑹𝑹𝑫𝑺𝑺 = 𝟏. 𝟎 𝟏 + 𝑰𝑹𝑹𝑫𝑺𝑺 (b) (3 points) Which investment should be chosen? You must justify your answer in 40 words or less. You can also show additional work below, if needed. 𝑵𝑷𝑽𝑮𝑷𝑷 = −𝟏𝟎𝟎𝟎𝟎𝟎 + 𝑵𝑷𝑽𝑫𝑺𝑺 = −𝟐𝟓𝟎𝟎𝟎 + 𝟓𝟎𝟎𝟎𝟎𝟎 = $𝟐𝟑, 𝟓𝟗𝟐. 𝟑𝟓 𝟏. 𝟏𝟓𝟏𝟎 𝟓𝟎𝟎𝟎𝟎 = $𝟏𝟖, 𝟒𝟕𝟖. 𝟐𝟔 𝟏. 𝟏𝟓 Invest in Gregory’s Pizza Parlor because it yields a higher 𝑵𝑷𝑽. 17. (5 points) Ray just bought a share of U.S. Generic Doll stock. The stock will pay a $3 dividend one year from today. Each of the subsequent 5 dividend payments (made yearly) will be 15% higher than the previous payment. After that, the dividends will remain constant forever. What is the present value of the stock if the effective annual discount rate for U.S. Generic Doll is 20%? 𝑪𝟕 𝟑(𝟏. 𝟏𝟓)𝟓 𝒏 𝑬𝟏−𝒚𝒆𝒂𝒓 𝟏+𝒈 𝟑 𝟏. 𝟏𝟓 𝟔 .𝟐 𝑷𝑽 = 𝑷𝟎 = [𝟏 − ( = [𝟏 − ( ) ]+ ) ]+ 𝟔 𝑬𝟏−𝒚𝒆𝒂𝒓 − 𝒈 𝟏 + 𝑬𝟏−𝒚𝒆𝒂𝒓 . 𝟐−. 𝟏𝟓 𝟏. 𝟐 𝟏. 𝟐𝟔 (𝟏 + 𝑬𝟏−𝒚𝒆𝒂𝒓 ) ⟹ 𝑷𝟎 ≈ $𝟐𝟑. 𝟔𝟑 𝑪𝟏 NOTE: YOU CAN TEAR THIS SHEET OFF AND USE AS EXTRA SCRATCH PAPER. PLEASE NOTE THAT ANYTHING ON THIS SHEET WILL NOT BE GRADED UNLESS EXPLICITLY SPECIFIED ON THE TEST. Perpetuity PV C r Annuity C 1 PV 1 r (1 r )T Logarithmic rule ab = c b = log c / log a Variance of a sample 1 T Var ( Ri R ) 2 T 1 i 1 Variance of a distribution, with each outcome having the same probability of occurring 1 T Var ( Ri R ) 2 T i 1 Covariance formula N Growing perpetuity C PV rg Growing annuity T 1 1 1 g PV C r g r g 1 r Quadratic formula ax2 + bx + c = 0 x b b 2 4ac 2a X ,Y Cov( X .Y ) i 1 ( xi x )( yi y ) N Correlation of A and B Cov( A, B) , where SD stands Corr ( A, B) SD( A) SD( B) for standard deviation Variance of a portfolio X A2 A2 2 X A X B A,B X B2 B2