1

Ch 11: Long-Term Liabilities

Notes, Bonds, and Leases

Long-term liabilities are recorded at the present value of

the future cash flows.

Two components determine the “time value” of money:

– interest (discount) rate

– number of periods of discounting

Types of activities that require PV calculations:

– notes payable

– bonds payable and bond investments

– capital leases

2

1.Present Value of a Single Sum

All present value calculations presume a discount

rate (i) and a number of periods of discounting (n).

There are 3 different ways you can calculate the PV1:

n

1. Formula: PV1 = FV1 [1/(1+i) ]

2. Tables: See Page 684, Table 4

3.Calculator if it has time value of money functions.

3

Long-term Notes Payable

Problem 1: On January 2, 2008, Pearson Company

purchases a section of land for its new plant site. Pearson

issues a 5 year non-interest bearing note, and promises to

pay $50,000 at the end of the 5 year period. What is the

cash equivalent price of the land, if a 6 percent discount

rate is assumed?

PV1 = 50,000 ( 0.74726) = $37,363

[ i=6%, n=5]

Journal entry Jan. 2, 2008:

Dr. Land

37,363

Dr. Discount on N/P

12,637

Cr. Notes Payable

50,000

4

Problem 1 Solution, continued

The Effective Interest Method:

Interest Expense =

Carrying value x Interest rate x Time period

(CV)

(Per year)

(Portion of year)

Where carrying value = face - discount.

For Example 1, CV= 50,000 - 12,637 = 37,363

Interest expense = 37,363 x 6% per year x 1year

= $2,242

5

Problem 1 Solution, continued

Journal entry, December 31, 2008:

Interest expense

2,242

Discount on N/P

2,242

Carrying value on B/S at 12/31/2008?

Notes Payable

Discount on N/P

$50,000

(10,395)

$39,605

(Discount = $12,637 - 2,242 = $10,395)

6

Problem 1 Solution, continued

Interest expense at Dec. 31, 2009:

39,605 x 6% x 1 = $2,376

Journal entry, December 31, 2009:

Interest expense

2,376

Discount on N/P

2,376

Carrying value on B/S at 12/31/2009?

Notes Payable

$50,000

Discount on N/P

(8,019) $41,981

(Discount = 10,395 - 2,376)

Carrying value on 12/31/2012 (before retirement)?

$50,000

7

2. Present Value of an

Ordinary Annuity(PVOA)

PVOA calculations presume a discount rate (i), where

(A) = the amount of each annuity, and (n) = the

number of annuities (or rents), which is the same as

the number of periods of discounting. There are 3

different ways you can calculate PVOA:

1. Formula: PVOA = A [1-(1/(1+i)n)] / i

2. Tables: see page 685, Table 5

3.Calculator if it has time value of money functions.

8

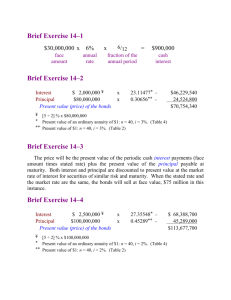

Problem 2: Bonds Payable

On July 1, 2007, Mustang Corporation issues

$100,000 of its 5-year bonds which have an annual

stated rate of 7%, and pay interest semiannually

each June 30 and December 31, starting December

31, 2007. The bonds were issued to yield 6%

annually.

Calculate the issue price of the bond:

(1) What are the cash flows and factors?

Face value at maturity = $100,000

Stated Interest =

Face value x stated rate x time period

100,000 x 7% x (1/2) = $3,500

Number of periods = n = 5 years x 2 = 10

Discount rate = 6% / 2 = 3% per period

9

Problem 2 - calculations

PV of interest annuity:

PVOA Table

PVOA = A(

PVOA Table

) = 3,500 (8.53020) = $29,856

i, n

i = 3%, n = 10

PV of face value:

PV1 Table

PV =FV1(

PV1 Table

) = 100,000 (0.74409)=$74,409

i, n

Total issue price =

i=3%, n=10

$104,265

Issued at a premium of $4,265 because the

company was offering an interest rate greater than

the market rate, and investors were willing to pay

more for the higher interest rate.

10

Problem 2 - Amortization Schedule

To recognize interest expense using the effective interest

method, an amortization schedule must be

constructed. (This expands the text discussion.)

To calculate the columns (see next slide):

Cash paid = Face x Stated Rate x Time

= 100,000 x 7% x 1/2 year = $3,500

(this is the same amount every period)

Int. Expense =

CV x Market Rate x Time

at 12/31/07 = 104,265 x 6% x 1/2 year = 3,128

at 6/30/08 = 103,893 x 6% x 1/2 year = 3,117

The difference between cash paid and interest expense

is the periodic amortization of premium.

Note that the carrying value is amortized down to face

value by maturity.

11

Problem 2 - Amortization Schedule

Date

7/01/07

12/31/07

6/30/08

12/31/08

6/30/09

12/31/09

6/30/10

12/31/10

6/30/11

12/31/11

6/30/12

Cash

Paid

3,500

3,500

3,500

3,500

3,500

3,500

3,500

3,500

3,500

3,500

Interest

Expense

3,128

3,117

3,105

3,093

3,081

3,069

3,056

3,042

3,029

3,015

Carrying

Difference Value

104,265

372

103,893

383

103,510

395

103,115

407

102,708

419

102,289

431

101,858

444

101,414

458

100,956

471

100,485

485

100,000

12

Problem 2 - Journal Entries

JE at 7/1/07 to issue the bonds:

Cash

104,265

Premium on B/P

4,265

Bonds Payable

100,000

JE at 12/31/07 to pay interest:

Interest Expense

Premium on B/P

Cash

3,128

372

3,500

Note that the numbers for each interest payment

come from the lines on the amortization schedule.

13

Bonds Payable at a Discount

If bonds are issued at a discount, the carrying

value will be below face value at the date of

issue.

The Discount on B/P account has a normal debit

balance and is a contra to B/P (similar to the

Discount on N/P).

The Discount account is amortized with a credit.

Note that the difference between Cash Paid and

Interest Expense is still the amount of

amortization.

Interest expense for bonds issued at a discount

will be greater than cash paid.

The amortization table will show the bonds

amortized up to face value.

14

Problem 2 - Retirement of Bonds

Assume that Mustang’s bonds were retired on June 30,

2008 (after the interest payment). Mustang

Corporation paid $104,000 to retire the bonds from the

marketplace. Record the entries on June 30, 2008.

JE at 6/30/08 to pay the interest:

Interest Expense

Premium on B/P

Cash

3,117

383

JE at 6/30/08 to retire the bonds:

Bonds Payable

100,000

Premium on B/P

3,510

Loss on Retirement

490

Cash

3,500

104,000

15

3. PV of an Annuity Due (PVAD)

The difference between an ordinary annuity and an annuity due is

the timing of the periodic payments: an annuity due has

payments (rents, annuities) at the beginning of each period.

The result is that there is one less period of discounting.

There are 3 different ways you can calculate PVAD:

n-1

1. Formula: PVAD = A [((1-(1/(1+i) )) / i) + 1]

2. Tables: see page 686, Table 6

PVAD Table

PVAD = A(

)

i, n

where n = number of payments (not periods)

3.Calculator if it has time value of money functions.

16

Leases

FASB issued SFAS No. 13, which requires certain

leases to be recorded as capital leases.

– Capital leases record the leased asset as a capital

asset, and reflect the present value of the related

payment contract as a liability.

Requirements of SFAS No. 13 - record as capital lease for

the lessee if any one of the following is present in the

lease:

– Title transfers at the end of the lease period,

– The lease contains a bargain purchase option,

– The lease life is at least 75% of the useful life of the

asset, or

– The lessee pays for at least 90% of the fair market value

of the lease.

17

Problem 3 - Leases

Lee Company (the lessee) signed a contract to lease equipment

from Lawrence Company (the lessor). The terms of the lease

were as follows:

1. Four year lease starting January 1, 2008.

2. Annual lease payments of $6,000. The first payment is due at

lease inception (January 1, 2008), with subsequent payments

on December 31, 2008, 2009, and 2010.

3. Bargain purchase option of $1,000 at end of lease (December

31, 2011).

Other information:

Lee’s borrowing rate: 8%

Useful life of equipment: 6 years with no salvage value.

18

Problem 3 - Leases

Requirement 1: Calculate the PVMLP

(Note that the lease payments are an annuity due.)

PVMLP = PV RENTS + PVBPO

PVAD Table

PV RENTS =PVAD= A(

PVAD Table

) = 6,000(3.5771) = $21,463

i, n

i =8%, n=4

PV1 Table

PVBPO = PV1 = FV1(

PV1 Table

) = 1,000(0.73503) = $ 735

i, n

i = 8%, n = 4

The present value of the minimum lease pmts = $22,198

19

Problem 3 - Leases

Date

1/01/08

1/01/08

12/31/08

12/31/09

12/31/10

12/31/11

Cash

Paid

Interest

Expense

6,000

6,000

6,000

6,000

1,000

-0- 1

1,2962

920

513

733

Carrying

Difference Value

22,198

6,000

16,198

4,704

11,494

5,080

6,414

5,487

927

927

-0-

1No

interest at 1/1/08, because no time has passed.

This is equivalent to a “down payment” which

immediately reduces the total liability.

2Int.

Expense = CV x MR x T = 16,198 x 8% x 1 year

3Rounding

difference of $1 absorbed in calculation.

20

Problem 3 - Leases

Requirement 3: Prepare the following journal

entries for the year 2008:

Initial lease at 1/1/08:

Equipment

22,198

Lease Liability

22,198

First payment at 1/1/08:

Lease Liability

6,000

Cash

6,000

Second payment at 12/31/08:

Interest Expense

1,296

Lease Liability

4,704

Cash

6,000

21

Problem 3 - Leases

For the last entry, we must calculate straightline depreciation on leased asset at

12/31/08.

Note that the calculation here is based on the

length of time that the lessee will actually

use the asset (6 years here because of the

BPO).

(Cost-SV)/Est. life =(22,198 - 0)/6 = $3,700

JE for Depreciation at 12/31/08:

Depreciation expense

Accumulated Depr.

3,700

3,700

22

Copyright

© 2008 John Wiley & Sons, Inc. All rights reserved.

Reproduction or translation of this work beyond that

permitted in Section 117 of the 1976 United States

Copyright Act without the express written permission

of the copyright owner is unlawful. Request for further

information should be addressed to the Permissions

Department, John Wiley & Sons, Inc. The purchaser

may make back-up copies for his/her own use only

and not for distribution or resale. The Publisher

assumes no responsibility for errors, omissions, or

damages, caused by the use of these programs or

from the use of the information contained herein.

23