ACCT 20100 Exam 1 Practice Problem For the Review Session

advertisement

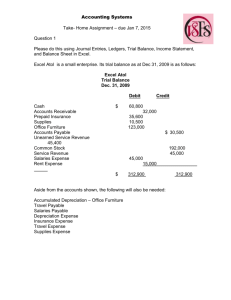

ACCT 20100 Exam 1 Practice Problem For the Review Session: Sunday September 19, 12:30-1:30pm, Jordan Auditorium, Mendoza College of Business Building Chi Minh opened Minh’s Window Washing on July 1, 2010. During July the following transactions were completed. The chart of accounts for Minh’s Window Washing contains the following accounts: Cash, Accounts Receivable, Cleaning Supplies, Prepaid Insurance, Equipment, Accumulated Depreciation—Equipment, Accounts Payable, Salaries Payable, Notes Payable, Contributed Capital , Retained Earnings, Service Revenue, Gas & Oil Expense, Cleaning Supplies Expense, Depreciation Expense, Insurance Expense, and Salaries Expense. July 1 July 1 July 3 July 5 July 12 July 18 July 20 July 21 July 25 July 31 July 31 Minh invested $12,000 cash in the business. Purchased used truck for $6,000, paying $3,000 cash and the balance on a three year note payable. Purchased cleaning supplies for $1,300 on account. Paid $2,400 cash on one-year insurance policy effective July 1. Billed customers $2,500 for cleaning services earned. Paid $1,000 cash on amount owed on note payable and $800 on amount owed on cleaning supplies. Paid $1,200 cash for employee salaries. Collected $1,400 cash from customers billed on July 12. Billed customers $5,000 for cleaning services earned. Paid gas and oil for month on truck $200. Declared and paid $900 dividend. Instructions (a) Journalize and post the July transactions to T-accounts. (b) Prepare a trial balance at July 31 on a worksheet. (c) Prepare adjusting journal entries for the following adjustments: (1) Services provided but unbilled and uncollected at July 31 were $1,500. (2) Depreciation on equipment for the month was $300. (3) One-twelfth of the insurance expired. (4) An inventory count shows $400 of cleaning supplies on hand at July 31. (5) Accrued but unpaid employee salaries were $600. (d) Prepare an Adjusted Trial Balance. (e) Prepare a set of financial statements including income statement, statement of retained earnings and balance sheet. (f) Prepare the closing entry to close out revenue and expense accounts.