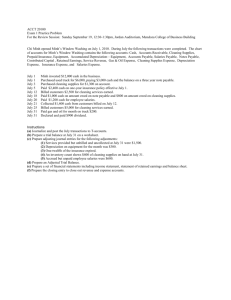

Chapter 8 - Fisher College of Business

advertisement

CHAPTER 8 Completing the Operating Cycle Learning Objective 1 Account for the various components of employee compensation expense. Describe the Employee Compensation Time Line Payroll Compensated Absences Stock Options and Bonuses Time Postemployment Benefits Pensions and Postretiremen t Benefits Other than Pensions Payroll Salaries and wages earned by employees in the current period. What are the correct journal entries? Recording the payment of Accounting for salaries of $2,700: this payable is similar to When employees work: Salariesjournal Expense. .entry . . . . . . .to . . .record . . . . . . . . .2,700 Salaries Payable . . . . . . . . . . . . . . . . . . 2,700 payment of every payable. When wages are The payable is debited paid: Salaries Payable. . . . . . . . . . . . . . . . . . . . . . 2,700 and cash is credited. Cash. . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2,700 However, accounting for salaries and related payroll taxes is never this simple. Federal and state income Withholdings taxes. Which taxes must employers withhold from Social employees’ salaries Security (FICA) and wages? taxes. Voluntary or contractual withholdings (union dues, They are notmedical additional expenses to the insurance premiums, and charitable employer since the employee pays the donations). taxes. The business acts as agent to assist in the collection of funds for the government or organization. Salaries Expense Entry Sally Wage works for you and earns $32,400 annually. Make the appropriate journal entry for Sally’s January salary. Salaries Expense. . . . . . . . . . . . . . . . . . . . . . 2,700 FICA Taxes Payable, Employee. . . . . . . 180 Federal Withholding Taxes Payable . . . 486 State Withholding Taxes Payable . . . . . 243 Union Dues Payable . . . . . . . . . . . . . . . . 68 Salaries Payable . . . . . . . . . . . . . . . . . . . 1723 To record Sally Wage’s salary. Payroll Tax Expense Entry Now that the appropriate journal entry is made for Sally’s wages, make the entry to record your company’s portion. Payroll Tax Expense. . . . . . . . . . . . . . . . . . . 278 FICA Taxes Payable, Employer . . . . . . . 180 Federal Unemployment Taxes Payable. 30 State Unemployment Taxes Payable. . . 68 To record liabilities associated with Sally Wage’s salary. Compensated Absences Matching principle The expense associated with the compensated absence must be accounted for in the period in which it is earned by the employee. Therefore, the expense is estimated. Salaries Expense . . . . . . . . . . . . . . . . . . . . 125 Sick Days Payable . . . . . . . . . . . . . . . . 125 To recognize accrued sick pay. Journal entry when the sick day is actually taken: Sick Days Payable . . . . . . . . . . . . . . . . . . . 125 Various Taxes Payables. . . . . . . . . . . . Cash. . . . . . . . . . . . . . . . . . . . . . . . . . . . To record payment of sick day net of FICA, federal, and state taxes. 35 90 Describe Bonuses and Stock Options Employees, generally top management, may have the option to purchase stock in the future at a price specified today. Generally, the stock is presently selling at an amount below the option price. The objective is to provide management with an incentive to effectively run the company in such a way that the stock price increases. Bonuses and Stock Options Your firm met its target goals this year. Your President, Mr. Will Fences, is therefore entitled to a bonus. His annual salary is $1 million and his bonus is 15 percent, payable at the end of the year. Make the appropriate December 31 journal entry for the bonus. Salaries Expense . . . . . . . . . . . . . . . . . . . . 150,000 Various Taxes Payables. . . . . . . . . . . . 60,000 Bonus Payable . . . . . . . . . . . . . . . . . . . 90,000 To record bonus earned by Mr. Will Fences. Post-employment Benefits Those benefits incurred after an employee has ceased to work for an employer but before that employee retires. Examples: severance packages, retraining costs, education costs. Journal entry when estimated salaries are $2,000: Salaries Expense . . . . . . . . . . . . . . . . . . . . 2,000 Benefits Payable. . . . . . . . . . . . . . . . . . 2,000 To record post-employment benefits for laid-off employees. When paid, a journal entry is made to reduce the payable and to record the cash outflow. Define Pensions Compensation received by an employee after retirement. Defined contribution plan. Employer sets aside money to be paid following retirement. Employee gets what was contributed plus the earnings. Defined benefit plan. Benefits based on number of years worked. Employee gets whatever benefit is defined in the plan. Company attempts to determine costs to be paid in the future and records an estimate in the current period. Learning Objective 2 Compute income tax expense including appropriate consideration of deferred tax items. Taxes on Operations What other taxes are companies responsible to pay? Sales Taxes Property Taxes Income Taxes Example: Sales Taxes Michael’s Mowers sold a lawnmower for $340. What is the journal entry assuming the state charges a 5 percent sales tax? Cash. . . . . . . . . . . . . . . . . . . . . . . . . . . . . Sales Revenue. . . . . . . . . . . . . . . . . . Sales Tax Payable. . . . . . . . . . . . . . . 357 340 17 From sale of lawnmower, including 5% sales tax. Example: Property Taxes The City of Greenlawn assesses property taxes on land and buildings. Michael’s Mowers pays its property taxes on a calendar-year basis and owes Greenlawn $6,200 for 2004. Make Michael’s appropriate journal entry. 12/31/03 Property Tax Expense . . . . . . Property Tax Payable. . . . . 6,200 6,200 To record property tax expense and liability to Greenlawn City. Example: Income Taxes Michael’s Mowers pretax income is $385,000. Its income tax rate for 2003 for both federal and state is 30 percent. Prepare an adjusting entry at year-end showing the company’s tax expense. 12/31/03 Income Tax Expense . . . . . . . .115,500 Income Tax Payable. . . . . . . 115,500 To record income tax expense and tax liability on $385,000 pretax income for 2001 using a 30 percent effective tax rate. Learning Objective 3 Distinguish between contingent items that should be recognized in the financial statements and those that should be merely disclosed in the financial statement notes. Contingencies Contingency: An event that may or may not occur. Accounting standard setters say proper disclosure depends upon the assessed outcome. Terms used to describe contingencies: probable, reasonably possible, and remote. A firm must obtain objective assessments and then account for those events based on that assessment. Contingent Liabilities Term Probable Definition The future event is likely Accounting Estimate the amount to occur. of the contingency and make the appropriate journal entry; provide detailed disclosure in the notes. Reasonably The chance of the future possible event occurring is more than remote but less than likely. Provide detailed disclosure of the possible liability in the notes. Remote No disclosure required. The chance of the future event occurring is slight. Learning Objective 4 Understand when an expenditure should be recorded as an asset and when it should be recorded as an expense. Describe the Expense/Asset Continuum Office Supplies Used Expense Repairs Research and Development Land and Building Asset Expense or Capitalize? Why the Debate? Michael’s builds a new $1 million store. Should it simply show this as an expense or capitalize it as an asset? If Michael’s chooses not to capitalize, the company’s financial statements will be misstated. The income statement in Year 1 will have too much expense. The income statements for Years 2 through 20 will contain too little expense. Potential investors may invest elsewhere because of the low net income figure resulting from the large expense. The balance sheet will not show an item that is expected to benefit future periods. Bad resource allocation decisions could result. Learning Objective 5 Prepare an income statement summarizing operating activities as well as other revenues and expenses, extraordinary items, and earnings per share. Income Statement Put these major components of an Income Statement in correct order: Net sales revenue Net income Sales revenue Cost of goods sold Operating expenses Operating income 2 6 1 3 4 5 Income Statement Format Revenues – Cost of goods sold = Gross margin – Selling expenses – General and administrative expenses = Operating income +/– Other revenues and expenses = Income before taxes – Income tax = Income after taxes +/– Extraordinary items = Net income Define Other Revenue and Expenses Those items incurred or earned from activities that are outside of, or peripheral to, the normal operations of a firm. For example, Michael’s Mowers sponsored a local little league team. Its expense for uniforms may be shown under “Other Revenues and Expenses.” Define Extraordinary Items Reserved for reporting special non-operating gains and losses. Restrictive and includes only those items that are: unusual in nature infrequent in occurrence material in amount Separate so financial statement users can know they are one-time or nonrecurring events. Examples: losses from floods, fires, earthquakes. Define Earnings per Share EPS is required on the income statement. If extraordinary items are included, EPS figures are reported on income before extraordinary items, on extraordinary items, and on net income. Allows potential investors to compare profitability across firms of different sizes. How do you do the calculation? Net income Average number of shares outstanding