Excel Atol

advertisement

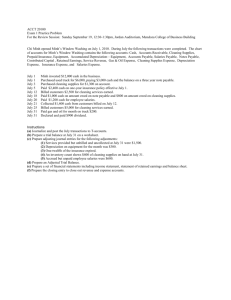

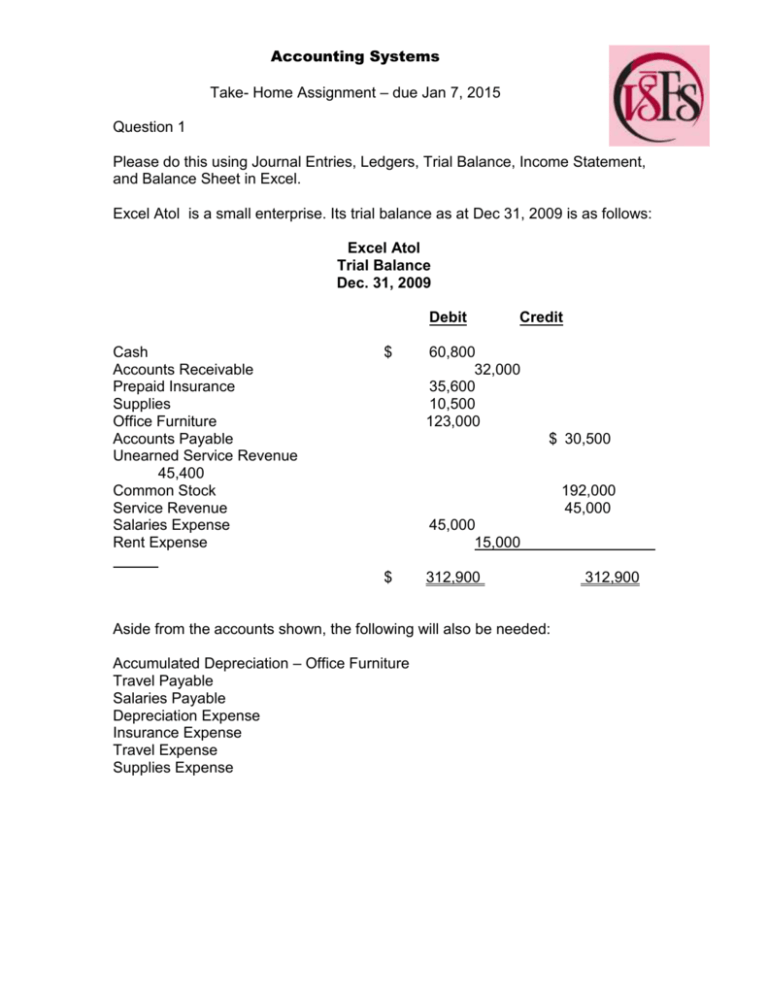

Accounting Systems Take- Home Assignment – due Jan 7, 2015 Question 1 Please do this using Journal Entries, Ledgers, Trial Balance, Income Statement, and Balance Sheet in Excel. Excel Atol is a small enterprise. Its trial balance as at Dec 31, 2009 is as follows: Excel Atol Trial Balance Dec. 31, 2009 Debit Cash Accounts Receivable Prepaid Insurance Supplies Office Furniture Accounts Payable Unearned Service Revenue 45,400 Common Stock Service Revenue Salaries Expense Rent Expense $ Credit 60,800 32,000 35,600 10,500 123,000 $ 30,500 192,000 45,000 45,000 15,000 $ 312,900 Aside from the accounts shown, the following will also be needed: Accumulated Depreciation – Office Furniture Travel Payable Salaries Payable Depreciation Expense Insurance Expense Travel Expense Supplies Expense 312,900 The following needs to be entered: 1. 2. 3. 4. $5000 of Supplies were used during the month Travel costs incurred but not paid were $2000 The insurance policy is paid for three years Only $12,000 of the Unearned Service Revenue was still Unearned by the end of the month 5. Dec 31 is a Wednesday, and employees are paid on Friday (5 day week). There are 20 employees, each earning $600 per week. 6. The office furniture is being depreciated straight line over 5 years at $2500 per month. 7. There are still $2,000 of services to be booked at the end of the month. Instructions: 1. 2. 3. 4. 5. 6. Prepare T-Accounts for the above Make journal entries for the end of month Re-do the trial balance Prepare a closing journal entry Prepare an income statement and balance sheet Work out the debt/equity ratio, return on assets, return on equity and the profit margin for this company. Question 2 A merchandising company shows the following on its trial balance as at Dec 31, 2009: Accounts Payable $ 75,000 Accounts Receivable 46,300 Accumulated Depreciation – Building 52,500 Accumulated Depreciation – Equipment 42,600 Building 190,000 Cash 50,000 Common Stock 150,000 Cost of Goods Sold 395,000 Depreciation Expense – Building 10,400 Depreciation Expense – Equipment 13,000 Dividends 28,000 Equipment 100,000 Insurance Expense 7,200 Interest Expense 11,000 Interest Payable 10,000 Interest Revenue 4,300 Merchandise Inventory 75,000 Mortgage Payable 97,000 Office Salaries Expense 32,000 Prepaid Insurance 4,400 Property Taxes Payable 4,800 Property Taxes Expense 4,800 Retained Earnings 26,600 Sales Salaries Expense 76,000 Sales 610,000 Sales Commission Expense 14,500 Sales Commissions Payable 3,500 Sales Returns and Allowances 8,000 Utilities Expense 11,000 Note: $20,000 of the mortgage payable is due next year. Instructions: a) Prepare a multiple-step income statement, a retained earnings statement, and a balance sheet b) Calculate the net profit margin and the gross profit margin Question 3 A company has made 13,000,000 CZK in credit sales over the past year. Its policy is to maintain a reserve of .5% for losses on its credit sales. There is a balance of 15,000 CZK in the reserve account at present. Prepare the transaction to complete the reserve Question 4 Your company is closing its books on December 31 of this year. You have noticed the following: a) Salaries are paid on the 15th of the month, and the salaries for December will be paid on time, and the necessary entries be made to adjust them for the remaining two weeks. The head of payroll thinks that the adjustments made at the end of the year can be forgotten. The amount involved is 15,732 CZK on sales of 500,000 CZK. What is you opinion? Show the journal entry. b) The bank has a loan outstanding for CZK 3,000,000, which is paying 12%. Interest. The payment date is the 20th of each month. Calculate the accrued interest, and prepare a journal entry to adjust the records. c) What is the role of accruals? Which accounting concepts do they respect? Question 5 Condensed financial data of Fairchild Company for 2010 and 2009 are presented below. Additional information: During the year, $70 of common stock was issued in exchange for plant assets. No plant assets were sold in 2010. Cash dividends were $260. Instructions Prepare a statement of cash flows using the indirect method. Good Luck!!