Summer Pick MFE Part 1

advertisement

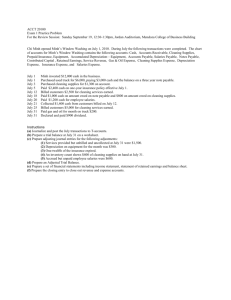

1 Learning Module #1 That was talking, this is doing. Doing is different than talking. Curly Sue What this course is and what it isn’t The Plan The website 2 Where are you now? From the following information for Laurel, Inc., prepare the financial statements for the year ending December 31, 2015. Cash Accounts Receivable Inventory Building Equipment Accumulated Depreciation Security Deposit Accounts Payable Salaries Payable Taxes Payable Note Payable, Long-Term Common Stock Paid In Capital- Ex Par Retained Earnings Treasury Stock Sales Cost of Goods Sold Salary Expense Rent Expense Depreciation Expense Office Expense Interest Revenue Interest Expense Income Tax Expense 58,000 15,000 80,000 200,000 100,000 20,000 3,000 12,000 4,000 6,000 40,000 5,000 45,000 334,000 10,000 410,000 200,000 50,000 36,000 10,000 10,000 1,000 5,000 30,000 Laurel, Inc. declared and paid a $5,000 dividend in 2015. The beginning Common Stock was $50,000 and beginning Retained Earnings was $259,000. Prepare a Trial Balance, Income Statement, Balance Sheet and Statement of Owners’ Equity for Laurel. 3 4 From the following for 2015 for CoJo, Inc. prepare an Income Statement and a Balance Sheet. assume a December 31 year end. Accounts Payable Accounts Receivable Accumulated Depreciation Administrative Expenses Advertising Expense Building Capital in Excess of Par Cash Common Stock ($1 Par) Cost of Goods Sold Depreciation Expense Equipment Gain on sale of equipment Interest Expense Inventory Notes Payable, Long-Term Patent Rent Expense Retained Earnings Sales Sales Returns and Allowances Salaries Payable Salary Expense Tax Expense Taxes Payable 200,000 120,000 56,000 58,000 20,000 300,000 288,000 98,000 12,000 500,000 32,000 140,000 6,000 10,000 180,000 100,000 50,000 36,000 143,000 900,000 4,000 60,000 120,000 29,000 29,000 5 Calculating the Earnings Per Share There are two levels of EPS B_____________ D_____________ 6 Cash Flows From the following information for Molly’s Munchies, prepare a Statement of Cash Flows for the year ended December 31, 2014 using the indirect method. The following data is for Fred’s Follies: Cash Accounts Receivable Inventory Prepaid Insurance Equipment Accumulated Depreciation Land Security Deposits Accounts Payable Wages Payable Rent Payable Interest Payable Taxes Payable Note Payable Common Stock ($1 each) Retained Earnings Sales Cost of Goods Sold Wage Expense Rent Expense Office Expenses Depreciation Expense Advertising Expense Insurance Expense Interest Expense Income Tax Expense Balance 12/31/15 Balance 12/31/14 80,000 68,000 70,000 500 340,000 80,000 120,000 12,000 35,000 6,000 7,500 6,000 16,000 120,000 300,000 120,000 1,200,000 575,000 260,000 24,000 70,000 60,000 15,000 9,000 14,000 52,000 20,000 35,000 90,000 3,000 270,000 20,000 10,000 30,000 10,000 6,000 7,000 5,000 140,000 160,000 50,000 Some of the equipment was acquired on March 31, 2015 by exchanging 60,000 shares of common stock worth $60,000. The additional common stock (other than that issued for the purchase of the equipment) was sold on June 30, 2015 for $1 per share. The company did not sell any equipment during the year. All the rest of the equipment and the land purchased during the year was purchased for cash. The retained earnings balance for both years is after all closing entries have been made. The Note Payable requires payments of $20,000 principal plus interest at 10% on June 30th of each year. 7 8 Now you do one - Not dying is not the same as living. The following balances are for Misty Company at December 31, Cash Accounts Receivable Inventory Prepaid Rent Equipment Accumulated Depreciation-Equipment Security Deposit Accounts Payable Salaries Payable Interest Payable Taxes Payable Note Payable Common Stock Retained Earnings Sales Cost of Goods Sold Salary Expense Rent Expense Interest Expense Depreciation Expense 2014 10,000 40,000 80,000 6,000 180,000 50,000 8,000 40,000 10,000 -0-0100,000 10,000 114,000 2015 30,000 50,000 60,000 3,000 210,000 60,000 9,000 50,000 -05,000 ______ 70,000 50,000 124,000 200,000 100,000 40,000 24,000 6,000 10,000 The common stock outstanding was 10,000 shares on January 1, 2014. On April 1, 2015, Misty issued 10,000 shares of common stock in exchange for $10,000 of equipment. On July 1, 2015, Misty sold an additional 30,000 shares of common stock. During 2015, the company paid a dividend of _____________. No equipment was sold during the year. The tax rate is 30% and 1/2 of 2015 taxes were paid in 2015. On the next page, prepare a Statement of Cash flows in good form using the indirect method. 9 10 The following data is for Calvin’s Catnip Treats, Inc.: Cash Accounts Receivable Allowance for Doubtful Accounts Inventory Prepaid Rent Equipment Accumulated Depreciation Land Security Deposit Patent Accounts Payable Wages Payable Rent Payable Taxes Payable Interest Payable Note Payable Common Stock ($1 each) Retained Earnings Sales Cost of Goods Sold Wage Expense Rent Expense Office Expenses Depreciation Expense Bad Debt Expense Interest Expense Income Tax Expense Balance 12/31/16 Balance 12/31/15 120,000 70,000 10,000 30,000 66,000 35,000 5,000 80,000 5,000 240,000 40,000 320,000 60,000 20,000 1,000 9,000 79,000 6,000 5,000 25,000 5,000 110,000 120,000 150,000 1,000,000 600,000 155,000 60,000 27,000 20,000 10,000 13,000 30,000 9,000 60,000 10,000 38,000 2,000 130,000 60,000 90,000 The land was acquired on April 1, 2016 by exchanging 20,000 shares of common stock worth $20,000. The additional common stock (other than that issued for the purchase of the land) was sold on July 1, 2016 for $1 per share. All equipment purchased during the year was purchased for cash. The retained earnings balance for both years is after all closing entries have been made. The Note Payable requires payments of $20,000 principal plus interest at 10% on December 31st of each year. 11 12 Learning Module #2 Managerial Element temerity comes out of Concentration a combination of confidence and hunger. (Arnold Palmer) We have been studying Financial Accounting Which deals with ___________________________________________ Managerial accounting is __________________________________________________ Cost Behavior We sell Tasteys. They cost $90 to make and sell for $ 300 each. Our only other expenses are the rent of $300 per month, utilities of $100 per month and a $10 per unit sales commission we pay to the salespeople. We sold ten during the year. A Contribution Margin Statement 13 Fixed Costs are Variable Costs are Calculating Break-even Target Profit Using the Contribution Margin% 14 “ The art of conversation lies in listening. ” — Malcolm Forbes Your Club is thinking about having a dinner. They expect to charge about $30 per head. They need to rent a room in Baker for $300 (includes servers). In addition to the $300, Baker will charge you $10 per dinner. How many dinners must you sell just to break even? How many dinners must you sell to make a profit of $600? Sarah sells cookies. She uses ingredients that cost $.20 per cookie and sells them for $.50 each. She pays her sales force a 10% commission on all cookies sold. She pays rent of $1,000 per month. Her other fixed costs are $2,000 per month. How many cookies must she sell to break-even? How many cookies does she need to sell to make $2,000 per month? Prepare a contribution margin statement at the level where she is making $2,000 per month. 15 Gracie Company sells Dodds. The following is an income statement for a recent month. Sales Cost of goods sold Gross Margin Operating Expenses Salaries and commissions Rent Utilities Other Net Income $250,000 150,000 100,000 $42,000 18,000 7,000 3,000 70,000 $30,000 Gracie sells one product, Dodds at $20 each. Cost of goods sold is variable. A 10% sales commission, included in salaries and commissions, is the only other variable cost. Gracie tells you that the income statement is not helpful, for she cannot determine such things as the break-even point. Redo the statement using the contribution margin format. What is the breakeven in units and dollars 16 Acme Company sells anvils and the following is per anvil Unit Selling Price Variable Costs $20 12 Total fixed costs $ 400,000 Total volume 100,000 units Prepare an income statement using the contribution margin format What is Acme’s Break Even point in units In $ 17 Now assume that Acme wants to make $1,000,000 per year. How many anvils does the company need to sell to accomplish this (in units and dollars). The CFO of Garven Company provides the following per-unit analysis, based on a volume of 100,000 units Selling Price Variable Costs Fixed Costs Total Costs Profit per unit $30 $12 9 21 $ 9 Answer each of the following questions independent of your answers to the other questions 1) What total profit does Garven expect to earn? 2) What would be the total profit at 110,000 units? (Be careful- they are fixed costs) 18 3) What is the break-even point in units? 4) Garven’s managers think they can increase volume to 120,000 units by spending an additional $ 60,000 on salespeople. What total profit would they earn if they make this move? 5) Break-even using Contribution Margin % 19 Now look at a Hot Dog Stand You have decided to open a hot dog stand at the corner of Court and Union. The following is your opening balance sheet. You own the only 50,000 shares of stock outstanding for your company. You sell the dogs for $2.00 each. You pay your worker a fixed salary of $20,000 plus $.10 for each dog she sells. (Dogs cost $.40 each- how do I know that?) Assets Cash Inventory Cart Total 5,000 10,000 35,000 50,000 Liabilities Owners’ Equity Common Stock 50,000 Retained Earnings Total -050,000 Income Statement Using Contribution Margin Format For the First Year Sales Cost of Sales Gross Margin Operating Expenses Wages Other Total Operating Expenses Operating Income 60,000 12,000 48,000 Sales 23,000 10,000 33,000 15,000 How many hot dogs do you need to sell to break-even Per Year Per Month Professional tip Per Week Per Day In negotiating, go ___________ then ________________. Per Hour 20 Homework Managerial Problem 1. Salmon Company makes Things. Things sell for $30 each and cost $10 each to make. Fixed costs are estimated to be $1,500,000 next year. What is the breakeven point in units and sales dollars for Salmon based on the above information How many Things must Salmon sell to make $1,200,000 next year? Problem 2 Billy Bob’s has given you the following income statement for June 2013. Sales Cost of goods sold Gross margin Operating expenses: Salaries and commissions Utilities Rent Other Total operating expenses Income $ 500,000 300,000 200,000 $ 80,000 20,000 22,000 18,000 140,000 60,000 Billy Bob sells one product, a running shoe for $100 per pair. A 10% sales commission, included in Salaries and commissions is the only other variable cost. The manager tells you that this financial statement is not very helpful to her. Redo the income statement using the contribution margin format. For Billy Bob’s determine the break-even in sales dollars and in units