1

Chapter 7

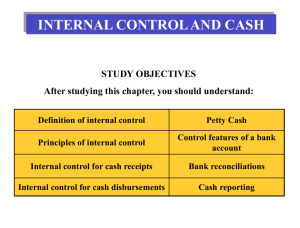

INTERNAL CONTROL

AND CASH

2

CHAPTER 7

INTERNAL CONTROL AND CASH

After studying this chapter, you should be

able to:

Identify the principles of internal control.

Explain the applications of internal control to

cash receipts.

Explain the applications of internal control to

cash disbursements.

Prepare a bank reconciliation.

Explain the reporting of cash.

Discuss the basic principles of cash

management.

Identify the primary elements of a cash

budget.

3

1

PRINCIPLES OF INTERNAL

CONTROL

11

Internal control

Safeguards an organization’s

assets from

Employee theft, robbery,

unauthorized use

Enhances the accuracy and

reliability of accounting records

Risk of errors and irregularities

4

PRINCIPLES OF INTERNAL

CONTROL

5

PRINCIPLES OF INTERNAL CONTROL

Establishment of

responsibility:

most effective when

only one person is

responsible for a

given task

Segregation of

duties:

the work of one

employee should

provide a reliable

basis for

evaluating the

work of

another employee

PRINCIPLES OF INTERNAL CONTROL

Documentation procedures:

documents provide evidence that

transactions and events have

occurred

7

Physical, Mechanical, and

Electronic Controls

Independent Internal Verification

Independent Internal Verification

Rotating employee’s

duties and requiring

employees to take

vacations

10

Limitations of Internal

Controls

Cost/Benefit - cost of establishing

procedure should not exceed expected

benefit

Human element - fatigue, carelessness,

indifference

Collusion - two or more individuals who

work together to get around controls

Size of business

11

Review

a.

b.

c.

d.

Segregation of duties means?

Rotating employee duties and

requiring vacations.

Reviewing, comparing and reconciling

information from two sources.

The responsibility for related activities

should be assigned to different

individuals.

Physical separation of employees from

each other.

12

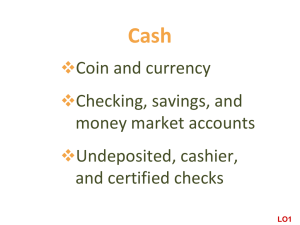

Cash consists of...

coins

currency

checks

money orders

money on hand

deposits in bank

13

Petty Cash Fund

is a cash fund used to pay relatively small amounts

14

USE OF A BANK

The use of a bank

minimizes the amount of currency that

must be kept on hand

contributes significantly to good internal

control over cash.

A “double” record of cash is

maintained, one by the

company, one by the bank.

These two accounts must

be reconciled.

15

Bank Statement

a copy of the

bank’s records

sent to the

customer for

periodic review.

Bank

Statement

shows

•check &

other debits

•deposits &

other credits

•daily cash

balance

16

4

11

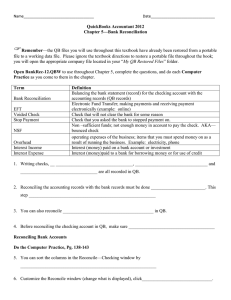

RECONCILING THE BANK

ACCOUNT

Reconciliation

is necessary as the balance per bank

and balance per books are seldom in

agreement due to time lags and errors

A bank reconciliation

should be prepared by an employee

who has no other responsibilities

pertaining to cash

17

RECONCILING THE

BANK ACCOUNT

Steps in preparing a bank reconciliation:

Determine deposits in transit

Determine outstanding checks

Note any errors discovered

Trace bank memoranda to the records

Each reconciling item used in determining the

“Adjusted cash balance per books” should be

recorded by the depositor with an adjusting

entry

18

BANK RECONCILIATION

Terms

Deposits in transit - deposits recorded by the

depositor that have not been recorded by the

bank.

Outstanding checks - checks issued and recorded

by the company that have not been paid by the

bank.

NSF check - a check that is not paid by the bank

because of insufficient funds in the customer’s

bank account.

Adjusted balance - same as true cash balance,

correct cash balance

20

BANK RECONCILIATION

21

ENTRIES FROM BANK

RECONCILIATION

GENERAL JOURNAL

Date

Apr. 30

Account Titles and Explanation

Cash

Miscellaneous Expense

Notes Receivable

Interest Revenue

(To record collection of notes

receivable by bank)

Debit

Credit

1035

15

1000

50

Collection of Note Receivable This entry involves four

accounts. Interest of $50 has not been accrued and the

collection fee is charged to Miscellaneous Expense.

22

ENTRIES FROM BANK

RECONCILIATION

GENERAL JOURNAL

Date

Apr. 30

Account Titles and Explanation

Cash

Accounts Payable — Andrea

Company

(To correct error in recording

check No. 443)

Debit

Credit

36

36

Book Error An examination of the cash disbursements

journal shows that check No. 443 was a payment on

account to Andrea Company, a supplier. The check, with

a correct amount of $1,226.00, was recorded at $1,262.00.

23

ENTRIES FROM BANK

RECONCILIATION

GENERAL JOURNAL

Date

Apr. 30

Account Titles and Explanation

Accounts Receivable — J. R. Baron

Cash

(To record NSF check)

Debit

Credit

425.60

425.60

NSF Check An NSF check becomes an

accounts receivable to the depositor.

24

ENTRIES FROM BANK

RECONCILIATION

GENERAL JOURNAL

Date

Apr. 30

Account Titles and Explanation

Miscellaneous Expense

Cash

(To record charge for printing

company checks)

Debit

Credit

30

30

Bank Service Charges Check printing charges (DM) and other

bank service charges (SC) are debited to Miscellaneous

Expense because they are usually nominal in amount.

25

6

11

Basic Principles of Cash

Management

Copyright © 2008 John Wiley & Sons, Inc. All rights

reserved. Reproduction or translation of this work

beyond that named in Section 117 of the United States

Copyright Act without the express written consent of the

copyright owner is unlawful. Request for further

information should be addressed to the Permissions

Department, John Wiley & Sons, Inc. The purchaser

may make back-up copies for his/her own use only and

not for distribution or resale. The Publisher assumes no

responsibility for errors, omissions, or damages, caused

by the use of these programs or from the use of the

information contained herein.

27