Chapter 7 - Cal State LA - Instructional Web Server

advertisement

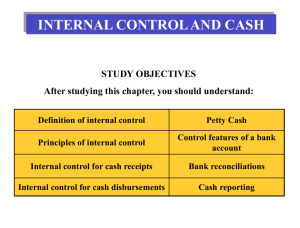

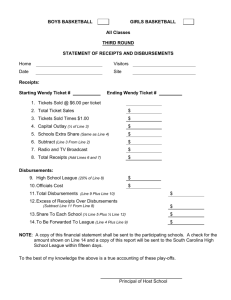

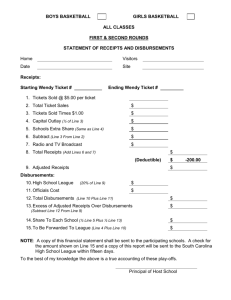

Financial Accounting: Tools for Business Decision Making, 4th Edition Kimmel, Weygandt, Kieso CHAPTER 7 Prepared by Dr. Joseph Otto 1 Chapter 7 INTERNAL CONTROL AND CASH 2 CHAPTER 7 INTERNAL CONTROL AND CASH After studying this chapter, you should be able to: Identify the principles of internal control. Explain the applications of internal control to cash receipts. Explain the applications of internal control to cash disbursements. Prepare a bank reconciliation. Explain the reporting of cash. Discuss the basic principles of cash management. Identify the primary elements of a cash budget. 3 1 PRINCIPLES OF INTERNAL CONTROL 11 Internal control Safeguards an organization’s assets from Employee theft, robbery, unauthorized use Enhances the accuracy and reliability of accounting records Risk of errors and irregularities 4 PRINCIPLES OF INTERNAL CONTROL 5 PRINCIPLES OF INTERNAL CONTROL Establishment of responsibility: most effective when only one person is responsible for a given task Segregation of duties: the work of one employee should provide a reliable basis for evaluating the work of another employee PRINCIPLES OF INTERNAL CONTROL Documentation procedures: documents provide evidence that transactions and events have occurred 7 Physical, Mechanical, and Electronic Controls Independent Internal Verification Independent Internal Verification Bonding of employees who handle cash Rotating employee’s duties and requiring employees to take vacations 10 Limitations of Internal Controls Cost/Benefit - cost of establishing procedure should not exceed expected benefit Human element - fatigue, carelessness, indifference Collusion - two or more individuals who work together to get around controls Size of business 11 Review a. b. c. d. Segregation of duties means? Rotating employee duties and requiring vacations. Reviewing, comparing and reconciling information from two sources. The responsibility for related activities should be assigned to different individuals. Physical separation of employees from each other. 12 Review a. b. c. d. Segregation of duties means? Rotating employee duties and requiring vacations. Reviewing, comparing and reconciling information from two sources. The responsibility for related activities should be assigned to different individuals. Physical separation of employees from each other. 13 Cash consists of... coins currency checks money orders money on hand deposits in bank 14 Cash is the most desirable asset... because it is readily convertible into any other asset. 15 2 11 INTERNAL CONTROL OVER CASH RECEIPTS Review a. b. c. d. Which of the following is not an internal control over cash receipts? Store cash in safes and bank vaults. Supervisors count cash receipts daily Bond personnel who handle cash. Having the same person who receives the cash to be the one that records it. 17 Review a. b. c. d. Which of the following is not an internal control over cash receipts? Store cash in safes and bank vaults. Supervisors count cash receipts daily Bond personnel who handle cash. Having the same person who receives the cash to be the one that records it. 18 3 11 INTERNAL CONTROL OVER CASH DISBURSEMENTS Petty Cash Fund is a cash fund used to pay relatively small amounts 20 Cash Disbursements ELECTRONIC FUNDS TRANSFER SYSTEM Check processing is expensive new methods are being developed to transfer funds among parties without the use of paper Electronic Funds Transfer (EFT) System a disbursement system that uses wire, telephone, telegraph, or computer to transfer cash from one location to another 21 Review a. b. c. d. Which of the following is not an internal control over cash disbursements? Stamp invoices paid. Use prenumbered checks and account for the sequence. Use cash registers. Have multiple people available to sign checks so they can be mailed promptly. 22 Review a. b. c. d. Which of the following is not an internal control over cash disbursements? Stamp invoices paid. Use prenumbered checks and account for the sequence. Use cash registers. Have multiple people available to sign checks so they can be mailed promptly. 23 USE OF A BANK The use of a bank minimizes the amount of currency that must be kept on hand contributes significantly to good internal control over cash. A “double” record of cash is maintained, one by the company, one by the bank. These two accounts must be reconciled. 24 Bank Statement a copy of the bank’s records sent to the customer for periodic review. Bank Statement shows •check & other debits •deposits & other credits •daily cash balance 25 4 11 RECONCILING THE BANK ACCOUNT Reconciliation is necessary as the balance per bank and balance per books are seldom in agreement due to time lags and errors A bank reconciliation should be prepared by an employee who has no other responsibilities pertaining to cash 26 RECONCILING THE BANK ACCOUNT Steps in preparing a bank reconciliation: Determine deposits in transit Determine outstanding checks Note any errors discovered Trace bank memoranda to the records Each reconciling item used in determining the “Adjusted cash balance per books” should be recorded by the depositor with an adjusting entry 27 BANK RECONCILIATION Terms Deposits in transit - deposits recorded by the depositor that have not been recorded by the bank. Outstanding checks - checks issued and recorded by the company that have not been paid by the bank. NSF check - a check that is not paid by the bank because of insufficient funds in the customer’s bank account. Adjusted balance - same as true cash balance, correct cash balance 29 BANK RECONCILIATION 30 ENTRIES FROM BANK RECONCILIATION GENERAL JOURNAL Date Apr. 30 Account Titles and Explanation Cash Miscellaneous Expense Notes Receivable Interest Revenue (To record collection of notes receivable by bank) Debit Credit 1035 15 1000 50 Collection of Note Receivable This entry involves four accounts. Interest of $50 has not been accrued and the collection fee is charged to Miscellaneous Expense. 31 ENTRIES FROM BANK RECONCILIATION GENERAL JOURNAL Date Apr. 30 Account Titles and Explanation Cash Accounts Payable — Andrea Company (To correct error in recording check No. 443) Debit Credit 36 36 Book Error An examination of the cash disbursements journal shows that check No. 443 was a payment on account to Andrea Company, a supplier. The check, with a correct amount of $1,226.00, was recorded at $1,262.00. 32 ENTRIES FROM BANK RECONCILIATION GENERAL JOURNAL Date Apr. 30 Account Titles and Explanation Accounts Receivable — J. R. Baron Cash (To record NSF check) Debit Credit 425.60 425.60 NSF Check An NSF check becomes an accounts receivable to the depositor. 33 ENTRIES FROM BANK RECONCILIATION GENERAL JOURNAL Date Apr. 30 Account Titles and Explanation Miscellaneous Expense Cash (To record charge for printing company checks) Debit Credit 30 30 Bank Service Charges Check printing charges (DM) and other bank service charges (SC) are debited to Miscellaneous Expense because they are usually nominal in amount. 34 5 REPORTING CASH 11 Cash Recorded in both the balance sheet and the statement of cash flows The balance sheet shows the amount of cash available at a given point in time The statement of cash flows shows the sources and uses of cash during a period of time. 35 REPORTING CASH Cash Equivalents Cash equivalents are Readily convertible to known amounts of cash So near maturity that their value is relatively insensitive to interest rate changes Examples include treasury bills, commercial paper, and money market funds 36 Restricted Cash Is cash that is not available for general use. Is set aside for special purpose. If not to be used within next year, report as noncurrent asset. 37 MANAGING AND MONITORING CASH The objective of managing cash is to Ensure that the company has sufficient cash to meet payments, yet Minimize the amount of idle cash on hand The operating cycle of a merchandising company is the average time it takes to go from cash to cash in producing revenues 38 Operating Cycle of a Merchandising Company 39 6 11 Basic Principles of Cash Management 7 11 Cash Budget Cash is vital. Planning the company's cash needs is a key business activity. Cash budget shows the anticipated cash flows, over a 1 to 2-year period. 41 CASH BUDGETING Cash receipts section includes expected receipts from the company’s principal sources of revenue Cash disbursements section includes expected payments for direct materials, direct labor, etc. Financing section shows expected borrowings and their repayment 42 BASIC CASH BUDGET CASH BUDGET JOURNAL Apr 30 Cash Miscellaneous Expense Notes Receivable Interest Revenue Apr 30 Cash Accounts Payable Apr 30 Accounts Receivable-Baron Cash Apr 30 Miscellaneous Expense Cash 1,035.00 15.00 1,000.00 50.00 36.00 36.00 425.60 425.60 30.00 30.00 45 Review a. b. c. d. Which one of the following is not one of the sections of a cash budget? Cash from operations section. Cash disbursements section. Cash receipts section. Financing section. 46 Review a. b. c. d. Which one of the following is not one of the sections of a cash budget? Cash from operations section. Cash disbursements section. Cash receipts section. Financing section. 47 Assign #9: E7-4, E7-8 48