Lecture 10 - cda college

advertisement

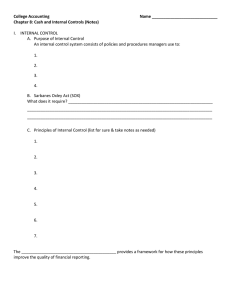

CDA COLLEGE ACC101: BOOK KEEPING II Lecture 10 Lecturer: Kleanthis Zisimos Lecture Topic List Bank Reconciliation statement Quick review on Bank account What is a bank account? Is it a current asset or a fixed asset? Debit or credit side? Recording transactions to the bank account What is a bank reconciliation A bank reconciliation is a comparison of a bank statement (sent monthly from your bank) with the bank account in the books of the company. The bank reconciliation is needed in order to identify and adjust the differences between the two statements Discussion example on the board Differences between Bank statement and Bank account 1. 2. 3. 4. Differences between Bank statement and Bank account may occur due to the following reasons Unpresented checks Uncleared deposits Bank charges or interests Errors in recording a transaction Bank reconciliation statement The bank reconciliation statement is computed for the correction of errors and adjustment of the differences. It has the following form PART 1 Bank statement amount X Less: Unpresented checks (X) Add. Uncleared deposits X X Bank reconciliation statement The results from part 1 should be equal with the results of part 2 PART 2 Bank account amount Less: Bank charges or interests Adjustment of errors X (X) X X Discussion Exercise 1. 2. 3. 4. 5. On 31 March 2010 the company’s bank account showed a debit balance of € 5000. The bank statement of March which was sent by the bank had a credit balance of 5600 . Make the bank reconciliation statement noting the following points Bank charges € 200 were not recorded in the books A check for € 1000 was not shown in the bank statem. A check deposit was not cleared in the bank for 500 A check for € 400 was not shown in the bank statem. A check payment of 100 to a supplier was wrongly recorded to the books of the company as a cash payment