File

advertisement

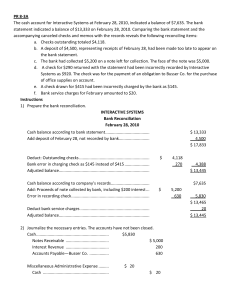

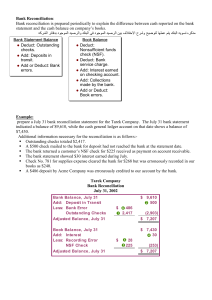

CHAPTER 8 INTERNAL CONTROL AND CASH Chapter 8-1 Cash Controls Cash consists of coins, currency, checks, money orders, and money on hand or on deposit in a bank. Cash receipts come from: cash sales collections on account from customers receipt of interest, rent, and dividends investments by owners bank loans proceeds from the sale of noncurrent assets Chapter 8-2 LO 3 Explain the applications of internal control principles to cash receipts. Use of a Bank Contributes to good internal control over cash. Minimizes the amount of currency on hand. Creates a double record of bank transactions. Bank reconciliation. Chapter 8-3 LO 6 Indicate the control features of a bank account. Use of a Bank Writing Checks Illustration 8-11 Written order signed by depositor directing bank to pay a specified sum of money to a designated recipient. Maker Payee Payer Chapter 8-4 LO 6 Indicate the control features of a bank account. Use of a Bank Bank Statements Illustration 8-12 Debit Memorandum Bank service charge NSF (not sufficient funds –bounced check) Credit Memorandum Collect notes receivable. Interest earned. Chapter 8-5 LO 6 Indicate the control features of a bank account. Reconciling Items Book Balance Bank Statement Balance Deduct: Outstanding checks. Add: Deposits in transit. Add or Deduct: Bank errors. Chapter 8-6 Deduct: Nonsufficient funds check (NSF). Deduct: Bank service charge. Add: Interest earned on checking account. Add: Collections made by the bank. Add or Deduct: Book errors. Use of a Bank Reconciliation Procedures Illustration 8-13 + Deposit in Transit + Notes collected by bank - - NSF (bounced) checks - Check printing or other service charges Outstanding Checks +- Bank Errors +- Book Errors CORRECT BALANCE Chapter 8-7 CORRECT BALANCE LO 7 Prepare a bank reconciliation. Use of a Bank E8-11 The following information pertains to Family Video Company. 1. Cash balance per bank, July 31, $7,263. 2. Cash balance per books, July 31, $7,284. 3. July bank service charge not recorded by the depositor $28. 4. Deposits in transit, July 31, $1,500. 5. Bank collected $900 note for Family in July, plus interest $36, less fee $20.The collection has not been recorded by Family, and no interest has been accrued. 6. Outstanding checks, July 31, $591. Instructions a) Prepare a bank reconciliation at July 31. b) Journalize the adjusting entries at July 31 on the books of Family Video Company. Chapter 8-8 LO 7 Prepare a bank reconciliation. Use of a Bank E8-11 a) Prepare a bank reconciliation at July 31. Cash balance per bank statement Add: Deposit in transit Less: Outstanding checks Adjusted cash balance per bank Cash balance per books Add: Collection of notes receivable Collection of interest Less: Bank service charge Note collection fee Adjusted cash balance per books Chapter 8-9 $7,263 1,500 (591) $8,172 $7,284 900 36 (28) (20) $8,172 LO 7 Prepare a bank reconciliation. Use of a Bank E8-11 b) Journalize the adjusting entries at July 31 on the books of Family Video Company. Dr. Cr. July 31 Cash 888 Bank charge expense 28 Miscellaneous expense Notes receivable Interest revenue 20 900 36 Note: Adjusting journal entry includes only the adjustments to the cash balance per books. Chapter 8-10 LO 7 Prepare a bank reconciliation.