STUDY OBJECTIVE 1 DEFINITION OF INTERNAL CONTROL

advertisement

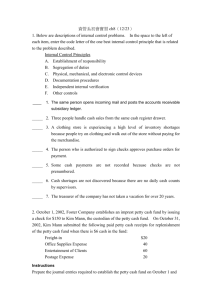

INTERNAL CONTROL AND CASH STUDY OBJECTIVES After studying this chapter, you should understand: Definition of internal control Petty Cash Principles of internal control Control features of a bank account Internal control for cash receipts Bank reconciliations Internal control for cash disbursements Cash reporting STUDY OBJECTIVE 1 DEFINITION OF INTERNAL CONTROL The plan of organization and all related methods and measures adopted by a business in order to: Safeguard assets Enhance accuracy and reliability of accounting records STUDY OBJECTIVE 2 PRINCIPLES OF INTERNAL CONTROL Establishment of responsibility Physical, mechanical, & electronic controls Segregation of duties Independent internal verification Documentation procedures Other Controls ESTABLISHMENT OF RESPONSIBILITY Control is most effective when only one person is responsible for a given task. Only one cashier should operate a cash register during a shift. Cash is reconciled at the beginning and end of the shift. SEGREGATION OF DUTIES • Related activities should be assigned to different employees • Record-keeping separate from custody The cashier should not update the accounting records. DOCUMENTATION PROCEDURES • Documents are pre-numbered • Sequence is accounted for • Documents are forwarded to accounting department promptly Checks have sequential numbers. Missing check numbers are investigated. PHYSICAL, MECHANICAL, & ELECTRONIC CONTROLS • Designed to safeguard assets and accounting records • Also designed to restrict access Bank vault Locked warehouse Access codes Passwords Alarms Time clocks INDEPENDENT INTERNAL VERIFICATION • • • • Review, comparison, & reconciliation of data prepared by another employee On a surprise basis INTERNAL AUDIT By an independent person DEPARTMENT Discrepancies noted and reported Manager compares daily sales summaries with cash register tapes. OTHER CONTROLS • Bonding employees who handle cash • Rotation of duties • Mandatory vacation Mandatory vacations make it impossible for a bookkeeper to permanently conceal “irregular” activities. SEGREGATION OF DUTES VS. INDEPENDENT INTERNAL VERIFICATION Segregation of Duties Assistant Cashier B Maintains custody of cash on hand Accounting Employee A Maintains cash balance per books Independent Internal Verification Assistant Treasurer C Makes monthly comparisons. Reports differences to treasurer. LIMITATIONS OF INTERNAL CONTROL Cost-Benefit Considerations The cost of implementing a control should be less than the perceived benefit. Human Element A system is only as good as the people operating it. Collusion Two people may conspire to override a control STUDY OBJECTIVE 3 INTERNAL CONTROL FOR CASH RECEIPTS • Only designated personnel are authorized to handle or have access to cash receipts. • Different individuals should: 1 receive cash 2 record cash receipt transactions 3 have custody of cash INTERNAL CONTROL FOR CASH RECEIPTS • Register tapes, remittance advices and deposit slips • Cash should be stored in safes and bank vaults • Access to storage areas should be limited to authorized personnel • Cash registers should be used in executing over-the-counter receipts INTERNAL CONTROL FOR CASH RECEIPTS • Daily cash counts and daily comparisons of total receipts. • All personnel who handle cash receipts are bonded and required to take vacations. • Cash registers are visible to customers. STUDY OBJECTIVE 4 INTERNAL CONTROL FOR CASH DISBURSEMENTS • • • • • • Payments made by pre-numbered check. Pay only approved invoices. Limit & specify check-signing authority. Store blank checks in a safe, and limit access. Separate approval and payment functions Stamp invoices when paid. VOUCHER SYSTEM • • • • Enhances control over cash disbursements. A network of approvals by authorized individuals acting independently to ensure that disbursements by check are proper. A voucher is an authorization form prepared for each expenditure. Vouchers are recorded in a journal called the voucher register. REVIEW QUESTION The use of pre-numbered checks in disbursing cash is an application of what internal control principle? Answer: Documentation procedures EFT SYSTEM • A disbursement system that uses wire, phone, or computer to transfer cash. • Regular payments such as those for house, car, and utilities are frequently made by EFT. STUDY OBJECTIVE 5 PETTY CASH FUNDS • Used to pay small amounts • An IMPREST SYSTEM involves: • 1 establishing the fund • 2 making payments from the fund • 3 replenishing the fund • Accounting entries are required when: • 1 the fund is established • 2 the fund is replenished • 3 the amount of the fund is changed ESTABLISHING THE FUND • Two steps to establish a petty cash fund 1 appoint a responsible custodian who will be responsible 2 determine the size of the fund (to cover 3-4 weeks) GENERAL JOURNAL Date Mar. 1 Account Titles and Explanation Petty Cash Cash (To establish a petty cash fund) The check is written to the custodian. Debit Credit 100 100 REPLENISHING THE FUND • Custodian initiates request for reimbursement. • Custodian prepares a schedule of payments with documentation • Treasurer approves replenishment. GENERAL JOURNAL Date Mar. 15 Account Titles and Explanation Postage Expense Freight-out Miscellaneous Expense Cash (To replenish petty cash fund) Debit Credit 44 38 5 87 On March 15 the petty cash custodian requests a check for $87. The fund contains $13 cash and petty cash receipts for postage $44, freight-out $38, and miscellaneous expenses, $5. STUDY OBJECTIVE 6 CONTROL FEATURES--BANKS Using a bank minimizes currency that must be kept on hand and contributes significantly to good internal control over cash. A company can safeguard its cash by using a bank as a depository and as a clearing house. WRITING CHECKS • • • • • A written order signed by the depositor directing the bank to pay a specified sum of money to a designated recipient. Three parties to a check are: 1 Maker/drawer issues the check 2 Bank/payer on which check is drawn 3 Payee to whom check is payable BANK STATEMENTS A bank statement shows: 1 checks paid & other debits charged against the account 2 deposits and other credits made to the account 3 account balance after each day’s transactions • • Debit memorandum indicate charges against the depositor’s account. (ATM service charges). Credit memorandum indicate amounts that increase the depositor’s account. (Interest income). STUDY OBJECTIVE 7 RECONCILING THE BANK ACCOUNT • Reconciliation is necessary because the balance per bank and balance per books are seldom in agreement due to time lags and errors. • Reconciliation should be prepared by an employee who has no other responsibilities pertaining to cash. RECONCILING THE BANK ACCOUNT • Steps in preparing a bank reconciliation: 1 Determine deposits in transit 2 Determine outstanding checks 3 Note any errors discovered 4 Trace bank memoranda to the records • Each reconciling item used in determining the adjusted cash balance per books should be recorded by the depositor. BANK RECONCILIATION LAIRD COMPANY Bank Reconciliation April 30, 2006 Cash balance per bank statement Add: Deposits in transit Less: Outstanding checks No. 453 No. 457 No. 460 The bank statement for the Laird Company shows a balance per bank of $15,907.45 on April 30, 2006. $ 15,907.45 2,201.40 18,108.85 $ 3,000.00 1,401.30 1,502.70 Adjusted cash balance per bank $ 12,204.85 Cash balance per books Add: Collection of $1,000 note receivable plus interest earned $50, less collection fee $15 Error in recording check 443 Less: NSF check Bank service charge Adjusted cash balance per books 5,904.00 On this date the balance of cash per books is $11,589.45. $ 11,589.45 $ 1,035.00 36.00 425.60 30.00 1,071.00 12,660.45 455.60 $ 12,204.85 ENTRIES FROM THE BANK RECONCILIATION GENERAL JOURNAL Date Apr. 30 Account Titles and Explanation Cash Miscellaneous Expense Notes Receivable Interest Revenue (To record collection of notes receivable by bank) Debit Credit 1035 15 1000 50 Collection of Note Receivable. This entry involves four accounts. Interest of $50 has not been accrued and the collection fee is charged to Miscellaneous Expense. ENTRIES FROM THE BANK RECONCILIATION GENERAL JOURNAL Date Apr. 30 Account Titles and Explanation Cash Accounts Payable — Andrea Company (To correct error in recording check No. 443) Debit Credit 36 36 Book Error. An examination of the cash disbursements journal shows that check No. 443 was a payment on account to Andrea Company, a supplier. The check, with a correct amount of $1,226.00, was recorded at $1,262.00. ENTRIES FROM THE BANK RECONCILIATION GENERAL JOURNAL Date Apr. 30 Account Titles and Explanation Accounts Receivable — J. R. Baron Cash (To record NSF check) Debit Credit 425.6 NSF Check An NSF check becomes an accounts receivable to the depositor. 425.6 ENTRIES FROM THE BANK RECONCILIATION GENERAL JOURNAL Date Apr. 30 Account Titles and Explanation Miscellaneous Expense Cash (To record charge for printing company checks) Debit Credit 30 30 Bank Service Charges Check printing charges (DM) and other bank service charges (SC) are debited to Miscellaneous Expense because they are usually nominal in amount. REVIEW QUESTION Which of the following items requires an adjusting entry by the depositor? 1. Outstanding checks 2. Deposits in transit 3. A bank error 4. Bank service charges Answer: Bank service charges STUDY OBJECTIVE 8 REPORTING CASH •Cash reported on the Balance Sheet includes: 1 Cash on hand (includes petty cash) 2 Cash in banks • Cash is the most liquid asset • Cash is listed first in the balance sheet. •Cash equivalents are investments with maturities of 3 months or less, such as money market funds, CD’s, and treasury bills and notes.