Ch. 9: Economic Instability: A Critique of the Self

advertisement

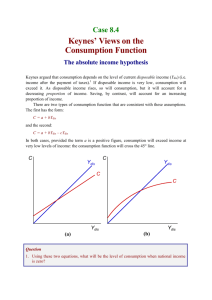

Ch. 9: Economic Instability: A Critique of the SelfRegulating Economy James R. Russell, Ph.D., Professor of Economics & Management, Oral Roberts University ©2005 Thomson Business & Professional Publishing, A Division of Thomson Learning 1 Review of the Classical Position Say’s Law holds, so insufficient demand in the economy is unlikely. Wages, prices, and interest rates are flexible. The economy is self-regulating. Laissez-faire is the right and sensible economic policy to implement. 2 Questioning the Classical Position: Keynes According to Keynes, it was possible for saving to increase and aggregate demand to fall. Individuals save and invest for a host of reasons. Saving is more responsive to changes in income than to changes in the interest rate. Investment is also responsive to technological changes, business expectations, and innovations in addition to the interest rate. 3 Keynes on Interest Rates Saving and investment depend on a number of factors. The interest rate is important in determining the level of investment, but other variables, such as the expected rate of profit, can be more important. 4 Exhibit 1: Keynes’s View of Say’s Law in a Money Economy 5 Keynes on Wage Rates Employees will resist an employer’s efforts to cut wages. Wages may be inflexible in the downward direction. The economy may not automatically cure itself of a recessionary gap. The economy may not be self-regulating. 6 Exhibit 2: The Economy Gets “Stuck” in a Recessionary Gap 7 New Keynesians and Wage Rates Keynes was criticized because he didn’t offer an adequate explanation of inflexible wages. Efficiency wage models provide a solid microeconomic explanation for inflexible wages. Efficiency Wage Models: it is sometimes in the best interest of business firms to pay their employees higher-than-equilibrium wage rates 8 Keynes on Prices The internal structure of an economy is not always competitive enough to allow prices to fall. 9 Is it a Question of the Time it Takes for Wages to Adjust? Classical (New Classical and Monetarists) Economists : Wages adjust quickly enough to consider the economy self-regulating. Keynesian (New Keynesian): Wages adjust so slowly that one cannot say the economy is self-regulating. 10 Exhibit 3: A Question of How Long It Takes for Wage Rates and Prices to Fall 11 Self-Test What do Keynesians mean when they say the economy is inherently unstable? “What matters is not whether the economy is self-regulating or not, but whether prices and wages are flexible and adjust quickly.” Comment on this statement. According to Keynes, why might aggregate demand be too low? 12 The Simple Keynesian Model Three Simplifying Assumptions 1. The price level is constant 2. There is no foreign sector 3. The monetary side of the economy is excluded. 13 The Keynesian Framework Of Analysis Keynes was interested in total expenditures, but was particularly concerned with consumption. Consumption depends on disposable income. Consumption and disposable income move in the same direction. When disposable income changes, consumption changes by less. 14 The Consumption Function Consumption=Autonomous Consumption + marginal propensity to consume (MPC) multiplied by disposable income. C=Co + MPC(Yd) MPC is equal to the change in consumption divided by the change in disposable income. MPC= C/ Yd 15 The Consumption Function Consumption can be increased in three ways: 1. Raise autonomous consumption 2. Raise disposable income 3. Raise the MPC 16 The MPC and the MPS Marginal propensity to save (MPS): the ratio of change in saving to the change in disposable income MPS= S/ Yd It also follows that since C+S= Yd then : MPS+MPC=1 17 Exhibit 4: Consumption and Saving at Different Levels of Disposable Income (in billions) 18 The Multiplier The Multiplier: the number that is multiplied by the change in autonomous spending to obtain the change in Real GDP. Real GDP = m x Autonomous Spending Multiplier(m) = 1 1- MPC Change in Total Spending = Multiplier X Change in autonomous spending 19 The Multiplier and Reality The multiplier takes time to have an effect. This process can take months. For the multiplier to increase Real GDP (the way we have described), idle resources must exist at each expenditure round. 20 Self-Test How is autonomous consumption different from consumption? If the MPC is 0.70, what does the multiplier equal? 21 The Simple Keynesian Model in the AD-AS Framework Shifts in the Aggregate Demand Curve Changes in C, I, G (foreign sector excluded by assumption) will shift AD Change in total spending = multiplier X change in autonomous spending 22 Exhibit 5: The Multiplier and Aggregate Demand 23 The Simple Keynesian Model in the AD-AS Framework The Keynesian Aggregate Supply Curve Price level constant until fullemployment (natural real GDP). Aggregate supply curve has both a horizontal and a vertical section. 24 Exhibit 6: The AS Curve in the Simple Keynesian Model 25 The Theme of The Simple Keynesian Model in AD-AS Framework Price level constant until full-employment (natural real GDP). AD shifts if there are changes in C, I, or G. Economy can be in equilibrium and a recessionary gap. Private sector may not be able to get the economy out a a recessionary gap. The government may have a management role to play in the economy. 26 Exhibit 7: Can the Private Sector Remove the Economy from a Recessionary Gap? 27 Self-Test What was Keynes’s position with respect to the self-regulating properties of an economy? What will happen to Real GDP if autonomous spending rises and the economy is operating in the horizontal section of the Keynesian AS curve? Explain. An economist who believes the economy is self-regulating is more likely to advocate laissez-faire than an economist who believes the economy is inherently unstable. Agree or disagree? Explain 28 Exhibit 8: The Derivation of the Total Expenditures (TE) Curve 29 Comparing Total Expenditures and Total Production There are three possible options: 1. Total Expenditures are less than Total Production 2. Total Expenditures are greater than Total Production 3. Total Expenditures equal Total Production 30 Moving From Disequilibrium to Equilibrium TE<TP: Growing inventories signal firms they have overproduced. Firms cut back on production to get to optimal inventory levels, lowering Real GDP. TE>TP: Shrinking inventories signal firms they have under-produced. Firms increase production to get to optimal inventory levels, increasing Real GDP. 31 Exhibit 9: The Three States of the Economy in the TE-TP Framework 32 The Theme of The Simple Keynesian Model In TE-TP Framework Price level constant until full-employment (natural real GDP). TE shifts if there are changes in C, I, or G. Economy can be in equilibrium and a recessionary gap. Private sector may not be able to get the economy out a a recessionary gap. The government may have a management role to play in the economy. 33 Exhibit 10: The Economy: In Equilibrium, and in a Recessionary Gap Too 34 Self-Test What happens in the economy if total production (TP) is greater than total expenditures (TE)? What happens in the economy if total expenditures (TE) are greater than total production (TP)? 35 Coming Up (Ch. 10): The Federal Budget and Fiscal Policy 36