2. Keynes was opposed to Say`s Law which states that supply

advertisement

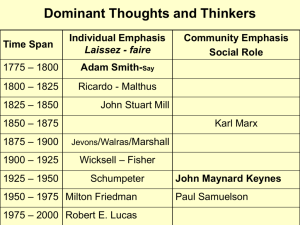

John Maynard Keynes is the author of Keynesian economics who was both an investor and economist of his time. Born in 1883 subject to British Queen Victoria and died in 1946. Keynesian Economics stemmed from ideas that have taken a toll on the American Economy. The belief that government creates jobs rather than the private sector is ludicrous. The new jobs bill will continue to destroy the American economy because the people being taxed are the people who have the money to create jobs. Jeffrey Immelt, GE chairman and head of the Obama’s Job Council sat next to Michelle Obama at her husbands Jobs Speech. Jeffery Immelt is one of those rich people who doesn’t pay taxes and more importantly, HE MOVED HIS BUSINESS TO CHINA. Just one of many who have no reason to create jobs in the United States, their country, because of the redicious regulations and high taxes imposed on business in the US. Businesses are moving out of this country for a reason. Logic would suggest that if they are all leaving and taking jobs away from the American people then something must be painfully wrong here. Keynesian Economics suggests the public sector, or the state can stimulate economic growth and improve stability in the private sector through interest rates, taxation, and public projects. He believed that unemployment can be remedied through government deficit spending and can be checked by means of government tax surpluses (Rothbard 2008). Keynesian Economics in a Nutshell 1. If investment exceeds savings there will be inflation. On the contrary if investment exceeds savings there will be recession. One of the things this suggests is at times when the economy is failing spending should be encouraged while saving would be discouraged. (Thus our current government). Naturally this contrary to logic and wisdom which suggests being thrifty during difficult times is important. Keynes did not believe that, in fact he said, “For the engine which drives enterprise is not thrift, but profit.” 2. Keynes was opposed to Say’s Law which states that supply creates demand. Keynes believed the opposite; output determined demand. 3. With regard to employment Keynes believed unemployment was caused by people not spending enough money total amounts of output result from total amounts of spending. 4. In a recession the total demand of economies fails – the business and the private sector begin to control their spending more thus lowering demand which then contributes to job loss and further spending deficits. Keynes believed that government should borrow money and boost demand by pumping money into the economy. (Sound familiar) Based on this type of thinking once the economy recovers government would then pay back the loans – in this case there is not money available to do so. In fact the term Ponzi Scheme as stated by Gov. Perry with regard to social security is an accurate assessment of Social Security. People paid money into social security with the belief it would be there when they reached retirement age. The Clinton administration took social security money so it would appear he had a surplus, he replaced the money with an IOU (Trust Fund Bonds) but he never paid the money back. Bill Clinton’s OMB noted back in 2000: These [Trust Fund] balances are available to finance future benefit payments and other trust fund expenditures-but only in a bookkeeping sense. These funds are not set up to be pension funds, like the funds of private pension plans. They do not consist of real economic assets that can be drawn down in the future to fund benefits. Instead, they are claims on the Treasury, that, when redeemed, will have to be financed by raising taxes, borrowing from the public, or reducing benefits or other expenditures. The existence of large trust fund balances, therefore, does not, by itself, make it easier for the government to pay benefits. (David C. John) 5. Successful economies have large contributions from both government and the private sector. 6. Keynes believe government should play in managing the economy which collided with Adam Smith’s thinking which was economies do better with the free market and away from government intervention. I think if we have clear understanding of spending then we have an understanding of why this government is failing miserably with regard to our economy and jobs as well as foreign policy. Perhaps this is just the result of an inexperienced person put in a position he was not qualified for in the first place. But that being said, why doesn’t he listen to anyone, successful in business and knowledgably about the free market? He appears to be a spoiled little boy, with a bully attitude, which is having a significant impact on everyone except him.