January 2015 Strategic Concepts ACA and EAP - eapa

advertisement

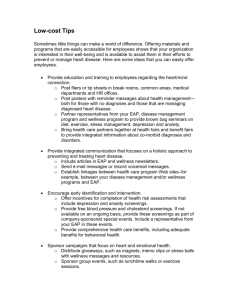

Opportunities for EAPs Surviving the Tidal Wave of Change . Now What?? W. Dennis Derr Ed.D. LPC BCPC Staff VP, Anthem Government Business Division Medicaid/Medicare Behavioral Health 1 Strategic Discussion Areas • A short walk down memory lane. • Threats and Opportunities as a result of historical Disruption Innovation in Health and Benefits as a result of Managed Care, the Affordable Care Act, Demographics, Technology • Impact of the coming self accountability focus via technology, benefit changes and generational shifts • Future Opportunities for EAP professionals including the Expanding Medicaid Medicare market. 2 Disruptive Innovation is here! A disruptive innovation is an innovation that helps create a new market and value network, and eventually disrupts an existing market and value network (over a few years or decades), displacing an earlier technology. 3 EAP Memory Lane 1970’s The growth of internal EAPs….Insurance payments for mental health 1980’s Random drug testing…….Birth of Managed Behavioral Health……Hughes Aircraft EAP medical savings study published. 1990’s External EAPs begin to replace internal EAPs……Worklife Programs and Wellness Programs rise in popularity. Rise of global EAPs 2000’s Internal EAPs are endangered species…..extensive price competition in behavioral health benefits, medical cost rises fastest in history, benefits cost savings (lowest price) focus. Mental Health Parity and the Affordable Care Act passed. Technology rise. 4 What do you think? Average session payment MSW through Insurance $200 $180 $160 $140 $120 $100 $80 $60 $40 $20 $0 MSW Session $75 1980 $64 Factoring Inflation 2014 5 The Current State of the EAP Landscape • EAP/Worklife continues to be a bundled 3nd or 4th tier product in the insurance industry. • EAP/Worklife continues the march downward as a commodity price product. Recent 3 session prices: – 10 cents PMPM for a large midwest manufacturer, – 5 cents PMPM as part of an employee disability plan seller. 6 Current State of the EAP/Worklife Industry • EAP/Worklife is already being included on a limited “free” basis into medical plans provided on Federal and Private Health Exchanges. • Movement to control cost by driving most services to self service on the web and reduce call center staff and limit face to face provider costs. 7 8 What do you think? Cost of EAP 3 session model 1986-2014 $3.00 $2.50 $2.00 1986 2014 $1.50 $1.00 $0.50 $0.00 1986 2014 9 Questions to Ponder? • If the average EAP utilization is 3-5% annually, is it worth covering the other 95-97%? • If employers have been doing health risk appraisals and offering wellness programs for 25 years…..why are we less healthy? • Why is the user satisfaction rate with a disdained aggressive low price EAP company, the same level as more expensive traditional EAPs? 10 Affordable Care State Exchange Federal Exchange Medical Home Public Exchange Medicaid Expansion Coordinated Accountable Care Integrated Care Coordinator Gold Plan Accountable Care Organization Platnum Plan Bronze Plan Private Exchange Minimum Actuarial Value Maximum Weekly Hours 11 Disruptive Affordable Care Act Basics • Effective 1/1/14 every American had to have health insurance provided either by their employer, through a state health exchange, or individual purchase. • Small employers with fewer than 50 full time equivalent employees are exempt from any penalties.. . 12 Disruptive Impact of the Affordable Care Act • In states (23) that did not support the expansion of Medicaid through the Act or by setting up exchanges, saw reductions in federal funding for substance abuse and mental health treatment. • Private Exchanges set up by Aon, Mercer and other consultants continue to grow offering providing ease of participation for employers who want a single service point and no accountability. • . 13 Disruptive Impact of the Affordable Care Act • Federal exchange prices and coverage are pushing employers to match pricing and coverage options with insurers. • Within the Exchange markets some level of “free” EAP is being built in through bulk purchase contracts with EAP marketers. This will continue to reduce the price and likelihood of success in the free standing EAP sales market. 14 Disruptive Impact of the Affordable Care Act • Free EAP continues to be added in at expanded levels by insurers, delivered primarily via web based and telephonic services to hold down costs. • Already some employers are questioning if they go into the exchange what responsibility do they have for add on benefits like EAP and Worklife? 15 Disruptive Impact of the Affordable Care Act • Remember that under parity and the DOL EAP rule EAP can not be a substitute for behavioral health coverage or be considered as providing treatment. 16 Employer Response to the Affordable Care Act • Employers are moving toward a “Chinese menu” approach to benefits and services, buying only what they need for a specific situation. EAP and Worklife, may become an “as needed” non essential service like CISD or Fitness for Duty evaluations. • Self Insured Employer’s providing healthcare can deduct incentive costs for certain participatory wellness programs and health-contingent wellness programs limited to smoking, metabolic syndrome, fitness program or educational program participation, weight reduction. 17 Employer Response to the Affordable Care Act • According to The Prudential Insurance Company • of America’s (Prudential’s) Seventh Annual Study of Employee Benefits: nearly a third (31%) say it’s likely that fewer employers will offer health insurance coverage. Mid-size employers (500 to 9,999 employees) anticipate a greater impact on all aspects of employee benefits compared to small or large companies. 18 Employer Response to the Affordable Care Act • Sixty-eight percent say that health care reform will have a significant impact on employee benefits funding, and 61% say it will have a significant impact on employee benefits communications. Large companies (10,000+ employees) were less likely to say that the number of employee benefits offered will be impacted. 19 Employer Response to the Affordable Care Act • Large service industries are considering utilizing PEO’s (Personal Employment Organizations) to fill needs via a contracting mechanism that releases them from healthcare obligations and allows more flexibility in seasonal staffing needs and overhead management. This would allow for a split workforce benefit offering without being discriminatory. 20 Walmart Bails On Obamacare-Sticks Taxpayers With Employee Healthcare Costs Forbes 12/09/12 Applebee’s CEO Threatens to Fire Employees And Freeze Hiring Because of ObamaCare Washington Post, November 9, 2012 Wendy’s Franchise Cuts Employee Hours to Part Time to Avoid ObamaCare USATODAY 1/ 07/13 21 States Cutting Hours to Avoid Obama Care Fox News 2/13/13 The costs of Obamacare are not just hitting businesses this year--they are also hitting the government, and public employees as well. Virginia, for example, is about to limit part-time employees to 29 hours per week in order to avoid triggering Obamacare’s requirement that employers provide health insurance to those working 30 hours per week or more. The state cannot afford the $110 million annual cost of insurance. Elsewhere, public institutions are taking similar steps to limit part-time work. In Ohio, Youngstown State University recently announced a 29-hour-per-week part-time limit, and placed employees on notice that they would be fired if they worked more than the maximum. Other public universities are doing the same across the nation, just as their private-sector counterparts are limiting part-time hours to avoid the Obamacare rule. 22 Disruptive Impact of The Affordable Care Act so far…. • Retail and service industries have been eliminating healthcare coverage, by reducing weekly hours below 30 per week, paying fines, or changing employee status. Wal-Mart is already manages hours to ensure the majority of their employees stay under the 30 hour threshold. 23 Be Scared Small business insurance market from health law delayed a year By Bloomberg News Service April 2, 2013 Small business employees will have to wait a year before they can choose their own medical plans after the Obama administration delayed a part of the 2010 Patient Protection and Affordable Care Act intended to provide them with coverage options. Starting in 2014, workers at companies with fewer than 100 employees were supposed to have been able to choose from a variety of health plans through new small business insurance marketplaces. They’ll instead wait until at least 2015, according to regulations released by the U.S. Department of Health and Human Services. In the meantime, small business employees will face a situation similar to what most companies offer, with their employers choosing the coverage. Health insurers will still offer the plans, though they’ll be competing for business from companies, not individuals. 24 Be Scared Likely impact will be to further drive small businesses to force employees into exchanges as individuals to be able to collect the tax benefits of covering their own healthcare cost. Small business’ that have current health insurance coverage may face increases in premium costs, pushing the Increase onto the employee, or stop providing health care benefits completely. 25 Employer Response to the Affordable Care Act • Managing the physical and psychological aspects of a newly insured population still falls on primary medical professionals under the medical home model and affordable care organizations not the employer. Non self insured employers will feel less motivation to support employee wellness or other programs without a direct business cost value ratio for doing so. • For large employers or those in highly competitive talent industries, they are likely to maintain a high level of broad benefits to maintain staff. This group represents < 20% of the employed workforce. 26 Disruptive Impact of The Affordable Care Act so far…. • According to Mercer an estimated 30% of small businesses (<500 ees) moved their employees into the State or Public Exchange Markets in 2014, estimated to increase to +50% by 2015. • Private exchanges have grown in 2015 for employers, and employees to shop for benefits. 27 Disruptive Impact of The Affordable Care Act so far…. • Major insurers estimate that by 2015 30- 50% of their revenue (not profit) will come through individual purchases via the State or Private Exchanges. With growing revenue from Medicaid and Medicare. 28 29 The way in which health and medicine is practiced today is no longer sustainable. Health insurers, medical professionals will in the next 3 years quickly become the extension of a mobile or web application”. M. Bertollini, CEO, Aetna, Keynote at the 2012, M Health Global Conference 30 • Over 30,000 health focused mobile apps were developed in 2013 • Over 1M websites are related to individual health issues or treatment 31 • Smartphone applications are an emerging delivery model for services that are: – Structured and based on a simple decision matrix – Reinforcing or reminding of specific behaviors or activities – Provide information (video / text) and allow for further exploration – Can be easily adaptable/customizable for specific patient conditions 32 Disruptive e-Health Trends (Mobile, Web, Tablet) • Lab in a stamp (<$1) being validated for use with urine or blood with 16 diagnostic diseases on one card. • ECG on mobile device is in final FDA approval • FDA has issued preliminary review and approval regulations for health apps. Telcoms partnering with developers. 33 The Truth About Apps and Web • Health and Behavior Mobile app effectiveness is linked to being an integrated critical part of the treatment plan by the treating professional. • Condition specific texting and rewards for response has shown clinical effectiveness in various populations and cultures beyond Smartphone apps. 34 The Truth About Health Apps and Web • With a technology and web skilled population what is the single point of use value? • Mobile and Tablet Apps are designed for specific use and have limited long-term continued use – Most continually used apps according to “AppWorld” are: 1. Music, 2. Social, 3. Games. 4. Porn 5. Navigation – Beyond the top 5 which have daily use, all others loose appeal within 14 days and are used one average once per month. 35 e-CBT Preferred Most of the British Commonwealth’s NHS’ now recommend e-CBT as more effective than face to face counseling based on research 36 E-CBT Apps 37 The Truth About Behavioral and Health Apps and Websites • According to web experts most apps and websites in the health industry are too busy, complex and not engaging. • Much of what is available on EAP/Work Life/Wellness websites is available in the public domain of the web. • Community “helpline” services are growing in metropolitan areas. Sponsored by private entities, governmental agencies they provide general information, child/eldercare resources and local resources. 38 Truth About EAP/Behavioral Health Websites and Mobile Apps • Format and design are primarily focused on; – Informational-articles on health, condition education etc. – Convenience- Find a counselor, simple screenings – One time use or special need single use tools. 39 Truth About EAP/Behavioral Health Websites and Mobile Apps • Little user motivation for continual engagement for • behavior change. – Sites are usually “static” in content and design – Actual user registration with more than one use is usually < 1% of covered population – Most EAPs/BH report cumulative registered users or web page visits which distorts web utilization. Inclusion of Wellness, Financial and a variety of Work Life topics increases density of site while decreasing engagement usability. More is not better. 40 The Future is Virtual Delivery of Service • Reducing costs of delivery, while maintaining • quality service levels is critical in the behavioral field. Options to consider: – Management App that provides basic tools, screening, instructional videos and resources. – Employee/Family App that provides basic screening tools, instructional videos and resources for employees. 41 Maybe We Should Do Wellness? 42 Wellness, Wellbeing, Health Risk Appraisals and EAP/Behavioral Health • Wellness is not new to EAP. – First EAP sponsored wellness HRA was through Dr. Eddington of U of Michigan and Michigan Bell EAP in 1982. • Since American’s have been taking HRAs for over 30 years what is the level of health improvement? 43 Wellness, Wellbeing, Health Risk Appraisals and EAP/Behavioral Health • To expand appeal of EAP many are incorporating • Wellness links or programs. ValueOptionsLimeaid, Magellan-HealthCoach, PPCW-Wellbeing HRA Co morbidity of psycho-social distress, mental health conditions and health although well documented continues to be seen as separate issues by employers, plan participants and the medical focus of major insurance organizations. 44 Is Wellness Via EAP Viable? • EAPs as Wellness vendors are weak in direct competition with stronger better funded Wellness marketing organizations, disease management etc., with product integration, extensive apps and web capability. • Stand alone Wellness providers (ActiveHealth, Healthways, etc.) did not get a significant boost due to the ACA definitions of wellness for self insured employers despite mandatory “wellness” componets in ACA legislation. 45 Is Wellness Via EAP even Viable? • Current Market confusion on what constitutes wellness is now being defined by the recent ACA rules on incentives limiting offerings. • Publication of “Why Nobody Believes the Numbers” by Al Lewis and “Cracking Health Costs” by Tom Emerick and Al Lewis have excited the benefit field by pointing out the failure of Wellness and disease management. 46 Now that we are depressed!!!!!! What is an EAP professional to do???????? 47 TO PREPARE FOR THE FUTURE TO PREPARE FOR THE FUTURE YOU NEED TO CREATE CREATE IT IT NOW! 48 Reading the Tea leaves 49 Your Reading • Pay attention to changing demographics – 1+ Million baby boomers are retiring every month. – More than half the US population is now covered by a form of government healthcare and growing. – Majority of workers are now either part time, contracted or occasional. 50 Your Reading….. • Public Sector Healthcare (Medicaid/Medicare) will continue to grow – 8 newly elected Republican governors are now looking to expand Medicaid in their states – Biggest influencers in healthcare are government –CMS-VA-Tricare – ACA enrollment is growing in year 2 – Major insurers are buying and consolidating Medicaid/Medicare managed care companies to establish strong growth positions. Aetna- Centene, Anthem – Amerigroup, Cigna -? – Healthcare has surpassed US manufacturing in employment in the US – “Beds, Meds and Eds” 51 Your Reading…… • Fastest growing area of behavioral health is in Medicaid/Medicare. • Growth in integrated physical and behavioral health in Medicaid was responsible for record profits for Anthem BCBS. (Billions of $$$) • CMS parity rulings are expanding the role of BH in integrated physical and behavioral health. – – – – CMS Autism Parity Letter to States CMS NCQA requirements for BH and PH Expansion of Substance Abuse benefits. Expected Behavioral Outcome Measures with penalties and incentives in 2015 52 Your reading……. • You have skills, talents and experience that creates an entrepreneurial opportunity for your future in public sector behavioral health. You can create or adapt to take advantage of the growth over the next 10 years. 53 So Where the Entrepreneurial Opportunities? – – – – – – – – Follow Up post discharge coordination and support Preventive or ER behavioral health assessment and referral Post hospitalization care coordination support Educational support for chronic populations (NY HARP) Special needs consultation Onsite Medical Home BH coordination Autism support services Life Skills training, housing resources. 54 Your Reading……… Where are the Opportunities with Employers? • Rethink the value proposition around what employers will value most with changing demographics. – Crisis response (limited business growth model) – Immediate interventions (limited business growth) – On demand Consultation for workplace issues/interventions/training 55 Your Reading……… Where are the Opportunities with Employers? Focus – – – on Leadership training at the front line level. Offer as part of your practice (Coaching +) Solve the demographic leadership problem for employers Deliver through alternative sources (continuing education, social media, religious institutions) • Be innovative and be brave. Remember that when faced with change or moving forward, most people put most of their effort in preventing or denying the existance the change occurring around them. 56 Be innovative and be brave. Remember that when faced with change or moving forward, most people put most of their effort in preventing or denying the existence the change occurring around them. The failure rate of not trying is always 100% 57 A competitive advantage begins with a launch process, in which an organization identifies an opportunity and mobilizes resources to capitalize on it. 58 W. Dennis Derr Ed.D. Email: w.dennis.derr@gmail.com Mobile: 703-863-4596 59