Chapter 5

advertisement

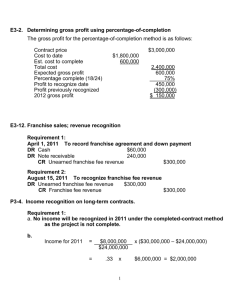

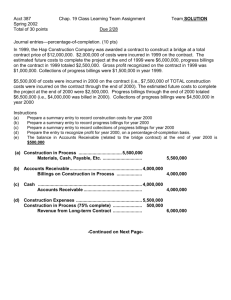

Intermediate Financial Accounting I Revenue Recognition Objectives of the Chapter 1. Discuss the revenue recognition principle and the problems associated with revenue recognition at point of sale. 2. Discuss the cases that revenue is recognized at a point other than at point of sale (i.e., before delivery). 3. Study the percentage-of-completion method for long-term contracts. Income Measurement And Profit Analysis 2 Objectives of the Chapter (contd.) 4. Study the completed-contract method for long-term contracts. 5. Discuss the installment method of accounting. 6. Study the accounting treatments for franchise, software sales and consignment. Income Measurement And Profit Analysis 3 Revenue Recognition Principle (SFAS No. 5) (-An Accrual Basis) Revenue is recognized when it is earned and realized or realizable (SFAC 5, par. 83). Earned : the entity has substantially accomplished what it must do to be entitled to compensation. Realized: goods are exchanged for cash or claims. Realizable: assets received as compensation are readily convertible into cash or claims to cash. In general, these conditions are met at time of sale (delivery) or when services are rendered (SFAC 5, par. 84). Income Measurement And Profit Analysis 4 Revenue Recognition Principle Other conditions for revenue recognition (Staff Accounting Bulletin No. 101(1999)): Persuasive evidence of a sale. Price is fixed or determinable. Collectibility is reasonably assured. Delivery has occurred or services have been rendered. Income Measurement And Profit Analysis 5 Impact of SAB 101 on Revenue Recognition for Service Industry FedEx: Recognizes revenue upon delivery of shipments (not during the packing, loading or transporting). United Airlines (UA): (Accounting Changes) Beginning Q1, 2000, UA recognizes mileage sale through Citibank credit card or longdistance phone companies after the transportation is provided, not when mileage were sold. Others: season tickets, annual membership, etc. Income Measurement And Profit Analysis 6 Type of Transactions Sale of product from Inventory: revenue recognized at time of sale. Rendering a service: revenue recognized when services have been performed and billable. Permitting use of an asset: revenue (i.e., interest, rents and royalties) recognized as time passes or assets are used. Sale of asset other than inventory: gain or loss recognized at date of sale or trade-in. Income Measurement And Profit Analysis 7 Problems Associated with Revenue Recognized at Point of Sale (Delivery) 1. Sales with buyback agreements: inventory should remain on the seller’s book and no revenue can be recognized. 2a. Sales with right of return exists: Revenue recognized if expecting insignificant amount of returns. Income Measurement And Profit Analysis 8 Problems Associated with Revenue Recognized at Point of Sale (contd.) 2b. Sales with right of return: When expecting high sales returns, no revenue can be recognized unless the following six conditions are met. (i) Sales price is determined; (ii) Buyers have paid or have the obligations to pay; Income Measurement And Profit Analysis 9 Problems Associated with Revenue Recognized at Point of Sale (contd.) 2b. Sales with right of return (contd.) (iii) The buyers’ obligation would not be changed due to theft of damage of the product after sales; (iv) Sellers are not responsible for the performance of the product; (v) Buyers and sellers are two separate economic entities; (vi) The amount of returns can be estimated. Income Measurement And Profit Analysis 10 Problems Associated with Revenue Recognized at Point of Sale (contd.) 3. Trade loading: Manufacturers reduced the price for wholesale at the fiscal year end to create instant sales. The wholesaler is loaded with more inventory than it can promptly resell. Income Measurement And Profit Analysis 11 Revenue Recognition over Time (during the earnings process) and others 1. During the production process(i.e., long-term contract): accounting methods of revenue recognition are percentage-of completion method and completed-contract method. 2. At the completion of production (i.e., for agriculture products and precious metals). Income Measurement And Profit Analysis 12 Revenue Recognition after Delivery 3. Installment Sales: revenue recognized after time of sale (delivery) as cash is collected. 4. Revenue recognition delayed until a future event occurred (i.e., real estate sale, sale of division). Accounting method: Deposit method. Income Measurement And Profit Analysis 13 Conditions for Revenue to Be Recognized at Completion of Production Market is reasonably assured; Costs of selling and distribution are insignificant and can be estimated; Production, not sale, is considered to be the most critical event in the earning process. Income Measurement And Profit Analysis 14 Conditions for Revenue to Be Recognized at Completion of Production (contd.) Example: Revenue is recognized when precious metals are mined or when agricultural crops are harvested because all conditions are met. Income Measurement And Profit Analysis 15 Conditions for Recognizing Revenue during Production Buyers can be identified and price has been agreed on; Future costs can be estimated and significant portion of service has been performed; The collectability of cash can be reasonable assured; Income Measurement And Profit Analysis 16 Conditions for Recognizing Revenue during Production The contract specifies the rights about goods or services to be performed and received by both parties; Both parties are expected to fulfil their obligations (AICPA statement of position 81). Income Measurement And Profit Analysis 17 Choice of P-O-C vs. C-C Method If all conditions are met, the percentage-of-completion (P-O-C) method must be applied to recognize construction revenue prior to the completion date. If conditions are not met, the completed-contract method will be applied to recognize revenue at or after the completion date. Income Measurement And Profit Analysis 18 Choice of P-O-C vs. C-C Method (contd.) Example: For long-term construction contract, when all conditions are met, the P-O-C method is used to account for construction revenue and construction expenses. Income Measurement And Profit Analysis 19 Financial Reporting of Long-Term (Construction) Contract Percentage-of-completion method: revenue is recognized according to the percentage of completion. The percentage of completion is computed based on costs. Completed-contract method: postpone the revenue recognition until time of sale. Income Measurement And Profit Analysis 20 Example A: (Long-Term Construction Contract) Contract Price = $700 Construction Estimated Estimated Cummulative Costs Costs to Total Percentage of Year Incurred Complete Cost Completion (%) x1 $100 $400 $500 1 20% 4 x2 $186 $264 $550 2 52% 5 3 6 $ 600 100% x3 $314 - 1. 500=100+400 2. 550=100+186+264 3. 600=100+186+314 (actual) 4. 20% = 100/500 5. 52% = (100 + 186)/550 6. 100%=(100+186+314)/ 600 Income Measurement And Profit Analysis 21 Example A (contd.) Year x1 x2 x3 Total Partial Billings $ 80 350 270 $700 Cash Collection $ 50 330 320 $700 Income Measurement And Profit Analysis 22 Example A (contd.) (P-O-C) Cumulative Current Current 7 Year Revenue Revenue Expense $ 140 1 $ 140 4 x1 100 364 2 224 5 x2 186 700 3 336 6 x3 314 Total $700 $600 1. $140 = 700 x 20% (contract price x cumulative % of completion) 2. 364 = 700 x 52% 3. 700 = 700 x 100% 4. 140 = 140 - 0 (cumulative revenue - previous years’ revenue) Gross Profit8 $40 38 22 $100 5. 224 = 364 -140 6. 336 = 700 - 140 - 224 7. Current expense = construction costs incurred 8. Net Income = current revenue - current expense Income Measurement And Profit Analysis 23 Example A (contd.) An alternative method to compute the gross profit: Total % Cum. Estimated of Gross Year Profit Completion Profit x1 $200 20% $40 x2 150 52% 78 x3 100 100% 100 Income Measurement And Profit Analysis Gross Profit $40 38 22 24 Example A - Journal Entries (P-O-C) Year x1 Year x2 Year x3 a. To Record Actual Cost: Construction in Progress 100 314 186 A/P 314 100 186 b. Partial Billings: 80 350 270 A/R 80 350 270 Progress Billings c. Cash Collection 50 330 320 Cash 50 330 320 A/R Note: Progress Billings = Billings on Construction construction contract Income Measurement And Profit Analysis 25 Example A - Journal Entries (P-O-C) (contd.) Year x1 Year x2 Year x3 d. End of Period- Recognition of annual income 100 1. Construction Expense 40 C-I-P 140 Construction Revenue 2. Closing Entries: 140 Construction Revenue 100 Construction Expense 40 Income Summary e. The end of Construction No (Customer is fully Billed) Entry Progress Billings C-I-P 186 38 314 22 224 224 336 336 186 38 No Entry 314 22 700 700 Note: Construction Expense = Cost of Construction Construction Revenue = Revenue from Long-Term IncomeContracts Measurement And Profit Analysis 26 Example A Financial Statement Presentation (P-O-C) B/S Year x1 Current Assets: CIP 140 Progress Billings (80) 60 Unbilled Revenue B/S Year x2 Current Liability: P-B 430 C-I-P (364) 66 B/S Year x3 C.A.: CIP 700 P.B (700) 0 Billing in excess of costs and recognized profit Income Measurement And Profit Analysis 27 Financial Statement Presentation (P-OC) (contd.) Year x1 ($140) Year x2 ($224) Year x3 ($336) CIP 100 40 186 38 314 22 Progress Billings 80 -- 1998 350 -- 1999 270 -- 2000 700 -- E.B. Note: Balance of CIP = cumulative revenue Income Measurement And Profit Analysis 28 Financial Statement Presentation (P-OC) (contd.) Income Statement Year x1 Year x2 Year x3 Revenue from Long-term contract 140 224 336 Construction Expenses 100 186 314 Gross Profit 40 38 Income Measurement And Profit Analysis 22 29 Financial Statement Presentation (P-OC) (contd.) Balance Sheet(12/31) Current Assets: A/R Inventories Construction in Progress Less: Billings Costs and recognized profits in excess of billings Current Liabilities: Billings Construction in Progress Billings in excess of costs and recognized profits x1 Year x2 30 50 x3 -- 140 (80) 700 (700) 60 0 430 (364) Income Measurement And Profit Analysis 66 30 Financial Statement Presentation (P-OC) (contd.) Note1 Summary of significant accounting policy Long-Term Construction Contracts. The company recognized revenues and reports profits from long-term construction contracts under the percentage-of-completion method…. Income Measurement And Profit Analysis 31 Example A (contd.) - Completed-Contract Method Gross Profit: X1 $0 X2 $0 X3 $100 X3: Total Revenues - Total Expenses = $ 700 - (100+186+314) = $ 700 - 600 = 100 Income Measurement And Profit Analysis 32 Example A (contd.) - Journal Entries (Completed-Contract) Year x1 Year x2 Year x3 a. Recording Actual Cost: CIP 314 100 186 A/P 314 100 186 b. Partial Billings: 80 350 270 A/R 80 350 270 Progress Billings c. Cash Collection 50 330 320 Cash 50 330 320 A/R d. End of Period No No No Recognition of annual Entry Entry Entry income Income Measurement And Profit Analysis 33 Journal Entries(Completed-Contract) (contd.) Year x1 Year x2 Year x3 e. The End of Construction (Recognize total expense and total revenue) 1. Construction Exp. C-I-P Construction Revenue 2. Construction Revenue Construction Expense Income Summary 3. Progress Billings CIP No No 600 100 700 700 No No No No Income Measurement And Profit Analysis 600 100 700 700 34 Financial Statement Presentation (C-C Method) Income Statement Year x1 Year x2 Year x3 Revenue from Long-term contract ----700 Construction Expenses ----600 Gross Profit --- --- Income Measurement And Profit Analysis 100 35 Financial Statement Presentation (C-C Method) (contd.) Balance Sheet (12/31) Current Assets: A/R Inventories: Construction in Progress Less: Billings Contract Costs in Excess of Billings Year x1 Year x2 Year x3 30 50 --- 100 (80) 700 (700) 20 0 Current Liabilities: Billings 430 Construction in Progress (286) Billing in Excess of Contract Costs Income Measurement And Profit Analysis 144 36 Example B Contract Price $700 Estimated Construction Costs to Estimated Cumulative Costs Complete Total % of Year Incurred the Contract Cost Completion x1 $100 400 $500 20% x2 186 364 650 44% x3 314 600 100% Income Measurement And Profit Analysis 37 Example B (contd.) Year x1 x2 x3 Total P-O-C C-C Cummulative Current Current G.P. G.P. Revenue Revenue Expense (L) (L) $140 $140 $100 40 0 308 168 186 -18 0 700 392 314 78 100 $700 $600 $100 $100 Income Measurement And Profit Analysis 38 Example B (contd.) An alternative method to compute the gross profit: Total Cumm. Cumm. Estimated % of Gross Gross Year G. Profit Completion Profit Profit x1 $200 20% $40 $40 x2 50 44% 22 (18) x3 100 100% 100 78 Income Measurement And Profit Analysis 39 Example B (contd.) Other Information (Billing and cash collection): Year Partial Billings Cash Collection x1 $80 $50 x2 350 330 x3 270 320 $ 700 $ 700 Total Income Measurement And Profit Analysis 40 Example B - Journal Entries (P-O-C) Year x1 Year x2 Year x3 a. Recording Actual Cost: C-I-P 314 100 186 A/P 314 100 186 b. Partial Billings: 80 350 270 A/R 80 350 270 Progress Billings c. Cash Collection 50 330 320 Cash 50 330 320 A/R Income Measurement And Profit Analysis 41 Example B - Journal Entries (P-O-C) (contd.) d. End of Period 1. Construction Expense C-I-P Construction Revenue C-I-P 2. Closing Entries: Construction Revenue I/S Construction Expense Income Summary e. The end of Construction Progress Billings C-I-P Year x1 Year x2 Year x3 100 40 314 78 186 140 - 140 - 168 18 392 - 168 392 18 100 186 314 40 78 No No Income Measurement And Profit Analysis 700 700 42 Example B (contd.) Year x1 x2 x3 C-I-P 100 18 40 186 314 78 700 x2 Progress Billings 80 -- x1 350 -- x2 270 -- x3 Income Measurement And Profit Analysis 43 Example B (contd.) - Journal Entries (Completed-Contract) Year x1 Year x2 Year x3 a. Recording Actual Cost: CIP 314 100 186 A/P 314 100 186 b. Partial Billings: 80 350 270 A/R 80 350 270 Progress Billings c. Cash Collection 50 330 320 Cash 50 330 320 A/R No No No d. End of Period Income Measurement And Profit Analysis 44 Journal Entries(Completed-Contract) (contd.) Year x1 Year x2 Year x3 e. The End of Construction (Recognize total expense and total revenue) 1. Construction Exp. C-I-P Construction Revenue 2. Construction Revenue Construction Expense Income Summary 3. Progress Billings CIP No No 600 100 700 700 No No No No Income Measurement And Profit Analysis 600 100 700 700 45 Example C (Long-Term Contract with an Overall Loss) Contract Price $700 Estimated Construction Costs to Estimated Cumulative Costs Complete Total % of Year Incurred the Contract Cost Completion x1 $100 400 $500 20% x2 186 429 715* 40% x3 429 715 100% * $715 > 700 (contract price) => a total estimated loss occurs and must be recognized immediately (source: ARB 45 and AICPA statement of position 81-1) Income Measurement And Profit Analysis 46 Example C (contd.) P-O-C C-C Cummulative Current Current G.P. G.P. Year Revenue Revenue Expense (L) (L) x1 $140 $140 $100 40 0 x2 280 140 186 (55)* (15) x3 700 420 429 0 0 Total $700 $715 ($15) ($15) * $40 gross profit was recognized in year x1. This profit is not expected to be realized in the future. Thus, the $40 profit must be offset in year x2. In addition, the estimated total loss of $15 should also be recognized immediately in year x2. Therefore, a loss of $55 ($40+$15) should be recognized in year x2. ** Billings and cash collection data are the same as those of example A. Income Measurement And Profit Analysis 47 Example C (contd.) An alternative method to compute the gross profit: Total Cumm. Cumm. Estimated % of Gross Gross Year G. Profit Completion Profit Profit x1 $200 20% $40 $40 x2 (15) 40% (15) (55) x3 (15) 100% (15) 0 Income Measurement And Profit Analysis 48 Example C (contd.) - Journal Entries (P-O-C) Year x1 Year x2 Year x3 429 100 186 429 100 186 a. CIP A/P b. A/R 80 Progress Billings c. Cash A/R 350 80 50 270 350 270 330 320 50 330 320 Income Measurement And Profit Analysis 49 Journal Entries(P-O-C) (contd.) Year x1 Year x2 Year x3 d. End of Period: 1. Construction Expense 420 100 195 C-I-P 40 Construction Revenue 420 140 140 C-I-P 55* 2. Closing Entries e. The End of Construction: Progress Billings C-I-P 700 700 * C-I-P and provision for loss on contract are combined. Income Measurement And Profit Analysis 50 Example C (contd.) Year x1: CIP (Year x1) 100 40 140 Partial Billings (x1) 80 B/S (x1) Current Assets: CIP 140 P-B (80) 60 Income Measurement And Profit Analysis 51 Example C (contd.) Year x2: (with a total estimated loss of $15) CIP (Year x2) P-B (Year x2) 100 55 80 40 350 186 430 271 B/S (Year x2) Current Lia: * The estimated P-B 430 overall loss must CIP (286)* be reported separately on the Billings in excess of costs B/S as a current and recognized profit 144 lia. The overall loss needs to be Estimated liability from out of the long-term contract 15 taken CIP account for reporting purposes. Income Measurement And Profit Analysis 52 Example C (contd.) CIP (2000) 100 55 40 186 429 700 P-B (2000) 80 350 270 700 Income Measurement And Profit Analysis 53 Example C (contd.) - Journal Entries (C-C) Year x1 Year x2 Year x3 429 100 186 429 100 186 a. CIP A/P b. A/R 80 Progress Billings c. Cash A/R 350 80 50 270 350 270 330 320 50 330 320 Income Measurement And Profit Analysis 54 Journal Entries(C-C) (contd.) Year x1 Year x2 Year x3 d. End of Period: Estimated Loss from LongTerm Contract C-I-P e. The End of Construction: Contract Expense Construction Revenue Progress Billings C-I-P 15* 15* 700 700 700 700 * To recognize the total estimated loss of ($15). Income Measurement And Profit Analysis 55 L-T Construction Contract with a Total Estimated Loss Example D Contract Price = $700 Estimated Construction Costs Estimated Cummulative Costs to Complete Total % of Year Incurred the Contract Cost Completion x1 $100 $400 500 20% x2 186 429 715 * 40% 815 ** x3 529 100% * a total estimated loss of $15 incurred. ** a total estimated loss of $115. Income Measurement And Profit Analysis 56 Example D (contd.) P-O-C Year x1 x2 x3 Total Cummulative Current Current G.P. Revenue Revenue Expense (L) $140 $140 $100 40 280 140 186 (55) 700 420 529 (100) $700 $815 ($115) C-C G.P. (L) 0 (15) (100) ($115) Billings and cash collection data are the same as those in example A. Income Measurement And Profit Analysis 57 L-T Construction Contract with a Total Estimated Loss Example E Contract Price = $700 Estimated Construction Costs Estimated Cummulative Costs to Complete Total % of Year Incurred the Contract Cost Completion x1 $100 $400 $500 20% x2 $186 $429 $715 * 40% x3 $329 $615 100% * a total estimated loss of $15 incurred. Income Measurement And Profit Analysis 58 Example E (contd.) Year x1 x2 x3 Total P-O-C C-C Cummulative Current Current G.P. Revenue Revenue Expense (L) $140 $140 $100 40 280 140 186 (55) 700 420 329 100* $700 $615 $85 G.P. (L) 0 (15) 100* $85 * $15 total estimated loss was recognized in Year x2. The overall income of Year x3 is $ 85. In order to have an overall income of x3 equals to $ 85, we need to recognize $100 income in x3. ** Billings and cash collection data are the same as those of example A. Income Measurement And Profit Analysis 59 L-T Construction Contract with a Total Estimated Loss Example F Contract Price = $700 Estimated Construction Costs Estimated Cummulative Costs to Complete Total % of Year Incurred the Contract Cost Completion x1 $100 $700 800 * 13% x2 186 429 715 ** 40% x3 529 815 100% * an estimated loss of $100 incurred. ** an estimated loss of $15 incurred. *** an loss of $115 incurred. Income Measurement And Profit Analysis 60 Example F (contd.) P-O-C Year x1 x2 x3 Total C-C Cummulative Current Current G.P. G.P. Revenue Revenue Expense (L) (L) $91 $91 $100 ($100) ($100) 280 189 186 85 85 700 420 529 (100) (100) $700 $815 ($115) ($115) ** Billings and cash collection data are the same as those of example A. Income Measurement And Profit Analysis 61 The Application of the P-O-C Method in the Service Industry Many transactions in the service industry require the performance of several acts that extend over a period of time. An accounting method called "proportional performance method” can be used to account for the revenues and expenses for these transactions. Income Measurement And Profit Analysis 62 The Application of the P-O-C Method (contd.) Example: With fixed number of acts: Additional acts are not fixed: Estimation of additional acts is required to compute the proportion of revenue to be recognized (as in P-O-C method). Note: If the service requires a final act, a completed performance method will be applied to account for revenues and expenses. Income Measurement And Profit Analysis 63 The Application of the P-O-C Method (contd.) Aging product: Wine, lumber, etc. No value increase can be recognized as revenue, unless a. a contract to age a specific product for a specific customer has been signed; and b. no return of product even if the customer is not satisfied with the product; and c. if future cost can be estimated. Income Measurement And Profit Analysis 64 The Application of the P-O-C Method (contd.) If all three conditions are met, the P-O-C method may (referred to as an accretion method) be applied to account for revenues and expenses prior to the completion of the production. Income Measurement And Profit Analysis 65 IFRS Insights IFRS only allows the POC method. If future costs cannot be estimated, the recognized cost will be set to equal the revenue (therefore, zero profit). Similar to GAAP, IFRS also requires the recognition of the projected overall loss when loss is expected for the entire longterm construction contracts. Income Measurement And Profit Analysis 66 Revenue Recognition after Time of Sale (i.e., at time of cash collection) Accounting Methods: a. Installment Sales Method b. Cost Recovery Method Income Measurement And Profit Analysis 67 a. Installment Method 1 Postpone the recognition of revenue (or profit) until the period of cash collection. This is not consistent with accrual accounting concept. 1. Rarely used for financial reporting (except for special cases)2 but commonly used for tax filing purposes. 2. Special case: when receivables are collectible over an extended period of time and no reasonable basis for estimating the degree of collectibility (i.e., B/D expense Estimation) --> Source: APB 10, para. 12, footnote 8. Income Measurement And Profit Analysis 68 a. Installment Method (contd.) If uncollectible account is expected, bad debt expense should be estimated and recognized rather than postponing the recognition of revenue until cash is collected. Income Measurement And Profit Analysis 69 1 b. Cost Recovery Method Postpone the recognition of revenue until cost is recovered. 1. Not acceptable for tax filing purposes; rarely used for financially reporting except for special cases. Income Measurement And Profit Analysis 70 Installment Sales Method Example Assume the following information: Installment sales Cost of installment Gross profit 20x1 $1,200 900 $300 20x2 $2,000 1,700 $300 Rate of gross profit on sales 25% 15% Cash receipts 20x1 Sales 20x2 Sales $600 $600 $500 Income Measurement And Profit Analysis 71 Installment Sales Method Example (contd.) Note: the following entries are based on the procedures which only defer the gross profit. This procedure has the same effect as deferring both sales revenue and cost of goods sold. Income Measurement And Profit Analysis 72 Installment Sales Method Example (contd.) 20x1 1. Installment A/R 1,200 Installment Sales 1,200 2. Cash 600 I A/R 600 3. Cost of Install. Sales 900 Inventory 900 4. Installment Sales 1,200 Cost of Install. Sales 900 Deferred Gross Profit 300 20x2 2,000 2,000 1,100 1,100 1,700 1,700 2,000 1,700 300 (to close installment sales and cost of installment sales and to recognize entire profit as deferred profit) Income Measurement And Profit Analysis 73 Installment Sales Method Example (contd.) 20x1 5. Deferred Gross Profit Realized Gross Profit on Installment sales 150a 20x2 225b 150 225 a. 25% x $600 = $150. b. 25% x $600 + 15% x $500 = $225. Income Measurement And Profit Analysis 74 Additional Problems of Installment Sales Accounting The following three problems are related to accounting for installment sales: 1. Interest on installment contract; 2. Uncollectible accounts; 3. Defaults and repossessions. Income Measurement And Profit Analysis 75 1. Interest on Installment Contract Using the installment sales made in 20x1 and assuming a 3% interest charge per quarter, the quarterly installment payment from customers should be: ? 3.7171 = $1,200 P4]3% present value of an annuity ? = $1,200 3.7171 = $322.83 Income Measurement And Profit Analysis 76 1. Interest on Installment Contract (contd.) The following table summaries the interest earned, cash received, installment A/R, installment A/R balance and realized gross profit of each quarter: Income Measurement And Profit Analysis 77 1. Interest on Installment Contract (contd.) 5/1/x1 Q3, x1 Q4, x1 Q1, x2 Q2, x2 (1) (2) Cash Interest Earned (Debit) (Credit) ----$322.83 $36 322.83 27.40 322.83 18.53 322.83 9.40 (3) Install. A/R (Credit) --$286.83 295.43 304.30 313.43 (4) (5) Bal. Of Realized Install. Gross A/R Profit $1,200 --$913.17 $71.70 617.74 73.86 313.44 76.08 0 78.36 $300 (1) as computed on previous page. (4) previous balance (2) 3% x previous balance in (4). of (4) - (3). (3) (1) - (2). (5) 25% x (3). Income Measurement And Profit Analysis 78 2. Uncollectible Accounts If repossession cannot compensate for uncollectible balances, the potential loss should be charged against bad debt expense account as in the case of other credit sales. Income Measurement And Profit Analysis 79 3. Defaults and Repossessions Assuming merchandize of $800 of installment sales made in 20x2 was repossessed in 20x3. The fair value of the repossessed item is only $400. Therefore, a loss of $280 occurs. If a bad debt expense was charged in 20x2, the allowance for uncollectible account will be debited instead of the loss account. Income Measurement And Profit Analysis 80 3. Defaults and Repossessions (contd.) When repossession occurs in year 20x3, the following entry will be recorded: Repossessed Merchandize Deferred Gross Profit Loss on Repossession Installment A/R Income Measurement And Profit Analysis 400 120 280 800 81 Financial Statement Presentation of Installment Sales Transactions A. Installment sales constitute an insignificant part of total sales. B. Installment sales are a significant part of total sales. Income Measurement And Profit Analysis 82 A. Installment Sales Constitute an Insignificant Part of Total Sales In this case, the accountant only needs to include the realized gross profit of the installment sales in the income statement as a special item following the gross profit on other sales. Income Measurement And Profit Analysis 83 Income Statement For the Year Ended 12/31/x1 Sales Cost of Goods Sold Gross Profit on Sales Gross Profit realized on Installment Sales $500,000 (270,000) $230,000 Total Gross Profit on Sales $230,150 150 Income Measurement And Profit Analysis 84 B. Installment Sales Are a Significant Part of Total Sales If installment sales are a significant part of total sales, the following presentation may be used: Income Measurement And Profit Analysis 85 Income Statement For the Year Ended 12/31/x2a Install. Sales Other Sales Total Sales 150,000 200,000 350,000 Cost of goods sold (80,000) (150,000) (230,000) Gross profit 70,000 50,000 120,000 Less deferred gross profit on install. sales of this year (50,000) (50,000) Realized gross profit on this year’s sales 20,000 50,000 70,000 Add gross profit realized on prior years 15,000 15,000 Gross profit real. this year 35,000 50,000 85,000 Income Measurement And Profit Analysis a. All amounts are assumed. 86 Cost Recovery Method No gross profit is recognized until cash collected exceeding the cost. Thus, all gross profit is deferred until cash collected exceeding the cost. Income Measurement And Profit Analysis 87 Example Cost Recovery Method Assuming in Jan. 20x1, Gateway Corp. sells merchandize costing $10,000 to Mendy Corp. for $15,000 with payments receivable of $9,000, $3,000 and $3,000 in 20x1, 20x2, and 20x3, respectively. The following entries will be recorded following the cost recovery method: Income Measurement And Profit Analysis 88 Example (contd.) 20x1 A/R Cost Recovery Method 15,000 Sales 15,000 CGS 10,000 Inventory 10,000 Cash 9,000 A/R 9,000 Sales 15,000 CGS 10,000 Deferred Gross Profit 5,000 Income Measurement And Profit Analysis 89 Example (contd.) Cost Recovery Method (To close sales and CGS and to record deferred gross profit under the cost recovery method) 20x2 Cash 3,000 A/R 3,000 Deferred Gross Profit 2,000 Gross Profit 2,000 20x3 Cash 3,000 A/R 3,000 Deferred Gross Profit 3,000 Gross Profit 3,000 Income Measurement And Profit Analysis 90 Gift Card Sale Revenue Recognition Revenue should be recognized when service is provided to the gift-card holder. When to recognize the expired unused balance on the gift-card? Income Measurement And Profit Analysis 91 States Do Not Require to Turn Over the Abandoned and Unclaimed Property For states recognize expiration date: Can recognize the revenue upon the expiration date. For states do not recognize expiration date: In order to recognize the unused expired balance as revenue, the company needs to prove that the expired unused balance is unlikely to be redeemed after certain periods statistically. Income Measurement And Profit Analysis 92 States Require to Turn Over the Abandoned and Unclaimed Property The expired unused balance of gift-card may need to be remitted to the state after five- year period. Income Measurement And Profit Analysis 93 Franchise Sales Many retail outlets (I.e., fast food, restaurants,etc.) are operated as franchises. A franchise agreement: the franchisor (I.e., McDonald's Corporation) grants the franchisee (I.e., an individual) the right to sell the franchisor's product and use its name for a specific period of time. The fees paid by the franchisee include: 1) the initial franchise fee and 2) continuing franchise fees. Income Measurement And Profit Analysis 94 Franchise Sales (contd.) The initial franchise fee is to cover: 1)the right to use its name and sell its products; 2)assistance in finding a location and constructing the facilities, 3) training employees. The initial franchise fee is usually a fixed amount but payable in installments. Income Measurement And Profit Analysis 95 Franchise Sales (contd.) The continuing franchise fees are paid for continuing rights and for advertising and promotion provided by the franchisor. These fees can be a fixed monthly or annual amount or a % of the sales. Income Measurement And Profit Analysis 96 Franchise Sales (contd.) Recognition of Franchise Fees: For the initial franchise fee: (based on SFAS 45) can only be recognized as revenue after substantial amount of the initial services (required by the franchise agreement) have been performed . For the continuing franchise fees: these fees are recognized by the franchisor as revenue in the periods they are received. Income Measurement And Profit Analysis 97 Franchise Sales –Example On 3/31/x2, the Applebee Corporation entered into a franchise agreement with Mary Armstrong in exchange for an initial franchise fee of $100,000. The initial services provided by Applebee include the selection of a location, construction of the building, training of employees and consulting services over several year. Income Measurement And Profit Analysis 98 Franchise Sales –Example (Contd.) $30,000 is payable on 3/31/x2, with the remaining balance payable in annual installments over a 3-year periods with a 7% annual interest rate. The franchisee will also pay continuing franchise fees of $2,000 per month for advertising and promotion provided by Applebee, beginning immediately after the franchise begins operations. Mary Armstrong opens her Applebee Restaurant on 9/6/x2. Income Measurement And Profit Analysis 99 Franchise Sales –Example (Contd.) Assume that the initial services to be performed by Applebee subsequent to the contract signing are substantial and the collectibility of the fee is reasonable certain the following entry is recorded: 3/31/x2: Cash 30,000 Note Receivable 70,000 Unearned franchise fee revenue 100,000 to record franchise agreement and down payment Income Measurement And Profit Analysis 100 Franchise Sales –Example (Contd.) Assume that substantial performance have occurred when the franchise began operation on 9/6/x2, the following entry would be recorded: 9/6/x2 Unearned franchise fee revenue 100,000 Franchise fee revenue 100,000 To recognize franchise fee revenue Income Measurement And Profit Analysis 101 Franchise Sales –Example (Contd.) Note:If collectibility of the initial fee is uncertain and there is no basis for estimating the uncollectible amounts, the initial entry(on 3/31/02) should be: Cash 30,000 Note Receivable 70,000 Deferred franchise fee revenue 100,000 The deferred franchise fee revenue is recognized as revenue using either the installment sales or cost recovery methods. Income Measurement And Profit Analysis 102 Franchise Sales –Example (Contd.) Revenue Recognition for Continuing Franchise Fees: Continuing franchise fee is recognized on a monthly basis as follows: Cash 2,000 Service revenue 2,000 Income Measurement And Profit Analysis 103 Multiple-Element Arrangements (ASC605-25-25-5) When one price is paid for multiple elements (i.e., software, upgrade, maintenance, etc.), this transaction is referred to as a multiple-element arrangement. These elements are considered separate deliverables (or separate units of accounting) if both of the following conditions are met: Income Measurement And Profit Analysis 104 Multiple-Element Arrangements (contd.) 1. the delivered item or items have value to the customer on a standalone basis and 2. If the arrangement includes a general right of return relative to the delivered item, delivery or performance of the undelivered item or items is considered probable and substantially in the control of the vendor. When both conditions are met, the elements are considered separate deliverables. Income Measurement And Profit Analysis 105 Multiple-Element Arrangements (contd.) The consideration/fee of the arrangement will be allocated to all deliverables/elements based on the relative fair value of these elements. The revenue of each element will be recognized upon the completion of each element. Fair value (ASU2009-13): Vendor’s sales price, or Third-party evidence of sales price, or Income Measurement And Profit Analysis Vendor’s estimates . 106 Multiple-Element Arrangements (contd.) If the conditions are not met, the delivered item(s) should be combined with other undelivered item(s) within the arrangement as one unit of accounting. The revenue of the arrangement will be deferred until all elements are delivered. Income Measurement And Profit Analysis 107 Consignment A manufacturer or a wholesaler may transfer goods to a dealer but the title of the goods remains with the manufacturer or the wholesaler. Party Manufacturer Dealer Account Used Consignment-out Consignment-in Purpose of To record the To record any sale account transfer of the of consignment goods (Debit) and goods (Credit) and transportation to record expenses cost (Debit) occurred for the consignment (Debit) Income Measurement And Profit Analysis 108 Example Consignment On 2/8/98, 300 units of goods were shipped to a dealer on a consignment basis. The total cost of goods is $ 1,800 ($6 each). The transportation cost $150 was paid by the consignor on 2/8. The consignee spent $100 on advertisement on 2/9/98. On 4/4, all the consignment units were sold for $10 each and the proceeds subtracted advertising expense ($100) and commission charge ($100), have been forwarded to the consignor on 4/20/98. Income Measurement And Profit Analysis 109 Example (contd.) Consignment Consignor (manufacturer) Consignee (Dealer) 2/8 Consignment No Entry out 1800 Inventory 1800 2/8 Consignment No Entry out 150 Cash 150 2/9 No Entry 2/9 (Adv.) Consignment-In 100 Cash 100 2/9 No Entry 4/4 Sale of 300 Units at $10 Cash 3000 ConsignmentIn 3000 Income Measurement And Profit Analysis 110 Example (contd.) Consignment Consignor (manufacturer) Consignee (Dealer) 4/20 receiving $2800 from dealer (deduct $100 commission and $100 Advertisement) 1. Cash 2800 Commission Exp. 100 Adv. Exp. 100 Sales Rev. 3000 2. CGS 1950 Consignment-out 1950 4/20 Consignment- In 2900 Cash 2800 Commission Earned 100 *If consignment-out has a debit balance, it is a current asset account to the consignor. * If the consignment-In has a debit balance, it would be a current asset account for the consignee. If the consignment-In has a credit balance, it would be a current liability account to the consignee. Income Measurement And Profit Analysis 111