Chapter 6, Receivables and Revenue Recognition

advertisement

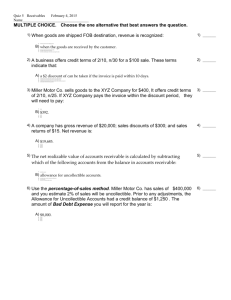

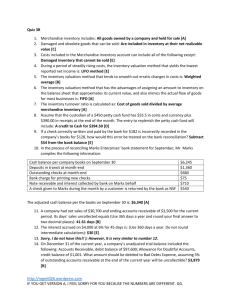

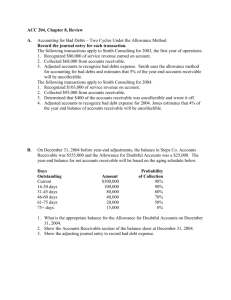

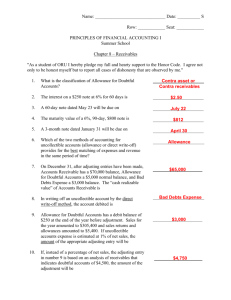

Chapter 6 -- Receivables and Revenue Recognition FINANCIAL ACCOUNTING AN INTRODUCTION TO CONCEPTS, METHODS, AND USES 12th Edition Clyde P. Stickney and Roman L. Weil Learning Objectives 1. Develop an introductory understanding of the quality of earnings as a concept of evaluating generally accepted accounting principles discussed in Chapters 6 to 12. 2. Understand why the allowance method for uncollectible accounts matches bad debts with revenues better than the direct write-off method. 3. Apply the allowance method for uncollectible accounts. 4. Analyze information on accounts receivable to evaluate a firm’s management of its credit operation. Learning Objectives 5. Develop a sensitivity to issues in recognizing and measuring revenues and expenses for various types of businesses. 6. Cement an understanding of the concept that net income over sufficiently long periods equals cash inflows minus cash outflows other than transactions with owners (a measurement issue), regardless of when firms recognize the revenues and expenses (a timing issue). Chapter Outline 1. Financial Reporting Environment 2. Quality of Earnings 3. Review of revenue recognition principles 4. Application of income recognition principles 5. Revenue recognition at time of sale 6. Analyzing information on accounts receivable Chapter Outline 7. Income recognition at times different from sale 8. Summary illustration of income recognition methods 9. Format and classification with the Income Statement 10. An International Perspective Chapter Summary Appendix 6.1 – Effects on the Statement of Cash Flows of Transactions Involving Accounts Receivable Quality of Earnings Refers to the ability managers have to use discretion in measuring and reporting earnings This discretion may involve: – Choosing among alternative accounting principles – Making estimates – Timing transactions in order to control recognition High quality earnings are presumed to be fair representations of the economic performance of the firm Low quality earnings overstate fair earnings Income Recognition Principle Revenue is recognized (recorded) when both: – The firm has performed all, or a substantial portion of, the services; that is, the revenue has been earned, and – The firm has received cash, a receivable or some asset capable of reasonable measurement; that is, the revenue is measurable. Income Recognition Principle Expenses are matched to the revenues that they generate – Since the firm only expends assets (causing expenses) in anticipation of revenue, fair measurement of net income calls for matching those expenses against revenue. – Expenses are recognized in the period in which the revenue is recognized. Figure 6.1: Operating Process for a Manufacturing Firm When has the firm earned revenue? When is the expense incurred? Revenue Recognition Rules Different recognition rules may be appropriate for different situations 1. At time of sale 2. Percentage of completion 3. Completed contract 4. Installment sales 5. Cost recovery first Revenue Recognition Rules Different industries or situations 1. Long-term contractors 2. Forestry products 3. Insurance 4. Franchisors Discuss Earning Revenue At Time of Sale Merchandising firms earn revenue when the sale is made. Revenue is then recognized at the time of the sale. And expenses that contributed to that revenue are recognized at the same time. This method is the general rule for sales of goods. It has the advantage of being easily verified. At Time of Sale (Cont.) A more technical version of this rule recognizes revenue when the title to the goods passes from seller to buyer. This may occur when the goods are moved from the seller’s loading dock to a shipper. Management has incentives to recognize revenues as early as the account will allow. Explain Recognition for Percentage of Completion Long-term construction companies may earn revenue as they go For example, a contract to pave a road is earned as the final payment is laid Expenses can be matched against this revenue and recognized in proportion The difficulty lies in measuring the percentage of completing – Engineering estimates, or – Percentage of the budgeted costs incurred Explain Recognition for Completed Contract If the percentage of completion cannot reasonably be estimated, then recognition of revenues should be delayed until the contract is completed and accepted by the customer. An example would be a contract to develop a computer program; it either works satisfactorily or it doesn’t; there is little meaning to a percentage of completion. In these cases, revenue is recognized upon completion of the contract. Completed Contract (Cont.) And expenses are matched; that is, they are recognized upon completion also. So where are cash (and other asset) outflows that are made before completion? – Such outflows are capitalized; that is, they are debited to an asset – This asset is credited (removing it) and an expense is debited upon completion Revenue Recognition for Installment Sales Recognized revenue as the seller collects cash from periodic payments. A common example is a rent-to-own store in which the customer takes possession of an asset and pays periodic payments like rent. The customer may return the asset and stop payments at any time. After a set number of payments is ownership of the asset is given. Some rent-to-own stores have been criticized because the implicit rate of interest in many such contracts is so high. Installment Sales (Cont.) In these cases, revenue may be recognized on a cash basis, as the cash is received. Matching of expenses calls for recognition of a proportional amount of the total cost of the asset. Review Revenue Recognition for Cost Recovery First A more conservative form of installment sales method has the same revenue recognition rule. But recognized expenses equal to revenue (and so zero income). Until the entire cost of the asset is covered. Income appears to be zero until the cost is recovered and then is equal to revenue until the payments are completed. Cost Recovery First (Cont.) This method front-end loads expenses but results in a greatly delayed recognition of income. This method is justified in sales where the probability of default by the customer is very high. Since income in these cases is very uncertain, no income is recognized until the cost is recovered. Different Industries -- What is the appropriate revenue recognition rule? 1. Long term contractors – Projects take several years to complete and cash inflows and outflows may be made during the project. 2. Forestry products – Similar to a long term contract, forests take many years to mature but cash inflow is typically at the sale. Different Industries -- What is the Appropriate Revenue Recognition Rule? 3. Insurance – What is a prepaid asset to the insured is a deposit paid in advance of services to the insurance company. Revenue is earned when the service is provided. 4. Franchisors– A franchisor sells rights to a franchisee who pays for them. These payments may be deferred until the franchisee earns revenue. How does uncollectible accounts affect revenue recognition? For credit sales, revenue is recognized (credited) at the time of the sale even thought the customer has not paid cash. Instead, an account receivable is established (debited). An account receivable is an asset that represents a promise to pay. Not all customers are able or willing to fulfill their promise. When a customer defaults, the account becomes valueless and must be credited and removed. Uncollectible Accounts (Cont.) The offsetting debit could be considered a reversal of revenue: – Most consider this a necessary and unpleasant expense of doing business. – In these cases, an expense could be debited and the revenue would remain. The timing of the recognition of this expense depends on the accounting method. Uncollectible Accounts (Cont.) An uncollectible account is written-off (the asset is removed) and an expense is recognized When the expense is recognized depends on the method of accounting for uncollectible accounts There are two basic methods for accounting for uncollectible accounts: a. Direct write-off The expense is recognized when the account is written-off This method is required for most tax purposes Uncollectible Accounts (Cont.) b. Allowance method The expense is matched to the revenue by recognizing an estimate of the expense in the same period as the credit sale Two variants: 1. Credit sales basis 2. Net receivables or aging of A.R. basis Explain Direct Write-Off Recognizes losses from uncollectible accounts in the period in which the account is determined to be uncollectible: Bad debt expense 134,000 Accounts receivable To record losses from know uncollectible accounts 134,000 Explain Direct Write-Off (cont.) Shortcomings: Fails to match bad debt expense with revenue, the revenue is recognized at the time of the sale but the expense is delayed until the account is determined to be uncollectible. Provides an opportunity to manipulate earnings each period by strategically writing-off accounts. The amount of accounts receivable is not the best estimate of the expected cash inflow; that is, if the firm and one million dollars in accounts receivable but a high default rate, the expected cash inflow may be much less than one million dollars. Discuss the Allowance Method GAAP requires that bad debts expense be matched against the revenue to which it gives rise. When revenue is recognized, a bad debts expense is also recognized as an estimate of the amount of revenue which may eventually prove uncollectible. The offset to this expense is called the allowance for uncollectible accounts: Bad debt expense 134,000 Allowance for uncollectible accounts To record losses from estimated uncollectible accounts 134,000 The allowance is a contra asset with a credit balance. And when it is subtracted from accounts receivable, the difference (net accounts receivable) represents an estimate of the cash value of accounts receivable. Credit Sales Basis 1. Begin with credit sales for the period. 2. Estimate the amount of uncollectible sales, – Typically as a percentage of sales. – This percentage may be based on experience coupled with current economic conditions. 3. Debit an expense (sometimes called loss or provision for bad debts) for this amount. Credit Sales Basis 4. Credit the allowance account for the same amount 5. When specific accounts are determined to be uncollectible: – Credit the specific account receivable removing it, – Debit the allowance for uncollectible accounts reducing it. Net Receivables & Aging of A.R. Basis 1. Estimate the net amount of receivables expected. 2. Take this amount as the ending balance in the allowance for uncollectible accounts. 3. Credit the allowance account for the amount needed to bring the current balance up to the amount that was estimated in step 1. Net Receivables & Aging of A.R. Basis (Cont.) 4. Offset this credit with a debit to bad debt expense for the same amount. 5. When specific accounts are determined to be uncollectible: – Credit the specific account receivable removing it, – Debit the allowance for uncollectible accounts reducing it. Aging of Accounts Receivable How do you estimate the net amount of receivables? One method is to analyze the accounts receivable and apply the assumption that overdue accounts are more likely to eventually prove uncollectible and the more overdue the account, the more likely it will prove uncollectible. Aging of Accounts Receivable (cont.) An aging schedule separates the accounts receivable into layers. – The base layer is comprised of all the accounts that are current or not overdue – Layers are added at intervals of perhaps 30 days separating accounts according to their age – Different percentages are applied to each layer with higher percentages being assigned to the older accounts Aging of Accounts Receivable (cont.) The sum of the product of the balance in a layer with its associated percentage gives an estimate of the net amount of uncollectible receivables. An Illustration of the Allowance Account Joe, a customer charges $5 of merchandise in year 1. In year 1, we do not know whether a specific account may eventually prove uncollectible, so we recognize revenue for the amount of the credit sale to Joe. At the end of year 1, we have to estimate the bad debt expense associated with that year’s sales. We may use either the percentage of sales method or the net receivables method. Consider this amount to be estimated to be $100. An Illustration of the Allowance Account (cont.) In year 2, we determine that the customer’s $5 receivable is uncollectible. We write this account off but do not recognize an expense here. The expense was anticipated by the journal entry at the end of year 1. Instead, we reduce the allowance account. An Illustration of the Allowance Account year 1 year 1 year 2 account receivable -- Joe sales revenue bad debts expense allowance for uncollectible accounts allowance for uncollectible accounts accounts receivable -- Joe 5 5 100 100 5 5 An Illustration of the Allowance Account A.R. -- Joe 5 sales revenue 5 bad debts exp. allow for u.a. 100 5 100 5 An International Perspective The International Accounting Standards Committee (IASC) says that the firm should recognize revenue when: 1. The seller has transferred significant risks and rewards of ownership to the buyer 2. Managerial involvement and control has passed from seller to the buyer 3. The seller can reliably measure the amount of revenue 4. It is probable that the seller will receive economic benefit 5. The seller can reliably measure the costs (including future costs) of the transactions An International Perspective (cont.) In addition, the IASC recommends – The allowance method for uncollectibles – The percentage of completing method for services – The matching principle for timing of expense recognition Chapter Summary This chapter has presented concepts of measurement of receivables and revenue. Quality of earnings was defined as choosing those measurement methods that fairly present the economic performance of the firm. The income recognition principle was presented along with some income recognition rules. Uncollectible accounts were presented including: allowance and direct-write-off methods of matching bad debt expense and aging of accounts receivable. Chapter Summary (Cont.) The accrual basis of accounting provides measures of operating performance that are superior to those provided by cash flow basis: recognizing revenues when earned and measurable rather than when cash is received, matching expenses to revenues without regard for when the timing of the cash outflow. Appendix 6.1 – Effects on the Statement of Cash Flows of Transactions Involving Accounts Receivable Transactions changing accounts receivable are operating activities. Under indirect method, to compute cash flow from operations: – Increase in accounts receivable is subtracted from net income. – Decrease in accounts receivable is added to net income. Appendix 6.1 (Cont.) Most firms report changes in accounts receivable net of allowance for uncollectible accounts as a single line in Operating Activities…. With no further adjustments in that section for uncollectible accounts to derive cash flow from operations. Firms with significant uncollectibles may disclose separately. If they report gross changes in accounts receivable in the Operating Activities section, they must addback to net income for bad debt expense.