Addendum 1 - UNM Hospitals

advertisement

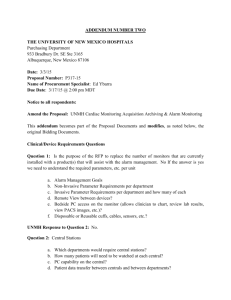

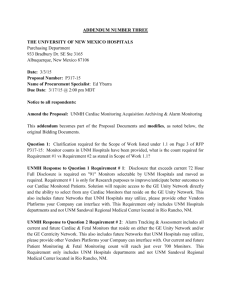

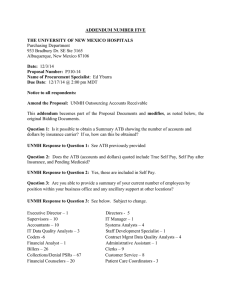

ADDENDUM NUMBER ONE THE UNIVERSITY OF NEW MEXICO HOSPITALS Purchasing Department 933 Bradbury Dr. SE Ste 3165 Albuquerque, New Mexico 87106 Date: 2/25/15 Proposal Number: P315-15 Name of Procurement Specialist: Ed Ybarra Due Date: 3/10/15 @ 2:00 pm MDT Notice to all respondents: Amend the Proposal: Employee Life and long-Term Disability Plan This addendum becomes part of the Proposal Documents and modifies, as noted below, the original Bidding Documents. Question 1: The questionnaire requests a one-time open enrollment up to the guaranteed issue limit for the voluntary life plans. When were the last open enrollments offered for each group? UNMH Response to Question 1: Open enrollment was last held at plan inception for each group. Question 2: The RFP requests that proposals include beneficiary management services. How are beneficiary records maintained today, and how would they transfer to a new insurance carrier (e.g. paper or electronic file) UNMH Response to Question 2: Presently these services are being handled in-house by each group. Method of the transfer of the information to the selected carrier will be determined during the implementation process. Question 3: The questionnaire states UNM Hospitals self-administers and self-reports premium, but there are several questions asking about enrollment via a carrier website. Will the life insurance plans be self-administered by the hospital groups, or will the insurance carrier be responsible for maintaining individual employee records and for generating monthly invoices? UNMH Response to Question 3: As noted in the RFP, UNMH is interested in moving to an on-line enrollment system, particularly for the voluntary life coverage’s with reporting back to UNMH for integration into their payroll system for premium deductions. Ideally this system would also include electronic EOI submission and approval notice. All plans will continue to be self-administered. Question 4: SRMC Specific: Do all 398 employees on the census file receive Basic Life/AD&D coverage? The Reliance Standard Premium History Report received with the RFP lists 166 basic life insured’s as of 09/01/2014. The number of supplemental life insured’s on the report is also less than half of the number of supplemental life insured’s on the census. Please clarify the discrepancy and provide an updated premium report that outlines current volumes and premiums if applicable. Response to Question 4: SRMC – Yes, all employees on the census receive Basic Life/AD&D. SRMC had an issue with their file for self-reporting. That has since been corrected and they are now reporting the correct enrollment. Question 5: UNMMG Specific: Please provide each employee’s gender on the census file. UNMH Response to Question 5: Census data for UNMMG has been updated and will be provided by our consultant. Question 6: UNMMG Specific: Please provide the current Life and AD&D premium rates. We understand experience data specific to the medical group is not available, but the current premium rates will be still be helpful in creating our proposal? UNM Response to Question 6: The current premium rates are not relevant to this RFP as UNMMG represents less than 10% of the enrollment in the larger UNM plan that they currently participate under. Question 7: If all three groups select the same carrier, will they be under one policy or will they require separate policies? If the expectation is separate policies, would they consider combining into a single policy if each is still rated separately? UNMH Response to Question 7: Each group may contract separately. Question 8: Has the group held any open enrollments in the last 3 years where no evidence of insurability was required by the current carriers? UNMH Response to Question 8: Open enrollment was last held at plan inception for each group. Question 9: I also want to note that some of the services available to a group the size of UNMH may not be available to a group the size of SRMC or UNMMG. We will respond to the questionnaire providing answers and responses with the largest entity in mind outlining our capabilities for a group of that size. Should only the smaller entities select us it should be noted that some of the questionnaire responses may not apply? This will be noted in our response but I want to be completely transparent during the RFP process? UNMH Response to Question 9: Duly noted and understood. Question 10: When will the answers to our questions be posted? UNMH Response to Question 10: As soon as possible. Question 11: Will you please offer a deadline extension? UNMH Response to Question 11: Yes, the new due date and time is 3/10/15. Question 12: Please resend the UNMMG census including genders. UNMH Response to Question 12: Census data for UNMMG has been updated and will be provided by our consultant. Question 13: Send the list of ported individuals that will NOT be allowed to port coverage, should the groups terminate their plan. Need the following information Coverage amounts Gender DOB Length of time remaining for coverage to be ported (limit is two years). UNMH Response to Question 13: Hartford has confirmed that for the UNMH population, individuals with ported coverage will remain with Hartford. SRMC – N/A Question 14: Exhibit J – question 29. This question reads “Desired performance criteria can be found in RFP Section # TBD. Can you please confirm if this criteria was included and if so, where it can be located? UNMH Response to Question 14: Please provide your standard Performance Guarantee Matrix Question 15: Disability Questions – Appendix 1. UNMH census. Please provide current census with dates of hire through 12/31/2014. UNMH Response to Question 15: Unable to provide this information at this time. This information may be provided and discussed with the selected vendor. Question 16: Disability Questions – Appendix 2: UNMH: Please provide updated premium file through 12/31/2014. UNMH Response to Question 16: Unable to provide this information at this time. This information may be provided and discussed with the selected vendor. Question 17: Disability Questions – Appendix 2: UNMH: Please provide paid amounts on open claims as of 12/31/2014. UNMH Response to Question 17: Unable to provide this information at this time. This information may be provided and discussed with the selected vendor. Question 18: Disability Questions – Appendix 2: UNMH: Please provide closed claims data (dates of disability and amounts paid) through 12/31/2014. UNMH Response to Question 18: Unable to provide this information at this time. This information may be provided and discussed with the selected vendor. Question 19: Disability Questions – Appendix 2: UNMH: Please provide an updated LTD experience (PDI) exhibit as of 12/31/2014 UNMH Response to Question 19: Unable to provide this information at this time. This information may be provided and discussed with the selected vendor. Question 20: Disability Questions – Appendix 2: UNMMG: Please provide LTD experience (as least open & closed claims for last 3 years through 12/31/2014). UNMH Response to Question 20: As noted in multiple locations within the RFP, experience information for UNMMG is not available. They are currently covered under the University of New Mexico (UNM) LTD coverage and experience is not available for UNMMG alone. Question 21: Disability Questions – Appendix 2: UNMMG: Please provide STD experience (paid premium & claims) for last 3 years. At 450 lives, this group is 100% credible for STD and therefore receiving claim experience data is critical. UNMH Response to Question 21: The STD coverage provided to UNMMG is offered through the Hospital Employee Benefit Association Trust and experience specific to UNMMG is not available. Question 22: UNMMG – The current Optional Life maximum is $1,850,000. The highest benefit on the census is listed at $660,000. Would it be possible to reduce the maximum benefit allowed on this plan to $700,000 - ensuring nobody loses coverage? The maximum benefit is very high for a group with under 400 employees. I will try to have underwriting provide two options: (1) a maximum if UNMMG purchases coverage on a stand-alone basis and (2) a maximum if UNMMG, UNMH and SRMC all purchase coverage through Sun Life Financial. It may not be possible to offer a maximum that high on a stand-alone basis. UNMH Response to Question 22: UNMMG currently offers Optional/Voluntary Life through the University of New Mexico (UNM). You may offer coverage with a lower maximum benefit but must agree to grandfather existing coverage amounts. Question 23: UNMMG – Please provide an updated census that includes genders. UNMH Response to Question 23: Census data for UNMMG has been updated and will be provided by our consultant. Question 24: SRMC – Do you have a specific STD plan that you would like us to quote? UNMH Response to Question 24: SRMC – 14/14 elimination, 13 weeks to tie into the 90 day elim on LTD. 50% to $2,500 or $3,000. Voluntary Question 25: UNMH – Can you confirm which employees are in the Executive class for the Life and LTD? We believe it's the employees highlighted in yellow but want to be sure. UNMH Response to Question 25: The executives are noted in yellow highlight on the census file. Question 26: Life / AD&D / Optional Life – Can you provide the following: Are there any plan changes that have occurred (that are not already provided)? If so, please outline those changes. UNMH Response to Question 26: All benefit information represents the current plan designs. There have not been any benefit modifications. Question 27: Long Term Disability - Can you provide the following: Are there any plan changes that have occurred (that are not already provided)? If so, please outline those changes UNMH Response to Question 27: All benefit information represents the current plan designs. There have not been any benefit changes Question 28: Long Term Disability Can you provide the following: Copy of the current Executive LTD contract. UNMH Response to Question 28: This information is included in Appendix 6C. Question 29: The census provided as "Appendix 1C UNMMG Census" does not provide the information to properly rate this unit. Please provide an updated census in the same format as those provided for UNMH and SRMC as Appendix 1A and Appendix 1B. UNMH Response to Question 29: The original census does provide all of the required information. We have however, put this information into a more user-friendly format. Please see revised Appendix 1C. Question 30: Please confirm how we are to identify Class 1, Executives on the census provided (Exhibit 1A). There are a small number of employees shaded in yellow at the top of the census that look to identify this class, but a confirmation would be appreciated UNMH Response to Question 30: The executives are noted in yellow highlight on the census file. Question 31: Please provide the carrier policy documents for Voluntary Life Insurance. It is included in the document provided for UNMMG, but not for UNMH and SRMC. UNMH Response to Question 31: UNMH Voluntary Life benefits are detailed in Appendix 6A. UNMMG Voluntary Life benefits are detailed in Appendix 7A. SRMC Voluntary Life benefits are detailed in Appendices 8A and 8B. Question 32: Is there consideration being given to extending the availability of Voluntary AD&D to UNMH and SRMC? Should proposals be prepared for that possibility? UNMH Response to Question 32: UNMH is not interested in offering Voluntary AD&D coverage at this time. SRMC – Yes, please include a quote for Voluntary AD&D. Question 33: UNMMG – Please request and provide 36 months of experience information from Assurant for UNM Medical Group, Inc. Policy Number 7500, Participation Number 6999214 for the Short Term Disability benefits. The policy format and the number of covered lives indicate that they have the ability to track and provide experience at UNMMG's unique performance level. This information is material to providing the most advantageous rate, premium level, and guarantee period. UNMH Response to Question 33: The STD coverage provided to UNMMG is offered through the Hospital Employee Benefit Association Trust and experience specific to UNMMG is not available Question 34: UNMMG – Would UNMMG consider a self-funded Short Term Disability administration option? UNMH Response to Question 34: UNMMG is only interested in fully insured coverage. Question 35: Please provide details of any "Value Added" benefits that each carrier may be offering. Examples might include, identity Theft benefits, Travel Protection Benefits, an Employee Assistance Plan, FMLA outsourcing, etc. UNMH Response to Question 35: Unable to provide this information at this time. This information may be provided and discussed with the selected vendor. Question 36: Please confirm why this is out to bid – are there any specific service, plan design or financial issues you are trying to address? UNMH Response to Question 36: This RFP has been released due to standard procurement requirements. There are not current issues. Question 37: Are any of the plans receiving a rate adjustment from the incumbent carrier? Will renewal information be shared? UNMH Response to Question 37: Incumbent carriers should also be responding to this RFP. Question 38: LTD - Please provide detailed open and closed claims listing for the SRMC group from Reliance Standard from inception, 10/2011. UNMH Response to Question 38: SRMC – There have not been any LTD claims since inception. Question 39: Life - Please provide copies of the following in-force two plan booklets: UNMH – Class 1 and UNMMG. UNMH Response to Question 39: UNMH Class 1 (Executives) plan information can be found in Appendix 6C. UNMMG Life coverage information is provided in Appendix 7A. Question 40: Life - RFP states that SRMC has 398 benefit eligible employees, but the 9/2014 Hartford billing info only has 166 covered lives. Please explain this discrepancy. UNMH Response to Question 40: SRMC – Yes, all employees on the census receive Basic Life/AD&D. SRMC had an issue with their file for self-reporting. That has since been corrected and they are now reporting the correct enrollment. Question 41: UNMMG – Life - Can you confirm that an EE has to participate in the Basic plan in order to be eligible to elect Supp Life Coverage? UNMH Response to Question 41: For UNMMG, both basic and supplemental life coverage’s are voluntary and may be elected independently by the employee. Question 42: If all groups are awarded to one carrier, can you confirm if all 3 groups will be on one policy? UNMH Response to Question 42: Separate contracts may be issued to each group. Question 43: If separate policies, can you confirm that all groups will renew together and that at no point will groups leave independently? UNMH Response to Question 43: Each group may negotiate this separately. Groups may be free to change carriers at any time independent of each other. Question 44: Could you please clarify your expectation for Exhibit A Veterans Preference Certificate and Exhibit C. UNMH Response to Question 44: Reference SECTION IV. ADDITIONAL INSTRUCTIONS TO CONTRACTORS – 4.1. VETERANS PREFERENCE and 4.3 SMALL AND DISADVANTAGED BUSINESS CERTIFICATION FORM for the expectations. If they don’t apply, write NA on them. Question 45: Could you please clarify the 60 page limit? It is our understanding that this limit would include all of our responses to Sections II and III, exclusive of exhibits. Would our response to the Terms and Conditions Section fall outside of the 60 page limit or would we need to count that has part of our 60 pages? UNMH Response to Question 45: Your response to the terms and conditions section fall outside of the 60 page limit. Question 46: Could you please confirm that Exhibit F Agreement, to include Attachments A and B do not need to be reviewed by our Legal team as part of this RFP process? UNMH Response to Question 46: Reference SECTION IV. ADDITIONAL INSTRUCTIONS TO CONTRACTORS – 4.6. SAMPLE AGREEMENT for expanded information. Question 47: Could you please confirm that Exhibit G UHIT Security Plan does not need to be reviewed as part of this RFP process? UNMH Response to Question 47: Reference SECTION IV. ADDITIONAL INSTRUCTIONS TO CONTRACTORS – 4.7. INFORMATION SECURITY PLAN for expanded information. Question 48: Regarding the individual plans for UNMH, SRMC, and UNMMG; are we quoting current plan designs for each division and as a collective to match UNMH’s plan? As a result, we are providing a total of 4 proposals? UNMH Response to Question 48: Each group may be quoted with their own unique plan designs. Question 49: Some of the documents cannot be accessed: 7A-7C. Can we get them in a different format? UNMH Response to Question 49: These are in standard pdf formats. You might check to be sure you’re running the latest version of Adobe. We do not have them in any other format but have re-saved the documents in pdf format and are labeled as 7A1, 7B1 and 7C1 respectively. Question 50: For SRMC and UNMMG, Life/AD&D plans: Participation percentage 5 year rate history including current and renewal 1-5 years of monthly paid premium, claims, lives, volume by coverage by actives/retirees Individual detail death claim listing: gender, DOB/age, date of death, date of disability, coverage amount 1-5 year Waiver of Premium Listing, gender, DOB/age, date of disability, face amount UNMH Response to Question 50: As noted earlier, specific information is not available on the UNMMG plans. SRMC – all available information has been provided. Question 51: For SRMC and UNMMG, LTD plans: Participation percentage 5 year rate history including current and renewal 1-5 years of monthly paid premium, claims, lives, volume Open paid claims: paid to date, net monthly benefit, diagnosis, offsets, prognosis. Closed paid claims: (minimum requirement) date of disability, claim term data, paid to date amount, valuation date Closed paid claims: ( opt requirement) net monthly benefit, gross monthly benefit, DOB/age, offsets, diagnosis, interest rate assumption UNMH Response to Question 51: As noted earlier, specific information is not available on the UNMMG plans. SRMC – There have been no LTD claims since inception. Question 52: Are we quoting STD? SRMC indicates “please quote an STD plan that takes their accrued PTO into account”; however, the rate grid shows UNMMG only for STD. UNMH Response to Question 52: STD should be quoted for UNMMG. UNMH is not interested in STD coverage at this time. SRMC – 14/14 elimination, 13 weeks to tie into the 90 day elim on LTD. 50% to $2,500 or $3,000. Voluntary Question 53: UNMH Specific: Please provide a copy of the current AD&D policy or certificate so that our proposal can match current plan provisions as closely as possible UNMH Response to Question 53: The AD&D benefit information can be found starting on page 55 of Appendix 6A. We have also obtained an updated copy of the Certificate and it is provided as Appendix 6A1. Question 54: UNMH Specific: Please provide a detailed listing of all death claims incurred between January 2010 and December 2014. UNMH Response to Question 54: Unable to provide this information at this time. This information may be provided and discussed with the selected vendor. Question 55: UNMH Specific: Is paid premium information available from September 2014 through December 2014? UNMH Response to Question 55: Unable to provide this information at this time. This information may be provided and discussed with the selected vendor. Question 56: UNMH Specific: Does the supplemental life experience include dependent premium and claims figures? If so, can the figures be separated by employee, spouse, and child? UNMH Response to Question 56: Unable to provide this information at this time. This information may be provided and discussed with the selected vendor. Question 57: UNMH Specific: Can each employee’s tobacco status be added to the census file? UNMH Response to Question 57: Unable to provide this information at this time. This information may be provided and discussed with the selected vendor. Question 58: Please send updated life and LTD experience for all accounts through 1/1/15. UNMH Response to Question 58: Unable to provide this information at this time. This information may be provided and discussed with the selected vendor. Note: as specified in the RFP, experience data is not available for UNMMG. Question 59: SRMC – Is it possible to include accrued PTO Bank levels on the census? If you are going to require employees to exhaust all but 1 or 2 weeks of PTO before STD will start, having banked amounts will allow us to provide discounts to the pricing. UNMH Response to Question 59: Unable to provide this information at this time. This information may be provided and discussed with the selected vendor. Question 60: Life / AD&D / Optional Life – Can you provide the following: detailed paid premium report that includes lives, volume, and premium by month for Optional Employee, Spouse, and Child Life - through 12/31/14 (the current data is only through August)? UNMH Response to Question 60: Unable to provide this information at this time. This information may be provided and discussed with the selected vendor. Question 61: Life / AD&D / Optional Life – Can you provide the following: Detailed paid claims which lists each claim by product with: date of death, date paid, benefit amount (Basic, Optional, AD&D, Spouse, Child), and paid amount through 12/31/14? UNMH Response to Question 61: Unable to provide this information at this time. This information may be provided and discussed with the selected vendor. Question 62: Long Term Disability. Can you provide the following: Detailed claims listing including open and closed claims with: date of disability, gender, date of birth, gross benefit, net benefit, offset amount by type (Social Security, Workers Comp, etc), Reserves amounts, and total paid to date claims - as of a 12/31/14 valuation date. UNMH Response to Question 62: Unable to provide this information at this time. This information may be provided and discussed with the selected vendor. Question 63: Long Term Disability. Can you provide the following: Paid and incurred exhibit by experience period showing paid premium, paid claims, reserves, and lives by time period with a valuation date of 12/31/14. UNMH Response to Question 63: Unable to provide this information at this time. This information may be provided and discussed with the selected vendor. Question 64: Long Term Disability. Can you provide the following: Are there any plan changes that have occurred (that are not already provided)? If so, please outline those changes. UNMH response to Question 64: All benefit information represents the current plan designs. There have not been any benefit changes. Question 65: Please provide an updated report of that named as "677162 UNM Hospital PW Status" that includes the face amounts of Life Insurance that are under consideration for a Life Insurance Waiver of Premium. UNMH Response to Question 65: Unable to provide this information at this time. This information may be provided and discussed with the selected vendor. Question 66: Please provide an updated report of that named "677162 UNM Hospital LTD Open Claims" to include the diagnosis of claimants that have Net Reserves of $100,000 or more. UNMH Response to Question 66: Unable to provide this information at this time. This information may be provided and discussed with the selected vendor. Question 67: Life - Please provide basic and supplemental life paid claims detail for UNMH for 1/1/2010 – 9/1/2014. UNMH Response to Question 67: Unable to provide this information at this time. This information may be provided and discussed with the selected vendor. Question 68: Life - Please advise if UNMH “Supplemental Life” experience exhibit with a Run Date of 9/16/14 combines employee and dependent life experience or if this reflects employee experience only UNMH Response to Question 68: Unable to provide this information at this time. This information may be provided and discussed with the selected vendor. Question 69: UNMH – LTD. Can you provide LTD Open and Closed claims listings with claims incurred from 1/1/2010 to present with a valuation date no earlier than 12/31/2014? The listings should include total paid amounts for each claim and dates of disability UNMH Response to Question 69: Unable to provide this information at this time. This information may be provided and discussed with the selected vendor. Question 70: UNMH – LTD. Can you provide an open claims listing containing (in addition to what’s been provided) gross benefit, net benefit, date of disability, date of birth, claim reserve, gender and offset information? UNMH Response to Question 70: Unable to provide this information at this time. This information may be provided and discussed with the selected vendor. Question 71: UNMH – Life. Can you provide a claims listing of paid life claims from 1/1/2010 – 12/31/2014 with the life amount paid, date of death, paid date, and identifiers of whether the claim is a Basic Life, Vol Life EE, or a Vol Life dependent claim? UNMH Response to Question 71: Unable to provide this information at this time. This information may be provided and discussed with the selected vendor. Question 72: UNMH – Life. Can you provide a listing of open and approved waiver claims with face amounts and date of disability from 1/1/2010-12/31/2014? UNMH Response to Question 72: Unable to provide this information at this time. This information may be provided and discussed with the selected vendor. Question 73: UNMH – Life. Does the Supplemental Life experience exhibit we received include both Employee and Dependent experience combined? If so, we would need the experience separated. UNMH Response to Question 73: Unable to provide this information at this time. This information may be provided and discussed with the selected vendor. Question 74: Could you please provide genders for Census #3? UNMH Response to Question 74: Unable to provide this information at this time. This information may be provided and discussed with the selected vendor. Question 75: UNMH Specific. Please provide a copy of a recent monthly billing statement/premium remittance statement to compare census volumes to reported volumes. Specifically, we’re interested in voluntary and spouse life coverage reported by age bracket and tobacco status. The premium report provided with the RFP simply uses the age 45-49 rates for reporting purposes UNMH Response to Question 75: Unable to provide this information at this time. This information may be provided and discussed with the selected vendor. Question 76: Please share UNM Hospital’s current benefit administration system/enrollment system. How are the benefits being enrolled now? UNMH response to Question 76: Employees enroll electronically via our Lawson system. Question 77: Disability Questions . Appendix 1: No physicians were found on any of the census information. Please confirm they are not eligible for coverage under the UNMH, SRMC, or UNMMG LTD plans. UNMH Response to Question 77: SRMC does not employ any physicians. Question 78: UNMH – Are you able to provide an indicator on the census which specifies who currently has the LTD coverage? The census has 5,457 employees while the billing has historically shown that approximately 4,400 people are covered on the LTD (over the last year or so). While we understand that there is a long waiting period, all of the employees on the census will have satisfied that waiting period by the time the effective date has arrived. As such, if we assume all employees are covered, it would be about a 25% increase in covered lives compared to what your historical data shows you have actually had covered. It may simply be that you are growing at that rate. If so, can you let us know that? We would view that as a positive so that would be great to know. UNMH Response to Question 78: You should be able to make this determination based on hire date. As noted in the RFP, employees currently have a 1 year eligibility waiting period before they become eligible for LTD coverage. Question 79: Life / AD&D / Optional Life. Can you provide the following: Current Hartford Life Bill (Life Products and LTD). UNMH response to Question 79: Unable to provide this information at this time. This information may be provided and discussed with the selected vendor. Question 80: Life / AD&D / Optional Life. Can you provide the following: As of 3/1/12, the Optional Life number of lives have jumped to 4,468 (from 2,562 in Jan, 2012). This is a 74% increase in lives, while the premium stayed almost the same (the Jan 2012 average cost per employee per month was $34.61 while the average cost per employee per month in March, 2012 was $20.05). Please provide clarification on this. UNMH Response to Question 80: We are thinking it’s most likely may have been a reporting error and the UNMH reports may have been corrected at some point. Question 81: Please clarify, by group (UNMH, UNMMG, SRMC), whether or not the eligible employees participate in the U.S. Social Security System, or if they participate as an alternative to the New Mexico PERA plan. UNMH Response to Question 82: SRMC participates in Social Security. Acknowledge receipt of this Addendum in the space provided in Exhibit B. Failure to do so may subject Offeror to disqualification. All other provisions of the Proposal Documents shall remain unchanged. This addendum is hereby made a part of the Proposal Documents to the same extent as those provisions contained in the original documents and all itemized listing thereof.