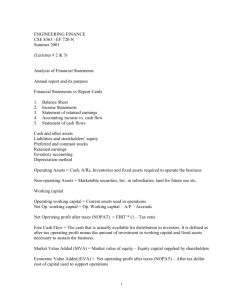

Financial Statement Analysis

advertisement

Financial Statement

Analysis

Assoc.Prof. Oktay Taş

Dr. Kaya Tokmakçıoğlu

What is Financial Analysis

• Financial analysis is the selection, evaluation,

and interpretation of financial data and other

pertinent data.

• The financial analysts must determine which

information is needed and how to use it.

Financial Analysis-Information

• Aside from financial data, other information is

necessary in the prediction of future financial

condition or operating performance of a firm.

• Examples: gross domestic product, the

consumer price index, purchasing price index,

rate of inflation, and corporate specific events

(e.g., mergers, patents, industry of buss.)

Purpose of Analysis

Financial statement analysis helps users

make better decisions.

Internal Users

Managers

Officers

Internal Auditors

External Users

Shareholders

Lenders

Customers

Purpose of Analysis

Financial measures are often used

to rank corporate performance.

Example measures include:

Growth

in sales

Return to

stockholders

Profit

margins

Determined by

analyzing the

financial

statements.

Return on

equity

What do we need for the Financial

Statement Analysis?

–

–

–

–

–

Financial statements

Notes to Financial Statements.

The definition of accounting methods

Auditing reports

5-10 years financial information

Financial Statements Are Designed

for Analysis

Classified

Financial

Statements

Comparative

Financial

Statements

Consolidated

Financial

Statements

Items with certain

characteristics are

grouped together.

Amounts from

several years

appear side by side.

Information for the

parent and subsidiary

are presented.

Results

in standardized,

meaningful

subtotals.

Helps identify

significant

changes and

trends.

Presented as if

the two companies

are a single

business unit.

Tools of Analysis

Dollar &

Percentage

Changes

Trend

Percentages

Component

Percentages

Ratios

Horizontal Analysis

Sales

Expense

Net Income

2002

41,500

40,000

1,500

2001

37,850

36,900

950

Increase/(Decrease)

Amount Percent

3,650

9.6%

3,100

8.4%

550

57.9%

Horizontal Analysis

Sales

2002

$41,500

2001 Difference

$37,850 $3,650

$3,650 ÷ $37,850 = .0964, or 9.6%

Dollar and Percentage Changes

Dollar Change:

Dollar

Change

=

Analysis Period

Amount

–

Base Period

Amount

Percentage Change:

%

Percent

Change

=

Dollar Change

÷

Base Period

Amount

Dollar and Percentage Changes

Evaluating Percentage Changes

in Sales and Earnings

Sales and earnings

should increase at

more that the rate

of inflation.

In measuring quarterly

changes, compare to

the same quarter in

the previous year.

Percentages may be

misleading when the

base amount is small.

Dollar and Percentage Changes

Let’s look at the asset section of Clover,

Inc. comparative balance sheet and

income statement for 2005 and 2004.

Compute the dollar change and the percentage

change for cash.

Clover, Inc.

Comparative Balance Sheets

December 31,

2005

Assets

Current assets:

Cash and equivalents

$ 12,000

Accounts receivable, net

60,000

Inventory

80,000

Prepaid expenses

3,000

Total current assets

$ 155,000

Property and equipment:

Land

40,000

Buildings and equipment, net

120,000

Total property and equipment $ 160,000

Total assets

$ 315,000

* Percent rounded to one decimal point.

2004

$ 23,500

40,000

100,000

1,200

$ 164,700

40,000

85,000

$ 125,000

$ 289,700

Dollar

Change

Percent

Change*

?

?

Clover, Inc.

Comparative Balance Sheets

December 31,

2005

Assets

Current assets:

Cash and equivalents

$ 12,000

Accounts receivable, net

60,000

Inventory

80,000

Prepaid expenses

3,000

$12,000

Total current assets

$ 155,000–

Property and equipment:

Land

40,000

Buildings and equipment, net

120,000

Total property and equipment $ 160,000

Total assets

$ 315,000

* Percent rounded to one decimal point.

2004

Dollar

Change

$ 23,500 $ (11,500)

40,000

100,000

1,200

$23,500

$ 164,700 = $(11,500)

40,000

85,000

$ 125,000

$ 289,700

Percent

Change*

?

Clover, Inc.

Comparative Balance Sheets

December 31,

2005

2004

Dollar

Change

Percent

Change*

Assets

Current assets:

Cash and equivalents

$ 12,000 $ 23,500 $ (11,500)

-48.9%

Accounts receivable, net

60,000

40,000

Inventory

80,000

100,000

Prepaid expenses

3,000

1,200

($11,500

÷ $23,500)

× 100% = 48.94%

Total current assets

$ 155,000

$ 164,700

Property and equipment:

Land

40,000

40,000

Complete the

Buildings and equipment, net

120,000

85,000

analysis for

Total property and equipment $ 160,000 $ 125,000

the other

Total assets

$ 315,000 $ 289,700

assets.

* Percent rounded to one decimal point.

Clover, Inc.

Comparative Balance Sheets

December 31,

2005

Assets

Current assets:

Cash and equivalents

$ 12,000

Accounts receivable, net

60,000

Inventory

80,000

Prepaid expenses

3,000

Total current assets

$ 155,000

Property and equipment:

Land

40,000

Buildings and equipment, net

120,000

Total property and equipment $ 160,000

Total assets

$ 315,000

* Percent rounded to one decimal point.

2004

Dollar

Change

Percent

Change*

$ 23,500 $

40,000

100,000

1,200

$ 164,700

(11,500)

20,000

(20,000)

1,800

(9,700)

-48.9%

50.0%

-20.0%

150.0%

-5.9%

40,000

85,000

$ 125,000

$ 289,700 $

35,000

35,000

25,300

0.0%

41.2%

28.0%

8.7%

Interpretation of Items

•

•

•

•

•

•

•

Current assets-current liabilities

Curent assets- plant assets

Plant assets – L-T Debts

Plant assets – Equity

Total Debt – Equity

Current Liab. – Total Sources

L-T Debts – Total Sources

Intrepretation of Items

•

•

•

•

•

•

•

Accounts recbl.- Accounts payable

Accounts receivable – Sales

Inventory – Sales

Sales – COGS

Sales – Gross Profit

Sales – Operating Income

Sales – Net Income

Trend Analysis

– are computed by selecting a base year

whose amounts are set equal to 100%.

• The amounts of each following year are

expressed as a percentage of the base

amount.

Trend % = Any year $ ÷ Base year $

Trend Percentages

Year

2000

Revenues

$27,611

Cost of sales

15,318

Gross profit

$12,293

1998 is the base year.

1999

$24,215

14,709

$ 9,506

What are the trend percentages?

1998

$21,718

13,049

$ 8,669

Trend Percentages

Year

Revenues

Cost of sales

Gross profit

2000

127%

117%

142%

1999

111%

113%

110%

1998

100%

100%

100%

These percentages were calculated by

dividing each item by the base year.

Trend Analysis

Trend analysis is used to reveal patterns in data

covering successive periods.

Trend

Analysis Period Amount

=

Percent

Base Period Amount

×100%

Trend Analysis

Berry Products

Income Information

For the Years Ended December 31,

Item

Revenues

Cost of sales

Gross profit

Item

Revenues

Cost of sales

Gross profit

2005

$ 400,000

285,000

115,000

2004

$ 355,000

250,000

105,000

2003

$ 320,000

225,000

95,000

2002

$ 290,000

198,000

92,000

2004

2004

2003

2002

2001

base period

its

145%is the129%

116% so 105%

150%

118%

amounts132%

will equal

100%.104%

135%

124%

112%

108%

(290,000 275,000)

(198,000 190,000)

(92,000 85,000)

100% = 105%

100% = 104%

100% = 108%

2001

$ 275,000

190,000

85,000

2001

100%

100%

100%

Component Percentages

Examine the relative size of each item in the financial

statements by computing component

(or common-sized) percentages.

Component

Percent

=

Analysis Amount

Base Amount

Financial Statement

Balance Sheet

Income Statement

× 100%

Base Amount

Total Assets

Revenues

Clover, inc.

Comparative Balance Sheets

December 31,

Complete the common-size analysis for the other

assets.

2005

2004

Common-size

Percents*

2005

2004

Assets

Current assets:

Cash and equivalents

$ 12,000 $ 23,500

3.8%

8.1%

Accounts receivable, net

60,000

40,000

Inventory

80,000

100,000

Prepaid expenses

3,000

1,200

($12,000 ÷ $315,000)

= 3.8%

Total current assets

$ 155,000×$100%

164,700

Property and equipment:

($23,500 40,000

÷ $289,700)

× 100% = 8.1%

Land

40,000

Buildings and equipment, net

120,000

85,000

Total property and equipment $ 160,000 $ 125,000

Total assets

$ 315,000 $ 289,700

100.0% 100.0%

* Percent rounded to first decimal point.

Clover, Inc.

Comparative Balance Sheets

December 31,

2005

Assets

Current assets:

Cash and equivalents

$ 12,000

Accounts receivable, net

60,000

Inventory

80,000

Prepaid expenses

3,000

Total current assets

$ 155,000

Property and equipment:

Land

40,000

Buildings and equipment, net

120,000

Total property and equipment $ 160,000

Total assets

$ 315,000

* Percent rounded to first decimal point.

2004

Common-size

Percents*

2005

2004

$ 23,500

40,000

100,000

1,200

$ 164,700

3.8%

19.0%

25.4%

1.0%

49.2%

8.1%

13.8%

34.6%

0.4%

56.9%

40,000

85,000

$ 125,000

$ 289,700

12.7%

38.1%

50.8%

100.0%

13.8%

29.3%

43.1%

100.0%

Clover, Inc.

Comparative Balance Sheets

December 31,

2005

Liabilities and Shareholders' Equity

Current liabilities:

Accounts payable

Notes payable

Total current liabilities

Long-term liabilities:

Bonds payable, 8%

Total liabilities

Shareholders' equity:

Preferred stock

Common stock

Additional paid-in capital

Total paid-in capital

Retained earnings

Total shareholders' equity

Total liabilities and shareholders' equity

* Percent rounded to first decimal point.

2004

Common-size

Percents*

2005

2004

$ 67,000 $ 44,000

3,000

6,000

$ 70,000 $ 50,000

21.3%

1.0%

22.3%

15.2%

2.1%

17.3%

75,000

$ 145,000

80,000

$ 130,000

23.8%

46.1%

27.6%

44.9%

20,000

20,000

60,000

60,000

10,000

10,000

$ 90,000 $ 90,000

80,000

69,700

$ 170,000 $ 159,700

$ 315,000 $ 289,700

6.3%

19.0%

3.2%

28.5%

25.4%

53.9%

100.0%

6.9%

20.6%

3.5%

31.1%

24.1%

55.1%

100.0%

Clover, Inc.

Comparative Income Statements

For the Years Ended December 31,

Common-size

Percents*

2005

2004

2005

2004

Revenues

$ 520,000 $ 480,000

100.0% 100.0%

Costs and expenses:

Cost of sales

360,000

315,000

69.2%

65.6%

Selling and admin.

128,600

126,000

24.7%

26.3%

Interest expense

6,400

7,000

1.2%

1.5%

Income before taxes

$ 25,000 $ 32,000

4.8%

6.7%

Income taxes (30%)

7,500

9,600

1.4%

2.0%

Net income

$ 17,500 $ 22,400

3.4%

4.7%

Net income per share

$

0.79 $

1.01

Avg. # common shares

22,200

22,200

* Rounded to first decimal point.

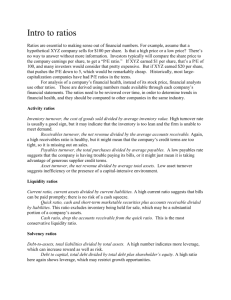

Ratios

• Ratios are simply relationships between two

financial balances or financial calculations. These

relationships establish our references so we can

understand how well we are performing

financially. Ratios also extend our traditional way

of measuring financial performance; i.e. relying on

financial statements. By applying ratios to a set of

financial statements, we can better understand

financial performance.

Ratios

A ratio is a simple mathematical expression

of the relationship between one item and another.

Along with dollar and percentage changes,

trend percentages, and component percentages,

ratios can be used to compare:

Past performance to

present performance.

Other companies to

your company.

Why are ratios useful

• Ratios standardize numbers and facilitate

comparisons.

• Ratios are used to highlight weaknesses and

strengths.

How can we use ratios?

• Compare with previous ratios

• Compare with standards (average is found

by the academicans, analysts e.g.)

• Compare with industrial average.

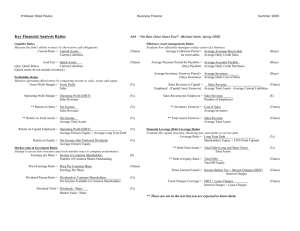

What are the five major categories of

ratios, and what questions do they

answer?

• Liquidity ratios: Can we make required payments?

• Activity ratios Asset management: right amount of

assets vs. sales?

• Debt management ratios (leverage Ratios): Right

mix of debt and equity?

• Profitability: Do sales prices exceed unit costs,

and are sales high enough as reflected in PM,

ROE, and ROA?

• Market value: Do investors like what they see as

reflected in P/E and M/B ratios?

Type of ratios

• Liquidity ratios provide information on

a firm's ability to meet its short-term

obligations.

• Activity ratios relate information on a

firm's ability to manage its resources

(that is, its assets) efficiently.

Type of ratios

• Financial leverage ratios provide

information on the degree of a firm's fixed

financing obligations and its ability to

satisfy these financing obligations.

• Profitability ratios provide information

on the amount of income from each

dollar of sales.

Type of ratios

• Return on investment ratios provide

information on the amount of profit,

relative to the assets employed to

produce that profit.

• Shareholder ratios describe the firm's

financial condition in terms of amounts per

share of stock.

Liquidity Ratios

Liquidity Ratios help us understand if we can meet our

obligations over the short-run. Higher liquidity levels indicate that

we can easily meet our current obligations. We can use several

types of ratios to monitor liquidity.

Let’s see if they can cover their shortterm obligations …

Liquidity ratios

• The current ratio is the ratio of current assets

to current liabilities; indicates a firm's ability

to satisfy its current liabilities with its current

assets.

• Quick ratio is the ratio of quick assets

(generally current assets less inventory) to

current liabilities; indicates a firm's ability to

satisfy current liabilities with its most liquid

assets.

Current ratio

current assets

Current ratio=

current liabilities

Example:

If current assets are $5 million and current

liabilities are $2 million,

Current ratio =

$5 / $2

=

2.5

Comments on current ratio

Current

ratio

2003

2002

2001

Ind.

2.34x

1.20x

2.30x

2.70x

• Expected to improve but still below the

industry average.

• Liquidity position is weak.

Quick ratio

current assets inventory

Quick ratio

current liabilities

Also referred to as the acid test ratio

or liquidity ratio

Liquidity ratios: example

Suppose the firm has the following:

Cash

Accounts receivables

Inventory

Accounts payable

a.

b.

$ 5

16

20

12

What is the firm’s current ratio?

What is the firm’s quick ratio?

Liquidity ratios: example, cont.

Cash

$ 5

Accounts receivables 16

Inventory

20

Accounts payable

12

a. What is the firm’s current ratio?

Current ratio = ($5 + 16 + 20) / $12 = 3.42

b.What is the firm’s quick ratio?

Quick ratio = ($5 + 16) / $12 = 1.75

Nike

Working capital, 2002, in millions

Cash and cash equivalents

Receivables

$ 575.5

1,621.1

Inventory

Other

Total current assets

1,373.8

275.8

$4,157.7

Accounts payable

Debts due

$ 504.4

480.5

Other

Total current liabilities

851.3

$1,836.2

Source: Nike Annual Reports, various years

Problem

• Suppose a company has a current ratio of

1.5 and a quick ratio of 0.8. If its current

liabilities are $2 million, what is its

inventory?

Activity ratios

But are they any good at this stuff?

Activity ratios

• Accounts receivable turnover is the ratio

of net credit sales to accounts receivable.

• Indicates how many times in the period

credit sales have been created and collected.

A/R Turnover Ratio

• Accounts Receivable Turnover measures the number of

times we were able to convert our receivables over into

cash. Higher turnover ratios are desirable.

•Net Sales / Average Accounts Receivable

•Avrg. accounts receivable = (Beg.A/R + End. A/R) / 2

If there is only one year of information can be calculated as follows:

A/R turnover =

credit sales

..times

accounts receivable s

A/R Turnover Ratio

• EXAMPLE — Sales are $ 480,000, the average

receivable balance during the year was $ 40,000 and

we have a $ 20,000 allowance for sales returns.

Accounts Receivable Turnover is ($ 480,000 - $

20,000) / $ 40,000 or 11.5. We were able to turn our

receivables over 11.5 times during the year.

• NOTE — We are assuming that all of our sales are

credit sales; i.e. we do not have any significant cash

sales.

Number of Days in Accounts

Receivable

• The Number of Days in Accounts Receivable is the average

length of time required to collect our receivables. A low

number of days is desirable. Days in Accounts Receivable is

calculated as follows:

365 or 360 / Accounts Receivable Turnover Ratio

• EXAMPLE — If we refer to our previous example and we

base our calculation on the full calendar year, we would

require 32 days on average to collect our receivables. 365 /

11.5 = 32 days.

Inventory Turnover Ratio

•Inventory Turnover is similar to accounts receivable turnover.

We are measuring how many times did we turn our inventory

over during the year. Higher turnover rates are desirable. A high

turnover rate implies that management does not hold onto excess

inventories and our inventories are highly marketable. Inventory

Turnover is calculated as follows:

Cost of Sales / Average Inventory

Avrg.Inventory = (Beg.Inventory + End.Inventory) / 2

EXAMPLE — Cost of Sales were $ 192,000 and the average inventory

balance during the year was $ 120,000. The Inventory Turnover Rate is 1.6 or

we were able to turn our inventory over 1.6 times during the year.

Inventory Turnover Ratio

• Days in Inventory is the average number of days we held our

inventory before a sale. A low number of inventory days is

desirable. A high number of days implies that management is

unable to sell existing inventory stocks. Days in Inventory is

calculated as follows:

• Inv.Turnover Ratio=365 or 360 / Inventory Turnover

EXAMPLE — If we refer back to the previous example and

we use the entire calendar year for measuring inventory, then

on average we are holding our inventories 228 days before a

sale. 365 / 1.6 = 228 days.

Activity ratios, continued.

• Total asset turnover is the ratio of sales to

total assets; indicates the extent that the

investment in total assets results in sales.

• Fixed asset turnover is the ratio of sales to

fixed assets; indicates the ability of the

firm's management to put the fixed assets to

work to generate sales.

Capital Turnover

Capital Turnover measures our ability to turn capital over into

sales. Remember, we have two sources of capital: Debt and

Equity. Capital Turnover is calculated as follows:

Net Sales / Interest Bearing Debt + Shareholders Equity

EXAMPLE — Net Sales are $ 460,000, we have $ 50,000 in Debt

and $ 200,000 of Equity. Capital Turnover is $ 460,000 / ($

50,000 + $ 200,000) = 1.84. For each $ 1.00 of capital invested

(both debt and equity), we are able to generate $ 1.84 in sales.

Turnover examples

Company

Nike (NKE)

Total asset turnover

for 2001

1.5355 times

Skechers (SKX)

2.3569 times

Timberland (TBO)

2.3456 times

Source: Companies’ respective annual reports

The operating cycle

• The operating cycle is the length of time it

takes to turn the investment of cash in

inventory back into cash.

• The longer the operating cycle, the greater

the need for liquid assets.

• The operating cycle is the sum of:

Number of days of inventory

Number of days of receivables

The operating cycle

• Now that we have calculated the number of days for receivables

and the number of days for inventory, we can estimate our

operating cycle. Operating Cycle = Number of Days in

Receivables + Number of Days in Inventory. In our previous

examples, this would be 32 + 228 = 260 days. So on average, it

takes us 260 days to generate cash from our current assets.

• If we look back at our Current Ratio, we found that we had 2.5

times more current assets than current liabilities. We now want to

compare our Current Ratio to our Operating Cycle.

• Our turnover within the Operating Cycle is 365 / 260 or 1.40.

This is lower than our Current Ratio of 2.5. This indicates that we

have additional assets to cover the turnover of current assets into

cash. If our current ratio were below that of the Operating Cycle

Turnover Rate, this would imply that we do not have sufficient

current assets to cover current liabilities within the Operating

Cycle. We may have to borrow short-term to pay our expenses.

The number of days inventory

• The number of days inventory

= inventory / avg. day’s cost of goods

sold

• This the number of days a company could

go without adding inventory until they

deplete inventory.

The number of days receivable

• The number of days receivable

= accounts receivable / average day’s credit

• This is the number of days it takes to collect

on credit accounts.

Net operating cycle

• The net operating cycle is the number of

days it takes to turn the investment in

inventory into cash, considering that

purchases are acquired with credit.

• The number of days payables

= accounts payable / average day’s

purchases

Net operating cycle, continued

+

Number of days inventory

Number of days receivable

Number of days payables

Net operating cycle

Example

Number of days

…

Inventory

Receivables

Payables

Net operating

cycle

General Electric

2002

41.4 days

148.9 days

93.7 days

96.6 days

Financial leverage ratios

But can they handle their debt load?

Leverage Ratios measure the use of debt

and equity for financing of assets.

Financial leverage ratios

• The debt to assets ratio indicates the

proportion of assets that are financed with

debt (both short-term and long-term debt).

• The debt to equity ratio indicates the

relative uses of debt and equity as sources

of capital to finance the firm's assets,

evaluated using book values of the capital

sources.

Debt to Equity Ratios

• Debt to Equity is the ratio of Total Debt to Total Equity. It

compares the funds provided by creditors to the funds

provided by shareholders. As more debt is used, the Debt to

Equity Ratio will increase. Since we incur more fixed interest

obligations with debt, risk increases. On the other hand, the

use of debt can help improve earnings since we get to deduct

interest expense on the tax return. So we want to balance the

use of debt and equity such that we maximize our profits, but

at the same time manage our risk. The Debt to Equity Ratio is

calculated as follows:

• Total Liabilities / Shareholders Equity

Debt to Equity Ratios

• Total Liabilities / Shareholders Equity

• EXAMPLE — We have total liabilities of $ 75,000 and

total shareholders equity of $ 200,000. The Debt to Equity

Ratio is 37.5%, $ 75,000 / $ 200,000 = .375. When

compared to our equity resources, 37.5% of our resources

are in the form of debt.

• KEY POINT — As a general rule, it is advantageous to

increase our use of debt (trading on the equity) if earnings

from borrowed funds exceeds the costs of borrowing.

Times Interest Earned

• Times Interest Earned is the number of times our

earnings (before interest and taxes) covers our

interest expense. It represents our margin of safety

in making fixed interest payments. A high ratio is

desirable from both creditors and management.

Times Interest Earned is calculated as follows:

• Earnings Before Interest and Taxes /

Interest Expense

Times Interest Earned

• The interest coverage ratio indicates the

firm's ability to satisfy interest obligations

on its debt.

• Also known as the times-interest-earned

ratio.

EBIT

Interest coverage =

interest expense

Financial leverage examples

Debt-to-assets

Nike (NKE)

40.41%

July,2002

Skechers (SKX)

51.16%

December, 2001

Timberland

40.47%

(TBL)

December,

2001

Source: Data from Yahoo! Finance

Debt-toequity

67.82%

104.75%

67.97%

Profitability ratios

But can they make any money doing

this stuff?

Gross profit margin

• Gross profit margin: the ratio of gross

profit to sales.

• Indicates how much of every dollar of sales

is left after costs of goods sold.

Gross profit margin

gross profit

=

sales

Operating profit margin

• Operating profit margin: the ratio of

operating profit (EBIT) to sales.

• Indicates how much of each dollar of sales

is left over after operating expenses.

operating profit

Operating profit margin =

sales

Net profit margin

• Net profit margin: the ratio of net income

to sales.

• Indicates how much of each dollar of sales

is left over after all expenses are paid.

Net profit margin

net profit

=

sales

IBM’s 2002 Income statement

in millions

Revenues

Less: Total costs

Gross profit

Less: Operating expenses

Operating income

Add: Other income

Less: Interest expense

Income before income taxes

Less: Provision for income taxes

Net income

Source: IBM 2002 Annual Report

$88,396

55,972

$32,424

20,790

$11,634

617

717

$11,534

3,441

$8,093

Profitability ratios: IBM in

2002

Gross profit margin

= $32,424 / $88,396

Operating profit margin

= $12,251 / $88,396

Net profit margin

= $8,093 / $88,396 =

=

36.68%

=

13.86%

9.16%

K Mart

Income Statement, 1/31/2001 in millions

Net revenues

$37,028

Less: Cost of revenues

29,658

Gross profit

$7,370

Less: Operating expenses

7,461

Operating income

-$91

Less: Interest expense

287

Add: Taxes (carryover)

134

Net income

-$244

Source: Kmart 10-K Report

Return on investment

Hey, what’s the bottom line?

Return on investment ratios

• Basic earning power ratio is a measure of the

operating income resulting from the firm's

investment in total assets.

Basic earning power = EBIT / Total assets

• Return on assets indicates the firm's net profit

generated per dollar invested in total assets.

Return on assets = Net profit / Total assets

Return on investment

• Return on equity is the profit generated

per dollar of shareholders' investment (i.e.,

shareholders' equity).

net profit

Return on equity =

book value of equity

Coming attractions

• Return on investment ratios & the Du Pont

system

• Shareholder ratios

• Common size analysis

• Effective use of financial analysis

Market Value (Shareholder)

Ratios

The view of the firm from the

perspective of the owners, investor

and general public …

Market Value (Shareholder)

Ratios

These ratios attempt to measure the economic status

of the organization within the marketplace.

Investors use these ratios to evaluate and monitor

the progress of their investments.

Market Value Ratios

• Earnings per share (EPS) is the amount of

income earned during a period per share of

common stock.

• Basic EPS & Diluted EPS

• Book value equity per share is the amount of

the book value of common equity per share of

stock.

• The price-earnings ratio (P/E or PE ratio) is

the ratio of the price per share of stock to the

earnings per share of stock.

Market Value Ratios, continued

• Dividends per share (DPS) is the dollar

amount of cash dividends paid during a

period, per share of common stock.

• The dividend payout ratio is the ratio of

cash dividends paid to earnings for a period.

Dividend payout ratio = DPS / EPS

Earning Per Share

• Growth in earnings is often monitored with Earnings per

Share (EPS). The EPS expresses the earnings of a company

on a "per share" basis. A high EPS in comparison to other

competing firms is desirable. The EPS is calculated as:

• Earnings Available to Common Shareholders /

Number of Common Shares Outstanding

• EXAMPLE — Earnings are $ 100,000 and preferred stock

dividends of $ 20,000 need to be paid. There are a total of

80,000 common shares outstanding. Earnings per Share

(EPS) is ($ 100,000 - $ 20,000) / 80,000 shares outstanding

or $ 1.00 per share.

Price to Earnings (P/E)

• The relationship of the price of the stock in relation to EPS

is expressed as the Price to Earnings Ratio or P / E Ratio.

Investors often refer to the P / E Ratio as a rough indicator

of value for a company. A high P / E Ratio would imply

that investors are very optimistic (bullish) about the future

of the company since the price (which reflects market

value) is selling for well above current earnings. A low P /

E Ratio would imply that investors view the company's

future as poor and thus, the price the company sells for is

relatively low when compared to its earnings. The P / E

Ratio is calculated as follows:

Price to Earnings (P/E)

• Price of Stock / Earnings per Share *

• * Earnings per Share are fully diluted to

reflect the conversion of securities into

common stock.

• EXAMPLE — Earnings per share is $ 3.00

and the stock is selling for $ 36.00 per share.

The P / E Ratio is $ 36 / $ 3 or 12. The

company is selling for 12 times earnings.

Price to Book Value (P/B)

• Book Value per Share expresses the total net assets of a

business on a per share basis. This allows us to compare the

book values of a business to the stock price and gauge

differences in valuations. Net Assets available to

shareholders can be calculated as Total Equity less Preferred

Equity. Book Value per Share is calculated as follows:

• Net Assets Available to Common Shareholders * /

Outstanding Common Shares

• * Calculated as Total Equity less Preferred Equity.

• EXAMPLE — Total Equity is $ 5,000,000 including $

400,000 of preferred equity. The total number of common

shares outstanding is 80,000 shares. Book Value per Share is

($ 5,000,000 - $ 400,000) / 80,000 or $ 57.50

Dividend Yield

• The percentage of dividends paid to shareholders in

relation to the price of the stock is called the

Dividend Yield. For investors interested in a source

of income, the dividend yield is important since it

gives the investor an indication of how much

dividends are paid by the company. Dividend Yield

is calculated as follows:

• Dividends per Share / Price of Stock

• EXAMPLE — Dividends per share are $ 2.10 and

the price of the stock is $ 30.00 per share. The

Dividend Yield is $ 2.10 / $ 30.00 or 7%

The DuPont system

• The Du Pont system was developed by

E.I. du Pont Nemours.

• The system is a method of decomposing

the return ratios into their profit margin

and turnover components. e.g.,

Return = total asset x net profit

on assets turnover margin

A further breakdown

• Return on equity can be broken down into

the return on assets and the equity

multiplier.

• The greater the financial leverage, the

greater the equity multiplier.

return on = return on × equity

equity

assets multiplier

net income net income assets

=

×

equity

assets

equity

Du Pont system: Return on assets

Return on assets

Net profit / Total assets

Net profit margin

Net profit / Sales

Operating profit margin

Operating profit / Sales

or EBIT / Sales

Earnings retention

(1 - tax rate)

Interest burden

Earnings before taxes / Operating profit

or EBT/EBIT

Total asset turnover

Total assets / Net profit

Du Pont system: Return on

equity

Return on equity

Net profit / Shareholders' equity

Net profit margin

Net profit / Sales

Operating profit margin

Operating profit / Sales

or EBIT / Sales

Earnings retention

(1 - tax rate)

Interest burden

Earnings before taxes / Operating profit

or EBT / EBIT

Total asset turnover

Total assets / Net profit

Equity multiplier

Total assets / Shareholders' equity

Kmart and the Du Pont system

8%

3.0

6%

2.5

4%

2.0

Number of

1.5 times

2%

Return 0%

-2%

1.0

-4%

Return on assets

Net profit margin

Total asset turnover

-6%

-8%

1990 1991 1992 1993 1994 1995 1996 1997 1998 1999 2000

Source: Kmart Inc., Annual Reports

0.5

0.0

Wal-Mart: ROA & ROE

30%

25%

ROA

ROE

20%

15%

10%

5%

0%

1991 1992 1993 1994 1995 1996 1997 1998 1999 2000 2001 2002

Source: Wal-Mart Stores, Inc., Annual Reports

Wal-Mart DuPont, 1991-2002

20%

3,5

3

2,5

2

times

1,5

1

0,5

0

15%

return

and 10%

margin

5%

Return on assets

Total asset turnover

2002

2000

1998

1996

1994

1992

1990

1988

1986

1984

1982

0%

Net profit margin

Source: Wal-Mart Annual Reports, various years

Problems

• Suppose a company has a return on equity

of 10% and a return on assets of 5%. What

is its debt-to-equity ratio?

• If a company has a return on assets of 5%

and a total asset turnover of 5 times, what is

its net profit margin?

An example

Time to see if you can really do this

stuff.

For a selected company …

• Calculate the following ratios:

Current ratio

Debt-to-equity ratio

Total asset turnover

Net profit margin

Equity multiplier

Return on equity

• and turnover components.

Common size analysis

Common size analysis

• Common size analysis is the analysis of

financial statement items through comparisons

among financial statement or market data.

• Common size analysis compares each item in a

financial statement with a benchmark item.

• Common size analysis is useful in analyzing

trends in profitability and trends in investments

and financing activity.

Common size analysis, continued.

• For the income statement, the benchmark is

sales; each item in the income statement is

restated as a percentage of sales.

• For the balance sheet, the benchmark is

total assets; each item in the balance sheet is

restated as a percentage of total assets.

Common size example:

Toys R Us

100%

Assets

75%

Other

Intangibles

Plant and equipment

Current assets

50%

25%

0%

1997 1998 1999 2000 2001 2002

Source: Toys R Us Annual Reports

Common size example:

Toys R Us

Liabilities

& equity

100%

75%

Shareholders' equity

50%

Other long-term

liabilities

Long-term debt

25%

Deferred taxes

Current liabilities

0%

1997 1998 1999 2000 2001 2002

Source: Toys R Us Annual Reports

Effective use of financial

analysis

Now what do we do with this stuff?

Uses of financial analysis

• Valuation

• Use financial relations to predict future cash

flows

• Determine creditworthiness

• Rating services (e.g., Moody’s)

• Bankruptcy prediction

• Develop a statistical model that predicts

bankruptcy on the basis of financial

characteristics

Case in point

IMC Global

IMC Global

• Industry: Agricultural chemicals

• Largest of the few companies in the

industry

• Chemical prices are cyclical and sensitive to

agricultural economy and world trade

IMC Global: Returns

10%

0%

-10%

-20%

-30%

-40%

-50%

-60%

-70%

-80%

ROE

ROA

1997

1998

1999

2000

Source: IMC Global 10-K Reports

2001

2002

IMC Global: Profit margins

15%

10%

5%

0%

-5%

-10%

-15%

-20%

-25%

-30%

-35%

Operating profit

margin

Net profit margin

1997

1998

1999

2000

Source: IMC Global 10-K Reports

2001

2002

IMC Global: Cash flows

600

400

200

0

CFO

CFI

CFF

-200

-400

-600

-800

1997

1998

1999

2000

Source: IMC Global 10-K Reports

2001

2002

IMC Global: Financial leverage

100%

Debt as a %

of assets

80%

60%

40%

20%

0%

1993

1995

1997

Source: IMC Global 10-K Reports

1999

2001

IMC Global:

Additional considerations

• IMC Global is in a cyclical industry

• IMC Global has many environmental

liabilities that are not shown in the balance

sheet

• The reaction of competitors/industry to

slump in phosphate prices affects the firm

Problems and dilemmas

There had to be a catch …

Problems and dilemmas

• Using accounting information

• historical data [book v. market value]

• flexibility regarding methods of accounting

[i.e., the possibility of earnings management]

• “fuzzy” items [i.e., Enron, Enron, Enron]

• the possibility of earnings manipulation [Enron,

Sunbeam, Waste Management …]

Problems and Dilemmas, continued

• Selecting a benchmark

• Financial ratios are most useful when

compared with ratios of similar

companies (e.g., by industry).

• It is difficult to choose comparison firms

or to determine the industry.

Shoe companies

Net profit margin

1997-2002

9%

8%

7%

6%

5%

4%

3%

2%

1%

0%

Nike

Reebok

Skechers

1997

1998

1999

2000

2001

2002

Source: Companies’ annual reports, various years

Problems and dilemmas, continued.

• Selecting and interpreting ratios

• A single ratio is not indicative of a

“good” or “bad” firm.

• Some ratios are not applicable to some

firms.

• Some ratios don’t make sense in certain

circumstance.

Forecasting with financial ratios

• Financial ratios are often used to determine

a trend over time, which may then be used

to develop expectations about the future.

• It is important to understand the accounting

numbers to adequately forecast based on

historical trends.

Wal-Mart Sales, 1971-2002

Sales $250,000

in

millions $200,000

$150,000

$100,000

$50,000

Fiscal year

Source: Wal-Mart Annual Reports, various years

2001

1999

1997

1995

1993

1991

1989

1987

1985

1983

1981

1979

1977

1975

1973

1971

$0

Enron Sales, 1991-2000

$120

$100

$80

Revenues

$60

(in billions)

$40

$20

$0

1991 1992 1993 1994 1995 1996 1997 1998 1999 2000

Fiscal year

Source: Enron 10-K Reports, various years

Matrix, Inc.

2005

Use this

informatio

n to

calculate

the

liquidity

ratios for

Matrix,

Cash

Accounts receivable, net

Beginning of year

End of year

Inventory

Beginning of year

End of year

Total current assets

Total current liabilities

Total liabilities

Total assets

Beginning of year

End of year

Revenues

$

30,000

17,000

20,000

10,000

15,000

65,000

42,000

103,917

300,000

346,390

494,000

Working Capital

Working capital is the excess of current

assets over current liabilities.

12/31/05

Current assets

Current liabilities

Working capital

$ 65,000

(42,000)

$ 23,000

Current Ratio

This ratio measures the

short-term debt-paying

ability of the company.

Current

Current Assets

=

Ratio

Current Liabilities

Current

=

Ratio

$65,000

$42,000

= 1.55 : 1

Quick Ratio

Quick

Ratio

=

Quick Assets

Current Liabilities

Quick assets are cash, marketable

securities, and receivables.

This ratio is like the current

ratio but excludes current assets

such as inventories that may be

difficult to quickly convert into cash.

Quick Ratio

Quick

Ratio

Quick

Ratio

Quick Assets

Current Liabilities

=

=

$50,000

$42,000

This ratio is like the current

ratio but excludes current assets

such as inventories that may be

difficult to quickly convert into cash.

= 1.19 : 1

Debt Ratio

A measure of creditor’s long-term risk.

The smaller the percentage of assets that

are financed by debt, the smaller the risk

for creditors.

Debt

Debt

Ratio

Ratio

==

Total

Total

Liabilities

Liabilities

÷ ÷ Total

Total Assets

Assets

=

$103,917 ÷

=

30.00%

$346,390

Uses and Limitations of Financial

Ratios

Uses

Limitations

Ratios help users

understand

financial relationships.

Management may enter

into transactions merely

to improve the ratios.

Ratios provide for

quick comparison

of companies.

Ratios do not help with

analysis of the company's

progress toward

nonfinancial goals.

Measures of Profitability

An income statement can be prepared in either a

multiple-step or single-step format.

The single-step format is simpler.

The multiple-step format provides

more detailed information.

Income Statement (Multiple-Step)

Proper Heading

{

{

Gross

Margin

Operating

Expenses

Nonoperating

Items

{

Remember to

compute EPS.

{

Martin Company

Income Statement

For the Year Ended 12/31/05

Sales, net

Cost of goods sold

Gross margin

Operating expenses:

Selling expenses

General & Admin.

Depreciation

Income from Operations

Other revenues & gains:

Interest income

Gain

Other expenses:

Interest

Loss

Income before taxes

Income taxes

Net income

$

$

$

$

$

785,250

351,800

433,450

$

293,350

140,100

197,350

78,500

17,500

62,187

24,600

86,787

27,000

9,000

$

$

(36,000)

190,887

62,500

128,387

Income Statement (Single-Step)

{

Proper Heading

Revenues

& Gains

Expenses

& Losses

Remember to

compute EPS.

{

{

Martin Company

Income Statement

For the Year Ended 12/31/05

Revenues and gains:

Sales, net

Interest income

Gain on sale of plant assets

Total revenues and gains

Expenses and losses:

Cost of goods sold

Selling Expenses

General and Admin. Exp.

Depreciation

Interest

Income taxes

Loss: sale of investment

Total expenses & losses

Operating income

$

$

$

785,250

62,187

24,600

872,037

$

743,650

128,387

351,800

197,350

78,500

17,500

27,000

62,500

9,000

Matrix, Inc.

2005

Use this

information

to calculate

the

profitability

ratios for

Matrix, Inc.

Number of common shares

outstanding all of 2005

Net income

Shareholders' equity

Beginning of year

End of year

Revenues

Cost of sales

Total assets

Beginning of year

End of year

$

27,400

53,690

180,000

234,390

494,000

140,000

300,000

346,390

Return On Assets (ROA)

This ratio is generally considered

the best overall measure of a

company’s profitability.

ROA

=

Operating

income

= $

=

53,690

16.61%

÷

Average total assets

÷ ($300,000 + $346,390) ÷ 2

Return On Equity (ROE)

This measure indicates how well the

company employed the owners’

investments to earn income.

ROE

Operating

=

income

= $ 53,690

=

25.91%

Average total stockholders'

÷

equity

÷ ($180,000 + $234,390) ÷ 2

More issues regarding ratios

• Different

operating

and

accounting

practices can distort comparisons.

• Sometimes it is hard to tell if a ratio is

“good” or “bad”.

• Difficult to tell whether a company is, on

balance, in strong or weak position.

Qualitative factors to be considered

when evaluating a company’s future

financial performance

• Are the firm’s revenues tied to 1 key

customer, product, or supplier?

• What percentage of the firm’s business is

generated overseas?

• Competition

• Future prospects

• Legal and regulatory environment

Objective 2

Perform a vertical analysis

of financial statements.

Vertical Analysis...

– compares each item in a financial statement

to a base number set to 100%.

• Every item on the financial statement is

then reported as a percentage of that base.

Vertical Analysis

Revenues

Cost of sales

Gross profit

Total operating expenses

Operating income

Other income

Income before taxes

Income taxes

Net income

1999

$38,303

19,688

$18,615

13,209

$ 5,406

2,187

$ 7,593

2,827

$ 4,766

%

100.0

51.4

48.6

34.5

14.1

5.7

19.8

7.4

12.4

Vertical Analysis

Assets

Current assets:

Cash

Receivables net

Inventories

Prepaid expenses

Total current assets

Plant and equipment, net

Other assets

Total assets

1999

$ 1,816

10,438

6,151

3,526

$21,931

6,847

9,997

$38,775

%

4.7

26.9

15.9

9.1

56.6

17.7

25.7

100.0

Objective 3

Prepare common-size

financial statements.

Common-size Statements

• On the income statement, each item is

expressed as a percentage of net sales.

• On the balance sheet, the common size is

the total on each side of the accounting

equation.

• Common-size statements are used to

compare one company to other companies,

and to the industry average.

Benchmarking

Percent of Net Sales

Lucent Technologies

MCI

10,8%

12,4%

8,0%

7,4%

43,0%

51,4%

28,8%

38,2%

Cost of goods sold

Income tax

Operating expenses

Net income

Objective 4

Compute the standard

financial ratios.

Ratio Classification

1 Measuring ability to pay current liabilities

2 Measuring ability to sell inventory and

collect receivables

3 Measuring ability to pay short-term and

long-term debt

4 Measuring profitability

5 Analyzing stock as an investment

Ratio Classification

Liquidity ratios: Mesuring ability to pay

current

liabilities

Activity ratios: Measuring ability to sell

inventory

and

collect

receivables

Financial leverage ratios: Measuring ability to

pay

short-term

and

long-term

debt

Profitability ratios: Measuring profitability of

the bussines.

Palisades Furniture Example

Net sales (Year 2002)

Cost of goods sold

Gross profit

Total operating expenses

Operating income

Interest revenue

Interest expense

Income before taxes

Income taxes

Net income

$858,000

513,000

$345,000

244,000

$101,000

4,000

(24,000)

$ 81,000

33,000

$ 48,000

Palisades Furniture Example

Assets

20x2

20x1

Current assets:

Cash

$ 29,000 $ 32,000

Receivables net

114,000

85,000

Inventories

113,000

111,000

Prepaid expenses

6,000

8,000

Total current assets

$262,000 $236,000

Long-term investments

18,000

9,000

Plant and equipment, net

507,000

399,000

Total assets

$787,000 $644,000

Palisades Furniture Example

Liabilities

Current liabilities:

Notes payable

Accounts payable

Accrued liabilities

Total current liabilities

Long-term debt

Total liabilities

20x2

$ 42,000

73,000

27,000

$142,000

289,000

$431,000

20x1

$ 27,000

68,000

31,000

$126,000

198,000

$324,000

Palisades Furniture Example

Stockholders’ Equity

Common stock, no par

Retained earnings

Total stockholders’ equity

Total liabilities and

stockholders’ equity

20x2

$186,000

170,000

$356,000

20x1

$186,000

134,000

$320,000

$787,000

$644,000

Measuring Ability to

Pay Current Liabilities

The current ratio measures

the company’s ability to pay

current liabilities with current assets.

Current ratio =

Total current assets ÷ Total current liabilities

Measuring Ability to

Pay Current Liabilities

•

•

•

•

•

Palisades’ current ratio:

20x1: $236,000 ÷ $126,000 = 1.87

20x2: $262,000 ÷ $142,000 = 1.85

The industry average is 1.80.

The current ratio decreased slightly

during 20x2.

Measuring Ability to

Pay Current Liabilities

The acid-test ratio shows the company’s

ability to pay all current liabilities

if they come due immediately.

Acid-test ratio =

(Cash + Short-term investments

+ Net current receivables)

÷ Total current liabilities

Measuring Ability to

Pay Current Liabilities

•

•

•

•

•

Palisades’ acid-test ratio:

20x1: ($32,000 + $85,000) ÷ $126,000 = .93

20x2: ($29,000 + $114,000) ÷ $142,000 = 1.01

The industry average is .60.

The company’s acid-test ratio improved

considerably during 20x2.

Measuring Ability to

Sell Inventory

Inventory turnover is a measure

of the number of times the average

level of inventory is sold during a year.

Inventory turnover = Cost of goods sold

÷ Average inventory

Measuring Ability to

Sell Inventory

•

•

•

•

Palisades’ inventory turnover:

20x2: $513,000 ÷ $112,000 = 4.58

The industry average is 2.70.

A high number indicates an ability to

quickly sell inventory.

Measuring Ability to

Collect Receivables

Accounts receivable turnover measures a company’s

ability to collect cash from credit customers.

Accounts receivable turnover =

Net credit sales ÷ Average accounts receivable

Measuring Ability to

Collect Receivables

•

•

•

•

Palisades’ accounts receivable turnover:

20x2: $858,000 ÷ $99,500 = 8.62 times

The industry average is 22.2 times.

Palisades’ receivable turnover is much

lower than the industry average.

• The company is a home-town store that

sells to local people who tend to pay their

bills over a lengthy period of time.

Measuring Ability to

Collect Receivables

Days’ sales in receivable ratio measures how

many day’s sales remain in Accounts Receivable.

One day’s sales = Net sales ÷ 365 days

Days’ sales in Accounts Receivable =

Average net Accounts Receivable ÷ One day’s sales

Measuring Ability to

Collect Receivables

• Palisades’ days’ sales in Accounts

Receivable for 20x2:

• One day’s sales:

• $858,000 ÷ 365 = $2,351

• Days’ sales in Accounts Receivable:

• $99,500 ÷ $2,351 = 42 days

• The industry average is 16 days.

Measuring Ability to

Pay Debt

The debt ratio indicates the proportion

of assets financed with debt.

Total liabilities ÷ Total assets

Measuring Ability to

Pay Debt

•

•

•

•

•

Palisades’ debt ratio:

20x1: $324,000 ÷ $644,000 = 0.50

20x2: $431,000 ÷ $787,000 = 0.55

The industry average is 0.61.

Palisades Furniture expanded operations

during 20x2 by financing through

borrowing.

Measuring Ability to

Pay Debt

Times-interest-earned ratio

measures the number of times

operating income can cover interest expense.

Times-interest-earned

= Income from operations

÷ Interest expense

Measuring Ability to

Pay Debt

•

•

•

•

•

Palisades’ times-interest-earned ratio:

20x1: $ 57,000 ÷ $14,000 = 4.07

20x2: $101,000 ÷ $24,000 = 4.21

The industry average is 2.00.

The company’s times-interest-earned ratio

increased in 20x2.

• This is a favorable sign.

Measuring Profitability

Rate of return on net sales shows the percentage

of each sales dollar earned as net income.

Rate of return on net sales =

Net income ÷ Net sales

Measuring Profitability

•

•

•

•

•

Palisades’ rate of return on sales:

20x1: $26,000 ÷ $803,000 = 0.032

20x2: $48,000 ÷ $858,000 = 0.056

The industry average is 0.008.

The increase is significant in itself and also

because it is much better than the industry

average.

Measuring Profitability

Rate of return on total assets measures

how profitably a company uses its assets.

Rate of return on total assets = (Net income

+ interest expense) ÷ Average total assets

Measuring Profitability

• Palisades’ rate of return on total assets

for 20x2:

• ($48,000 + $24,000) ÷ $715,500 = 0.101

• The industry average is 0.049.

• How does Palisades compare to the

industry?

• Very favorably.

Measuring Profitability

Common equity includes additional

paid-in capital on common

stock and retained earnings.

Rate of return on common stockholders’ equity

= (Net income – preferred dividends)

÷ Average common stockholders’ equity

Measuring Profitability

• Palisades’ rate of return on common

stockholders’ equity for 20x2:

• ($48,000 – $0) ÷ $338,000 = 0.142

• The industry average is 0.093.

• Why is this ratio larger than the return on

total assets (.101)?

• Because Palisades uses leverage.

Measuring Profitability

Earnings per share of common stock

= (Net income – Preferred dividends)

÷ Number of shares of common stock

outstanding

Measuring Profitability

•

•

•

•

Palisades’ earnings per share:

20x1: ($26,000 – $0) ÷ 10,000 = $2.60

20x2: ($48,000 – $0) ÷ 10,000 = $4.80

This large increase in EPS is considered

very unusual.

Analyzing Stock as an

Investment

• Price/earning ratio is the ratio of market

price per share to earnings per share.

• 20x1: $35 ÷ $2.60 = 13.5

• 20x2: $50 ÷ $4.80 = 10.4

• Given Palisades Furniture’s 20x2 P/E ratio

of 10.4, we would say that the company’s

stock is selling at 10.4 times earnings.

Analyzing Stock as an

Investment

Dividend yield shows the percentage

of a stock’s market value returned as

dividends to stockholders each period.

Dividend per share of common

(or preferred) stock ÷ Market price per share

of common (or preferred) stock

Analyzing Stock as an

Investment

•

•

•

•

Dividend yield on Palisades’ common stock:

20x1: $1.00 ÷ $35.00 = .029 (2.9%)

20x2: $1.20 ÷ $50.00 = .024 (2.4%)

An investor who buys Palisades Furniture

common stock for $50 can expect to receive

2.4% of the investment annually in the form

of cash dividends.

Analyzing Stock as an

Investment

Book value per share of common stock

= (Total stockholders’ equity – Preferred equity)

÷ Number of shares of common stock outstanding

Analyzing Stock as an

Investment

• Book value per share of palisades’ common

stock:

• 20x1: ($320,000 – $0) ÷ 10,000 = $32.00

• 20x2: ($356,000 – $0) ÷ 10,000 = $35.60

• Book value bears no relationship to market

value.

Objective 5

Use ratios in decision making.

Limitations of Financial

Analysis

• Business decisions are made in a world of

uncertainty.

• No single ratio or one-year figure should be

relied upon to provide an assessment of a

company’s performance.

Objective 6

Measure economic value added.

Economic Value Added (EVA®)

• Economic value added (EVA®) combines

accounting income and corporate finance to

measure whether the company’s operations

have increased stockholder wealth.

• EVA® = Net income + Interest expense –

Capital charge