Do you conduct enterprise analysis?

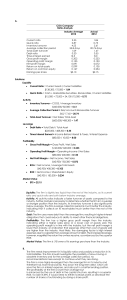

advertisement

Dr. David M. Kohl Professor Emeritus Agricultural and Applied Economics Virginia Tech Blacksburg, VA 24060 (540) 961-2094 (Alicia Morris) (540) 719-0752 (Angela Meadows) e-mail: sullylab@vt.edu Weekly Website Columns: Ag Globe Trotter: www.farm-credit.com Road Warrior of Agriculture: www.cornandsoybeandigest.com Viability of Dairy Industry in Northeast “Keys” Macro PA natural resources plus location to markets plus conservative mode & mentality plus infrastructure plus possibility to diversify modest size plus Is Your Business “Farmcreditable / Bankable/ or FSAable?” Do you know your cost of production? Do you conduct enterprise analysis? Do you complete and utilize accrual adjusted income statements? Do you have accurate up to date balance sheets? Do you utilize key financial ratios in your business planning? Do you have a three prong risk management program? (revenue, inputs, & interest rates) Do you conduct sensitivity analysis on cash flows? Do you communicate if you have problem? Do you meet key metrics, ratios, & credit scores? Do you utilize a business plan? New Economic RealitiesFinancial Metrics Measure Code Red Code Yellow Code Green Working Capital/Exp. Or Rev. <15% 15-33% >33% Debt/Asset Ratio >60% 40-60% <40% Credit Score <650 650-700 700+ Op. Exp. Revenue (Excluding Depr. & Int.) >80% 70-80% <70% Coverage Ratio <125% 125- 200% >200% 1 2 Profitability - Return On Assets ((Net Income + Interest - Management Fee) / Total Farm Assets) Owned Leased Red (0-4) under 4 percent under 6 percent Yellow (5-8) 4 to 7 percent 6 to 10 percent Green (9-10) over 7 percent over 10 percent Capital Turnover Ideal capital turnover varies by enterprise (Revenue/Total Assets) Red (0-4) under 20 percent Yellow (5-8) 20 to 40 percent Green (9-10) over 40 percent Margin Management Net Profit/Gross Revenue Red Owned Land $ 50,000 (net income) + 20,000 (interest paid) 70,000 - 40,000 (f amily $ 30,000 withdrawals or mgt f ee) $30,000 $500,000 assets = 6% (0-4) under 9 percent Yellow (5-8) 9 to 16 percent Green (9-10) over 16 percent Gross Revenue divided by Total Assets equals Capital Turnover $450,000 $500,000 = 90% Owned 0 - neg 1 - 0% 2 - 1% 3 - 2% 4 - 3% 5 - 4% 6 - 5% 7 - 6% 8 - 7% 9 - 8% 10 - > 8% 0 - negative 1 - 1 to 4% 2 - 5 to 9% 3 - 10 to 14% 4 - 15 to 19% 5 - 20 to 24% 6 - 25 to 29% 7 - 30 to 34% 8 - 35 to 40% 9 - 41 to 50% 10 - > 50% Leased 0 - 1% or neg 1 - 2% 2 - 3% 3 - 4% 4 - 5% 5 - 6% 6 - 7% 7 - 8% 8 - 9 - 10% 9 - >10% 10 - > 12% 3 Repayment Capacity & Coverage Margin Red (0-4) Yellow (5-8) Green (9-10) Repayment Capacity $ 50,000 (net income) + 20,000 (non-farm rev.) 70,000 + 30,000 (dep & int.) 100,000 - 40,000 (family withdrawals) $ 60,000 (capacity available) - 40,000 (int & prin. pmt.) $20,000 (coverage margin) Use 3-year average f or less variation. Capacity Available divided by Interest & Principal Payment equals Coverage Ratio Coverage: $60,000 $40,000 =150% Ratio 0 - < 100% 1 - 100 to 109% 2 - 110 to 114% 3 - 115 to 119% 4 - 120 to 124% 5 - 125 to 134% 6 - 135 to 149% 7 - 150 to 174% 8 - 175 to 199% 9 - 200 to 249% 10 - > 250% Operating Expense/Revenue Operating Expenses (excluding interest & depreciation) / Gross Revenue Red (0-4) Yellow (5-8) Green (9-10) Operating Expense: $370,000 $450,000 =82% Gross Revenue: 0 - >90% 1 - 89% 2 - 85 to 88% 3 - 81 to 84% 4 - 80% 5 - 77 to 79% 6 - 73 to 76% 7 - 71 to 73% 8 - 70% 9 - 65 to 69% 10 - < 65% Signs of a Dairy Business in Difficulty account payables / supplier credits > 10% of revenue constant refinancing of operating loans not covering variable cost of production- more than six months not covering total cost of production- more than eighteen months annual loss of earned net worth more than 10% of total net worth operating expense to revenue ratio (excluding interest and depreciation) over 85% interest paid revenue ratio over 15% of revenue percent equity under 30% credit scores under 650 have more than five different sources of credit on balance sheet Financial Profits Diagnosis Worksheet Problem Low Profit Margin Low ROA Symptoms Low ROA Causes Solution/ Treatment Poor buying marketing Poor efficiency Poor strategy Poor execution Murphy’s Law Business Poor Risk Refinancing Lack of planning of execution Growth High mgmt. fee Reduce Increasing Lack Increase operating debt payables plan mgmt. plan Marketing plan Purchasing plan Know your costs Poor credit score Rejected credit Higher insurance rates Not paying bills on time Too much debt Budget Slow capital turnover Below High asset values Low revenue Sell Low liquidity Poor Using short term funds/profits to fund long term assets Poor debt structure Build Rapid Slower average to peers Low Profits Poor High financial leverage industry working capital to revenue current ratio Missed payments Rejected credit Personal stress High levels of debt compared to peers aggressive growth Beginning producers Murphy’s Law overhead margin thru efficiency or growth family & home expenses Seek counsel in improving the credit report fixed assets Sell unneeded or unproductive assets Sell leased fixed assets Machinery & equipment budgets per unit an annual working capital reserve margin Refinance Pay income taxes & deferred taxes growth Allocate profits Reduce liabilities rather than increase assets Capital stock infusion Management Diagnosis Worksheet Problem Symptoms Causes Solution/ Treatment Management & Labor Poor communications Labor turnover Unproductive labor High labor cost Over scheduled Poor scheduling Lack of planning Doing vs. managing Job Long term transition planning No estate plan No wills No mgt. transitions Failure to train next generation Poor profits Last minute corrections Time management Lack size and scope of business Philosophy of generations Thunder stage comfort 3-year Environmental , Technology & Sustainability Non compliance Loss of efficiency & sustainability Miss match of resources to mode of operations Challenges with public Lack of understanding of rules Lack of understanding of technology or sustainability Independent vs. interdependent Lack of understanding of consumer and public 2 Marketing Risk Management Home Lack Know Failure Lack Plan run hitter to hit tops & bottoms of the market Failed before Too complex of time of understanding Failure to know costs No strategy No time table for execution responsibilities Delegation Training DISC personality profile Salary / perks Meetings Hire facilitator rule (away from business) Hire for your weaknesses 6 year rule Hire facilitator Business plan Exit plan -6 hours of training per week Records & documentation Waste & nutrient management plan Time allocation cost Strategy Execution Risk mitigation Advisor Turnaround Strategies divide cost of production earned net worth vs. appreciated net worth strategy monthly & quarterly variance analysis actual projected year over year macro / micro quick victories to build upon meeting management variable fixed total cost partners, spouses, lenders agendas minutes assignments and to do lists focus on larger costs SWOT analysis prioritization of goals business planning, execution, and monitoring