Chapter 19 Floating v. Fixed

advertisement

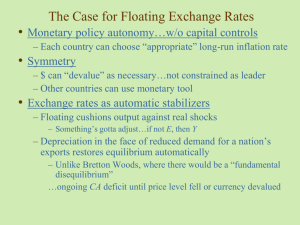

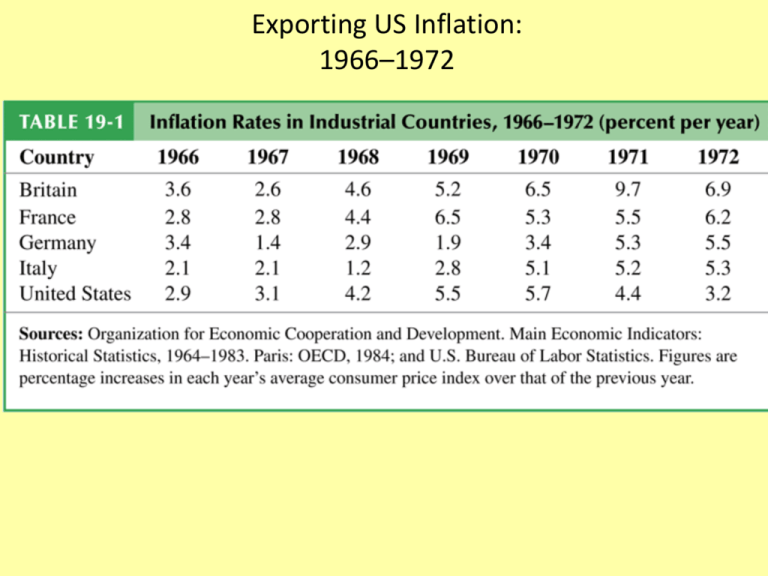

Exporting US Inflation: 1966–1972 Effect on Internal and External Balance of a Rise in the Foreign (US) Price Level, P* The “simple” solution for the £, M, ¥, FF, … • Revalue against the $ • Let the $ depreciate The Case for Floating Exchange Rates – Monetary policy autonomy…w/o capital controls • Each country can choose “appropriate” long-run inflation rate – Symmetry • $ can “devalue” as necessary…not constrained as leader – Exchange rates as automatic stabilizers • Floating cushions output against real shocks – Something’s gotta adjust…if not E, then Y • Temporary reduction in demand for country’s exports depreciation attenuates output reduction Effects of a Temporary Fall in Export Demand Exchange rate, E DD2 DD1 2 E2 (a) Floating exchange rate 1 E1 Depreciation leads to higher demand for and output of domestic products AA1 Y2 Y1 Exchange rate, E (b) Fixed 1 exchange rate E Output, Y DD2 3 1 AA2 Y3 Y2 Y1 DD1 Fixed exchange rates mean output falls as much as the initial fall in aggregate demand AA1 Output, Y The Case for Floating Exchange Rates – Monetary policy autonomy…w/o capital controls • Each country can choose “appropriate” long-run inflation rate – Symmetry • $ can “devalue” as necessary…not constrained as leader – Exchange rates as automatic stabilizers • Floating cushions output against real shocks – Something’s gotta adjust…if not E, then Y • Temporary reduction in demand for country’s exports depreciation attenuates output reduction • Permanent reduction in demand for country’s exports depreciation restores equilibrium automatically The Case Against Floating Exchange Rates • Lack of discipline • Destabilizing speculation – Hot money …but “fundamental disequilibrium” one-way bet under fixed rates – A “vicious circle” of depreciation and inflation. E deprec Pim up CoL up W up P up E deprec – Floating exchange rates make a country more vulnerable to money market disturbances…that’s the tradeoff: L up R up E-apprec. CA & Y down A Rise in Money Demand Under a Floating Exchange Rate Exchange rate, E DD 1 E1 2 E2 AA1 AA2 Y2 Y1 Output, Y The Case Against Floating Exchange Rates • Lack of discipline • Destabilizing speculation – Hot money …but “fundamental disequilibrium” one-way bet under fixed rates – A “vicious circle” of depreciation and inflation. E deprec Pim up CoL up W up P up E deprec – Floating exchange rates make a country more vulnerable to money market disturbances…that’s the tradeoff: L up R up E-apprec. CA & Y down • Recall: fixed rates cushion output against monetary shocks L up M up nothing shifts under fixed rates The Case Against Floating Exchange Rates • Injury to International Trade and Investment – Exchange rate risk – But forward markets can protect traders against foreign exchange risk. – International investments face greater uncertainty about payoffs denominated in home country currency. • Uncoordinated Economic Policies – Countries can engage in competitive currency depreciations. – A large country’s fiscal and monetary policies affect other economies …aggregate demand, output, and prices become more volatile across countries if policies diverge. Macroeconomic Interdependence Under Floating Rate The Large Country Case – Effect of a permanent monetary expansion by US • $ depreciates, US output rises • Small country’s output may rise or fall. Its currency appreciates Its CA and output decrease US economy expands It sells more to US Its output rises – Effect of a permanent fiscal expansion by US • US output rises, US currency appreciates • Small country’s output rises Its currency depreciates Its CA and output rise US economy expands It sells more to US Its output rises Large Country => Locomotive The Case Against Floating Exchange Rates • Injury to International Trade and Investment – Exchange rate risk – But forward markets can protect traders against foreign exchange risk. – International investments face greater uncertainty about payoffs denominated in home country currency. • Uncoordinated Economic Policies – Countries can engage in competitive currency depreciations. – A large country’s fiscal and monetary policies affect other economies …aggregate demand, output, and prices become more volatile across countries if policies diverge. • Free Float Really Managed Float – Fear of depreciation – inflation spiral intervention More Case Against Floating Exchange Rates • Speculation and volatility in the foreign exchange market • Expectation of depreciation in short-run Rush to sell currency Depreciation in short-run … and recovery to fundamental value in long-run High nominal and real exchange rate volatility under floating Violation of Purchasing Power Parity Disruption of trade ??? Nominal and Real Effective Dollar Exchange Rate Indexes, 1975–2010 Purchasing Power Parity??? Source: International Monetary Fund, International Financial Studies. Milestones ‘a Floating Vietnam Expansion – Inflation – Commodity price boom F L O A T I N G Yom Kippur War Oil Shock Stop – Go Inflation Plaza Accord Louvre Accord – Black Monday – Japan Bubble – S & L Debacle Berlin Wall Down – Maastricht – ERM Crisis Global Savings Glut – China rising – Developed country aging – Reserve buildup – Tech slowdown Global Housing Tequila Crisis – Recycling petrodollars Emerging Mkt Boom America Held Hostage East Asia Crisis – Contagion 2nd O i l S h o c k – Leveraging Volcker Disinflation – Deleveraging – Twin Deficits – Rust Belt – Lost Decade – LTCM Dot.com bubble – US Capital Inflow – US CA Deficit – Greenspan Put Bubble • US Saving down CRISIS The Great Recession Rush to safety