Answers - UCSB Economics

advertisement

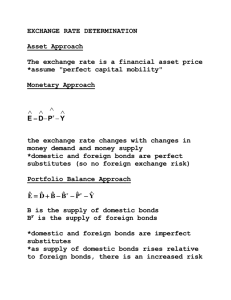

Economics 181 Homework #4 Answers: 1. a. As a result of the monetary contraction abroad, the foreign real interest rates rises. In the long run, the exchange rate rises and therefore the domestic currency depreciates. Also, foreign output decreases and domestic output increases. b. Now, if the foreign nominal interest rate rises as a result of a rise in foreign inflation expectations, the opposite of part a occurs. The long-run expected expected price of foreign currency falls, shifting the AA curve to the left. In this case, domestic output does not need to rise. Under a fixed exchange rate the domestic country will import the foreign inflation, but if there exists a floating exchange rate then the domestic country can be safe from the foreign inflation. 2. From the DD-AA model, we know that the AA schedule must equate M/P=L(R + expected depreciation + risk premium, Y). Thus in this case, an increase in the risk premium shift the AA curve out, causing a currency depreciation and an increase in overall output. Under the fixed exchange rate regime, output will remain the same. This is because the exchange rate parity must hold, thus there will be no depreciation and no effect on output. 3. a. Japan will increase domestic interest rates, which will cause investors to expect a stronger yen in the future. This in return will cause the yen to immediately appreciate. Thus, Japan’s goods will now be more expensive relative to foreign goods, thereby raising the demand for foreign output. In the end, Foreign output rises and Japan’s output falls. Thus, Japan’s current account surplus will be expected to fall as output falls, and as a portion of the increase in foreign goods will come from the U.S., and the U.S.’s current account deficit will decrease somewhat. b. Japan’s fiscal expansion will help cut the U.S.’s current account deficit. This is because, Japan’s fiscal expansion would cause the yen to appreciate, thus foreign goods become relatively cheaper and the world demand for foreign goods rises. Some of this rise in demand for foreign goods would increase the demand for U.S. exports and hence the U.S. current account situation would be helped. 4. a. A favorable shift in demand for a country’s goods, causes that country’s real exchange rate to appreciate. A favorable shift in the world demand for non-German EMU exports appreciates the euro (and the German mark) against non-euro currencies. b. This adversely affects Germany’s output level. c. The adverse output effect for Germany decreases with the increase of the proportion of trade between Germany and other euro-zone countries. 5. The stability of the EMS depended upon the ability of member countries’ central banks to defend their currencies. The level of foreign currency reserves to which a central bank has access affects its ability to defend its currency. For example, the larger the stock of reserves, the better positioned a central bank is to defend its currency. Credits from the central bank of a strong-currency country can help a weaker central bank’s fight to defend its currency. Investors in the foreign exchange market will be much less likely to speculate against a weak currency if they know that there are many countries with reserves to defend it.