foreign exchange rate

advertisement

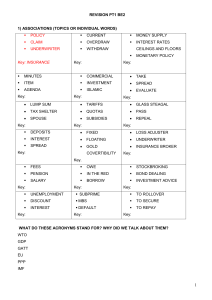

MONETARY SYSTEMS 1 Lecture 6 Vallyon Andrea AGENDA 1. 2. 3. Presentation about the money history Exchange rate systems History of International Monetary Systems 2 LEARNING GOALS To describe the different types of exchange rate systems Understand the history of monetary systems 3 CORE MATERIAL Stephen Valdez: An Introduction to Global Financial Markets, Macmillan Press Ltd.1997 CH 7, page:137- 173 4 DILEMMA OF SIMPLIFIED EXCHANGE RATE POLICY Fixed or free-float? Two extremities + others = exchange rate systems 5 EXCHANGE RATE DEFINITIONS The price of one currency expressed in terms of another currency. U.S. dollar buys 1.40 Canadian dollars, the exchange rate is 1.4 to 1. Also called foreign exchange rate. The exchange rate is the price at which the currency of one country can be converted to the currency of another 6 CHANGES IN EXCHANGE RATES effects on the profits the value of foreign investments held by individual investors. For a Swiss investor owning Japanese securities, a strengthening of the Swiss Franc relative to the yen tends to reduce the value of the Japanese securities because the yen value of the securities is worth fewer francs 7 EXCHANGE RATE SYSTEMS 1 Freely floating or flexible exchange rate Market forces of supply and demand determine rates. Forces influenced by a. price levels b. interest rates c. economic growth Rates fluctuate over time randomly. 8 FREELY FLOATING SYSTEM 9 FREELY FLOATING OR FLEXIBLE EXCHANGE RATE Advantages No problems with international liquidity Automatic correction in the balance of payment Insulated from external events Disadvantages Uncertainty Speculation can be destabilising specially in the short run Todays crises questioning the power of the market 10 EXCHANGE RATE SYSTEMS 2 Managed Float (Dirty Float) Market forces set rates unless excess volatility occurs. The government intervenes to influence the exchange rate 11 EXCHANGE RATE SYSTEMS 3 Target-Zone Arrangement Central bank intervenes to set the exchange rate at the preannounced price, by selling or buying foreign exchange currency in return for the national currency Market forces constrained to upper and lower range of rates Members to the arrangement adjust their national economic policies to maintain target. 12 13 CRAWLING PEG IN HUNGARY (1995-2001) After a period of increasing external and internal imbalancies : crawling peg was introduced by Bokros government The currency is pegged to USD and Euro Band:+/ - 2.5% Monthly devaluation at a preannounced rate (progressively decreasing crawl from 1.9% to 0.25) The interest rate was decreased also Result: inflation dropped from 31% to 10.8% (1998) 14 EXCHANGE RATE BAND Limit within the rate of exchange can fluctuate Used as an intermediate scheme between fixed and free float regimes Maximum rate: ceiling rate maximum rate the CB is willing to allow in the interbank market. At this rate the CB will ? Foreign currency to maintain the rate of exchange at that level Minimum rate: floor rate the CB will allow At this level the CB will ? foreign currency so that the exchange rate remains at that level 15 CRAWLING PEG IN HUNGARY 2001-2008 2001-2002: Widening the band: +/-15% 2003: depreciation of the middle of the band: 283.36 forint/euro 2008: elimination of band: floating rate 16 17 TOOLS OF INTERVENTION Why to intervene? Exchange rate strongly effects competitiveness Tools: Interest rate Open market activity Compulsory deposit rate 18 Thank you! 19