Business Validation - UC Davis Graduate School of Management

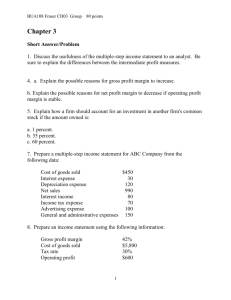

advertisement

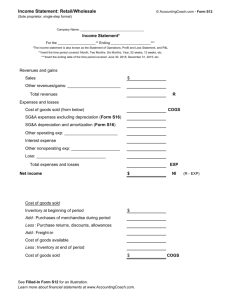

Business Validation Mark Szczerba Roll Global Introduction • Brief introduction • Business Models & Definitions • Capital Requirements & Reducing Risk • Variety of Business Models • Specific examples • Exercises Roll Global • Roll Global is a diverse $3B company focused on consumer packaged goods and agricultural products • Roll has a number of well known brands: • Roll is well known for marketing and branding agricultural products What makes a good business? • Will it work? • Are materials available? • Is it scalable? • Can it be tested cost effectively? • Can the management team grow the business? • Can the team grow with the business? • Who is the customer? • How many customers? • Value proposition to the customer? • Competition? Technology Market Team Business Model • How much revenue can you generate? • What are the costs? • What are the long term goals? Business Model: How will you make money? • What is your strategy? – What is your aspiration? Is it clear? – Where will you compete? What is the market size? – How will you ensure success? What is your “value proposition”? – Do you have the capabilities? Do you have the right team? Business Model: How will you make money? – Who are the customers for your product/service? – Why do your customers want your product/service? – Are they willing to pay for your product/service? VALUE PROPOSITION Solving critical problem? Cost reduction? Efficiency gain? Filling a gap? Providing experience? Can manage better? Business Model: How will you spend money? • How much will it cost to generate your revenues? • COGS: Cost of goods sold – direct costs associated with product sold • OPEX: Operating expenditure – cost to run a business • CAPEX: Capital expenditure – cost to purchase or add value to an asset • How much revenue can you make and how quickly? • Cost of Capital: cost to finance the business (cost of equity or debt); return required before generating value Definitions: Gross Margin • Revenue – Money coming into the business from product sales • Cost of Goods Sold (COGS) – What it costs to make your products – E.g. pizza boxes, toppings, and hourly labor • Gross Margin (%) – Proportion of each dollar of revenue that goes to profit – Revenue −COGS Revenue – Is your business successful? Is your Gross margin better or worse than industry average? Definitions: Expenses • Fixed costs – Don’t change with production levels in the short term – E.g. Overhead, Assets, Land • Variable costs – Change with business activity – E.g. Direct labor, Packaging material Definitions: Profitability • Cash Burn rate Example Income Statement Amounts in US $ thousands – How much cash you lose over a period of time (E.g. per month) • EBITDA Revenue Cost of Goods Sold Gross Profit Gross Profit Margin – Earnings Before Interest, Tax, Depreciation and Amortization SG&A Expense – Basically net income + interest, taxes, depreciation and amortization Operating Income – Useful for valuation comparisons • Net Income – Revenues minus all expenses Depreciation & Amortization Operating Margin Non operating Income Non operating Expenses Income Before Taxes Income Taxes Net Income After Taxes (before accounting adjustments for affiliated companies) Accounting adjustments for affiliated companies Total Net Income Mar 2013 Mar 2012 23,498 26,679 14,474 16,134 9,024 10,545 38.4% 39.5% 6,029 7,066 1,502 1,796 1,211 1,373 0 0 50 (308) 4 20 1,265 1,084 475 365 790 719 (214) (187) 576 532 Definitions: Pro-Forma Statements • Pro-Forma Statements – “Best Guess” predictions on cash flow • “back of the envelope” – Designed to show the impact of a certain choices Definitions: J-Curve $120 $100 Profit ($MM) $80 $60 $40 Capital required to reach “Cash Flow Break Even” $20 $0 -$20 -$40 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 Capital Requirements Business Value (Increasing value and reducing risk along the way) Commercial Launch Beta Customer Proof of concept Time Cash Flow Break Even Revenue Models Unit Sales Advertising Fees Franchise Fees Utility Fees Subscription Fees Sell a product or service to customers (wholesale, retail, or direct). Sell opportunities to distribute messages (viewers, readers, listeners, or others) Sell and support a replicable business for others to invest in, grow, and manage Sell goods and services on a per-use basis Charge a fixed price for providing access to your goods or services Transaction Fees Charge a fee for referring, enabling or executing a transaction License Fees Sell the rights (exclusive or nonexclusive) to use patent- or copyrightprotected IP Final thoughts… • Have a plan B – And C and D • Seek market validation quickly – Get to market fast and with less capital – Don’t do it all right off the bat • What is your unfair advantage? – Why can you do this, can you defend it? Now it’s your turn……. Cost/unit Price/unit # units sold/year Revenue/yr Annual Profit/yr How much will it cost you? – How much funding do you need? – Look closely at your expenses • Create an Excel file • Cut and paste the following expenses... • Delete the rows you don’t need (that aren’t significant) • Add time periods across the top • Start making assumptions... Next Steps: Validating Your Business Using the exercises in the coursebook, identify the critical uncertainties around your business and business model. 1. Rank and order the uncertainties. 2. Identify which should be resolved first (in the next 9-12 months). These are your business milestones. 3. List the resources (people, equipment, $) you need to reach those milestones.