File

advertisement

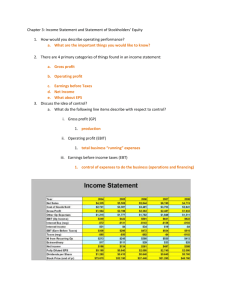

BUA108 Fraser CH03 Group 80 points Chapter 3 Short Answer/Problem 1. Discuss the usefulness of the multiple-step income statement to an analyst. Be sure to explain the differences between the intermediate profit measures. 4. a. Explain the possible reasons for gross profit margin to increase. b. Explain the possible reasons for net profit margin to decrease if operating profit margin is stable. 5. Explain how a firm should account for an investment in another firm's common stock if the amount owned is: a. 1 percent. b. 35 percent. c. 60 percent. 7. Prepare a multiple-step income statement for ABC Company from the following data: Cost of goods sold $450 Interest expense 30 Depreciation expense 120 Net sales 990 Interest income 80 Income tax expense 70 Advertising expense 100 General and administrative expenses 150 8. Prepare an income statement using the following information: Gross profit margin Cost of goods sold Tax rate Operating profit 42% $5,800 30% $600 1 BUA108 Fraser CH03 Group 80 points 9. Using the following information prepare a common size income statement: Net sales Cost of goods sold Gross profit General and administrative expenses Selling expenses Operating profit Income tax expense Net profit $1,000 600 $ 400 250 120 $ 30 10 $ 20 11. Use the following information to analyze the BJ Company. Calculate any profit measures deemed necessary in order to discuss the profitability of the company . BJ Company Income Statements For the Years Ended Dec. 31, 2009 and 2008 Net sales COGS Gross profit General and administrative expenses Operating profit Interest expense Earnings before taxes Income taxes Net income 2 2009 $174,000 114,000 $ 60,000 54,000 $ 6,000 (1,000) $ 5,000 2,000 $ 3,000 2008 $167,000 115,000 $ 52,000 46,000 $ 6,000 (1,000) $ 5,000 2,000 $ 3,000 BUA108 Fraser CH03 Group 80 points 13. Bright Company purchased 20% of the voting common stock of Bulb Company on January 1 and paid $400,000 for the investment. Bulb Company reported earnings of $300,000 for the fiscal year ended December 31. Cash dividends were paid during the year in the amount of $20,000. a. Calculate the investment income and the ending balance in the investment account on the balance sheet for Bright Company on December 31 using the cost method. b. Calculate the investment income and the ending balance in the investment account on the balance sheet for Bright Company on December 31 using the equity method. 14. Analyze the common size income statements below for Toby Company: Net sales COGS Gross margin Research and development Selling, general and administrative Restructuring, asset impairments and other charges Income/(loss) from operations Interest expense Income/(loss) before taxes Provision for/(benefit from) income taxes Net income/(loss) Sales growth Operating cost growth 80% 31% 3 2010 2009 100% 100% 54 63 46% 37% 14 20 5 9 1 8 26% 0% (1) (2) 25% (2%) 8 0 17% (2)%